Bitcoin tried CME and tested Bakkt in the derivatives market of 2019

In the past two years, few things in the cryptocurrency market have changed. Bitcoin and Satoshi impersonators are still running rampant, the SEC is still unclear on how to regulate token-issuances and Bitcoin is, yet again, ending the year on a higher-low. One key aspect of the market that has seen stark development is the market for cryptocurrency-derivatives.

Specifically Bitcoin Futures. In December 2017, the Chicago Mercantile Exchange [CME], and the Chicago Board of Options Exchange [CBOE] launched Bitcoin Futures, and since then the market, both spot and future, has never been the same.

Get the Ball Rolling

More than anything else, a green light from the CME and the CBOE signaled a level of trust from institutions and regulators. Seeing this approval, the markets rallied, taking Bitcoin close to $20,000. While the market spurred then stalled in 2018, the response to the Bitcoin Futures market this past year has been less black-and-white and lost in a sea of gray.

With Bitcoin rallying from $3,400 to $13,500 in six months and then dropping down to $7,000, the consistent unpredictable volatility was a boon for the fluctuation-hungry derivatives market. Coupled with the two-horse race being bogged down to an individual medley, the lone Chicago exchange would’ve reaped profits galore, however, the introduction of a regulated physical adversary would halt, or add to its volume pump.

Keeping in mind these contributing factors the CME’s performance can be divided into three phases – prior to the Bitcoin pump [January to April], in the midst of the Bitcoin rise [April to September] and post the Bakkt introduction [September to December].

Before the Rise

For many in the industry, the calendar began in April, with the first quarter forgotten in price suppression. With Bitcoin seeing minimal price action, the regulatory focus rested on SEC’s rulings on Bitcoin ETF proposals, while institutions were focused on the release JP Morgan’s in-house digital currency.

Despite price and volume actions being muted, CME was not. In February, as Bitcoin was trading at $3,500, Terry Duffy, the CEO of the CME Group adopted a policy of “walk before you run.” He added that without regulatory clarity, the development of any asset-class would be unlikely,

“I think, until, governments really start to accept cryptocurrencies of some way, shape or form, it’s going to be very difficult for major-commercials [banks] to come in here and really get Gung-ho on Bitcoin.”

A month later, this policy of ‘wait and see,’ was firmly out the window as the CME Group became the sole-exchange in the regulated futures market with the CBOE bowing out. In a March 14 statement, the cross-town rival stated it will not add a Bitcoin Futures contract.

Duffy, in March, highlighted a key principle of Bitcoin that could concern regulators – its limited supply. In an interview, he stated that the finite amount of Bitcoin is uneasy for regulators because they are used to dealing with assets without a supply-cap. When it comes to crypto “the regulators right now are a little careful about just rubber-stamping anything,” said Duffy. Interestingly, these statements were made when the Commodity Futures Trading Commission [CFTC] was reviewing Bakkt.

For the CME Group, the first quarter of the year was dismal. Bitcoin was moving up, but only marginally; February saw slumping volumes and the CEO of the exchange stated that regulation was lacking. While this painted a bleak picture for CME’s diversified product, news of its demise was “greatly exaggerated,” according to AMBCrypto’s conversation with Joseph Edwards, Enigma Securities’ head of research, adding a caveat that “it’s a product with a limited lifespan.”

Bitcoin-breakout

The fateful day

Once Bitcoin broke out in the second quarter, there was no looking back for CME. On April 2, Bitcoin rose from $4,100 to well over $5,000, in an unprecedented move, institutions rushed to CME’s derivatives.

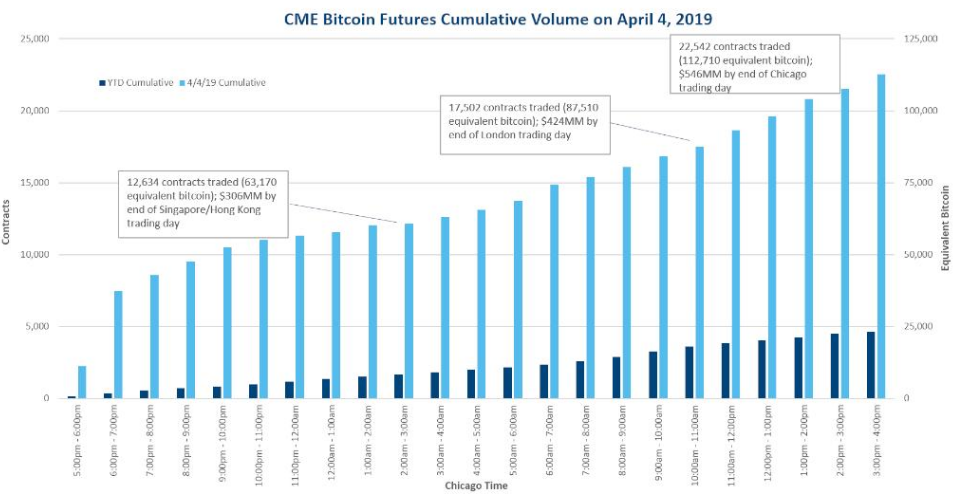

Two days after the spot-rise, daily volume of Bitcoin-Futures surged to 22,542 contracts, a new ATH. With each contract representing 5 BTC, valued at around $5,100 per coin, the daily-volume was well over $570 million. To put that rise in context, on April 1, pre-boom, the volume was a paltry 2,162. On the day of the rise, the volume swelled by 455 percent, with 12,015 contracts traded.

Source: CME Group, Twitter

The ensuing months

The ensuing months saw much more of the same. In the thick of the Bitcoin pump, the CME Group hit a new ATH, breaking the April 4 mark. On May 13, as the spot-price rose by 12.07 percent, following from a 13.86 percent move-up seen two days prior, over 33,700 contracts were traded, worth over 168,000 BTC.

CME Bitcoin futures reached an all-time record high of 33.7K contracts on May 13 (168K equivalent bitcoin), up nearly 50% from the last record of 22.5K contracts on April 4. See how market participants are using $BTC to manage uncertainty: https://t.co/hDgraMj5pe pic.twitter.com/ct1xkjoJDF

— CMEGroup (@CMEGroup) 13 May 2019

This increased volume continued into June, as Bitcoin hit its 2019 high of $13,800, and began its descent. Caught in a descending triangle, BTC-spot was waning, with the market holding onto only one strand of forthcoming positive-news from New York, much to the dismay of Chicago.

The competitor calls

Bakkt, the digital assets platform of the Intercontinental Exchange [ICE] parent-company of the NYSE was making a ton of noise for the past year. With their November 2018 launch delayed due to regulatory concerns and a slumping market, in June 2019, ICE confirmed that the project was not dead, and would begin their test-phase shortly.

With a launch of late-September, the market was red-in-anticipation, given the crowd it would attract, rivaling the CME, while plying a different set of products. Bakkt’s main sell, for which its custody wing was imperative, was the physically-delivered nature of their Bitcoin Futures contract. Analysts primed Bakkt to be a litmus-test to how Wall Street liked their BTC Futures – in hand, or in dollars. Edwards stated that Bakkt could be vital if it does “scale out and become a ‘hub’ for institutions interested in crypto.”

Institutions, prior to Bakkt, did not have a regulated-safe way of procuring Bitcoin, hence, this platform was monumental. Some were of the opinion that Wall Street would be less inclined to the physically-backed, as they don’t really ‘need’ Bitcoin, much like they don’t need the underlying oil or grain of commodity Futures, according to the professor of finance at the Tepper School of Business, Carnegie Mellon University, Bryan Routledge in conversation with AMBCrypto. Theoretically, he said,

“An institutional investor is simply slotting a futures contract into a big portfolio.”

In sentiment, CME’s cash-settled alternative has “little to do with the actual [crypto] currency” as per Jack Tao, co-founder of cryptocurrency-derivatives exchange, Phemex, who told AMBCrypto that some institutional-traders have “no actual interest in Bitcoin as a currency and a store of value.” Hence, to draw parallels, Bakkt looks more inviting, he stated,

“Bakkt’s futures, by being physically settled, seem instead more compatible with the already mature cryptocurrency environment, which may be the reason behind their better performance.”

The closing bell

In August, while Tim McCourt, the managing director of the CME Group told Forbes that on average, around 7,237 BTC contracts were traded on the CME YTD, the imminent onset of Bakkt saw the regulated exchange shiver.

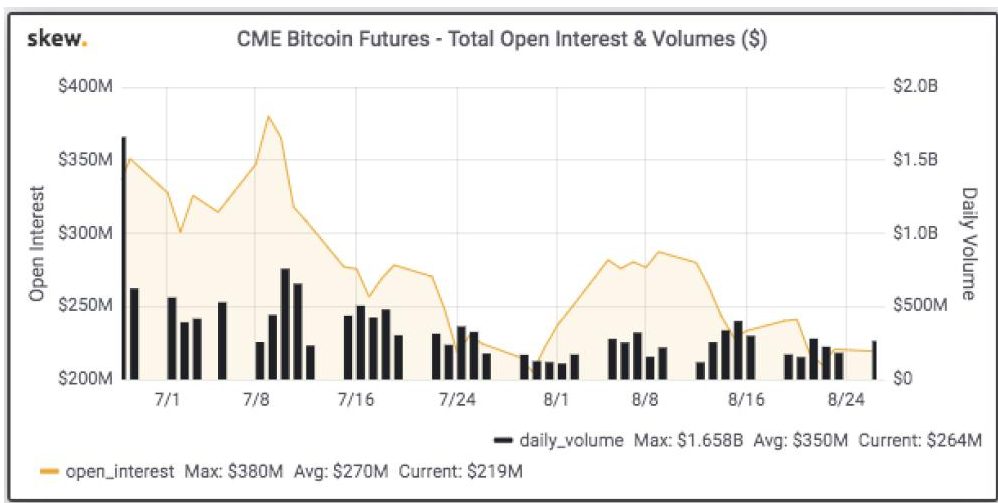

A normalcy within the crypto world was the anticipation and price-effect of every set of CME BTC Futures expiry, but given the Bakkt-rumor-mill, this anticipation was different and rather muted. During the close of August, over 50 percent of the open-positions were set to expire on CME’s BTC Futures contracts.

On August 27, Skew markets recorded daily volume at $264 million, down 25 percent from the average for the year. It should be noted that this volume is inflated, compared to the April figures owing to Bitcoin’s 95 percent price increase.

Source: Skew Markets, Twitter

Keeping in mind McCourt’s figure of 7,237, the squeeze was even more pronounced. The average volume from July 26 to August 29, in daily-volume, was 4,349, a drop of nearly 40 percent. Moreover, this sum of 7,237 contracts was further pushed by extreme BTC-price movements seen on April 2nd and May 13.

Bakkt in the game

The much-awaited Bakkt launch, on September 23, failed quite miserably. With Bitcoin trading in a descending triangle, on the cusp of a move-downward, the underwhelming response to Bakkt saw a $2,000 drop. On its maiden day, Bakkt saw a paltry 71 BTC worth of volume, two years prior on CME’s first trade-day, over 5,200 BTC-equivalent contracts were traded.

On the flip side, as Bakkt stalled, CME spurred. On 24 September, CME saw over 14,000 contracts traded, significantly higher than their YTD average of 7,237 and the highest in over a month, the next two days saw almost 10,000 contracts traded as well.

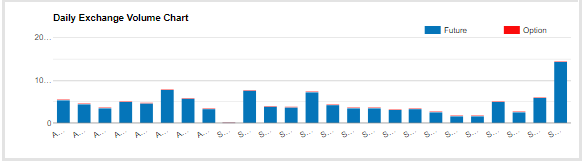

Below is the volume from 21 August to 24 September.

A “total flop,” was how Greenspan described the Bakkt launch, while analyst and economist Alex Krüger, referred to the market response as a “disappointment.” Institutions, in their eyes, made their stance clear – ‘We don’t trust cryptocurrencies [yet] to take custody,’ this was seen as a boon to CME and a bane to ICE’s brainchild.

Bakkt out too soon

As the markets were ruling out Bakkt and institutions were thought to be crypto-averse, volatility saw them return. Towards the end of October, as the prices kept declining and then bounced-up following Xi Jinping’s blockchain-blessing, Bakkt saw a massive uptick in volume, reaching $10.3 million, an increase of 53 percent from its previous high.

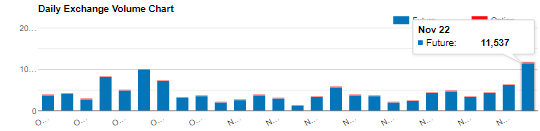

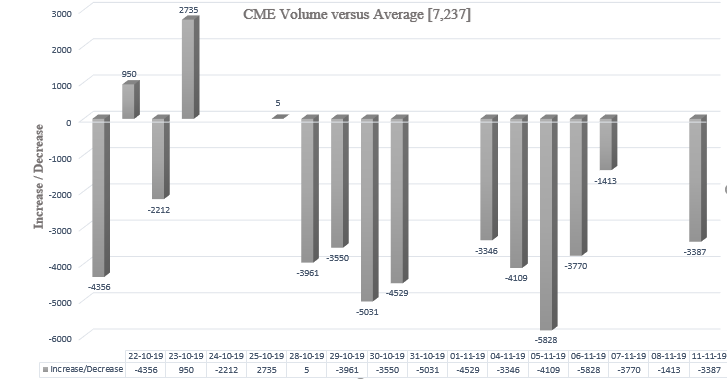

The CME Group, since the October 22 price pump began, saw dismal volumes. Daily volume, barring three occasions [October 23, 25, and 28] was below the average 7,237, mentioned by McCourt. The chart below shows the negative-volumes of CME against this average, with the aforementioned three exceptions.

The rush didn’t stop there. With reports surfacing of a crypto-crackdown in China, Bitcoin dropped to $6,900 for the first time in six months with the Bakkt volume jumping to $20.3 million, and as the price rebounded to $7,700, four days later, the volume jumped to $42 million. Since then, volume was locked between the $15 million to $30 million range.

CME saw a brunt of the move as well. On November 22, CME saw over 11,500 contracts traded, equating to $414 million based on the price of Bitcoin at the time. CoinGecko, the crypto-analytics website reported that over $20 million was traded in crypto-derivative volume. Hence, indicating that it was a collective response to volatility, not one confined to Wall Street.

New Horizon

As Bitcoin Futures seem to be the norm, even among the regulated, a new frontier of speculation will be front-and-center in 2020 – Options. Both CME and Bakkt have come out with Options trading, while the former will roll it out in January, the latter’s are already trading.

Given the like-for-like movement of the two, the derivatives market would be very interesting given this added layer of speculation. With Bakkt’s option launch making less noise than usual, CME could very-well take the cake. Edwards stated,

“We are interested to see the response to the CME options launch; things have been more quiet than we expected around the Bakkt options launch, so there may still be a chance to seize some short-term initiative back there.”

Vlad Miller, the CEO of Ethereum Express told AMBCrypto that the launch of CME’s options is one of the most “important events in 2020,” one which will cause a wave of spot-price movement as well. He added,

“This means that competition between CME and ICE in 2020 may intensify as both exchanges release their options. It would be especially interesting to see corporate hedge flows grow, led by mining companies and backed by option contracts.”

Looking to the Future

Coin or contract, that was the question posed before the cryptocurrency-community two years ago, but with the market maturing, the question was changed to coin AND contract.

Since the beginning, CME became the home of institutional trading but in 2019, its ambitions were dented by the introduction of Bakkt. While the market initially shrugged ICE’s venture off, it soon embraced it, even more than CME’s cash-settled Futures. Now it looks like the two are moving in symphony, riding the ever-volatile Bitcoin market evidenced by the commensurate volume rise-and-fall following price movements.

Given all the fanfare around derivatives, one that is measure is dollars, perspective is required. Some say the development in Futures-trading is a by-product of the overall maturation of the market, and this could pave the way for sophisticated trading, maybe even an ETF. Phemex’s Jack Tao was of this opinion,

“I think that, as an industry, we are approaching a level of sophistication and maturity which allows these new financial products to co-exist without creating unforeseen market distortions, this will most likely favour the launch of new products such as ETF and options.”

Perhaps, the more pressing question should be – is derivatives-trading diluting the principle and ethos of the cryptocurrency market? Is moving coins or contractual-coins on a centralized-exchange, CME or Bakkt for that matter contributing to the morale claims laid down in Satoshi’s whitepaper? With every high and low of the CME’s cash-settled volume, is the case for financial freedom being made? Professor Routledge concluded, with something to ponder,

“The launch aspiration of Bitcoin was to be decentralized. It turns out that most of the activity with Bitcoin seems to be in … well trading it on organized highly centralized exchanges.”

The post appeared first on AMBCrypto