Coinbase Custody clients now have the ability to use their Cosmos assets to earn rewards through staking without having to put their funds at risk.

By Bryce Ferguson, Product Manager, Coinbase Custody

Coinbase Custody was the first crypto custodian to offer staking and active governance for digital assets held in safe, offline storage. This means that our clients can earn rewards through staking activities and vote without having to put their funds at risk. We are excited to announce that we now provide clients a secure and seamless way to stake their Cosmos ($ATOM).

Cosmos is a Proof-of-Stake (PoS) blockchain designed to improve the interoperability between other blockchains. PoS assets, like Cosmos, incentivize participants to help secure the network by “staking” their assets to a validator who runs open source blockchain software in exchange for sharing in the rewards for mining blocks. Staking is an important ecosystem trend and we are committed to helping our clients get the most out of these types of assets. Coinbase Custody currently offers staking for Tezos ($XTZ) and Algorand ($ALGO).

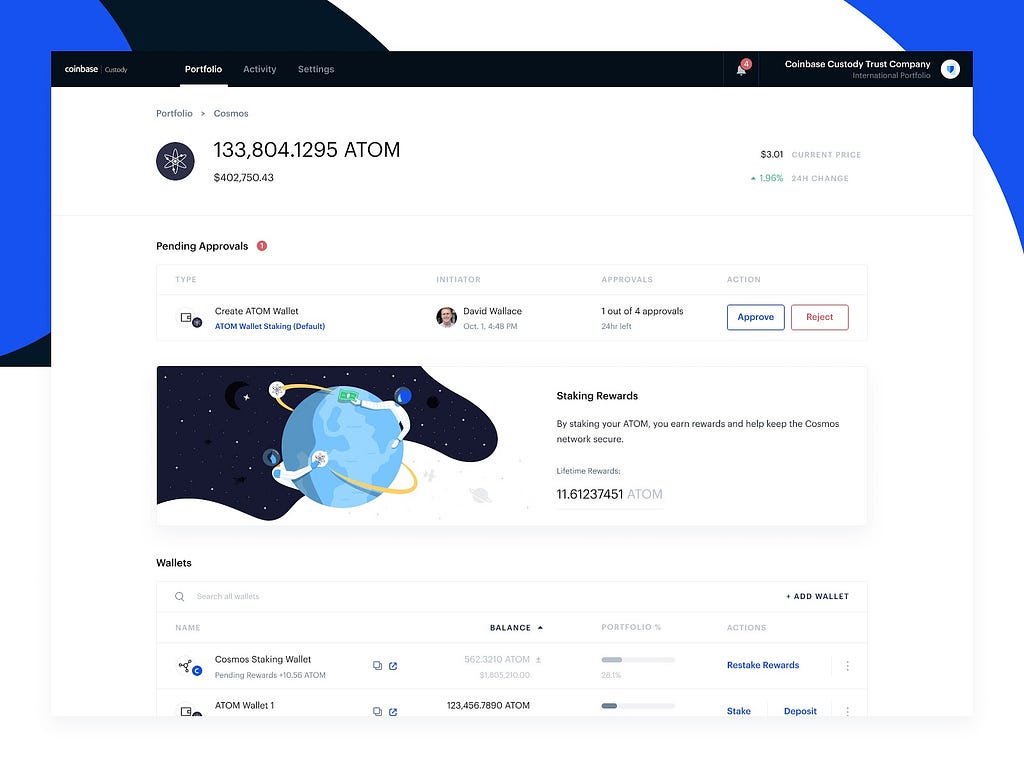

Coinbase Custody clients will now be able to log into their accounts and use our simple user interface to start staking their Cosmos assets. Clients will be able to choose how much they would like to stake and whether to delegate to Coinbase Custody or a third-party validator.

Secure staking straight from cold storage

Currently, most Cosmos staking services on the market require some level of hot storage to operate. Similar to our Tezos staking services, we have worked to ensure our Cosmos staking service leverages our existing offline storage systems. In doing so, we are able to offer clients the ability to stake their ATOMs without compromising on asset security.

Our Cosmos staking service builds on our experience successfully running a Tezos validator since April 2019. We are currently the largest Tezos validator in the world, have had zero slashing incidents, and have had an uptime of 99.99% since launch. We are applying the same controls to Cosmos staking that we use with Tezos staking.

Industry leading risk management

Assets staked to a PoS network traditionally are exposed to the risk of a “slashing” event, where if a validator breaks the rules users have to forfeit a portion of their staked tokens. This can be triggered in a variety of ways including if the validator experiences any downtime or if the validator double-signs a block. If Coinbase Custody fails to meet certain network standards and slashing occurs, Coinbase Custody will cover this risk and clients will not be impacted by any potential slashing event. Although slashing is unlikely, we want our clients to feel comfortable that in choosing our Cosmos staking service they are choosing an option that aims to mitigate risk.

To participate in Cosmos staking, simply log into your Coinbase Custody account and navigate to the ATOM asset page. To learn more about Coinbase Custody or schedule a personal demonstration of the platform, please visit custody.coinbase.com.

This article may contain links to third-party websites or other content for informational purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase Custody Trust Company, LLC or its affiliates (“Coinbase Custody”), and Coinbase Custody is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase Custody is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase Custody is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase Custody of the site or any association with its operators.

Unless otherwise provided, images herein are by Coinbase.

Coinbase Custody launches staking for Cosmos was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog