According to a report published by U.S.-based cryptocurrency exchange Coinbase on August 28, 2019, students are becoming more and more interested in digital currencies and the number of courses offered in University on blockchain technology and bitcoin (BTC) is increasing.

Crypto Education

In August 2018, Coinbase, the most popular crypto exchange, did a study on students and universities across the country in order to understand at what speed the interest in cryptocurrencies is spreading. The research, in collaboration with Qriously, aims to understand to what extent American students are aware of blockchain technology and cryptocurrencies, evaluating the number of courses focused on BTC or blockchain, how many students participate, what kind of students, and for which reason.

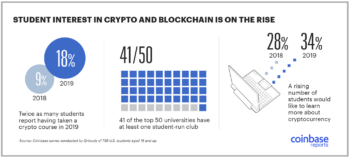

The results found in the 2019 report are even more complete than the previous year. Coinbase has analyzed the courses of the top 50 universities in the state for undergraduate and graduate-level students. The first positive information is that the number of courses offered by top global universities on crypto or blockchain increased from 42 percent in 2018 to 56 percent this year.

(Source: Coinbase)

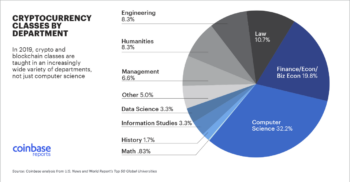

And, even though computer science classes still are the most common, accounting for 32.2 percent, blockchain technology is also being taught in very different fields such as economics, humanities, and law-school to cite some. However, to compile a ranking of the best universities in this sector, data on classes is not sufficient. Coinbase also considered all the extracurricular activities of each university such as official research initiatives and student-run crypto clubs leveraging data from Google Scholar attributions.

(Source: Coinbase)

On the podium this year we find Cornell University which offers 14 courses on cryptocurrency or blockchain and boasts a research group known as IC3, an initiative of faculty members that brings together the best researchers to move these blockchain-based solutions from today’s whiteboards and proof-of-concepts to tomorrow’s fast and reliable financial systems of execution and record.

Crypto Benefits from Distrust in the Financial System

This increased number of available courses is the result of an increase in demand from student participation. According to the report, 34 percent of the 735 U.S. students surveyed, are interested in taking a course on crypto or blockchain, compared to just 28 percent in 2018, while 18 percent declared having taken a class on the topic.

(Source: Coinbase)

This increased interest stems from the fact that students regard the current financial system as unstable and inefficient. The search for alternatives is, therefore, a natural step.

Meanwhile, interest in security and future applications of blockchain technology are falling respectively from 37 percent to 29 percent and from 31 percent to 27 percent.

Furthermore, two characteristics that have certainly contributed to this increase in interest are the fact that some courses are available online and integrate different disciplines such as “Financial Regulation in a Digital Age” taught at the National University of Singapore which clarifies students the use of blockchain in finance while also considering the regulatory issues that need to be addressed to fully leverage the potential.

Students are therefore becoming aware of this monetary revolution and are increasingly interested in advanced technologies. One of the reasons, according to Cornell Blockchain club co-founder Joseph Ferrera, might be linked with future opportunities. He states:

“If you go to a big bank or a well-established consulting firm, you kind of know what you’re going to get. With crypto you get to shape the field and become a leader.”

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4

Source: BTCManager.comThe post appeared first on XBT.MONEY