Around the Block sheds light on key trends in crypto. Written by Connor Dempsey, sourced from the work and insights from the entire team at Coinbase Ventures & Corp Dev

TLDR:

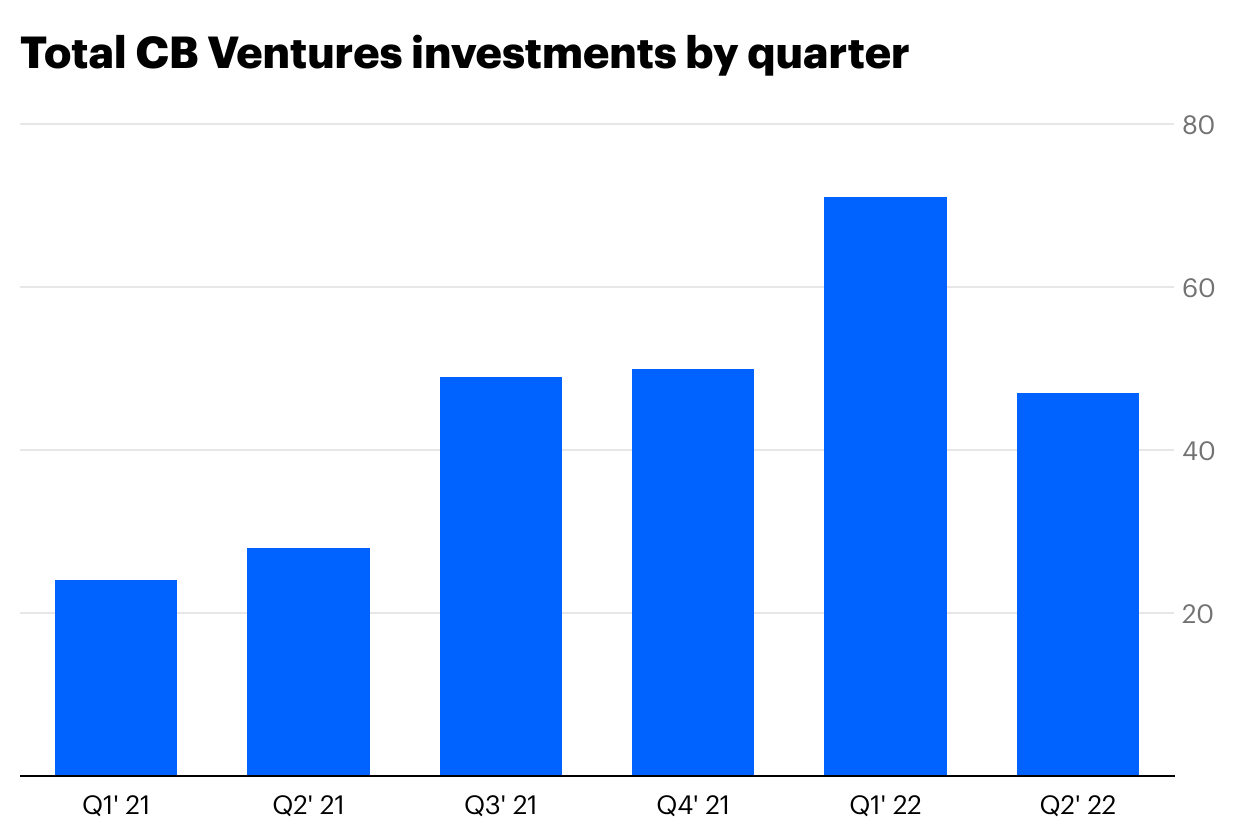

- Coinbase Ventures deal activity reflected the overall pace of the venture landscape, down 34% QoQ. Activity remained up 68% YoY, reflecting the steady growth of our venture practice over the past year

- Among the key trends observed, we believe that Web3 gaming will onboard the next massive wave of crypto users, with experienced founders from Web2 gaming continuing to pour into the space

- We’re excited about Web3 user applications working to upend the captive models of Web2 and give users control over their audiences and communities

- The Solana ecosystem continues to show impressive momentum and developer traction

- Massive UX improvements are coming to crypto that will obfuscate away complexity and deliver experiences on par with Web2

- The United States continues to be home to the bulk of companies in our portfolio, with Singapore, UK, Germany, and India all establishing impressive innovation hubs

- Where CeFi lenders faltered this year, DeFi lending platforms were resilient

- Current price action aside, we remain convinced that the opportunity within crypto and Web3 are far greater than most realize.

The first half of 2022 was turbulent for all markets. The Dow and S&P had their worst first halves since 1962 and 1970. The NASDAQ had its worst quarter since 2008. Bitcoin had its worst quarter since 2011, DeFi TVL ended down 70% from its high, and June NFT sales slumped to levels not seen in a year.

A core part of the crypto market chaos stemmed from the collapse of the $60B Terra ecosystem in May. This contributed to the implosion of a $10B crypto fund (Three Arrows Capital) that had leveraged exposure to Terra along with a few other trades that moved against them (GBTC, stETH). Next, it was revealed that Three Arrows Capital had borrowed heavily from some of the largest centralized lenders in crypto. Unable to recoup these loans, several of these lenders were forced into bankruptcy.

The macro market downturn seeped into the venture landscape as well.

Venture landscape

The broader venture market began to show signs of cooling in Q1, with total funding dropping for the first time since Q2 2019. That trend continued in Q2, with total venture funding dropping 23%, marking the largest dip in a decade. The quarter also saw later stage companies like Klarna raising down rounds; a further sign of the times.

Crypto venture funding still saw a record Q1, but as we wrote in our last letter, we’d already begun seeing signs of a slowdown that we expected to surface in Q2. Sure enough, data from John Dantoni at The Block showed that crypto venture funding dollars decreased 22%: the first down quarter in two years.

In Q2, Coinbase Ventures continued to rank among the most active investors in crypto, but also saw deal place slow, with the total count decreasing 34% QoQ, from 71 to 47. Despite the slowdown compared to the fervent pace of late 21 and Q1 22, our Q2 activity still increased 68% YoY; indicative of the overall growth of our venture practice.

The decline largely reflected the overall market conditions — with volatility in the markets, we saw many founders rethink or put their rounds on pause, particularly at the later stages. We’re seeing that many companies are foregoing a fundraise unless absolutely necessary, and even then, only if they feel confident that they can show the growth needed to justify a new round.

Gloomy macro environment aside, there are still plenty of high quality founders raising at the seed stage, where we’re most active. Looking beyond the price action at the areas that we invested in shows the range of real utility that’s continuing to be built and paints a promising picture of the future: one with a vibrant array of Web3 user applications, improved UX, robust DeFi markets, scalable L1/L2 ecosystems, and all of the tools developers need to build the next killer app.

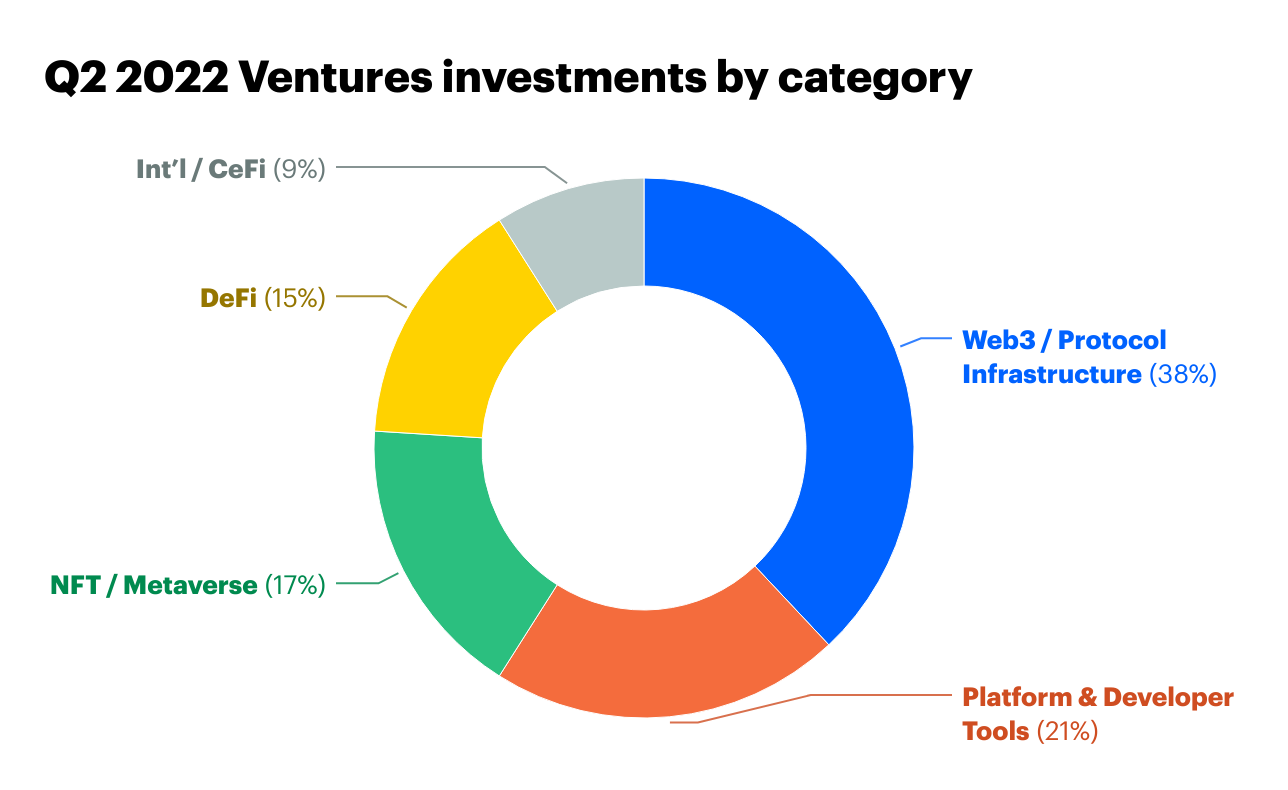

Here’s how our activity broke down over Q2.

Now, let’s look at some themes that stood out. (* denotes Coinbase Ventures portfolio company)

The coming era of blockchain gaming

With the meteoric rise and subsequent fall of Axie Infinity activity, many pundits have been gleefully quick to dismiss blockchain gaming as a passing fad. As we wrote in September, Axie was experiencing a positive feedback loop that could turn negative should the fervor driving the game die down, which is ultimately what happened. Regardless, Axie posted nearly $1B in sales in a single month and attracted 2M DAUs with essentially zero marketing budget. This put the entire gaming world on notice to the power of this new vertical.

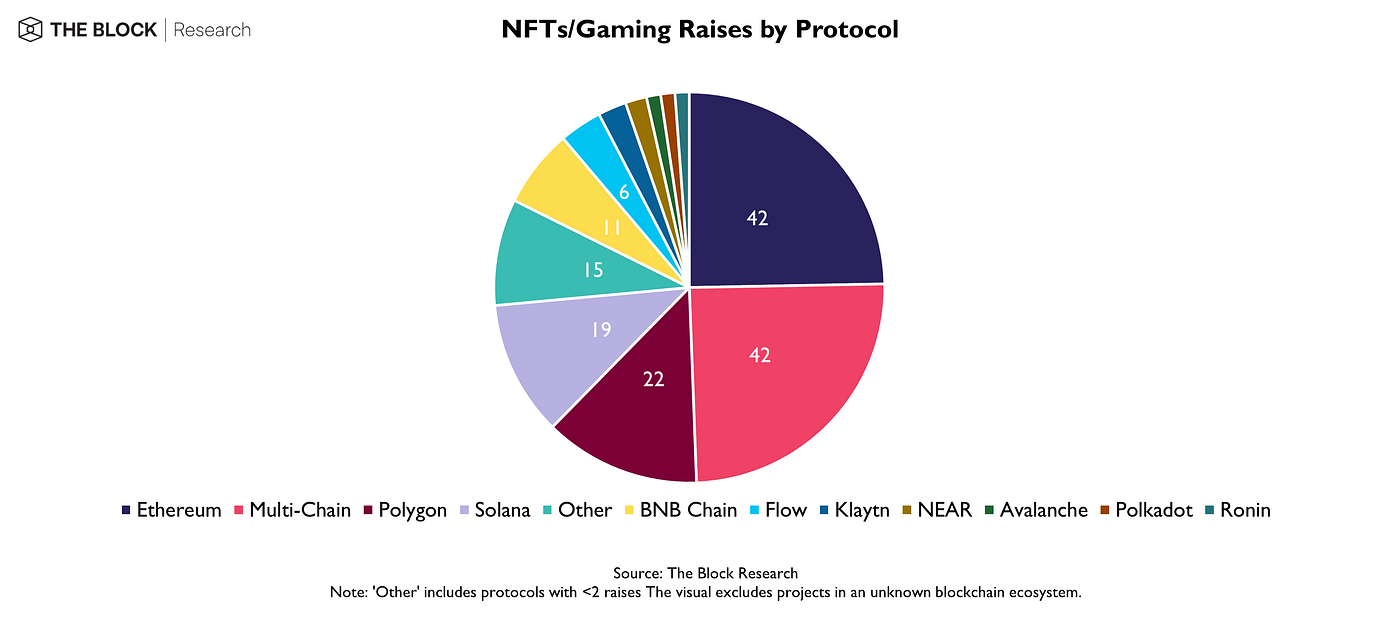

With an estimated 3.2B+ gamers in the world, we strongly believe that Web3 gaming will onboard the next massive wave of crypto users. Web3 gaming remained a sector of heavy investment in Q2, with The Block estimating that $2.6B+ was raised. Our activity over the last few quarters only strengthens our conviction.

As we saw in Q1, founders with strong track records in Web2 gaming continue to embrace this category. For example, Azra games*, was founded by the creators of the $1.4B+ mobile blockbuster Star Wars Galaxy Heroes. Their goal is to build a combat RPG game with a robust in-game economy that can still garner mainstream appeal. The space has also attracted Justin Kan, co-founder of the game streaming platform Twitch, which was sold to Amazon for $1B. Kan’s new company, Fractal*, is building a marketplace for NFT gaming assets.

Companies like Venly* will add fuel to the fire with a suite of tools that let Web2 game developers seamlessly make the leap into Web3. Established gaming powerhouses are even starting to come around, with Fortnite creator Epic Games now allowing NFT based games into its game store.

It will take some time for this sector to mature, but it’s growing increasingly clear that blockchain gaming will be a massive category in the future. Expect an increased focus on sustainable economics and gameplay that infuses NFTs with more familiar Web2 gaming experiences.

Rewiring Web2

Beyond gaming, the next generation of Web3 user applications are working to upend the captive models of Web2 and to give users control over their audiences and communities. One company we’re particularly excited about is Farcaster*: a sufficiently decentralized social network founded by Coinbase alumns Dan Romero and Varun Srinivasan. Their early product resembles Twitter, but with the key difference of letting users own the relationship with their audiences.

Farcaster is an open protocol, similar to email (SMTP). While Farcaster has built the first social app on the protocol, other developers can build competing clients, just like we have Gmail and Apple iCloud. While you can’t take your Twitter followers with you to TikTok, someone could build a TikTok equivalent on the Farcaster protocol, and Farcaster users can take their followers with them to a new, differentiated platform. Not only can users maintain better ownership of their audience, but it also opens the door for more aligned monetization. Where most advertising spend goes directly to Twitter, Instagram, etc, Farcaster users with large followings can monetize their audiences directly across platforms.

Another investment we’re excited about is Highlight.xyz*, which sits at the burgeoning intersection of Web3 and music. Highlight will let musicians create their own web3-enabled fanclubs / communities (no coding necessary), complete with token gating, access to NFT airdrops, merchandise and more. Highlight joins other CBV portcos like Audius*, Sound.xyz*, Mint Songs*, and Royal*, all offering musicians new avenues for connecting with and monetizing their fanbases.

All told, we remain excited about Web3’s potential to reimagine entrenched Web2 models for social media, music, and more, and ultimately return power to creators.

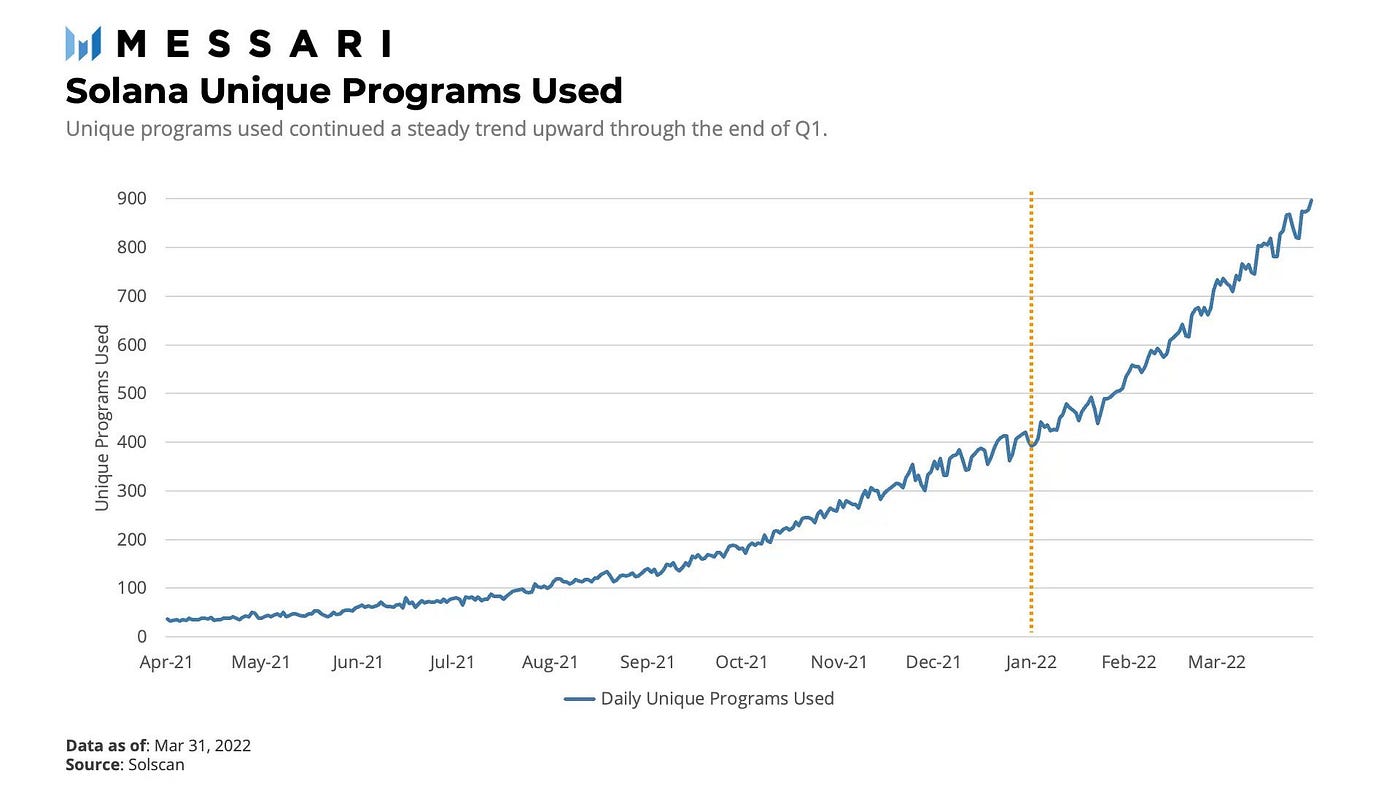

Solana sunrise

Noticeable in our Q2 activity was the continued momentum behind the Solana ecosystem. While Ethereum and the EVM remain king as far as developer traction and compatible apps, we’re noting a clear trend in early teams placing importance on Solana. All in, we did 10 deals building on Solana in Q2.

Given that Solana smart contracts are coded in Rust as opposed to the EVM’s Solidity, founding teams often choose between building in one or the other. Increasingly, we’re seeing teams opt to support both the EVM and Solana from the onset — like recent additions in Coherent and Moralis. We’ve seen others start on EVM and opt to fully transition to Solana while the above mentioned Fractal opted to build on Solana from the onset.

Add in the fact that multiple large funds have publicly expressed support for the ecosystem, and it suggests that Solana’s staying power is real. Chain liveliness however (the ability for Solana to remain online) remains an issue that is paramount for the Solana team to solve.

The UX of Everything

An overall clunky and disjointed crypto user experience has long been a hurdle for adoption. Think of what a user has to do to execute a typical transaction: convert fiat to crypto, transfer crypto to a wallet, bridge crypto to their network of choice, and then finally execute a transaction.

In Q2, we’ve invested in multiple teams (not yet announced) working on streamlining and verticalizing the entire retail transaction journey. Soon developers building in crypto and Web3 will be able to deploy the entire transaction stack with a few simple lines of code and standard set of APIs.

The end result will be a future where, for example, a user can execute a DEX transaction in a single click. In the background, fiat will be converted into crypto, moved to a wallet, bridged to an L1/L2, before executing the swap and custodying the asset in their wallet of choice. All of the complexity will be obfuscated away and we’ll have user experiences on par with Web2 — a massive unlock.

Where are the buidlers?

This quarter we took a look at where the founding teams we’ve invested in are based. While crypto is a global industry, somewhat unsurprisingly, the largest concentration of our founding teams hail from the United States — home to 64% of our 356 portfolio companies; all the more reason for regulators to foster rather than inhibit this fast growing sector.

Singapore has established itself as the base of many of the teams building in Asia. Meanwhile, the UK and Germany are home to growing hubs, with policy makers proactively working towards regulatory clarity. We continue to be impressed by founding teams in India, who we expect to play a major role in the future of crypto adoption (CBV portfolio company Frontier, with 30 engineers in India has built a wonderful mobile-first DeFi aggregator supporting 20+ chains and 45+ protocols).

This quarter, we were also excited to back five teams founded by former Coinbase employees, including the aforementioned Coherent and Farcaster, as well as three others not yet announced. We’re proud to continue to support employees who receive a world class crypto education at Coinbase and go on to found world class companies and projects.

Wrapping up

While there’s plenty to be excited about in the future, there are also plenty of lessons to be learned in the present. The current crypto crises is similar to those we’ve seen play out in traditional finance. The opaqueness that centralized lenders and Three Arrows Capital operated under resulted in an inability for lenders to properly evaluate the risk of their counterparties. Lenders didn’t know how much the others had lent to 3AC, nor did they know how much leverage and risk 3AC was taking on. Investors didn’t know how much risk they were exposed to altogether. When the market moved against both the lenders and 3AC, lenders were left with massive holes in their balance sheets, and investors were left holding the bag.

However in contrast to the centralized lenders facing insolvency, it’s important to note that blue chip DeFi lenders Aave, Compound, and MakerDAO operated without a hitch. Every loan and its terms remained transparently on-chain for all to see. When collateralization levels fell below thresholds, collateral was sold via autonomous code and lenders were paid back. This same code also dictated that Celsius was forced to pay back $400M in loans to Aave, Compound, and MakerDAO — no court order needed (though overcollaterization played a role). All told, it served as a powerful proving point for decentralized finance.

That’s just to say that it may be easy to get discouraged by the current price action while forgetting just how far we’ve come in a short period. When the last bear market hit, the most popular user application was Crypto Kitties. These days, there are more profound, impactful innovations than we can count. DeFi, NFTs, a rich DAO ecosystem, all came about in the last two years, and even came together to make a real impact on the world stage. Meanwhile, layer2 scaling solutions are finally here, and can take us from the dial-up to broadband phase, capable of supporting a rich array of user applications with simple UX to boot.

As in previous downturns, detractors are once again confidently pronouncing crypto dead. However, from our seat in the industry, we’re invigorated by the brilliant founders we see working tirelessly to move this technology forward. As the entire financial system and world digitizes itself, we remain convinced that the opportunity within crypto and Web3 are far greater than most realize.

The post appeared first on The Coinbase Blog