By Sid Coelho-Prabhu, Coinbase Wallet lead

Today we’re announcing that you can now lend out your crypto and earn interest on decentralized finance (DeFi) apps through Coinbase Wallet.

Thousands of Coinbase Wallet users have already deposited millions of dollars into DeFi apps like Compound and dYdX, earning interest at rates ranging up to 6% APR. Users currently access these apps through Wallet’s built in decentralized application (dapp) browser or via WalletLink on desktop. However, it isn’t easy to compare rates or view total balances across different providers.

With today’s announcement, we’re making it even easier to use these DeFi apps by integrating them into the Wallet experience. You can now compare different rates from providers, easily deposit your crypto without opening a web browser, and view your balances on a simple, unified dashboard.

The easiest way to earn interest on your crypto

With this new lending experience, you’re just a few taps away from putting your money to work. Pick a coin to lend, pick a smart contract, and enter the amount you wish to lend. Your crypto is then deployed directly to the smart contract to start earning interest.

Once you’ve loaned out your crypto through the DeFi app(s) you can watch your interest grow right from your Wallet app.

And you can cash out by withdrawing the crypto from the smart contract back to your Wallet.

Best of all, this feature is available to users around the world on day one. We’re rolling out on iOS this week, and Android will follow in the coming weeks.

How DeFi loans work

DeFi borrowing and lending apps are “smart contracts” or programs that run on the Ethereum blockchain.

After you deposit your crypto into the DeFi contract, the contract then loans your crypto out to borrowers who pay interest. The contract dynamically manages interest rates based on the supply and demand for loans.

DeFi loans are backed by collateral from the borrower. So, for example, if a borrower wants to borrow $50, they might need to lock up at least $100 of crypto on the blockchain as collateral first (exact requirements vary by contract).

If the borrower does not repay or if the collateral value falls below a certain level, the contract attempts to sell the collateral to recover the debt and repay lenders.

At the time of publication, you can lend out Ethereum and a variety of Ethereum-based tokens such as USDC, DAI, BAT, REP, WBTC and ZRX. Interest rates currently vary from 0.03% to 4.17% APR depending on the coin and contract you choose. Interest rates are floating and can change frequently.

Proceed with caution

Before you get started, please be aware that DeFi lending apps are relatively nascent and come with risks. DeFi apps are programs running on the blockchain, and like any computer code they can potentially have bugs that cause you to lose money. Returns are not guaranteed and your deposits are not insured.

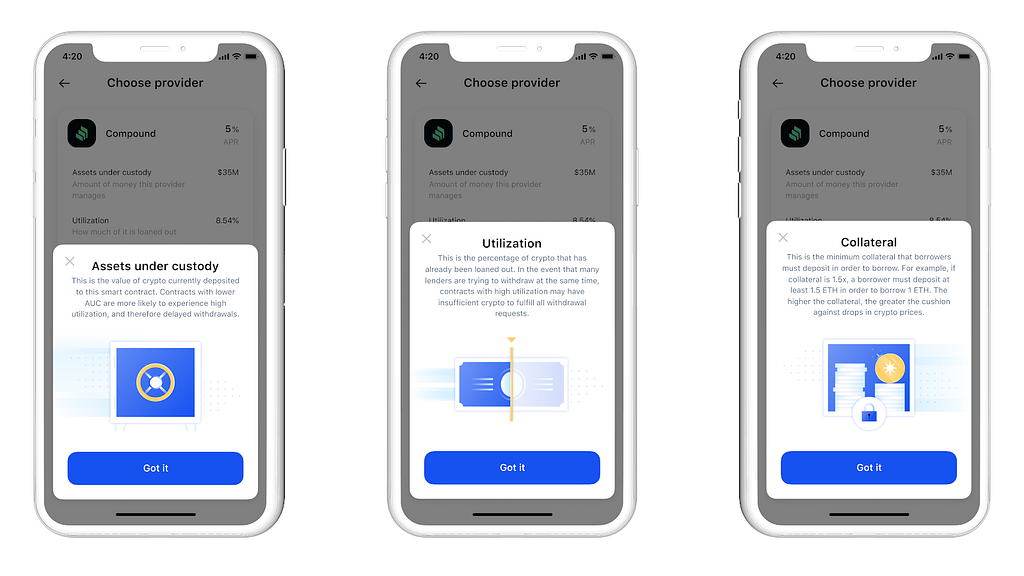

We display basic information and definitions like a contract’s Assets under Custody, Utilization, and Minimum Collateral, to help you choose between contracts. However, we suggest also doing your own research to understand how these apps work and what the risks are. And remember that Coinbase does not control these decentralized apps.

About Coinbase Wallet

The Coinbase Wallet app is Coinbase’s user-controlled cryptocurrency wallet. With Coinbase.com, you can buy crypto and Coinbase stores it (along with your private keys) for you; with Coinbase Wallet, you store your own crypto (safeguarded by a private key that only you know). Coinbase Wallet also offers a dapp browser. To learn more, visit our website.

We hope you enjoy using Coinbase Wallet. Your feedback helps us make Wallet better for everyone. You can reach us at wallet.support@coinbase.com. Please reach out with feedback or if you ever need some troubleshooting.

This website may contain links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., and its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Unless otherwise noted, all images provided herein are by Coinbase and are for illustration purposes only. Actual product may vary, including the dapps available and integrated with Coinbase Wallet.

Coinbase Wallet makes it easier to earn interest through DeFi apps was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog