Despite the growing DeFi craze in the past few months, a recent survey compiled by CoinGecko revealed that just 23% participate actively in some form of yield farming. However, many of the farmers answered that they don’t know how to read smart contracts but were enjoying high ROIs.

Yield Farming Is A Growing Trend

This year can be safely categorized as the decentralized finance (DeFi) boom. The rapid explosion of its popularity could be attributed to some extent to yield farming – the process of earning a return on capital by locking up funds with specific protocols and receiving rewards.

The popular cryptocurrency data aggregator CoinGecko conducted a survey to shed some light on users’ perspective and approach towards digital assets, the DeFi sector, and yield farming in particular.

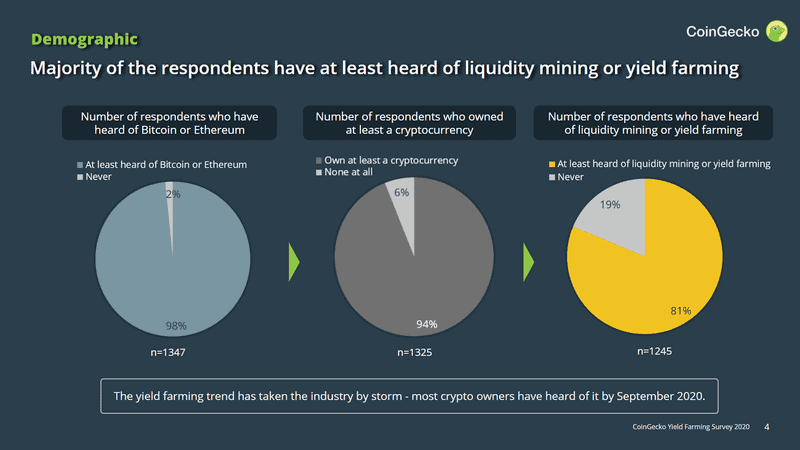

As the chart below illustrates, nearly all respondents have heard of the two largest cryptocurrencies – Bitcoin and Ethereum. 94% have purchased at least one digital asset, while 81% have heard of liquidity mining or yield farming.

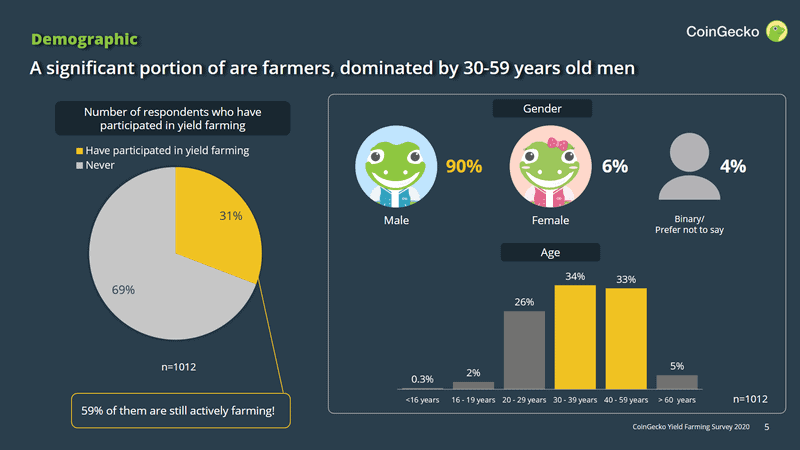

Interestingly, out of 1,347 respondents, only 23% answered that they had participated in yield farming in the past two months. According to CoinGecko, this indicated that yield farming is “still a niche but growing trend.”

The survey also demonstrated that yield farming is primarily dominated by males (90%), while females were only 6%. The remaining 4% preferred not to answer (or were binary).

Farmers Don’t Know How To Read (Smart Contracts)

The past several months displayed that the DeFi field doesn’t lack risks. Whether it was human errors or hacks, numerous protocols failed, resulting in significant losses for investors.

Most of the study participants (79%) claimed that they understand the associated risks to a “reasonable extent.” However, 40% of yield farmers answered that they don’t know how to read smart contracts, and 33%% were not aware of impermanent loss.

According to CoinGecko, these results suggested that farmers are unable to calculate their real ROIs and are “extreme risk-takers for the sake of the high returns.”

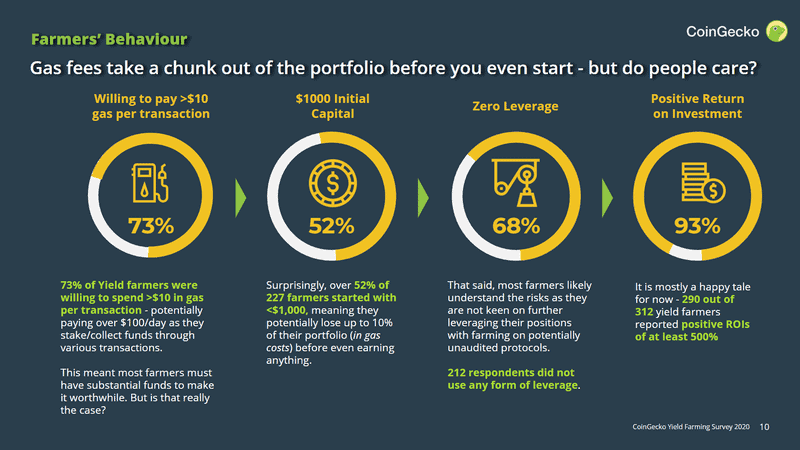

Nevertheless, 93% of respondents noted that they had massive ROIs of at least 500% from yield farming. CoinGecko commented that these results are “not a surprise find as many of the current new pools provide insanely high APY of over 1,000%. Our opinion is that these high yields offered are not sustainable as it comes with high risk.”

The large rewards for farmers mean that they don’t mind paying the higher fees on the Ethereum network. Over 70% answered that gas fees of $10 or more per transaction seemed reasonable at this point.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato