Three blockchain projects have teamed up to develop a Decentralized Finance (DeFi) savings project that allows investors to earn high-interest yields on stablecoin deposits, according to a Monday release.

Anchor Savings Protocol

Dubbed Anchor, the savings protocol is a joint venture between interoperable, scalable blockchain network Cosmos, decentralized web 3.0 blockchain interoperability network Polkadot, and decentralized stablecoin Terra.

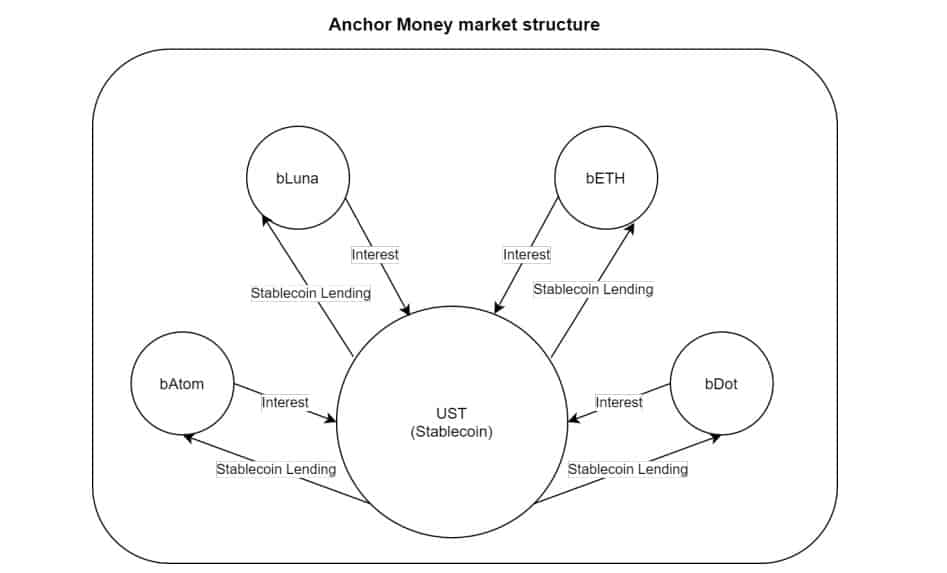

Per the announcement, the partners claim Anchor’s “high” interest rates are sustained by staking rewards generated from multiple Proof-of-Stake (PoS) blockchains in the industry.

Staking Investments

Once investors make stablecoin deposits on the platform, Anchor’s protocol uses part of the deposits to acquire staking positions across many PoS networks. The block rewards received from the staking positions are then distributed to the investors as interest for their deposits.

Unlike other DeFi protocols like Compound that have volatile annual percentage rate (APR), the creators of the project claim that Anchor’s yields are not only high but also dependable, making the platform a perfect household savings product.

Commenting on the development, Do Kwon, Terra’s founder, and CEO explained:

“While DeFi staples such as Maker and Compound have been revolutionary in creating fully decentralized crypto money markets, the volatility of their interest rates makes them unsuitable to be used as a household savings product. DeFi mass adoption needs the creation of a fully decentralized savings account that offers dependable APR.”

Anchor’s team further claims that the project’s economic model is similar to that of commercial banks where part of customers’ deposits is stored as reserves for withdrawal, while the other part is invested to generate more revenue.

Anchor plans to acquire staking positions in PoS blockchains that offer interest rates between 7% to 9% per annum, per the release. The product will debut on the Cosmos, Polkadot, and Terra blockchains by the end of Q3, 2020. The creators also intend to scale the project to other PoS ecosystems in the future.

Decentralized Governance

Anchor’s team has established a governance committee dubbed the Interchain Asset Association (IAA) to oversee the platform. The steering committee members include Do Kwon from Terraform Labs, Zaki Manian from Cosmos, and Jack Platts, an advisor at Web3 Foundation.

IAA will initially oversee the operations and development of the protocol. However, as Anchor continues to develop, decision making will be decentralized through the issuance of governance tokens to members of the ecosystem.

Manian expressed his optimism saying:

“The imminent Stargate upgrade opens the door to Interchain Economy, I look forward to working with IAA to bootstrap the fundamental economic primitives in the world interoperable blockchains.”

Platts added that “staking liquidity is an especially important problem set for Polkadot because the unboding period for staked DOTs is 28 days. Projects like Anchor that allow DOT holders to gain liquidity while staking solve a real problem and Anchor’s emphasis on mainstream adoption for this technology is the right approach.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato