The volatility index (VIX) is used to measure the implied levels of volatility in a market, and it also represents a counter index to traditional ones that track upward movements. It’s used widely by investors when assessing risks and quantifying fear.

COTI, an enterprise-grade fintech platform, has taken it upon itself to launch a decentralized version of the popular stock market VIX index. Called cVIX, it’s a first of its kind and brings certain benefits for crypto traders.

COTI’s cVIX Market Fear Index

In a press release shared with CryptoPotato, the cVIX index is intended to measure the implied level of volatility on the cryptocurrency market and provide traders and investors with an additional tool when making important entry and exit decisions.

It’s worth noting that the index will be built in a completely decentralized manner, meaning that it will run on its own and without the outside involvement or ownership of a legal entity. In addition, the newly-launched cVIX index uses Chainlink‘s architecture as well as multiple oracles to retrieve the financial information that’s required.

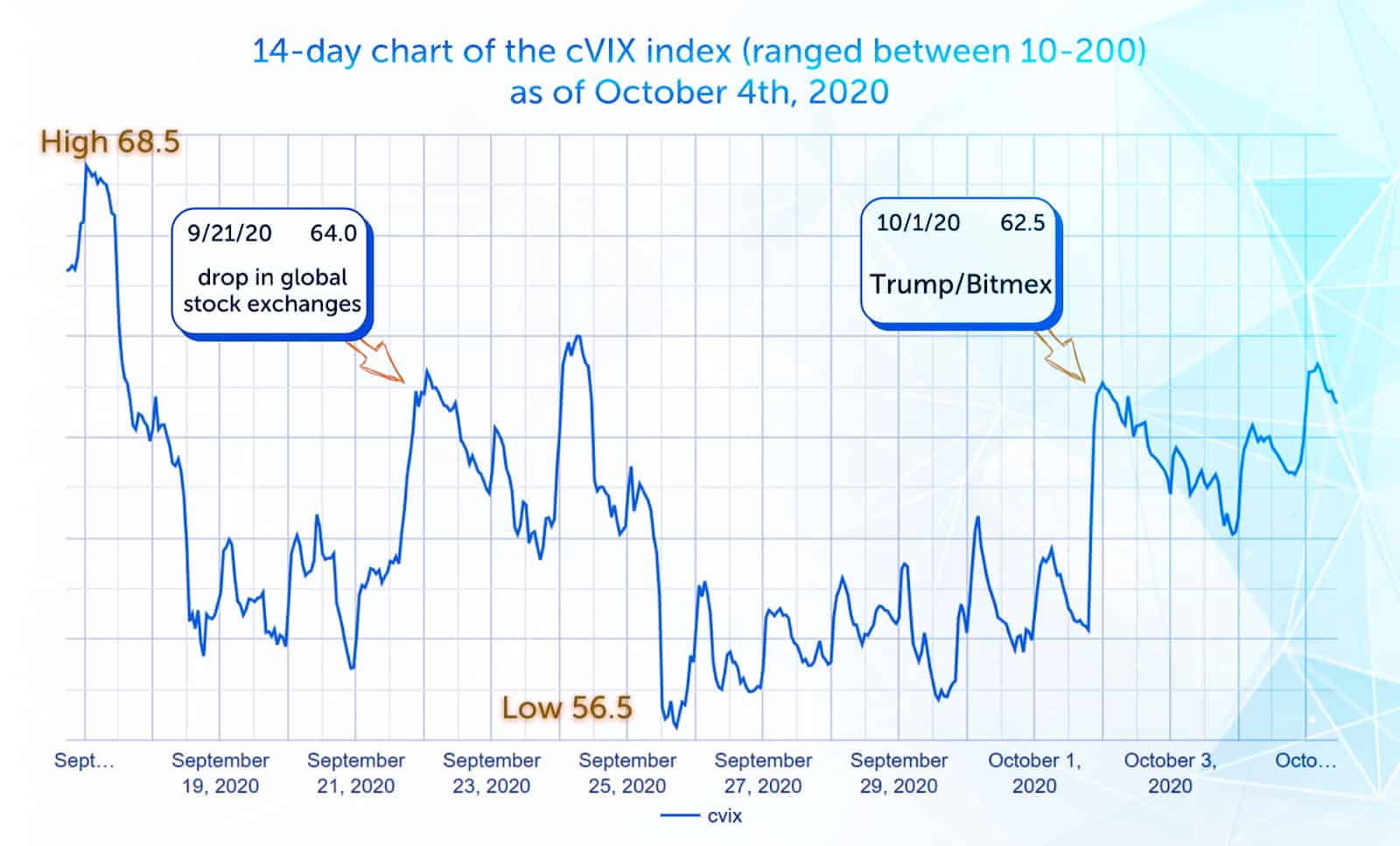

The following chart, based on a 14-day time frame, demonstrates the correlation between macroeconomic shockwaves and the index. These events include the drop in global stock exchanges that took place on September 21, the BitMEX CFTC fiasco, as well as the news about President Trump’s positive COVID-19 test.

Additional Offerings

In addition to the index, COTI will also introduce a self-adjusting and decentralized trading system that allows for a permissionless means of entering long and short positions based on the cVIX index.

Basically, traders who rely on volatility can insure themselves against market stagnation, while traders who take long positions on the index can profit in the events of high volatility.

Initially, cVIX will support deposits and trades in USDT and ETH, but the platform is expected to grow support for additional cryptocurrencies quickly in the near future. It’s also expected to fully migrate to COTI’s proprietary consensus algorithm Trustchain as it will start on Ethereum.

The post appeared first on CryptoPotato