The volatility in the crypto market has been growing and Bitcoin has broken out of its consolidation phase. This uptick in volatility may indicate a larger game at play for the future of Bitcoin.

This expectation has been in the market for a long time, even when BTC consolidated and more and more users were accumulating the digital asset. The current value has still remained under $11k, which has been the new support range visible in the BTC market. This level has been seen as a great entry point for traders, as the premium for December futures has also noted a decline.

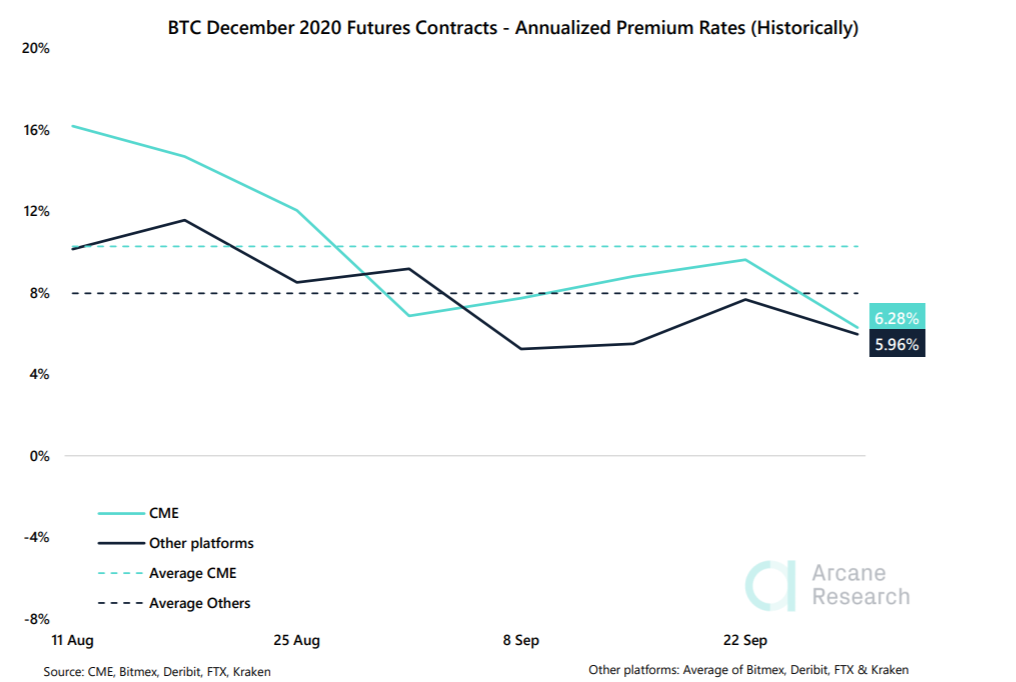

As the September expiry culminated, the focus was now shifted to the December contracts. The above chart highlighted the rise and fall in premium since August, while currently, it was noting a downwards slope. The Chicago Mercantile Exchange [CME] was still witnessing a higher premium of 6.28% compared to other retail-focused platforms. This indicated how bullish big investors have become on bitcoin relative to other traders. The faltering price of BTC has posed a perfect opportunity for these investors to enter the market, including the low premium of GBTC.

$gbtc at historically low premium to bitcoin $btc price. I’m not overly bullish #Bitcoin but added size to my gbtc long position today based off outperformance we should see in near term. pic.twitter.com/Nseejn8VCn

— Open Water Trader (@uptickcrypto) September 29, 2020

According to Financial analyst, Ian Dyer, the premium remained usually the lowest while Bitcoin consolidates and a rally is predicted. On 30 September, the premium for GBTC was the lowest at 6% which was considered to be a bullish sign in the market.

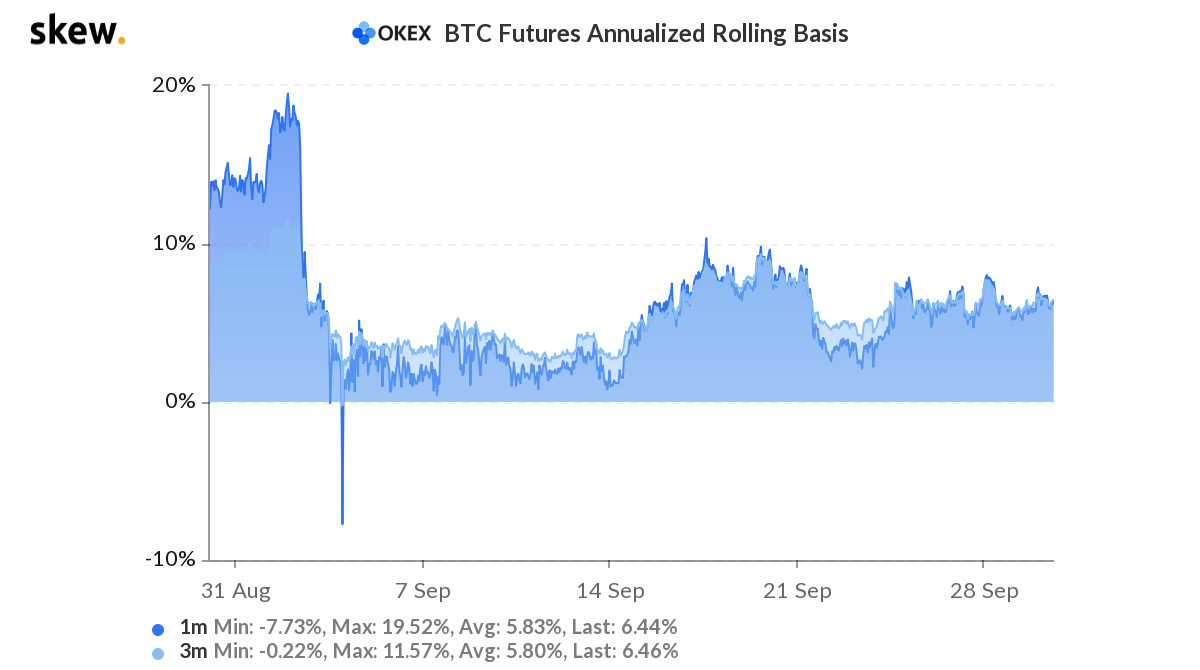

With GBTC and Bitcoin futures both recording a great entry point for traders, the December expiry will likely witness gradual changes. Currently, The annualized premium dropped to 6.44% as prices slid.

The post appeared first on AMBCrypto