Trading in the crypto markets can be a rollercoaster – your portfolio can soar to all time highs or plummet if you fail to control your risk. Success in trading isn’t about how much you make but how much you keep, as a single decision can make or break your portfolio.

One such decision comes to choosing your margin type – how do you know when to opt for cross margin or isolated margin when trading? Choosing between these two margin strategies isn’t just a matter of preference but a critical component of risk management.

In this guide, we’ll explain the two main types of margin on BitMEX and how to navigate the platform effectively. Whether you’re a seasoned trader or a beginner, understanding these basics will help you make better trading decisions and keep your risks under control in a volatile market.

TL;DR

- Margin Trading: Refers to the amount of funds needed to enter and maintain a leveraged position.

- Initial Margin: The minimum amount required to open a position.

- Maintenance Margin: The minimum amount required to keep the position from being liquidated.

- Cross Margin: Uses your entire account balance to prevent liquidation.

- Isolated Margin: Limits risk to the margin assigned to a specific position.

What is Margin Trading?

Margin refers to the amount of funds needed to enter and maintain a leveraged position. Margin trading allows you to borrow funds from a broker to purchase a larger position in an asset, which can magnify your potential gains but also increases your risk of larger losses.

There are two key types of margin:

- Initial Margin: The minimum amount required to open a position.

- Maintenance Margin: The minimum amount required to keep the position from being liquidated.

This is much like traditional finance – the broker will require you to put up a certain percentage of the total position value as your own “margin” or collateral – often around 20-50% of the total amount.

When trading crypto, an exchange like BitMEX plays a similar role. Let’s say you want to buy 100 ETH that’s trading at $10 per token. With spot trading, you’d need $1,000 to make this purchase. But with margin trading, you can put up $500 (a 50% margin) and the exchange will loan you the other $500.

Now, if ETH goes up to $12 and you sell, you’d make a $200 profit (100 x $2 gain per token). But if it drops to $8, you’d lose $200 (100 x $2 loss per token). So the potential gains and losses are amplified or “leveraged” compared to trading without margin.

The key risks are that if the value of your position declines significantly, the broker may issue a “margin call” requiring you to add more funds to your margin account to maintain the position. If you can’t meet the margin call, the exchange can close out your position to try to recoup their loaned funds.

What is Cross Margin?

Cross Margin is a margin method where your entire account balance is used to prevent liquidation on your positions. This method is helpful if you…

- Have multiple positions open with the same settlement cryptocurrency.

- Are hedging (protecting against losses) or arbitraging (taking advantage of price differences).

Key Points About Cross Margin:

- Shared Margin: Your positions can draw from your total account balance to avoid liquidation.

- Default Setting: All positions are initially set to Cross Margin.

- Realised Profit: Every ten minutes, any profit made is added to your available balance, which can then be used to cover losses or open new positions.

An Example of Using Cross Margin

Imagine you have 1 BTC in your account, and you open a long position on BTC/USD with 0.5 BTC. If the market moves against you and your position starts to lose value, your position will draw additional margin from the remaining 0.5 BTC in your account to prevent liquidation.

If you have another position that is profitable, the realised profits from that position can also be used to support the losing position, thereby reducing the risk of liquidation.

What is Isolated Margin?

Isolated Margin is a method where the margin assigned to a position is restricted to a specific amount. This means your risk is limited to the initial margin you set.

Key Points About Isolated Margin:

- Limited Liability: If your position is liquidated, only the margin assigned to that position is lost, not your entire account balance.

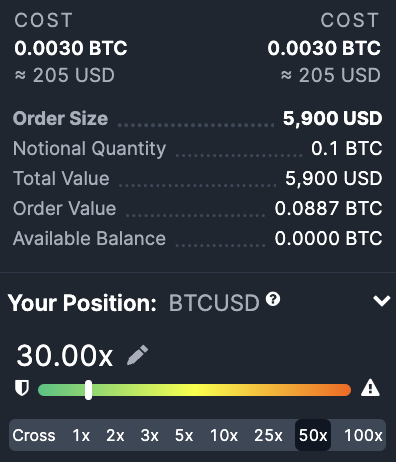

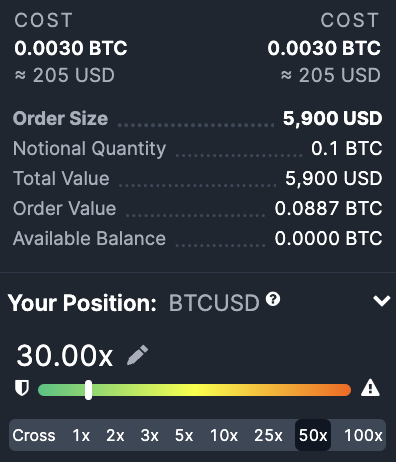

- Adjustable Leverage: You can adjust your leverage at any time using the leverage slider on the trading dashboard.

- For Speculative Trades: Useful for short-term trades where you want to limit potential losses.

Setting and Adjusting Isolated Margin:

By default, positions on BitMEX are set to Cross Margin. If you wish to switch to Isolated Margin:

- Go to the order controls panel on the left side of your Trading UI.

- Use the leverage slider to set your desired leverage.

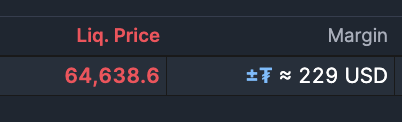

- Your liquidation price will update as you adjust your leverage, allowing you to manage your risk effectively.

An Example of Using Isolated Margin

Suppose you have 1 BTC in your account and you open a long position on BTCUSD using 0.1 BTC with 10x leverage. If the market moves against you and your position loses value, only the 0.1 BTC you assigned to this position is at risk. Even if the position gets liquidated, your remaining 0.9 BTC in the account is safe. This allows you to cap your losses to the initial margin used for that position.

A Summary of Isolated vs Cross Margin

When to Use Which Margin?

- Cross Margin: Ideal if you want to maximise the use of your total account balance and have multiple positions to manage.

- Isolated Margin: Better for speculative trades where you want to cap your potential losses.

How to Adjust Leverage and Add Margin to a Position on BitMEX

Use the Leverage Slider on your order form to adjust leverage to a desired level. Adjusting leverage will affect your liquidation price. Sliding it to the far left will move you out of Isolated Margin and back into Cross Margin.

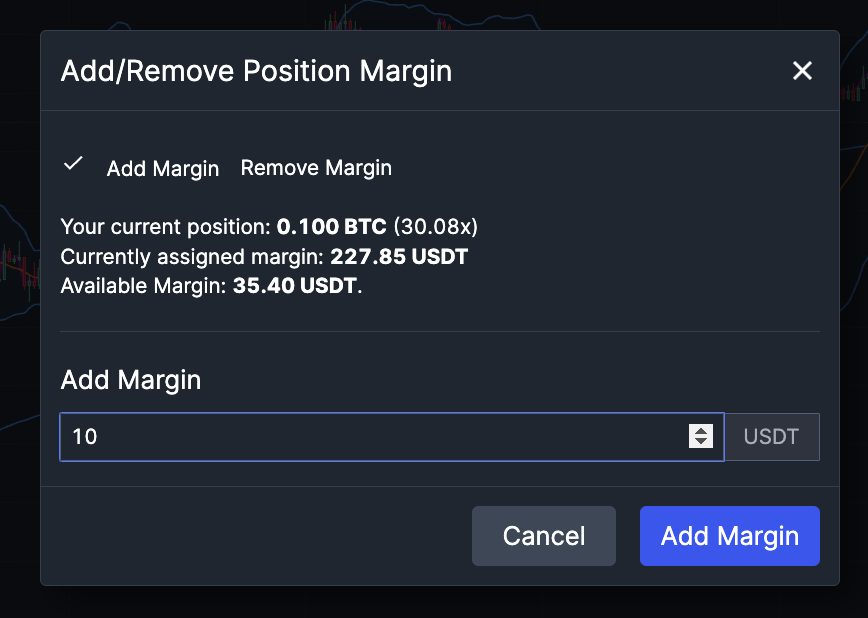

Adding Margin to an Isolated Position:

- Select the Isolated Position: Click the + increment icon next to the margin line item in the Positions List.

2. Choose Amount to Add: Select the amount of margin to add to the position.

3. Confirm: Note the new margin value, liquidation price, and leverage after confirmation.

Top Tips for Trading Crypto

- Avoid Maximum Leverage: In highly volatile markets, using maximum leverage can lead to quick liquidations. Adjust your leverage to manage risk effectively.

- Monitor Liquidation Prices: Keep an eye on your liquidation price, especially during significant market movements, to avoid unexpected liquidations.

Understanding these margin types and how to use them effectively can help you manage your trades and reduce risks on BitMEX. Ready to start trading?

Right now, we’re offering new users up to $5,000 in BMEX Tokens within their first 30 days. Check out how to get your share here.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

Related

The post appeared first on Blog BitMex