Mr. Qiao Wang, the co-founder of crypto intelligence firm Messari, Inc., said Sunday that Bitcoin’s total addressable market (TAM) might be approximately $20 trillion. If that’s the case, the Bitcoin price would surge to $1 million USD a coin. While that’s a welcome projection for Bitcoin holders, it might be a bit of a stretch. Here’s what Wang tweeted Sunday:

But to be clear, he did also qualify this tweet by saying:

This is not meant to be hopium, but a reminder that TAM is a moving target.

Now that may be so, but it’s an extraordinary way to make that reminder.

The Merits and Limits of A $1 Million Bitcoin Price Target

There is, however, some degree of usefulness in modeling Bitcoin’s prospects this way. The digital gold thesis is after all, not merely a theory cooked up by Bitcoin investors. It’s the express purpose of Bitcoin. Satoshi Nakamoto designed it specifically for the purpose of digitally simulating the properties of gold. He makes this design philosophy explicit in the 2008 Bitcoin white paper:

The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

Fixing the ultimate quantity of the coin at 21 million is also analogous to gold. But that doesn’t necessarily mean Bitcoin’s total market cap will exceed gold. It certainly could. It could even surpass gold’s market cap. But this is very broad speculation. Only if Bitcoin were to achieve global mass adoption would this be possible. And while the crypto has a lot of fantastic features that make it an excellent financial product, that level of scale is hardly a certainty.

Could The Gold Market Cap Really Triple?

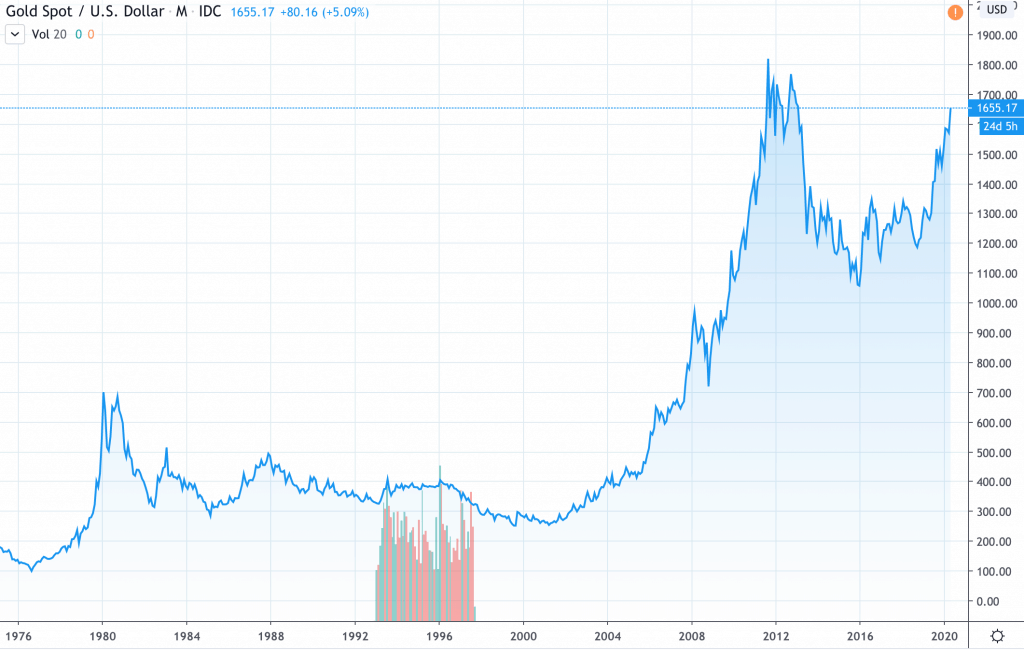

Further, this speculation on Bitcoin’s total address market rests on top of another broad speculation: that gold’s market cap will triple in price. Spot gold today is triple what it was in 2006. So it’s not at all out of the cards for gold’s market cap to triple again from today’s level. But it did take a decade and a half to make those gains. This isn’t something that happened overnight.

And as any hedge fund will caution, past performance is not necessarily indicative of future results. Just because gold did triple in price, doesn’t mean it will again. And there’s no way to be certain of such a vast macro movement over so much time. Especially in these most chaotic times of unrivaled uncertainty as the pace of technological change accelerates, these kinds of projections don’t hold much in the way of substance. But of course, Mr. Wang doesn’t intend it to.

* Disclaimer: This article is the opinion of the author and does not represent professional financial or investing advice.

The post Crypto Analyst: Digital Gold Thesis Puts Bitcoin Price At $1 Million appeared first on CryptoPotato.

The post appeared first on CryptoPotato