The novel coronavirus took the world by a storm like lightning from a clear sky. In a little more than a few months, over 200,000 people from across the globe got infected, while the death count continues to rise.

This urged governments to take immediate action, and it feels as if the whole world is under quarantine. Naturally, the fear of the unknown and how far it could go caused a lot of turmoil in the financial and stock markets.

Companies are feeling the impact of the virus as major indexes recorded losses that haven’t been seen since the 2008 Sub-Prime. The S&P 500, The Dow Jones Industrial Average (DJI), FTSE 100, Nikkei 225, and so forth, all charted massive decreases.

The situation got so bad that the United States moved to employ emergency rate cuts, bringing them down to near-zero. Moreover, the country is also considering giving away free $1,000 checks to American adults, pumping billions of dollars in the economy.

Needless to say, the cryptocurrency market felt the impact as well. Its capitalization was essentially halved, as it lost more than $150 billion in a matter of days. Bitcoin charted one of its most vicious declines of 40% in 24 hours. Every single cryptocurrency felt the impact, as most of them lost half or more of their value. And while some are recovering throughout the past couple of days, there’s still a long way to go.

With this in mind, CryptoPotato took the opportunity to reach out to some of the most influential leaders in our field. We wanted to explore how the current financial crisis is impacting crypto, across the different segments spanning from VC, exchanges, marketing companies, projects, and so forth.

Hedge Funds and VCs: Positioned Accordingly

Among those with the highest risk exposure throughout times of financial crisis are hedge funds. After all, they work to leverage the capital of their clients, and vicious slumps of the kind could spell massive troubles.

One of the well-known hedge funds in the field of cryptocurrencies is Morgan Creek Digital. It’s backed by the institutional powerhouse Morgan Creek Capital.

Morgan Creek’s Co-Founder, Anthony Pompliano (Pomp), said that they have been anticipating a market downturn since the middle of 2019 and that the response to this situation would be large rate cuts and significant quantitative easing, which proved to be the case.

According to Pompliano, “The thought has always been that those two things would happen around the same time as the Bitcoin halving, which would create an attractive situation for Bitcoin’s outlook.”

“That is what is happening now. We believe that the recent events, while incredibly painful for many people across the world, are unfolding along the lines of how we have positioned ourselves.”

Kenetic: Cautious But Optimistic

Venture capital (VC) companies are perhaps the backbone of the cryptocurrency industry. They invest money in promising projects, which, in turn, drive the entire field forward.

It’s only natural that funding during times of crisis is going to be scarce. After all, billions of dollars have been erased from the market’s capitalization as major and industry-leading projects saw their native cryptocurrencies lose half of their value.

However, leaders should learn how to build and succeed in a time of scarce funding, according to Jehan Chu, a Managing Partner at VC firm Kenetic Capital.

Chu also believes that “this will be a formative lesson that will shape the character of this generation of founders, provided they survive the downturn.” He also thinks that they will ultimately “face up to the challenge,” and the entire industry will emerge leaner and stronger.

The Big Winner? Crypto Exchanges See Peak Volume Records

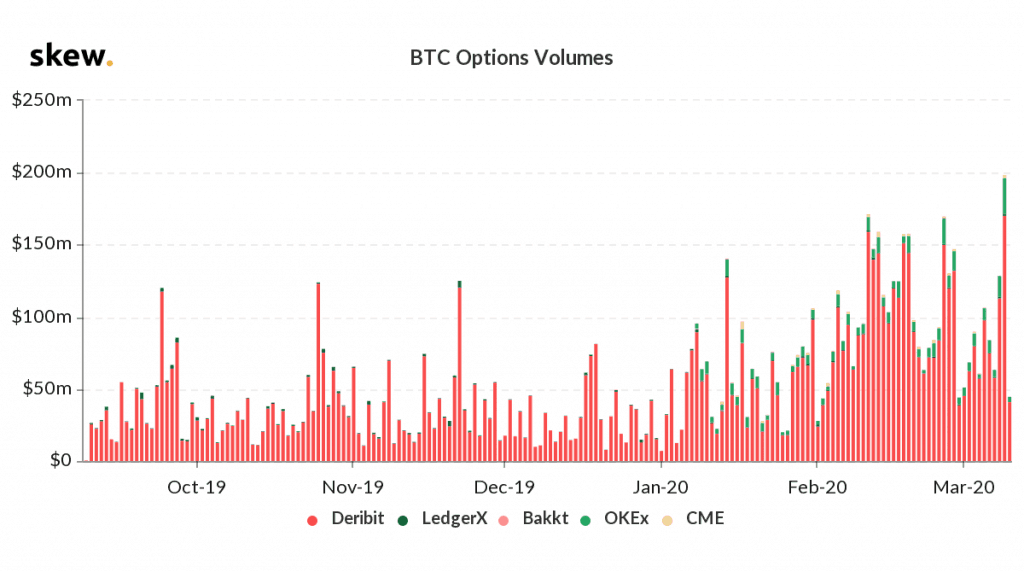

Cryptocurrency exchanges have been feeling the pressure throughout the past couple of weeks. As volatility ramps up, so does trading volume. What is more, however, the price was going down viciously, which also had an impact on the insurance funds of some of the exchanges, including Binance – the leader in this field.

Speaking on the matter was Aaron Gong, VP of Binance Futures, who said that on March 12th (when Bitcoin dropped 50% to as low as $3600) alone “the Insurance Fund lost more than 50% of its value as its USDT reserves fell from 12.8 million to 6.2 million USDT.” In response, Binance injected an additional 5 million USDT to the fund in order to protect more users from the auto-deleverage liquidations.

That’s one of the main differences between cryptocurrency exchanges and conventional ones. Traditional platforms have installed circuit breakers, which trigger trading halts during times of severe downwards volatility.

As mentioned above, traditional markets also suffered. However, when the S&P 500 fell 8% a few days ago, this triggered the circuit breakers, and the trading was halted for 15 minutes. This gives time for investors to reevaluate the situation and act accordingly.

Up until recently, no such mechanisms were available on any of the cryptocurrency exchanges and traders marked substantial losses as Bitcoin declined with 40% in a matter of hours on Friday, March 13th.

However, Huobi recently launched a new feature that acts much like the traditional Wall Street circuit breakers in order to protect its traders. Evidently, these times of crisis push for new and previously unused features in the crypto markets as well.

Marketing: Feels The Impact Both Ways

Who better to assess the damage on the market than cryptocurrency marketing agencies. After all, they deal with projects and can quickly determine whether or not the market is scared based on the marketing efforts different companies are ramping up.

“Situations like these make it easy to differentiate between experienced and inexperienced companies,” told us Elad Mor, Co-Founder of Market Across, a famous Blockchain PR agency. “Those who have been around for a while have gone through setbacks of the kind before, while rookies are in panic mode.”

“At these times it’s easy to spot the crypto veterans – the ones that have been around and are cool as a cucumber, looking for the opportunity and even launching PR and content marketing campaigns that revolve around the complicated times we’re in at the moment in light of the COVID-19 pandemic.” – According to Mor.

Conferences Cancelled and Moved Online

There’s another side of the marketing industry, though – one that has been significantly hurt. Conferences throughout the entire world have been canceled to comply with the instructions of health officials.

However, this could also create opportunities.

Erhan Korhaliller, Founder of Blockchain PR Agency EAK Digital & Istanbul Blockchain Week, shared that “health has to be the main priority for any event organizers and we remain positive that a further five months to plan the conference will only lead to a bigger and better event.”

Moreover, organizers are always looking for alternatives. As such, the people behind Istanbul Blockchain Week “decided to launch a new remote conference called BlockDown 2020 – a digital-first remote conference to turn a negative situation into a positive one. We will tackle the negative effects, head-on, and come out stronger of it.”

The Istanbul Blockchain Week is not the only conference to go virtual. The biggest annual event of the cryptocurrency ecosystem, Consensus 2020, will also turn to an online solution.

Time For Opportunities?

In any case, the world has yet to see what the extent of this virus will be and if the financial crisis will keep on with its fury.

Governments are already starting to take measures, but some fear that the COVID-19 virus has only been the pin to the corporate bubble, which has been inflated for too long.

It’s also true, though, that situations like these create life-changing opportunities for the cryptocurrency field, as a whole, to present itself in all its glory and decouple from traditional finance as a viable alternative.

The post Crypto & Coronavirus: How Is The Industry Affected By The Emerging Financial Crisis? Experts Pitch In (Exclusive) appeared first on CryptoPotato.

The post appeared first on CryptoPotato