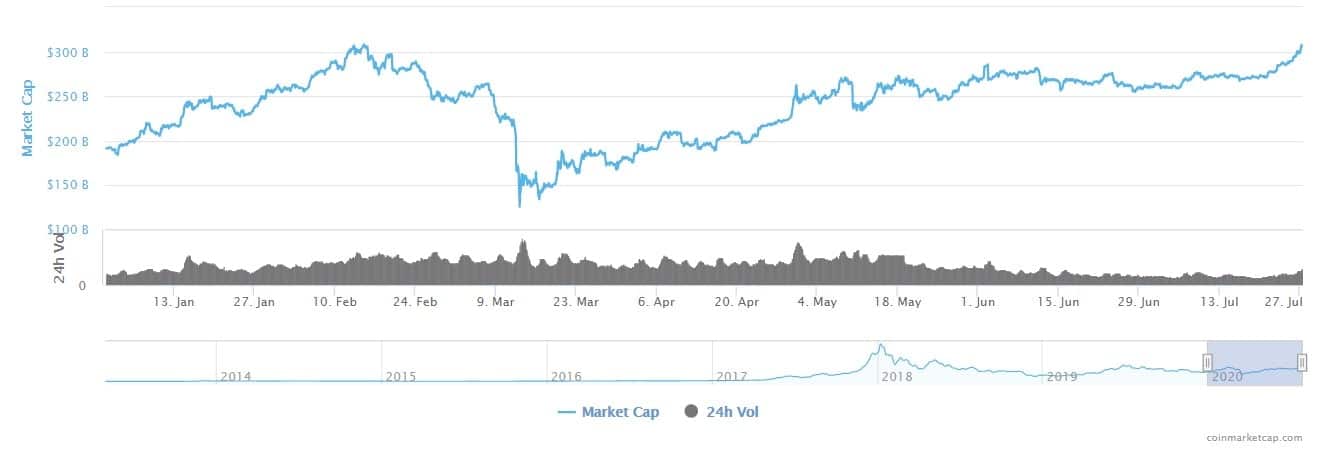

Crypto asset markets have been on fire over the weekend with a surge of $17 billion, or just under 6%, since Saturday morning. The move has lifted total market capitalization to its highest level since mid-February, and the first time it has been over $300 billion for five months.

Following a largely flat year in 2019, crypto markets recovered to a high of $308 billion by mid-February this year. A pullback occurred in the following weeks, and then Covid-19 came along, smashing crypto markets back to their winter lows again.

Ethereum In The Driving Seat

Today that has all been forgotten as a complete recovery has been made, with altcoins driving the momentum. Ethereum has been in the driving seat with a long-awaited revival that has seen prices hit $330 today.

The move has lifted the asset to its highest levels since late June 2019 when prices tapped $360 for a very short while. This level is now the next critical resistance zone, as, beyond it, Ethereum can form a new higher high, which will confirm its bull market. Momentum for the asset has been driven by the announcement that the final public testnet for ETH 2.0 will go live next week.

Bitcoin’s dwindling dominance has given rise to new calls for altseason as it drops perilously close to 60%. BTC dominance has done the inverse of total market cap, falling to its lowest level since mid-February.

Markets are now at a critical juncture where failure to break past this year’s previous high could see a more extended period of consolidation, but if things blow past it, then yes, altseason may well have just begun.

What About Bitcoin?

Despite that fall in market share, the king of crypto has made it back into the five-figure territory. Bitcoin tapped $10,340 a couple of hours ago. It is back at its June 1 spike and just below resistance, which lies at $10,500.

BTC must close above this level for the rally to be confirmed, as failure to do so could see a quick pullback into the mid $9,000 zone as day traders take quick profits off the table.

As usual, Bitcoin is likely to determine the sentiment for the rest of the market, and its next move will be critical. After months of range-bound boredom, things are finally heating up in the world of cryptocurrencies.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato