The volatility which characterizes the current market conditions, as well as Bitcoin’s relative stability in recent weeks can definitely be deceiving. Bitcoin is currently trading above $10,000 and rumors of institutional capital on the way are attracting the attention of many investors, especially in light of the news that Bakkt, the new Bitcoin futures trading platform of ICE, will be launched in September. However, there’s no significant enthusiasm among the general public and past experience proves that only a sharp rise in price drives the masses forward.

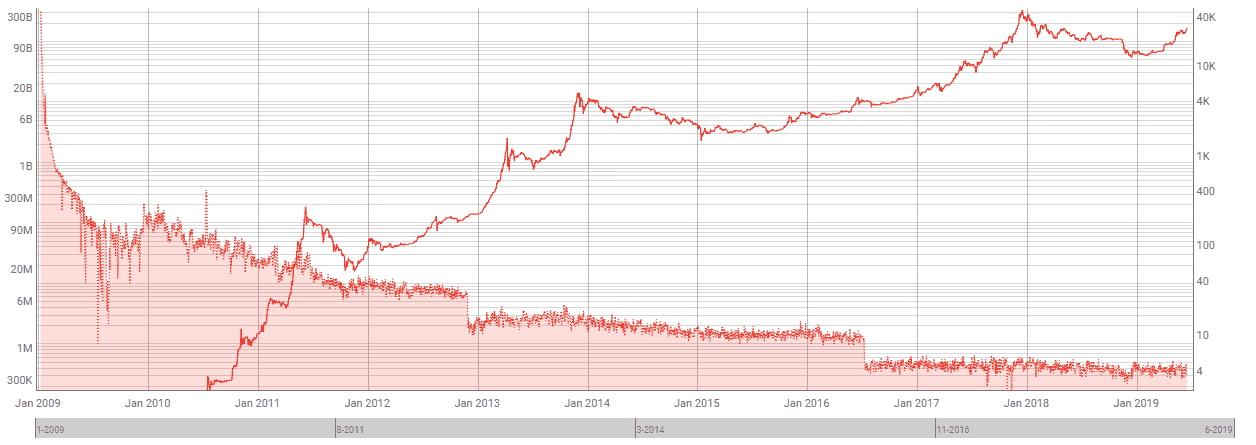

In the meantime, you can see the comparison of the value of the network against inflation in Bitcoin in a logarithmic chart:

Source: coinmetrics

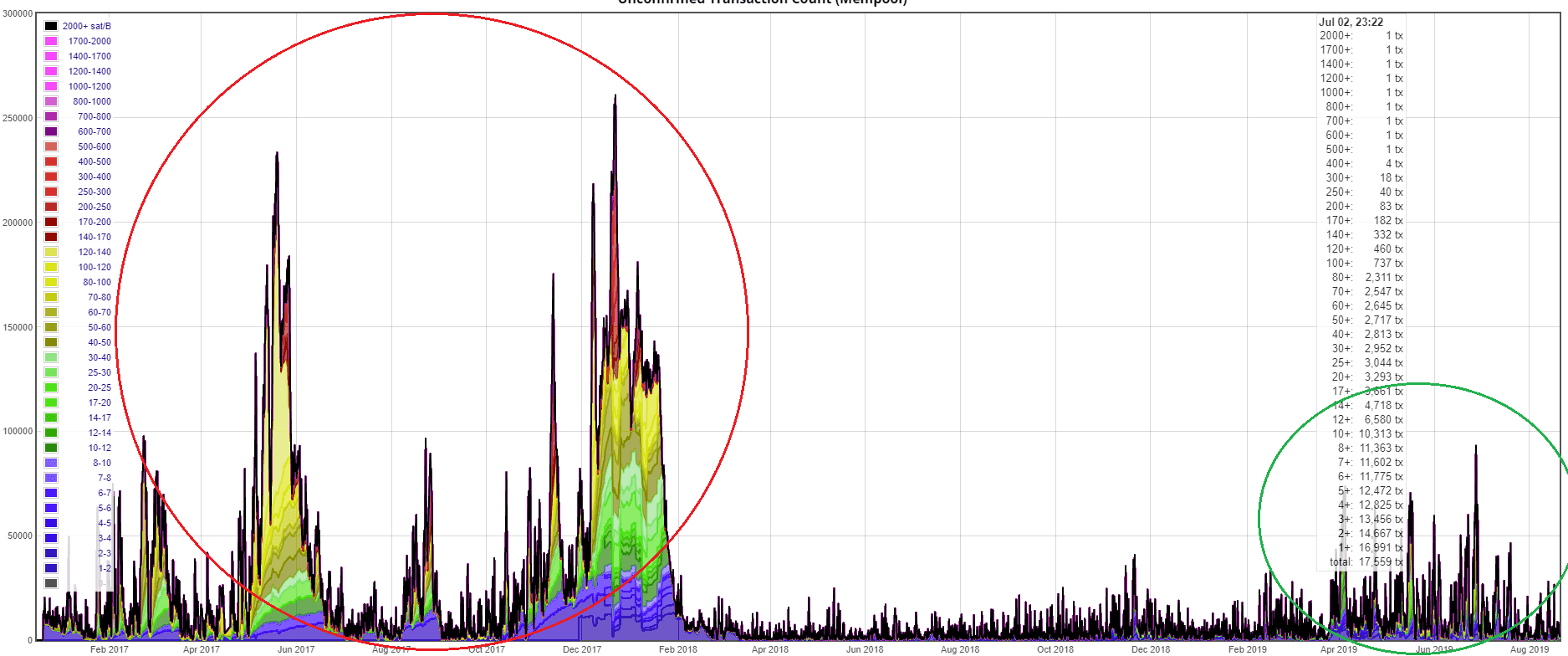

It is also interesting to note that since Segwit was implemented, the unapproved transactions that have reached the Mempool have been trending downwards.

Source: jochen-hoenicke

However, while Bitcoin’s winter is behind us, alternative currencies holders can still feel the fierce cold and see how Bitcoin’s dominance in the market and social networks overcomes all the dramas of ICOs whose names no longer go before them.

Will the Alt’s recover? And if so, who will be the last survivors on the Alt’s island? Recently, we are seeing more and more exchanges that are delisting Alt’s that do not meet regulatory requirements or whose trading volume is controlled by bots, market makers or is nonexistent at all. The Alt’s situation is definitely not in its prime, but have we hit rock-bottom yet?

Of course, the regulatory domain also brings news as New Zealand issued guidelines for payroll payments in cryptocurrencies and the IRS issued another round of letters with a request to regulate the matter as soon as possible. In addition, the New York Supreme Court ruled that the New York Attorney General has jurisdiction over Bitfinex and required the parent company, iFinex, to provide the documents previously requested.

In conclusion, the crypto market continues its maturation and continually heals itself. 2019 keeps a positive trend and it seems the industry’s most important mission is to build appropriate infrastructure and build the grounds more meaningful adoption.

Market Data

Santander UK Reportedly Halts Coinbase Payments. Well-known bank Santander UK has reportedly halted payments to the popular cryptocurrency exchange Coinbase. The decision has supposedly been made because of the increased fraud associated with the US-based exchange.

6 Reasons Why 2020 Could Be the Best Year in Bitcoin’s History. Bitcoin’s halving, the increasing amount of people comparing it to gold, Libra’s controversy, traditional inflation, mass adoption, and its scarcity are just six of the reasons for which 2020 could be the best year in Bitcoin’s history.

Bitcoin Price Surges After Bakkt Bitcoin Futures Launch Date Announced. The Intercontinental Exchange (ICE) will have its Bakkt Bitcoin futures trading platform launched on September 23rd. The news caused Bitcoin to begin a series of positive moves.

Satoshi Nakamoto “Reveal”: Yet Another PR Stunt? A press release started circulating the Internet a few days ago, claiming that Satoshi Nakamoto would reveal his identity yesterday. However, the websites mentioned have no relation to the anonymous creator of Bitcoin and were created using cheap domains just a few days ago, hinting that the whole thing is nothing but fake.

Binance to Launch Localized Stablecoins Resembling Facebook’s Libra. The world’s largest cryptocurrency exchange, Binance, is set to launch a regional version of Facebook’s Libra. The project is called Venus and it’s intended to battle the “financial hegemony” and to leverage Binance’s position as an established leader in the field.

Samsung Adds Bitcoin Support to Its Blockchain Keystore. Recently, Samsung, the South Koreain international conglomerate, announced the company’s Blockchain Keystore SDK for developers. The latest release now supports Bitcoin. This version follows the previous release which only supported ERC20-based tokens and ETH.

Israeli Bitcoiners Petition Banks to Disclose Crypto Policies. The Israeli Bitcoin Association, which is a nonprofit organization, has filed a freedom of information petition with a court in Jerusalem. It seeks to require local banks to disclose their policies on money which originates from digital currencies.

Charts

This week we’ve analyzed Bitcoin, Ethereum, Ripple, Augur, and Metal; click here for the full price analysis.

More news for you:

The post appeared first on CryptoPotato