Bitcoin

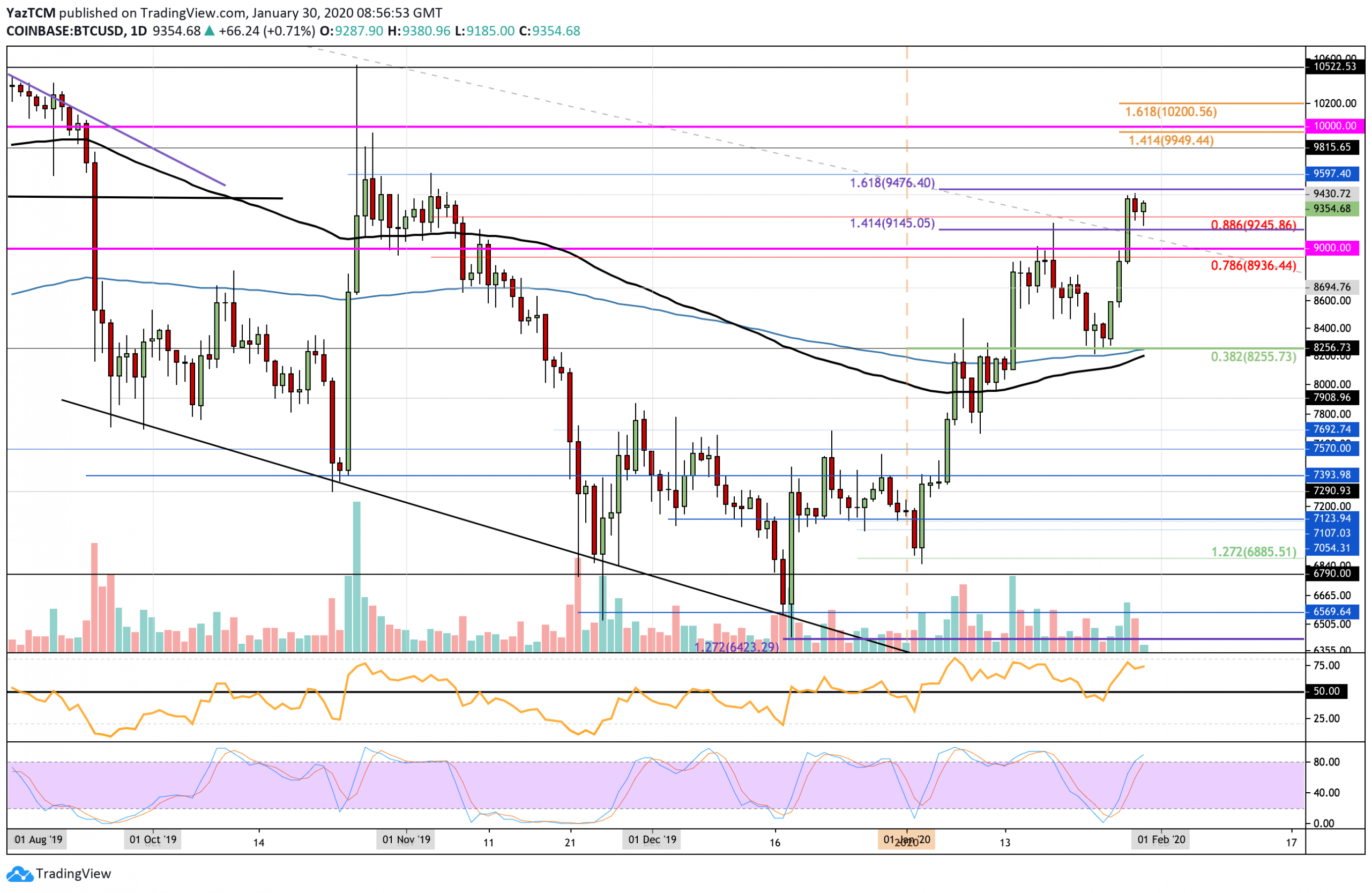

Bitcoin saw a further 10% price surge over the past week as the number 1 ranked cryptocurrency breaks above the $9,000 level. It had found major support at $8,255 (short term .382 Fib Retracement), which allowed it to rebound and climb. Bitcoin went on to rise into resistance provided by the November high at $9,430 before stalling.

If the buyers continue to drive Bitcoin higher, the first level of resistance is located at $9,476 (1.618 Fib Extension). Above this, resistance lies at $9,600, $9,800, and $10,000. On the other hand, if the sellers regroup and push BTC lower, initial support is expected at $9,250. Beneath this, support lies at $9,000, $8,700, and $8,250 (200-days EMA).

Ethereum

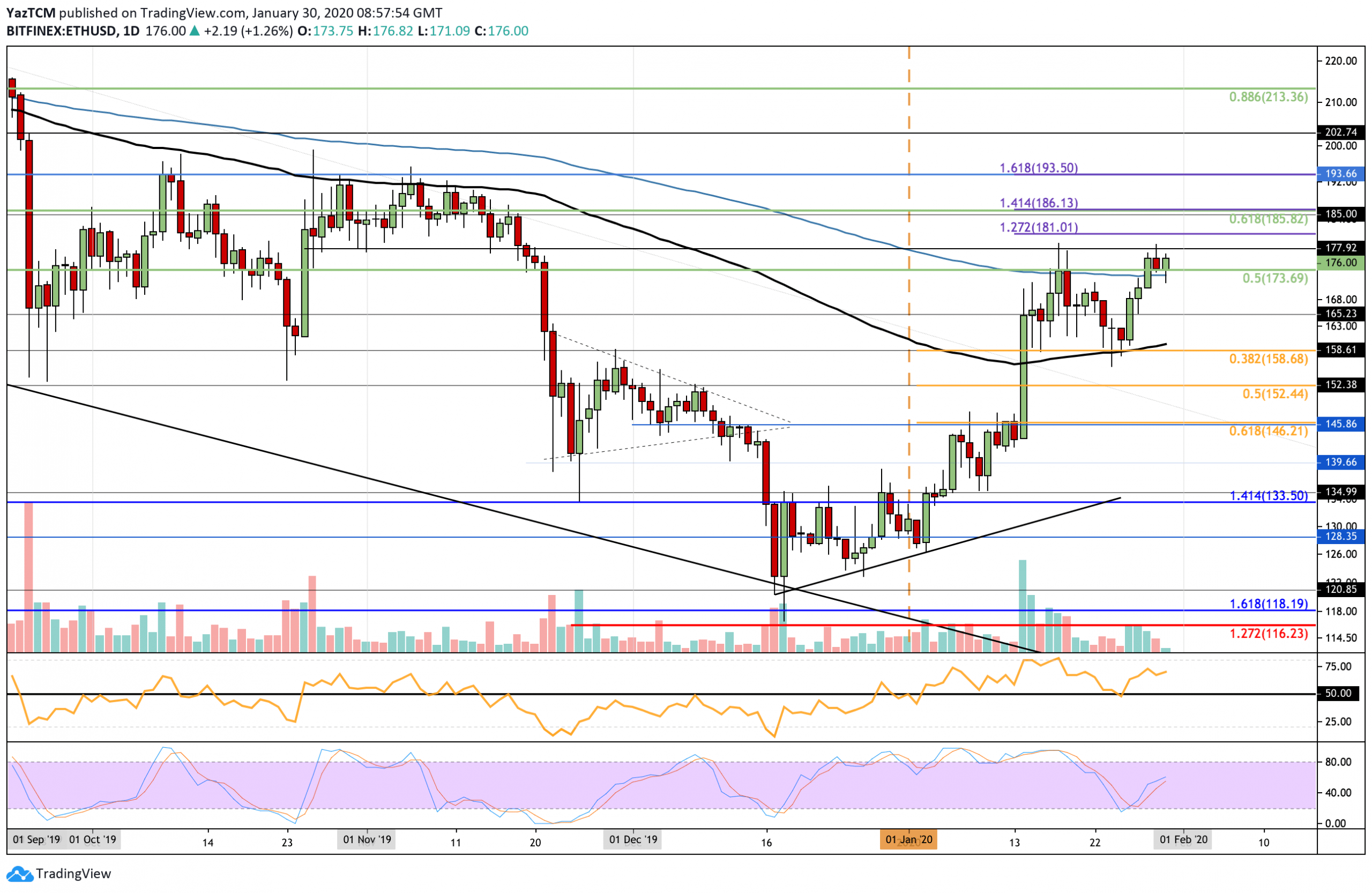

Ethereum saw an impressive 7.50% price hike this week as it returns to the January highs at $178. It managed to rebound from the support at $158 (.382 Fib Retracement & 100-days EMA), which saw it climbing higher above the 200-days EMA at $173.

Looking ahead, if the bulls continue to bring the coin above the January highs, resistance can be expected at $181. Beyond this, resistance lies at $185 (bearish .618 Fib Retracement), and $193 (1.618 Fib Extension). Alternatively, if the sellers push lower, the first level of support lies at $173 (100-days EMA). Additional support lies at $165, $159 (100-days EMA), and $152.

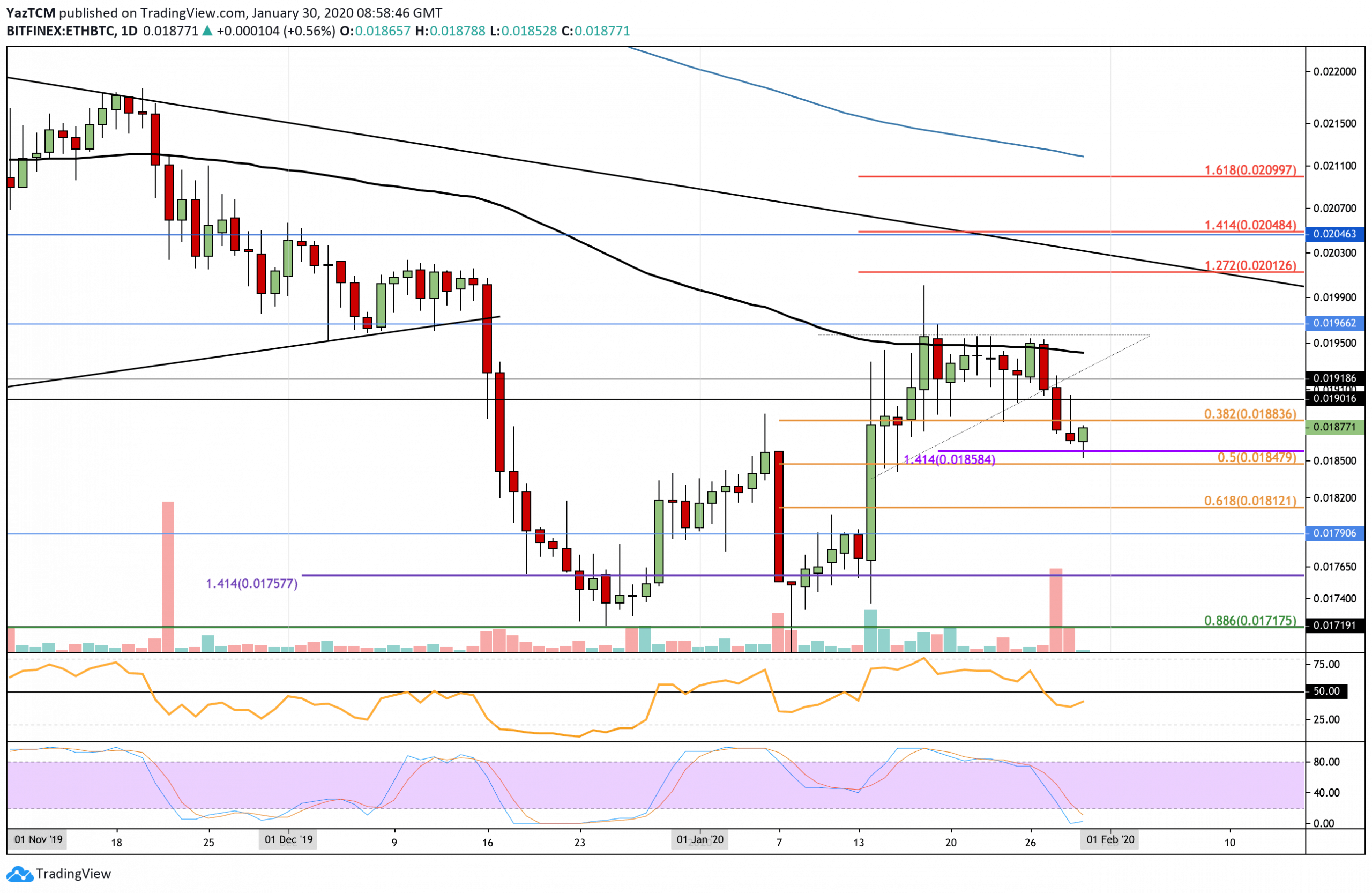

Against Bitcoin, ETH dropped by a total of 3% before finding support at 0.0185 BTC and rebounding to climb to the current price of 0.0187 BTC. ETH dropped beneath 0.0188 BTC, but the support at 0.0185 BTC has stopped it from slipping further lower this far.

If the buyers can bring ETH above 0.0188 BTC, resistance lies at 0.019 BTC, 0.0191 BTC, and 0.0195 BTC (100-days EMA). On the other hand, if the sellers push beneath 0.0185 BTC, support lies at 0.0181 BTC, 0.018 BTC, and 0.0179 BTC.

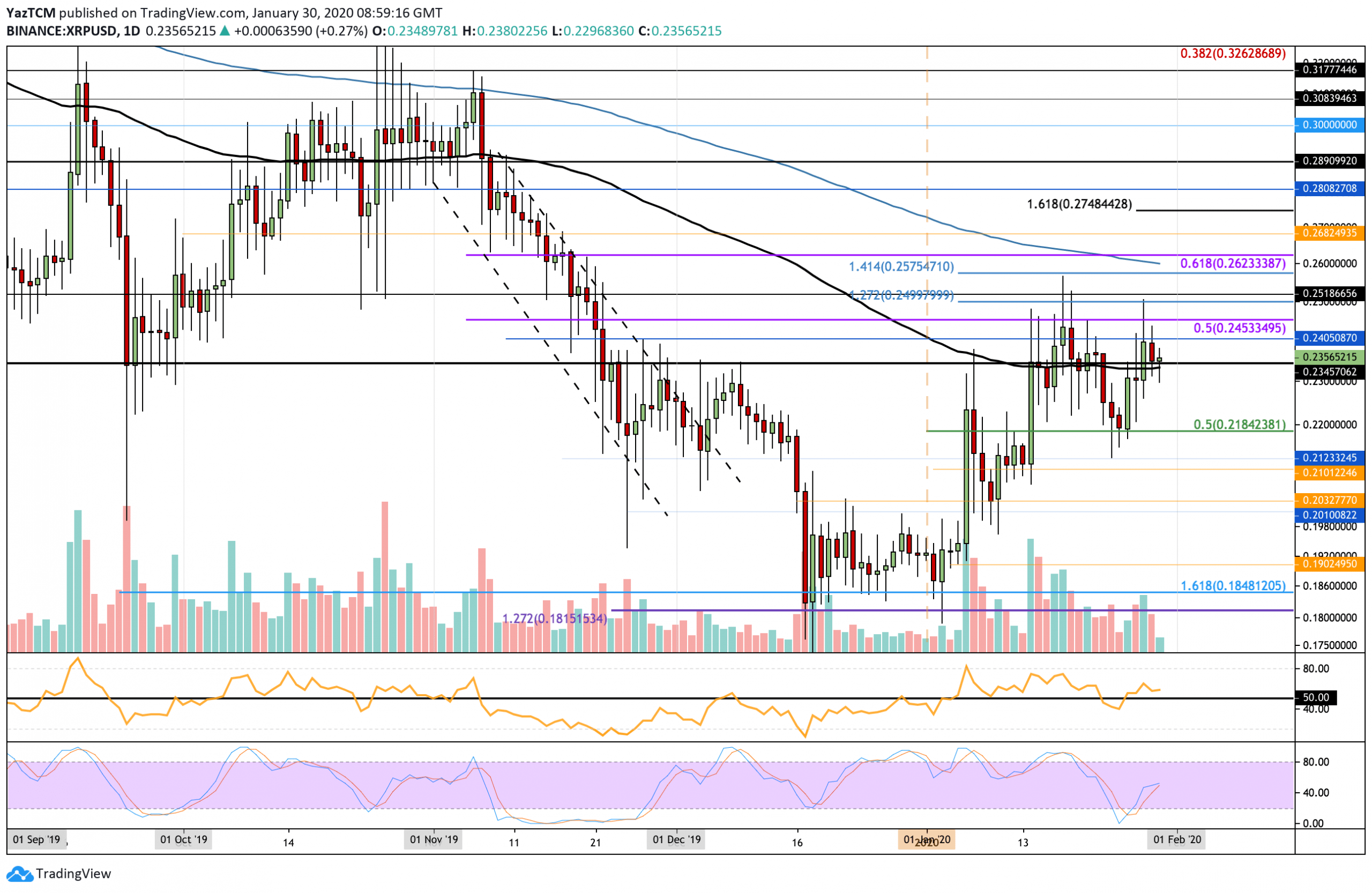

XRP saw a somewhat muted 3% price increase this week as it trades at $0.235. It held firmly at the $0.218 support (short term .5 Fib Retracement) but was unable to overcome strong resistance at $0.24. It even briefly spiked higher toward $0.25 but quickly reversed and fell.

Looking ahead, If the buyers hold $0.2345 and push higher, resistance lies at $0.24. Above this, additional resistance lies at $0.245 (bearish .5 Fib Retracement), $0.25, and $0.257. Alternatively, if the sellers push XRP beneath $0.2345, support lies at $0.218, $0.212, and $0.21.

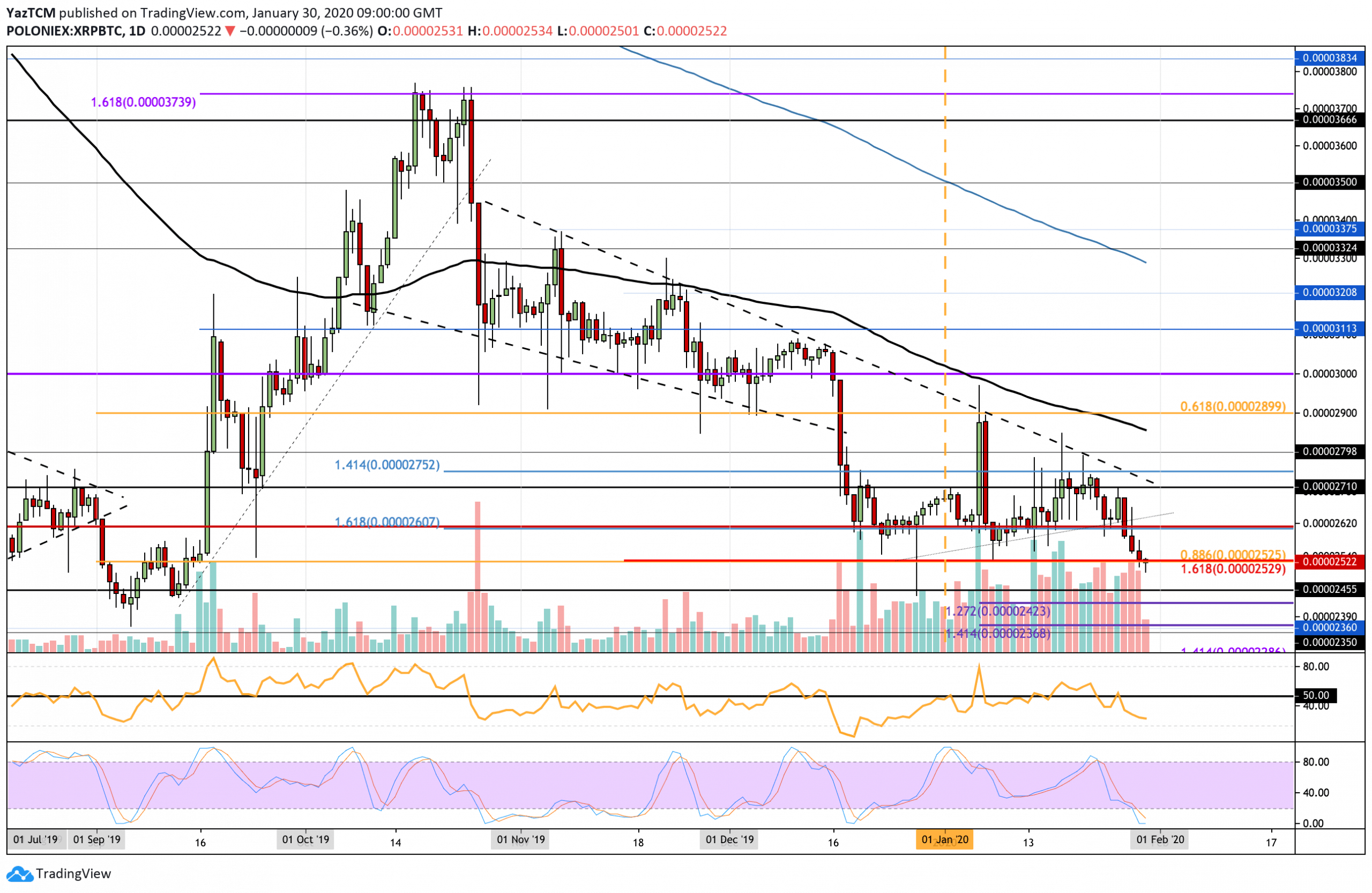

Against BTC, XRP dropped by a total of 5%, causing it to break beneath the strong support at 2600 SAT to reach 2525 SAT. XRP did spike lower today, creating a fresh 2020 low at 2500 SAT, but it quickly rebounded back above 2525 SAT.

Moving forward, if the bulls can rebound from the 2525 SAT support, resistance lies at 2600 SAT. Above this, additional resistance lies at 2710 SAT, 2750 SAT, and 2800 SAT. On the other hand, if the sellers push and close beneath 2525 SAT, support lies at 2500 SAT, 2455 SAT, and 2400 SAT.

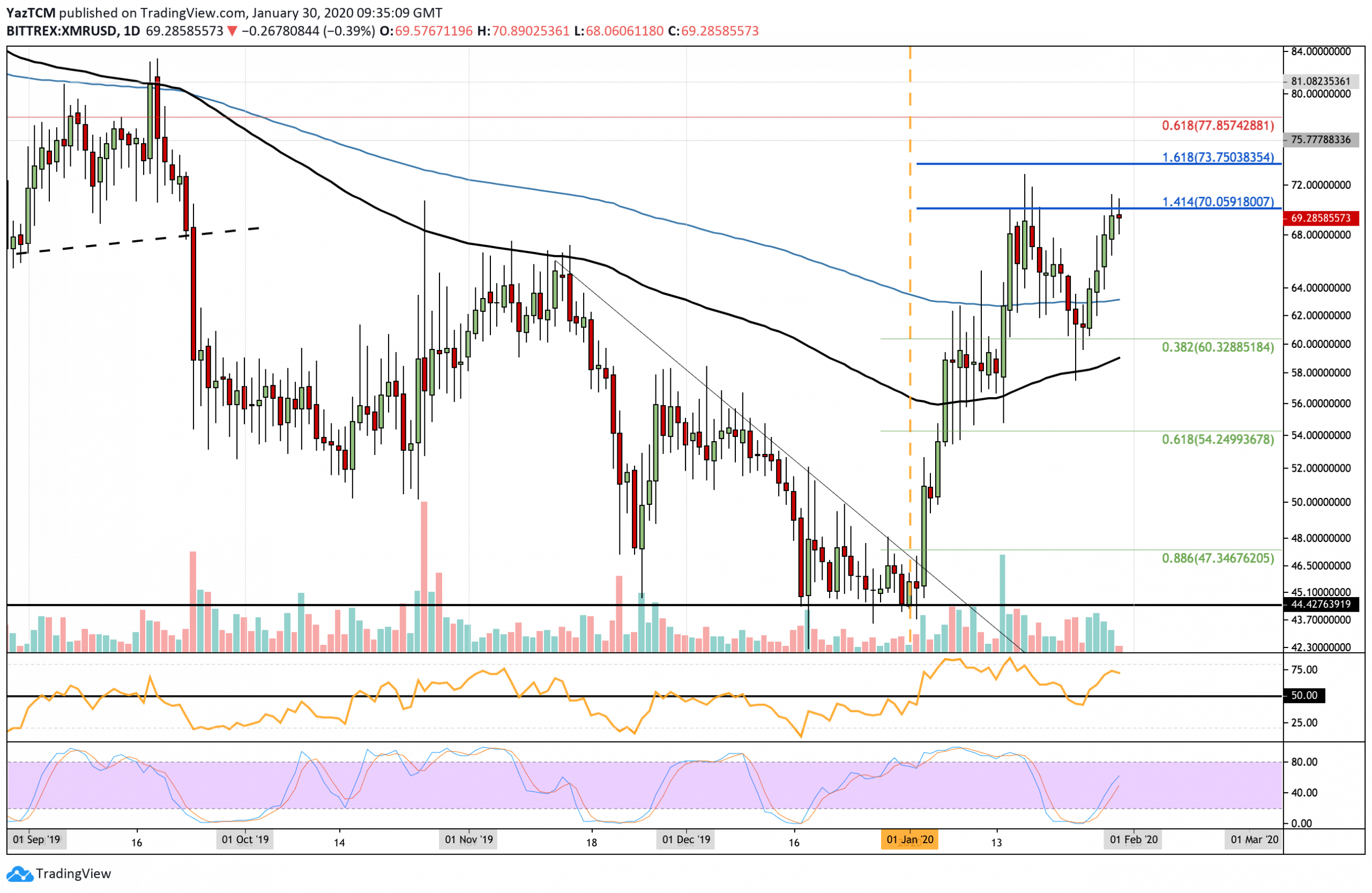

Monero saw a sharp 11% price hike over the past week as it performed better than Bitcoin. It had found support at $60 last Friday, which allowed it to rebound higher above the 200-days EMA and back into the January highs at around $70.

Looking ahead, if the bulls can bring XMR above $70, resistance is located at $73.75 (1.618 Fib Extension), $75.77, and $77.85 (long term bearish .618 Fib Retracement). Alternatively, if the sellers cause XMR to turn away from $70, support lies at $64 (200-days EMA) and $60. Beneath $60, support lies at $58 and $54.

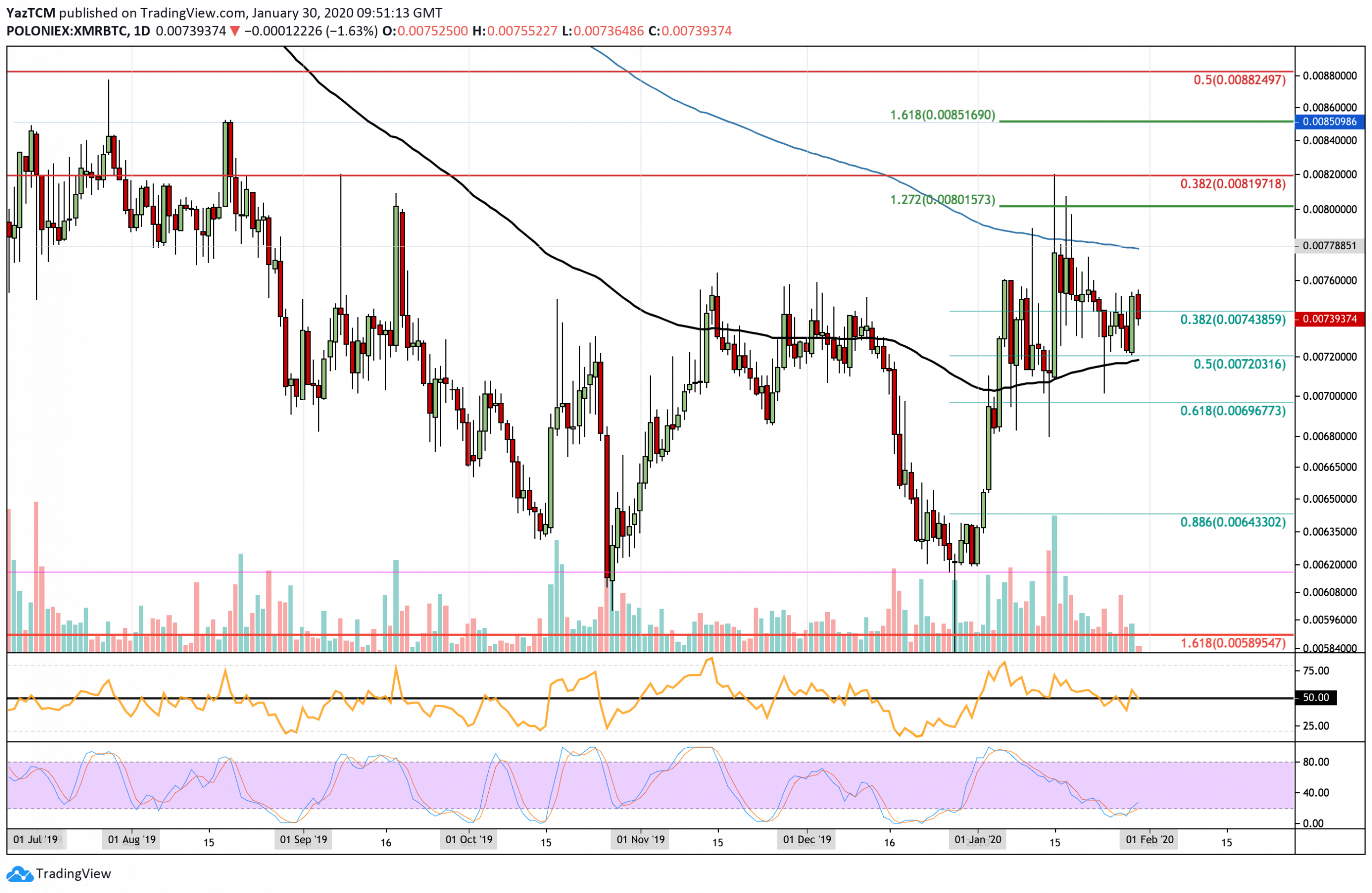

Against BTC, XMR pretty much moved sideways with a small 2% price increase on the week. The support at 0.0072 BTC allowed XMR to rebound higher to reach the current level at 0.0074 BTC. However, there is still major indecision within the market as the RSI zig-zags above and below the 50 level.

If the RSI can remain above 50 and push XMR/BTC higher, close resistance is located at 0.0076 BTC. Above this, resistance lies at 0.0077 BTC (200-days EMA) and 0.008 BTC (1.272 Fib Extension). Alternatively, if the sellers push XMR lower, support is expected at 0.0072 BTC (.5 Fib Retracement). Beneath this, additional support lies at 0.00696 BTC, 0.0068 BTC, and 0.00643 BTC.

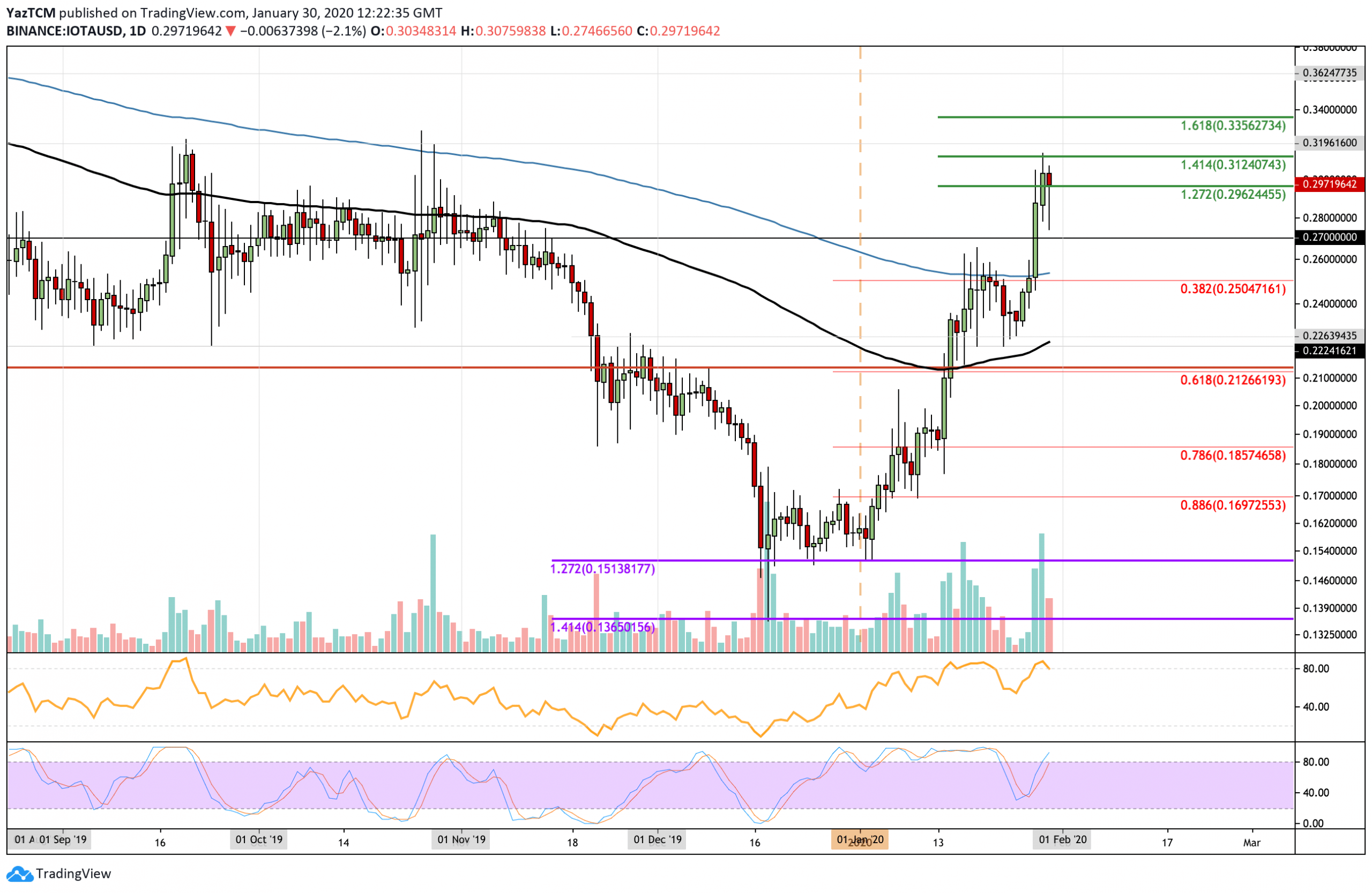

IOTA saw an extraordinary 31% price explosion this last week, bringing the price for the coin up to $0.297. It had climbed as high as $0.31 but ran into resistance provided by a 1.414 Fib Extension, causing it to roll over and fall slightly. This latest price move brings the total monthly price increase up to 86% for IOTA.

Looking ahead, if the bulls continue to climb higher from $0.297, resistance lies at $0.312 and $0.32. Above this, additional resistance lies at $0.335 (1.618 fib Extension) and $0.362. Alternatively, if the sellers push IOTA beneath $0.296, support lies at $0.27, $0.25 (200-days EMA), and $0.22 (100-days EMA).

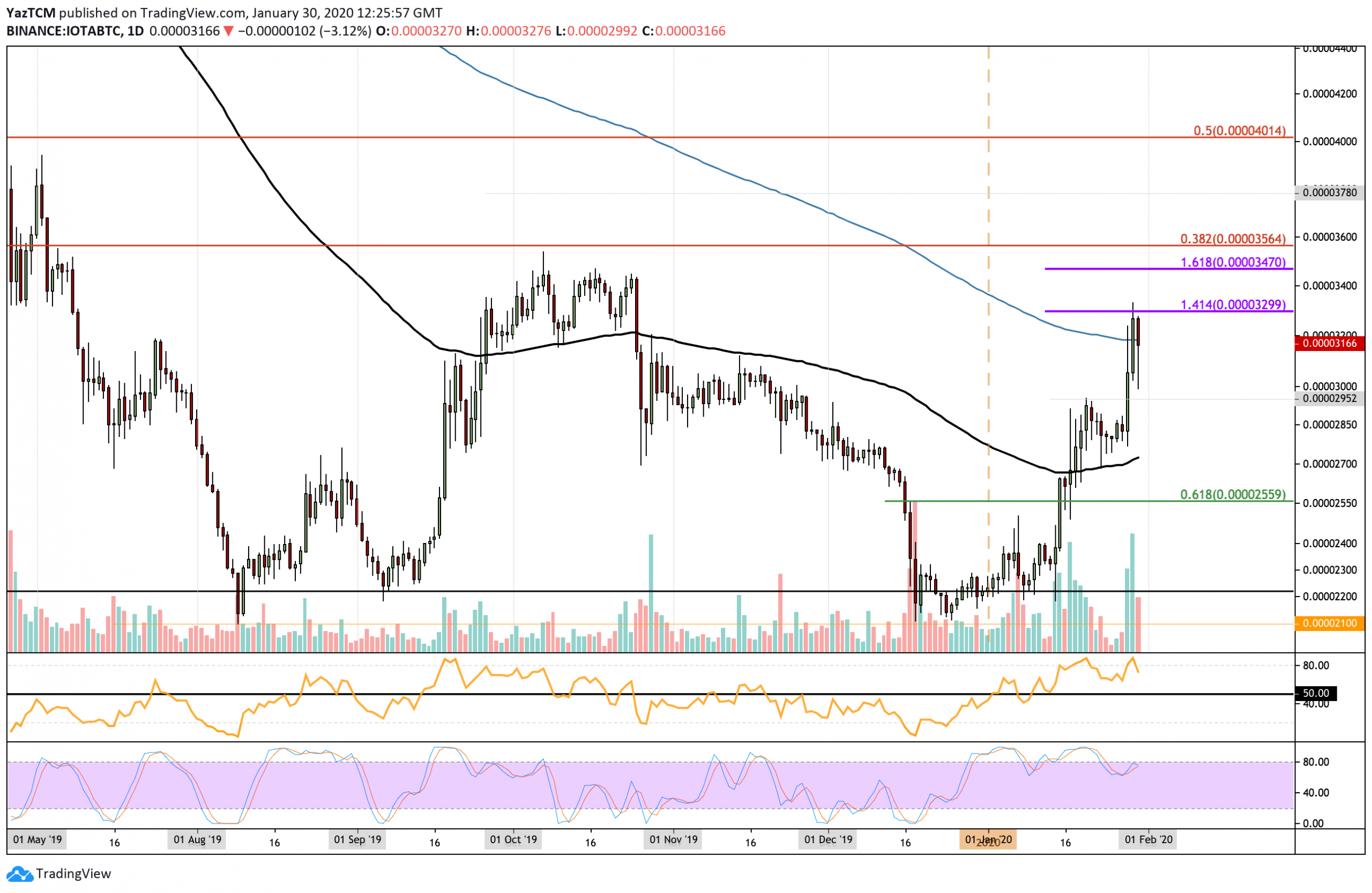

Against BTC, IOTA surged into resistance at 3300 SAT – breaking above the 200-days EMA where it has currently found support. IOTA has now increased by a total of 43% against BTC in January alone.

Looking ahead, if the bulls bring IOTA above the 3300 SAT level, resistance lies at 3470 SAT, 3564 SAT (bearish .382 Fib Retracement), and 3780 SAT. On the other hand, if the sellers push beneath the 200-days EMA, support lies at 3000 SAT, 2700 SAT (100-days EMA), and 2560 SAT (.618 Fib Retracement).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato