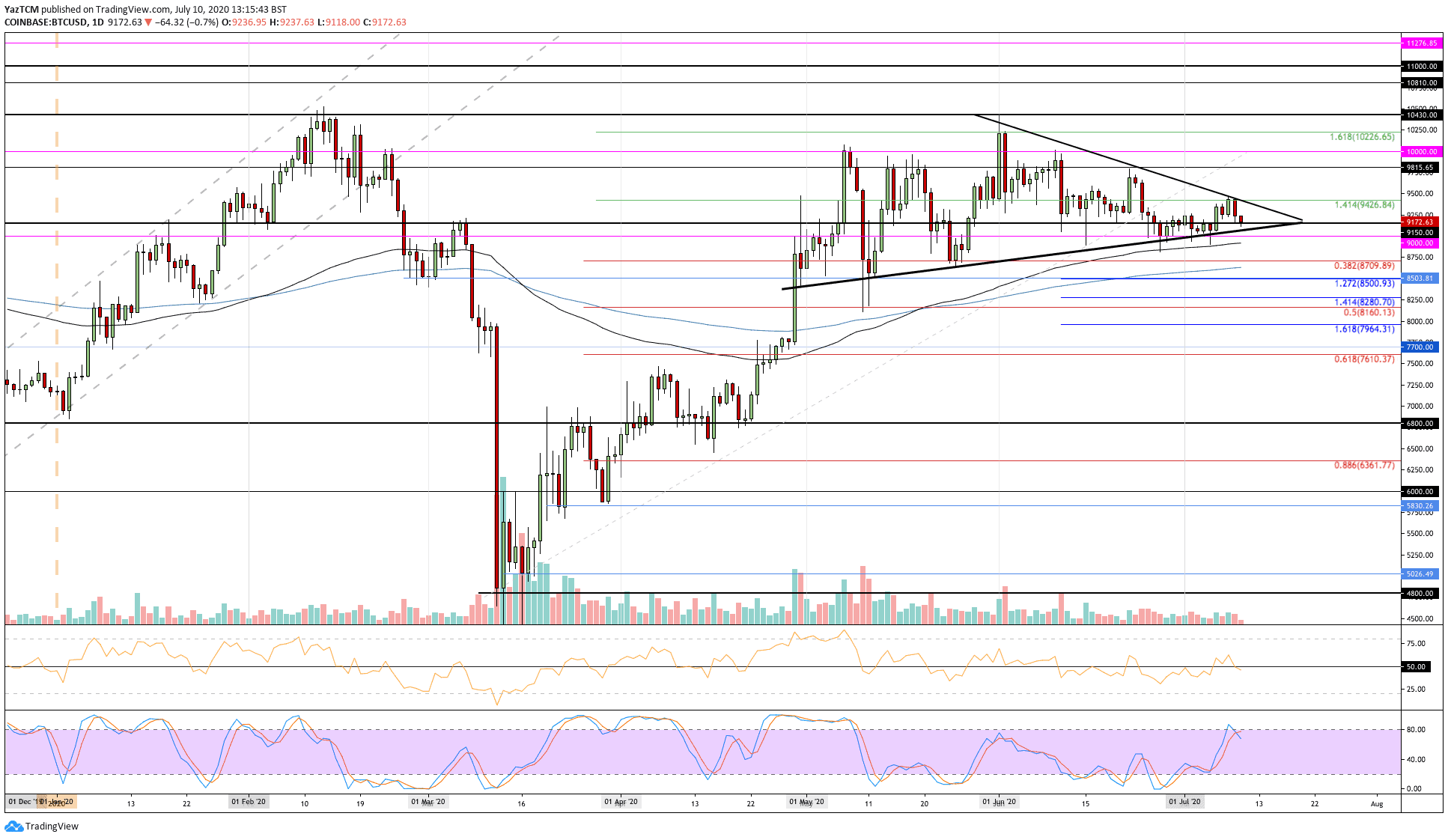

Bitcoin

Bitcoin saw a small 1% increase this week as it continued to trade sideways within the confines of a symmetrical triangle pattern. BTC has been trapped within this triangle since the start of June 2020, and a breakout will dictate the next direction.

Looking ahead, if the buyers can rebound from the lower boundary of the triangle and push above the upper boundary, the first level of resistance will be located at $9,815. This is followed by additional resistance at $10,000, $10,226, and $10,430 (2020 high).

On the other side, if the sellers push beneath the triangle, the first level of support is found at $8,900 (100-day EMA). Beneath this, added support lies at $8,700 (.382 Fib Retracement) and $8,500 (downside 1.272 Fib Extension).

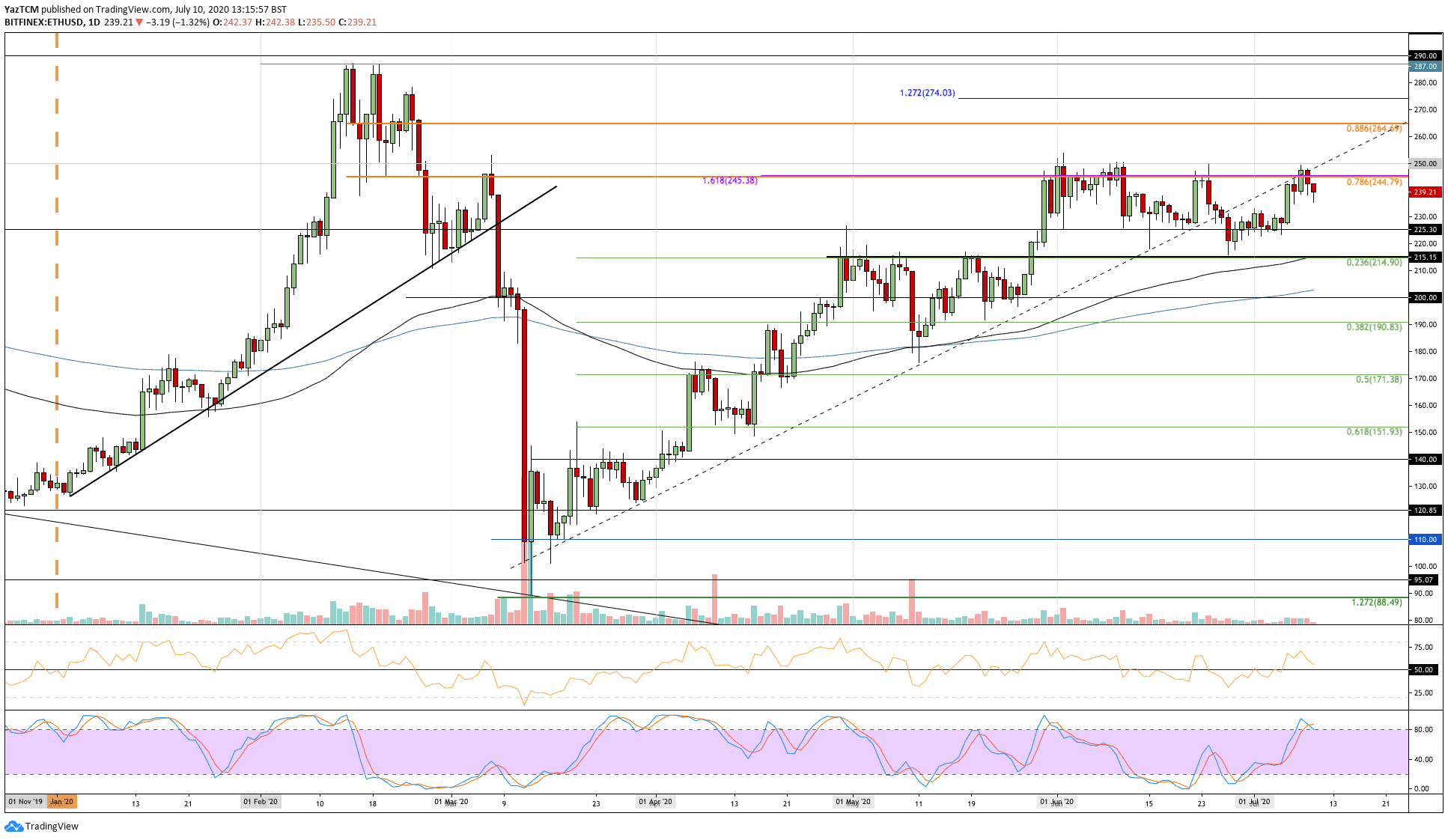

Ethereum

Ethereum saw a 5.3% surge this week as the coin climbed toward the $240 level. ETH started the week off by rebounding from the support at $225 as it pushed higher into the resistance marginally beneath $250. From there, ETH fell lower into the $240 level. A break above $250 is likely to cause it to start another bullish run toward the 2020 high at $287.

Moving forward, the first level of resistance to pass is $250. Above this, added resistance is found at $265 (bearish .886 Fib Retracement), $275, and $287 (2020 high).

On the other side, if the sellers push lower, the first level of strong support lies at $225. Beneath this, added support is found at $215 (.236 Fib Retracement & 100-day EMA), and $200 (200-day EMA).

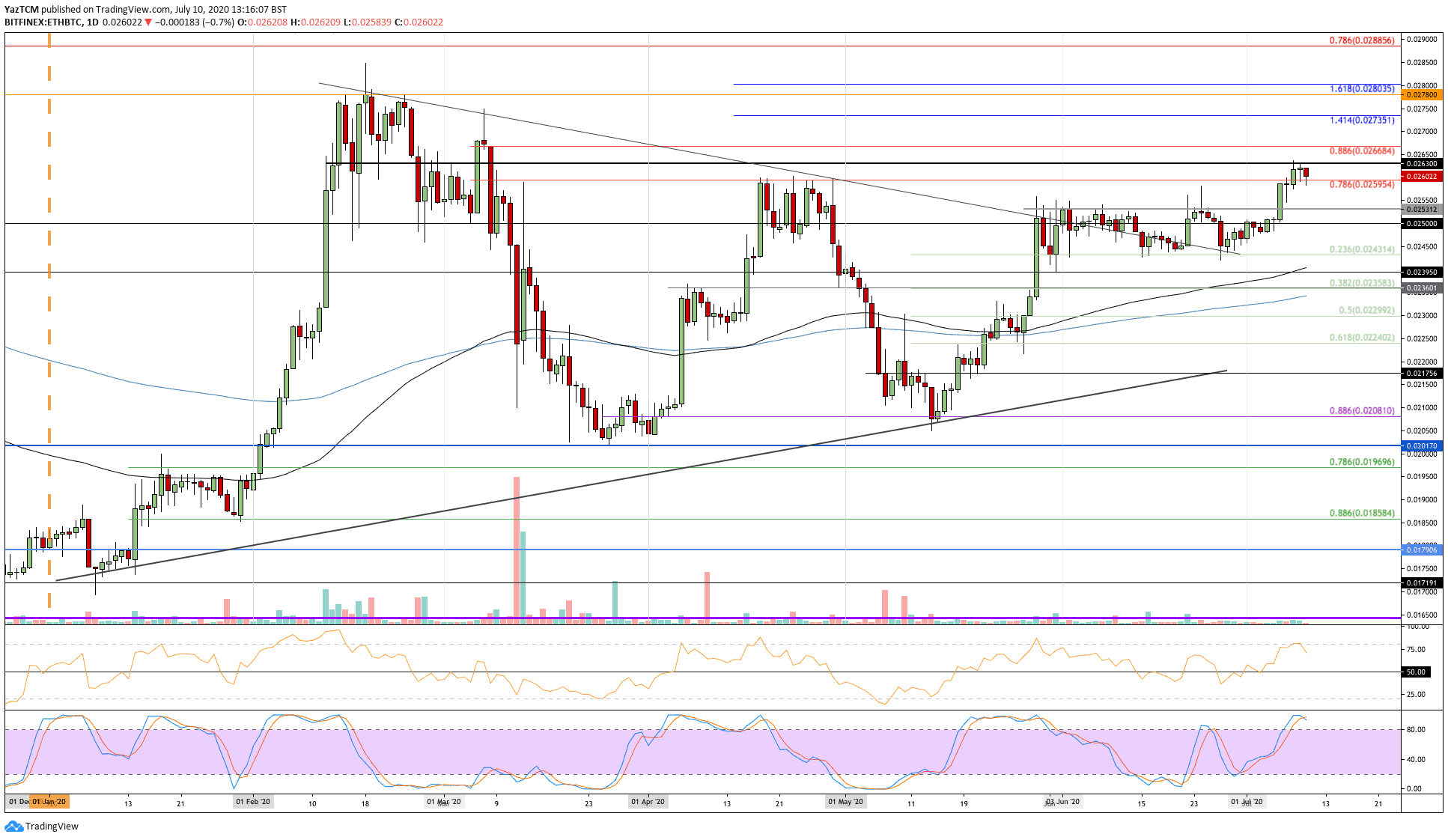

Against Bitcoin, Ethereum pushed higher this week to create a new 4-month high at 0.0263 BTC. The coin started the week beneath the 0.025 BTC resistance as it pushed higher to break the previous strong resistance at 0.0253 BTC, which had caused trouble for the market during May and June.

After breaking 0.0253 BTC, ETH climbed into the 0.0263 BTC resistance level, where the buying pressure stalled.

Looking ahead, if the bulls push beyond 0.0263 BTC, resistance is expected at 0.0266 BTC (bearish .886 Fib Retracement). Above this, added resistance lies at 0.0273 BTC and 0.0278 BTC (2020 high).

On the other side, if the sellers push lower, the first level of support lies at 0.026 BTC. This is followed by added support at 0.0253 BTC and 0.025 BTC.

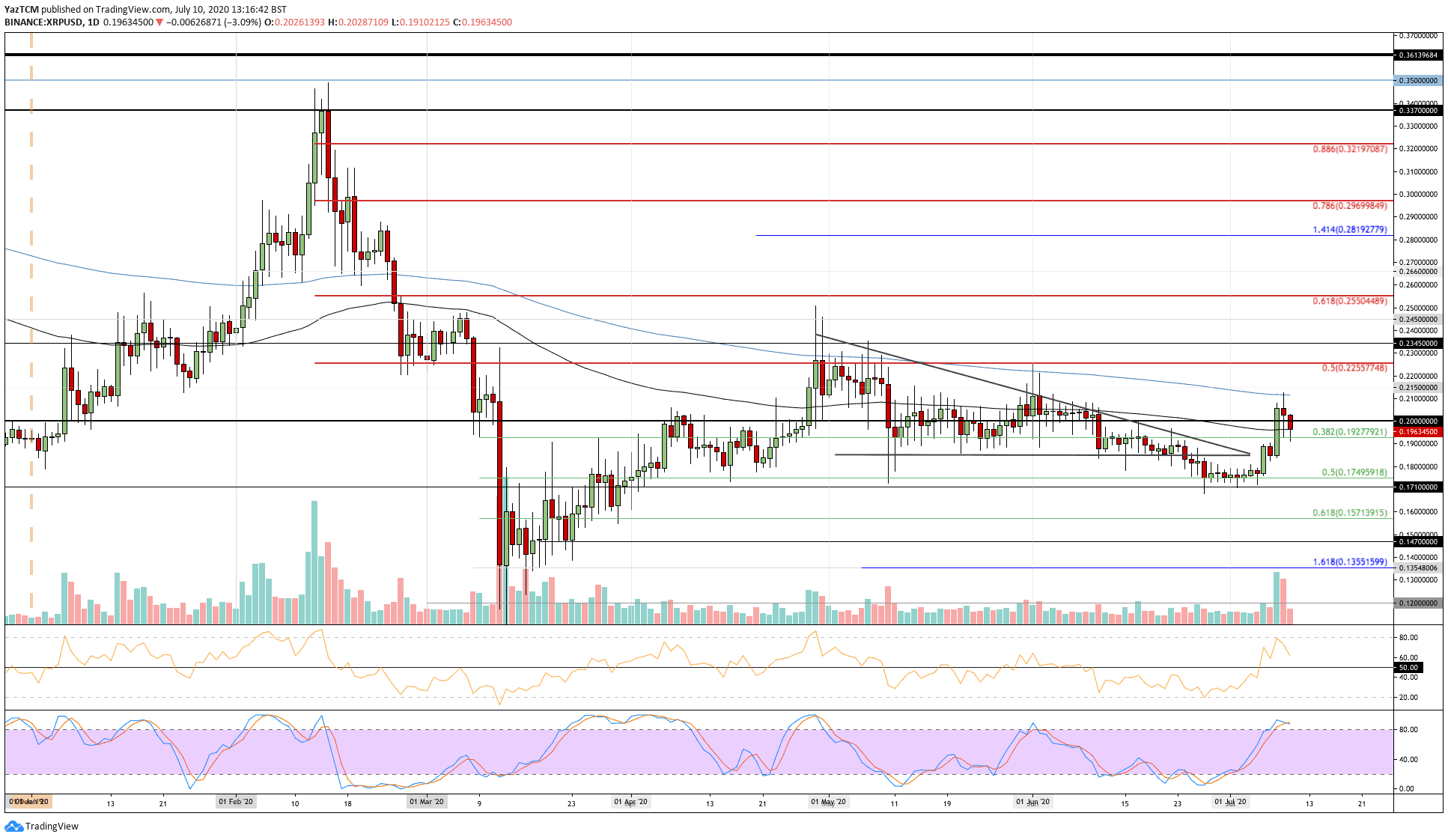

Ripple

XRP saw an impressive 11% surge this week, which had the cryptocurrency briefly climbing back above the $0.20 resistance level. XRP started the week off by trading at the support at $0.175 (.5 Fib Retracement level).

From there, it rebounded higher as it broke above the 100-day EMA at $0.196 and pushed over $0.20 to reach the 200-day EMA resistance at $0.215. It was unable to break this resistance, which caused it to drop lower into the 100-day EMA support at $0.196 where it currently rests.

Moving forward, if the buyers push back above $0.20, the first level of resistance is found at $0.215 (200-day EMA). Above this, added resistance lies at $0.225 (bearish .5 Fib Retracement) and $0.235.

On the other side, if the sellers push beneath the 100-day EMA, the first level of support lies at $0.192 (.382 Fib Retracement). This is followed by added support at $0.175 (.5 Fib Retracement).

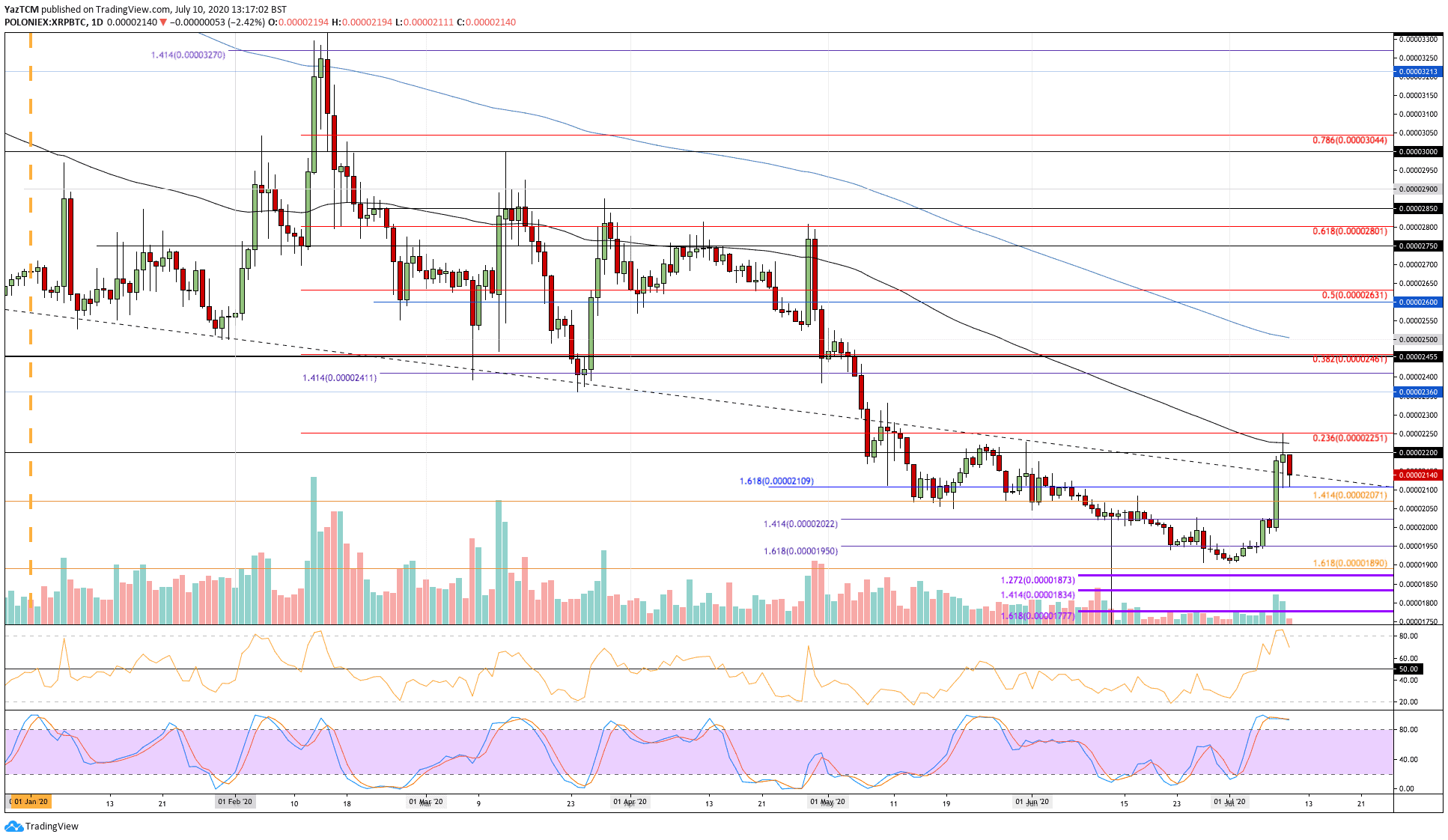

Against Bitcoin, XRP finally started to recover from the disastrous 3-month period in which prices dropped by a total of 40% to reach as low as 1900 SAT. XRP rebounded from 1900 SAT this week as it pushed higher beyond the resistance at 2000 SAT and 2100 SAT to reach the 2200 SAT level.

The coin didn’t break above 2200 SAT and rolled over to drop into the current 2140 SAT level.

Looking ahead, if the bulls push beyond 2200 SAT, the first level of resistance lies at 2250 SAT (bearish .236 Fib Retracement). Above this, added resistance is found at 2300 SAT and 2360 SAT.

On the other hand, if the sellers push beneath 2100 SAT, support is found at 2071 SAT, 2050 SAT, and 2000 SAT.

Cardano

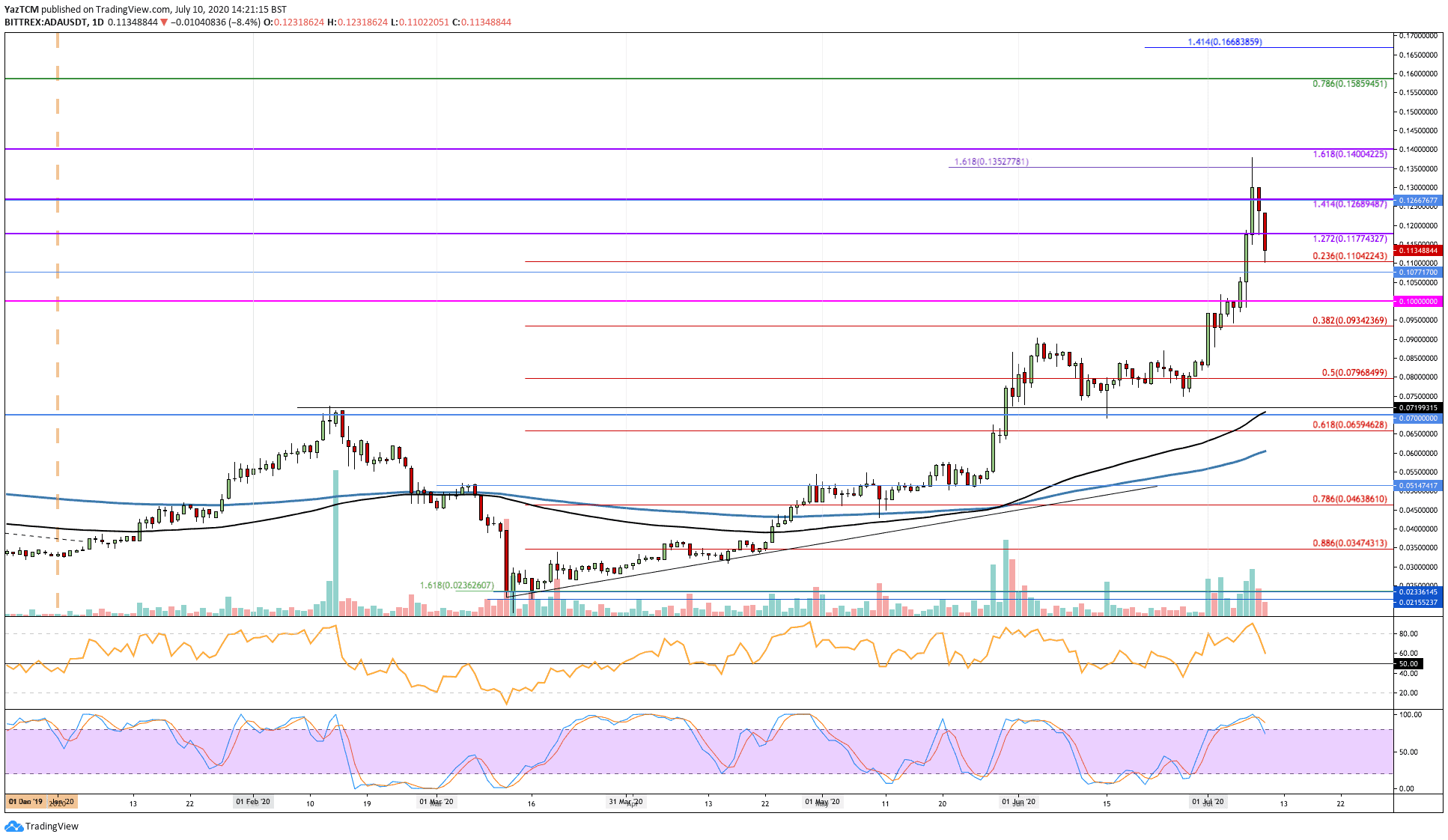

Cardano saw an impressive 17% price surge this week, which saw the coin climbing into a new 24-month high price. The cryptocurrency started the week at the $0.095 support. It quickly began to rise as it broke past resistance at $0.1 and continued to reach as high as $0.135.

Since then, ADA rolled over and has fallen into the support at $0.11 (.236 Fib Retracement).

Moving forward, if the buyers push higher again, the first level of resistance is expected at $0.117 (1.272 Fib Extension). This is followed by added resistance at $0.127, $0.135, and $0.14 (1.618 Fib Extension level).

On the other side, if the sellers push beneath $0.11 (.236 Fib Retracement), added support lies at $0.1. This is followed by support at $0.09 (.382 Fib Retracement) and $0.08 (.5 Fib Retracement).

Against Bitcoin, Cardano also saw an impressive price surge this week as it started the week off by trading at the 1000 SAT level as it pushed higher to reach the resistance at 1500 SAT (1.414 Fib Extension). ADA has dropped into the support at 1240 SAT (.236 Fib Retracement) since reaching this high.

Looking ahead, if the buyers push upward again, resistance lies at 1300 SAT, 1400 SAT, and 1500 SAT (1.414 Fib Extension). Added resistance is expected at 1600 SAT (bearish .786 Fib Retracement).

On the other side, if the sellers push beneath the support at 1240 SAT, added support is found at 1080 SAT (.382 Fib Retracement), 1000 SAT, and 960 SAT (.5 Fib Retracement).

Dogecoin

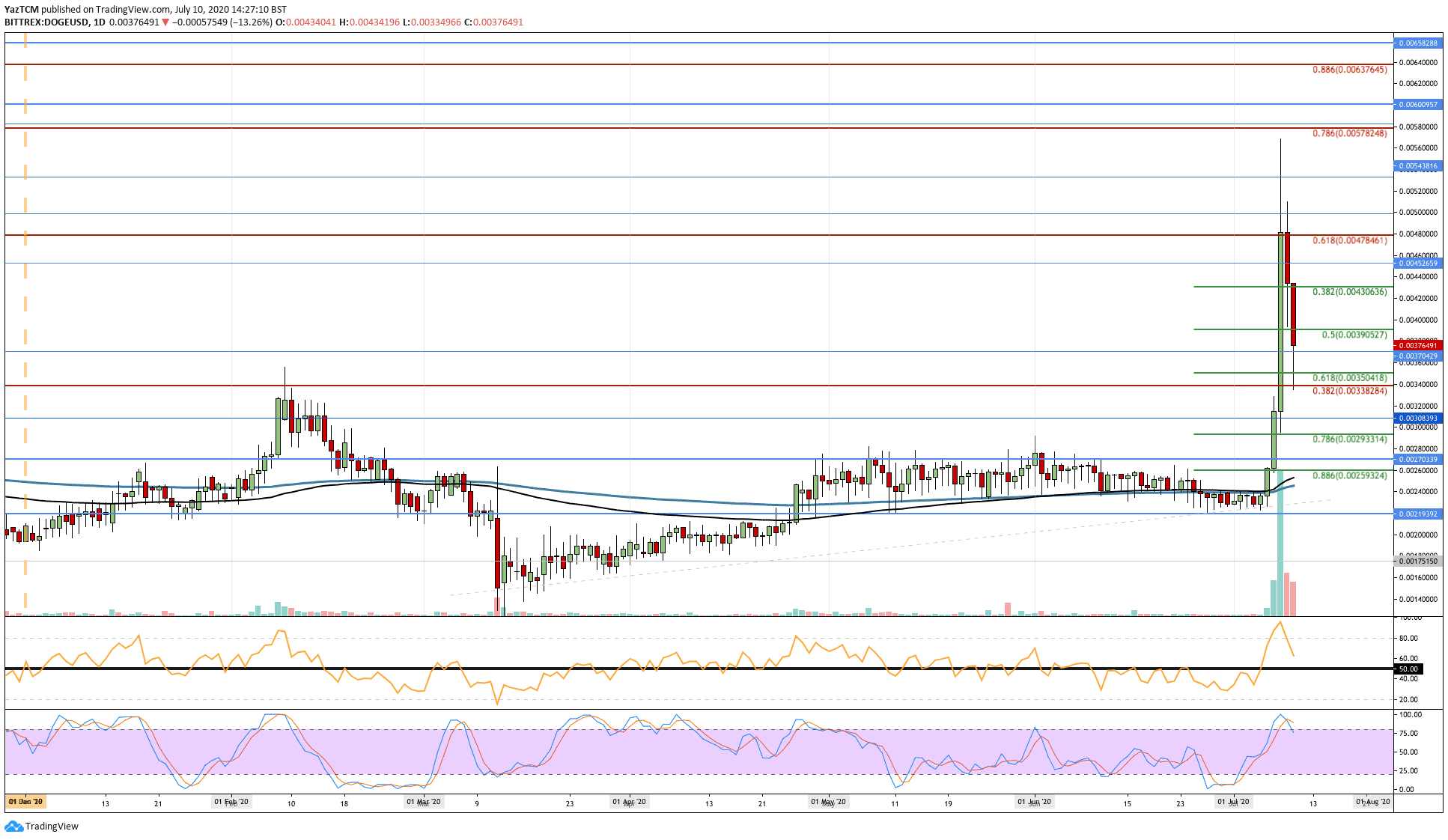

Dogecoin saw a super pump over the past week of trading as the cryptocurrency reached as high as $0.0057. The coin started the week off by trading beneath $0.0024 as it started to surge. It quickly broke the resistance at $0.0027 that caused the coin trouble in May and June and continued further higher until reaching $0.0057.

More specifically, the cryptocurrency closed its candle at the resistance provided by a bearish .618 Fib Retracement level at $0.0048. From there, DOGE has dropped toward the $0.0037 level.

Looking ahead, if the buyers regroup and push higher again, resistance is expected at $0.004, $0.0046, and $0.0047 (bearish .618 Fib Retracement). If the bulls continue above $0.0047, added resistance lies at $0.005 and $0.0057 (bearish .86 Fib Retracement).

On the other side, if the sellers push beneath $0.0037, support is expected at $0.0035 (.618 Fib Retracement), $0.0032, and $0.0030 (.786 Fib Retracement).

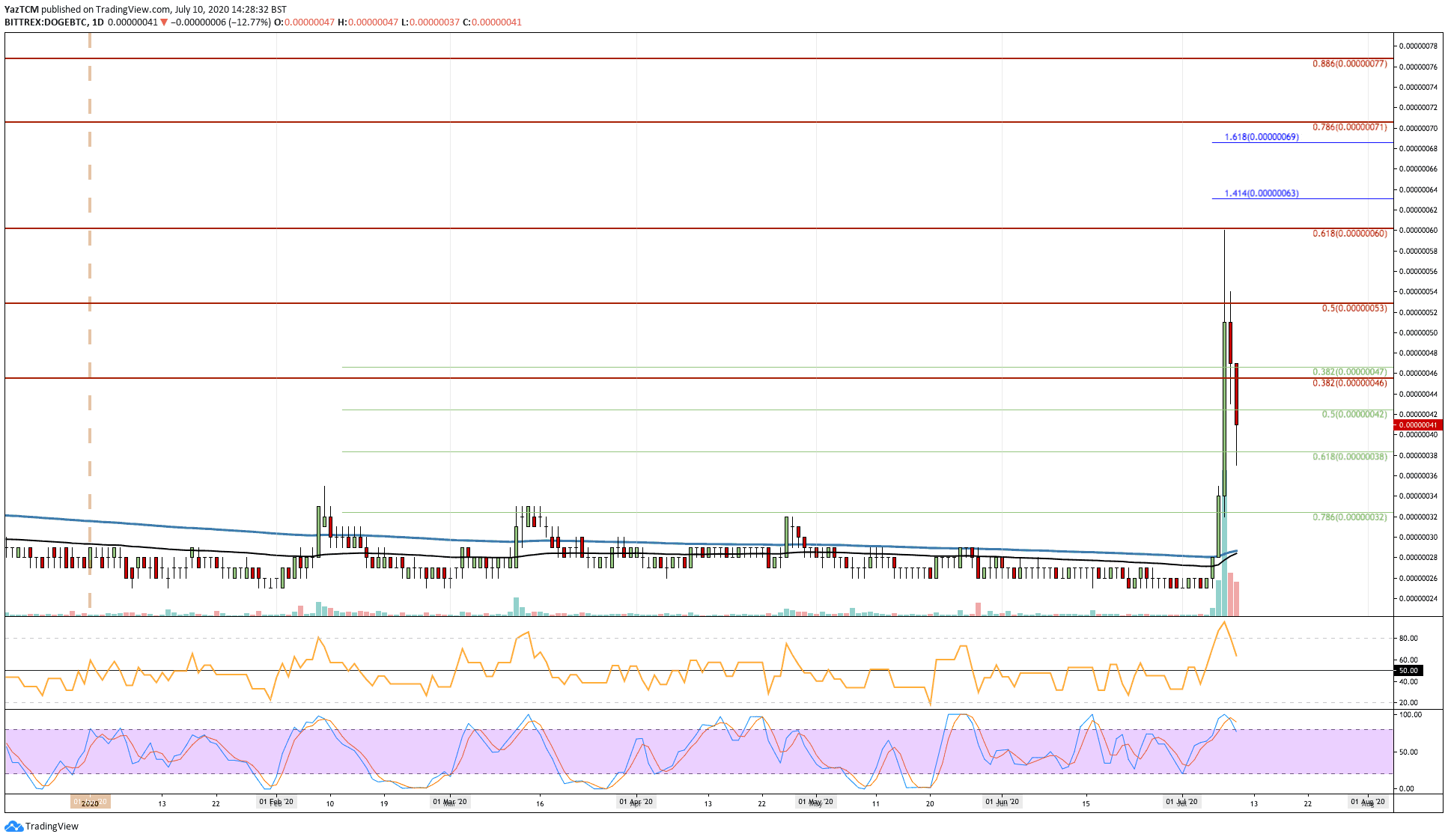

Dogecoin also saw a very impressive week against Bitcoin as the coin started trading at the 26 SAT level and went on to push as high as 60 SAT during the week. Dogecoin had been very static in 2020 and was never able to pass the 34 SAT resistance.

The resistance above was penetrated during the week as Dogecoin surged to 60 SAT (bearish .618 Fib Retracement). Since reaching this level, DOGE has dropped lower as it trades at 41 SAT.

Moving forward, if the bulls regroup and push higher, the first level of strong resistance is found at 46 SAT (bearish .382 Fib Retracement). This is followed by added resistance at 53 SATS (bearish 5 Fib Retracement), 60 SAT (bearish .618 Fib Retracement), and 71 SAT (bearish .786 Fib Retracement).

On the other side, the first level of support is expected at 38 SAT (.618 Fib Retracement). Beneath this, added support is found at 35 SAT and 32 SAT (.786 Fib Retracement).

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato