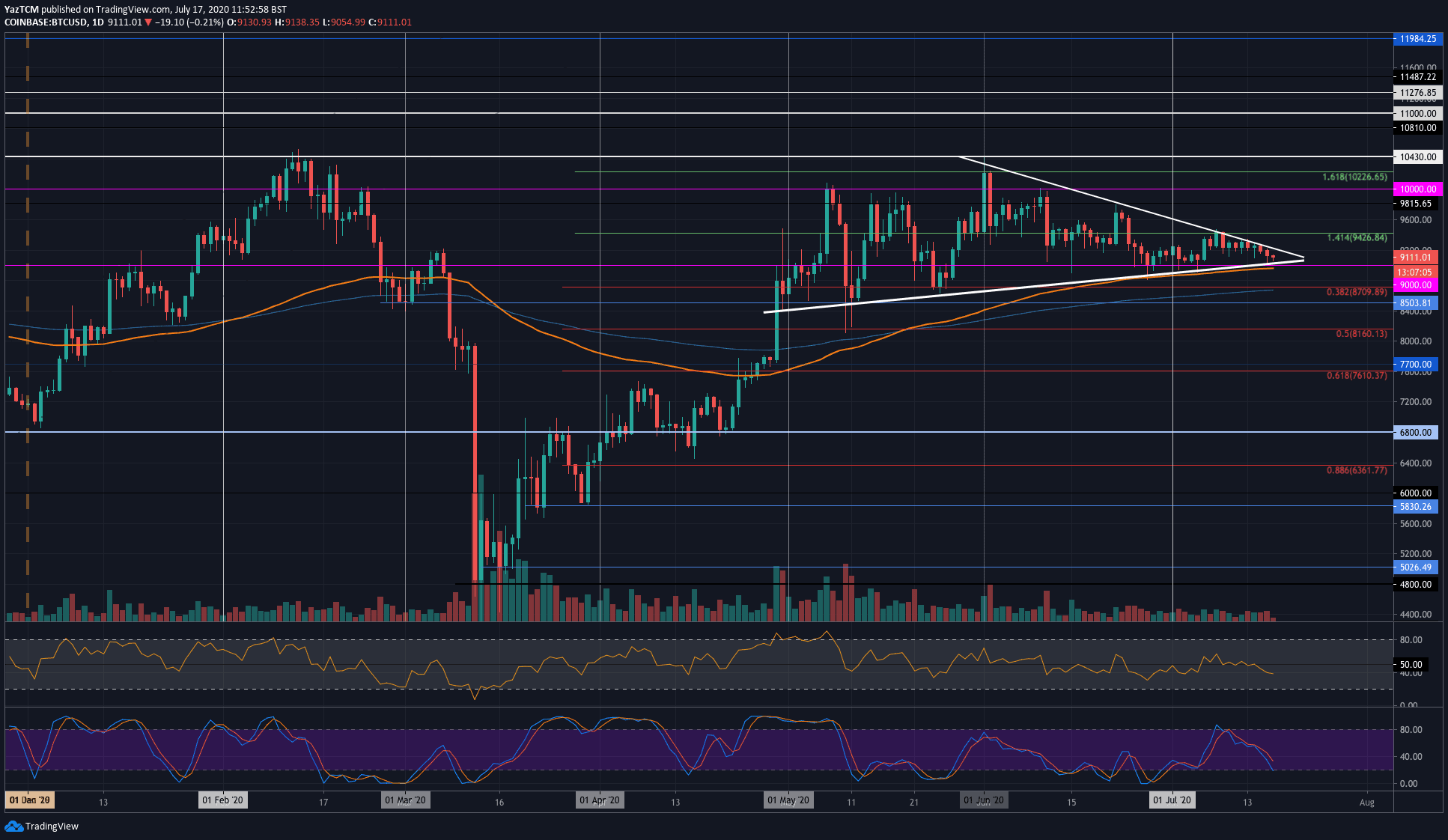

Bitcoin

Bitcoin saw a small 1% price decline this week, but it managed to remain within the confines of a symmetrical triangle pattern.

Throughout the week, BTC attempted to break above the upper boundary of the triangle on numerous occasions but failed each time. The coin recently found support at the lower edge of the triangle.

BTC can be considered directionless (neutral) until a breakout occurs from this triangle. If it breaks toward the upside, then BTC can be expected to head back to the 2020 highs at around $10,430. Alternatively, if it breaks lower, BTC could unwind back toward $8,000.

Looking ahead, the first level of resistance above the triangle lies at $9,426. This is followed by added resistance at $9,815, $10,000, and $10,226.

On the other side, the first level of support lies at $9,000 (100-days EMA & lower boundary of the triangle). Beneath this, support is found at $8,700 (.382 Fib Retracement & 200-days EMA), $8,500, and $8,160 (.5 Fib Retracement).

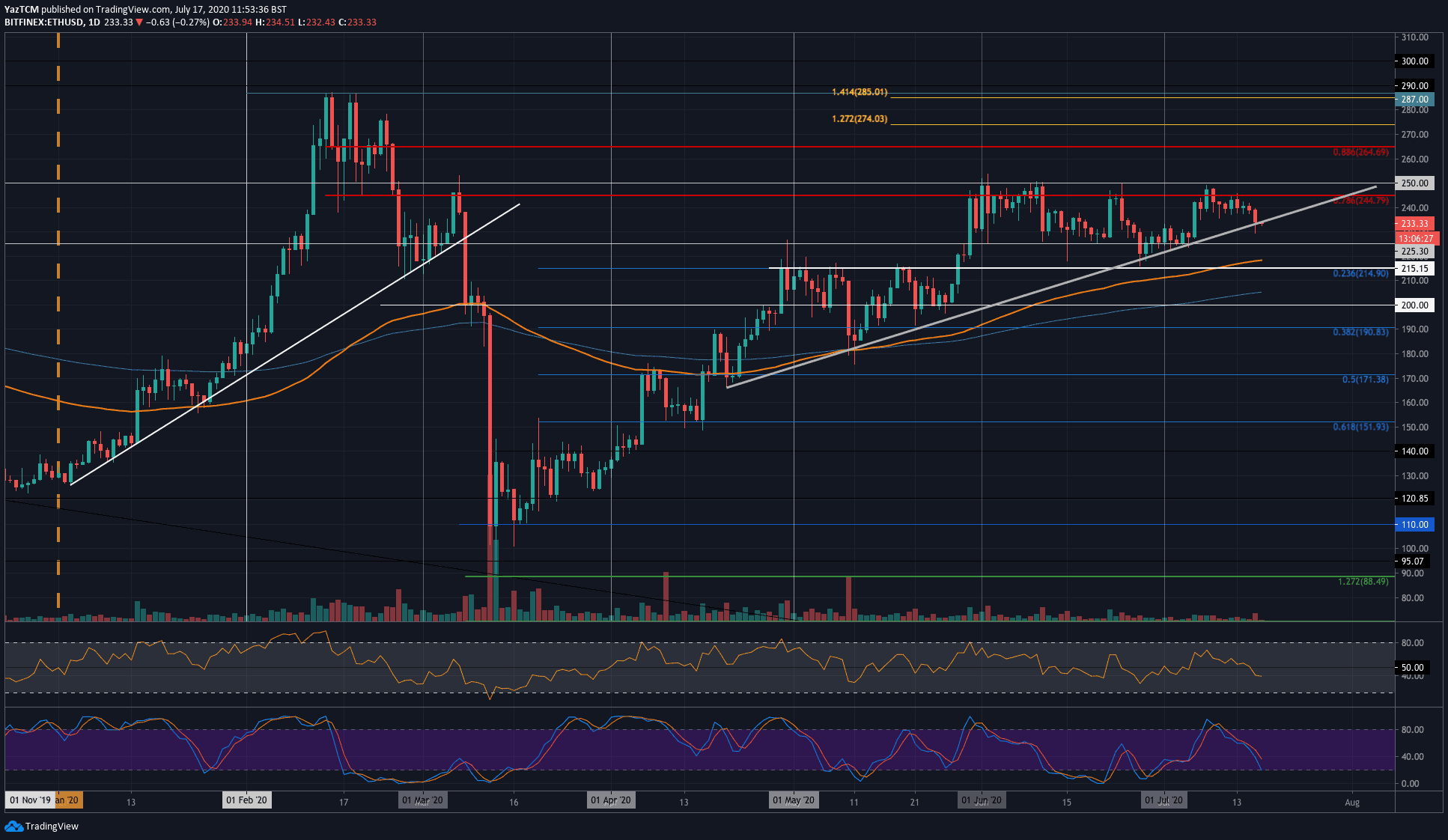

Ethereum

Ethereum saw a 2.2% price drop this week as it falls into the $233 level. The cryptocurrency attempted to push above the $245 resistance level earlier in the week but failed to do so. This caused it to roll over and head into the support at the rising trend line.

ETH dipped beneath the trend line yesterday. However, the bulls managed to regroup and push it above the trend line before the candle closed, which has kept the uptrend alive for ETH.

Looking ahead, if the sellers push beneath the rising trend line, the first level of support lies at $225. Beneath this, added support is found at $215 (.236 Fib Retracement & 100-days EMA), $205 (200-days EMA), and $200.

On the other side, the first level of resistance lies at $245 (bearish .786 Fib Retracement). This is followed by resistance at $250 and $265 (bearish .886 Fib Retracement).

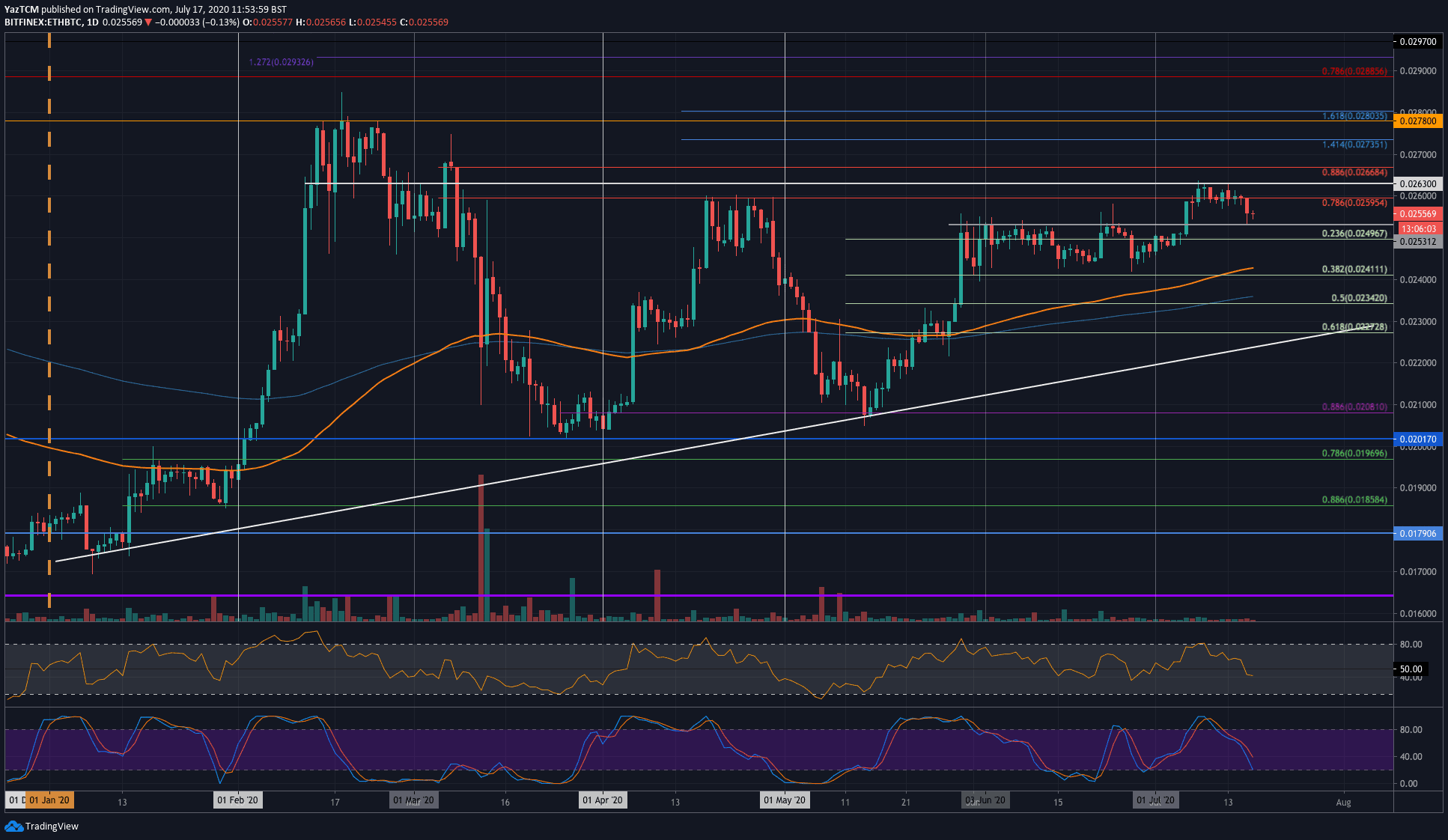

Against Bitcoin, Ethereum also fell slightly lower this week as it drops toward 0.0255 BTC. The coin started the week at the 0.0263 BTC resistance. It was unable to overcome this level, which caused it to roll.

ETH recently found support at the 0.0253 BTC level, which allowed the coin to bounce slightly higher today.

Looking ahead, if the sellers eventually push ETH beneath 0.0253 BTC, the first level of support is expected at 0.025 BTC (.236 Fib Retracement). This is followed by added support at 0.0241 BTC(.382 Fib Retracement & 100-days EMA), and 0.0234 BTC (.5 Fib Retracement & 200-days EMA).

On the other side, the first level of resistance lies at 0.0263 BTC. Above this, resistance is found at 0.0266 BTC (bearish .886 Fib Retracement) and 0.27 BTC.

Ripple

XRP moved sideways this week as it trades at $0.196. XRP started off July on the strong footing as it bounced from $0.175 and reached as high as $0.21 (200-days EMA).

However, from there, XRP started to head lower over the course of the past few days as it dropped beneath $0.20 again to land at the support at $0.192, which is provided by a .382 Fib Retracement.

Looking ahead, if the sellers push beneath $0.192, support can be found at $0.18, $0.175 (.5 Fib Retracement), and $0.171.

On the other side, if the buyers rebound from $0.192, resistance is first expected at $0.20. Above this, resistance lies at $0.21 (200-days EMA) and $0.215.

Against Bitcoin, XRP also started July off very strong as it rebounded higher from 1900 SAT to reach as high as 2250 SAT (bearish .236 Fib Retracement). Likewise, from there, XRP started to head lower throughout the week until support was found recently at 2100 SAT.

Moving forward, if the sellers break beneath 2100 SAT, support is expected at 2071 SAT, 2022 SAT, and 1950 SAT.

On the other side, the first level of strong resistance lies at 2200 SAT. Above this, resistance is found at 2250 SAT (bearish .236 Fib Retracement) and 2350 SAT (1.272 Fib Extension level).

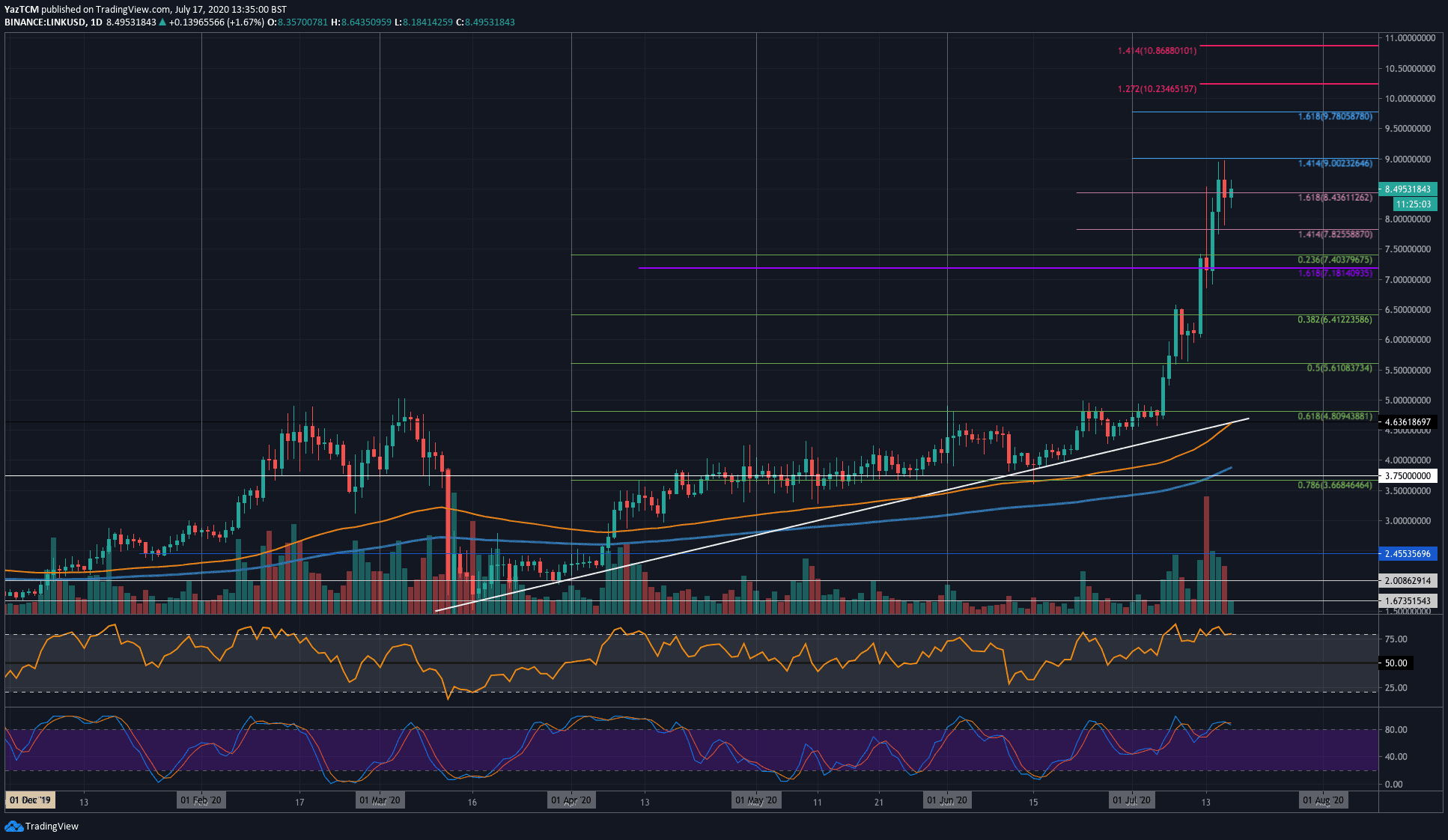

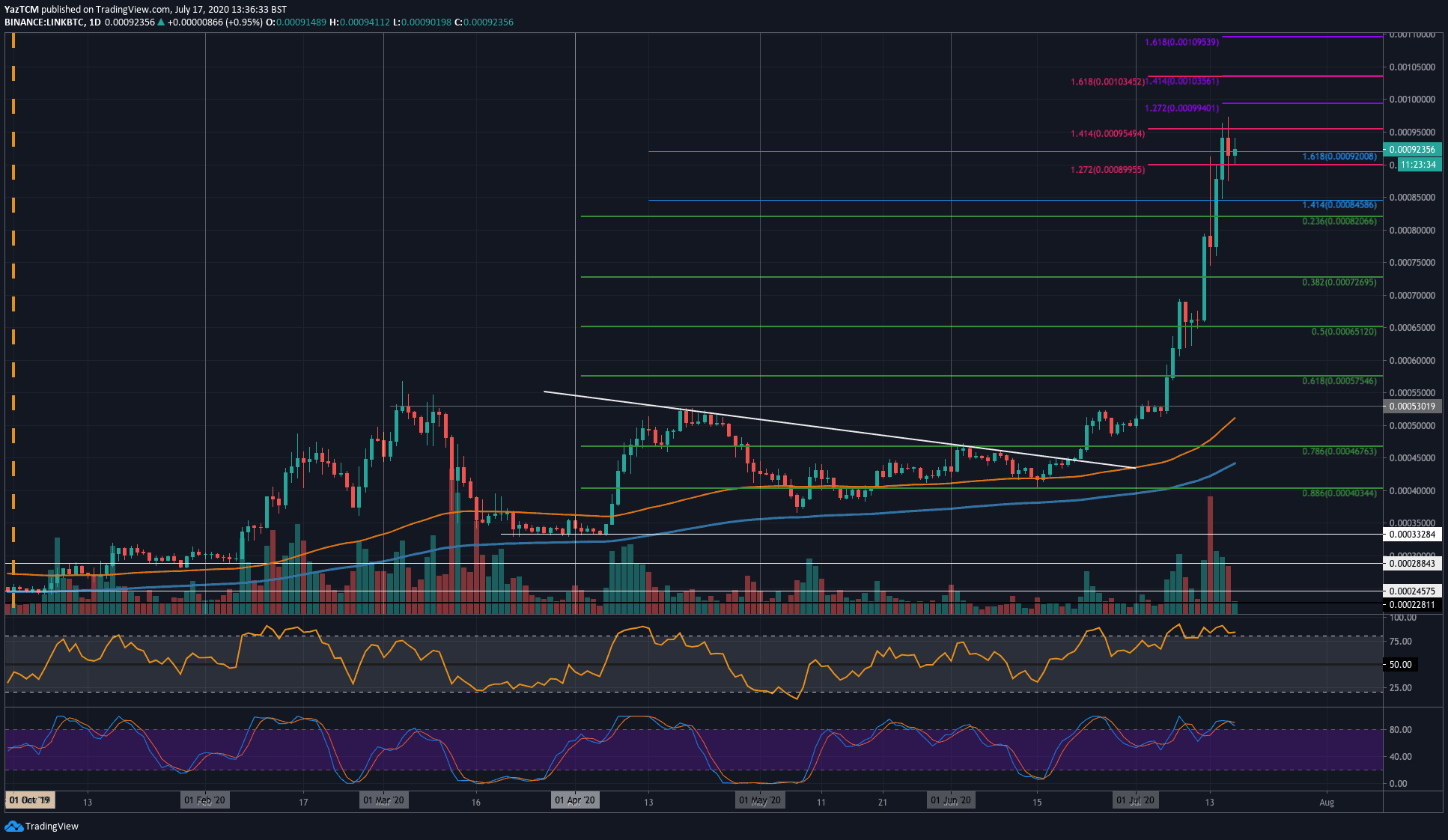

Chainlink

Chainlink saw a commanding 45% price explosion this week as the cryptocurrency reached the $8.50 level. LINK started the week at the $6.00 mark as the coin began to push higher. It quickly reached $7.40, where it found resistance for a couple of days.

After breaking above $7.40, LINK continued into the resistance at $9.00 – provided by a 1.414 Fibonacci Extension level. LINK has since dropped from here as it returns to the $8.50 level.

Looking ahead, if the buyers push above the $9.00 level, resistance is then expected at $9.78 (1.618 Fib Extension – blue), $10.00, and $10.23 (1.272 Fib Extension).

On the other side, the first level of support lies at $8.00. Beneath this, support is found at $7.40 (.236 Fib Retracement), $7.00, and $6.41 (.382 Fib Retracement).

LINK has also been marauding forward against Bitcoin itself. The coin started the week at the 65,000 SAT level as it started to push higher. It reached as high as 96,000 SAT before it rolled over and fell to the current 92,300 SAT level.

Looking ahead, if the buyers push higher, the first level of resistance lies at 95,500 SAT. Above this, resistance is expected at 99,400 SAT (1.272 Fib Extension), 10,000 SAT, and 10,350 AST (1.618 Fib Extension).

On the other side, the first level of support lies at 90,000 SAT. Beneath this, support is found at 82,000 SAT (.236 Fib Retracement), 80,000 SAT, and 72,700 SAT (.382 Fib Retracement).

Tezos

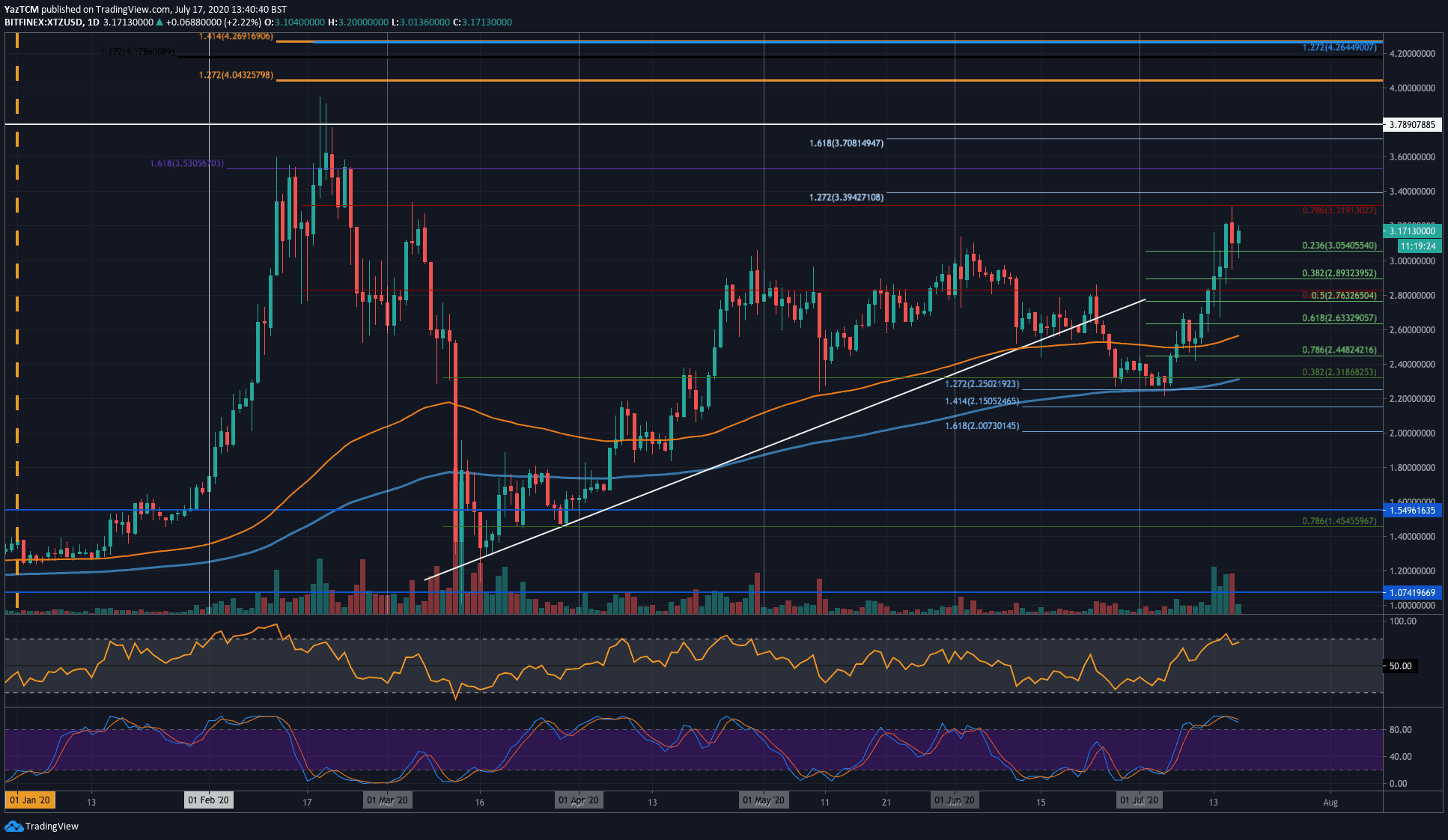

Tezos saw an impressive 30% price hike this week, which allowed the coin to reach the $3.18 level. Tezos started the week off by trading at $2.50 (100-days EMA). From there, it pushed higher over the week until resistance was met at $3.31 (bearish .786 Fib Retracement).

Tezos has since dropped into the support at $3.05 (.236 Fib Retracement).

Moving forward, if the buyers can break above $3.31, the first level of resistance above is located at $3.40. This is followed by resistance at $3.53, $3.78, and $4.00.

On the other side, the first level of support lies at $3.05. Beneath this, added support is found at $2.89 (.382 Fib Retracement), $2.80, and $2.63 (.618 Fib Retracement).

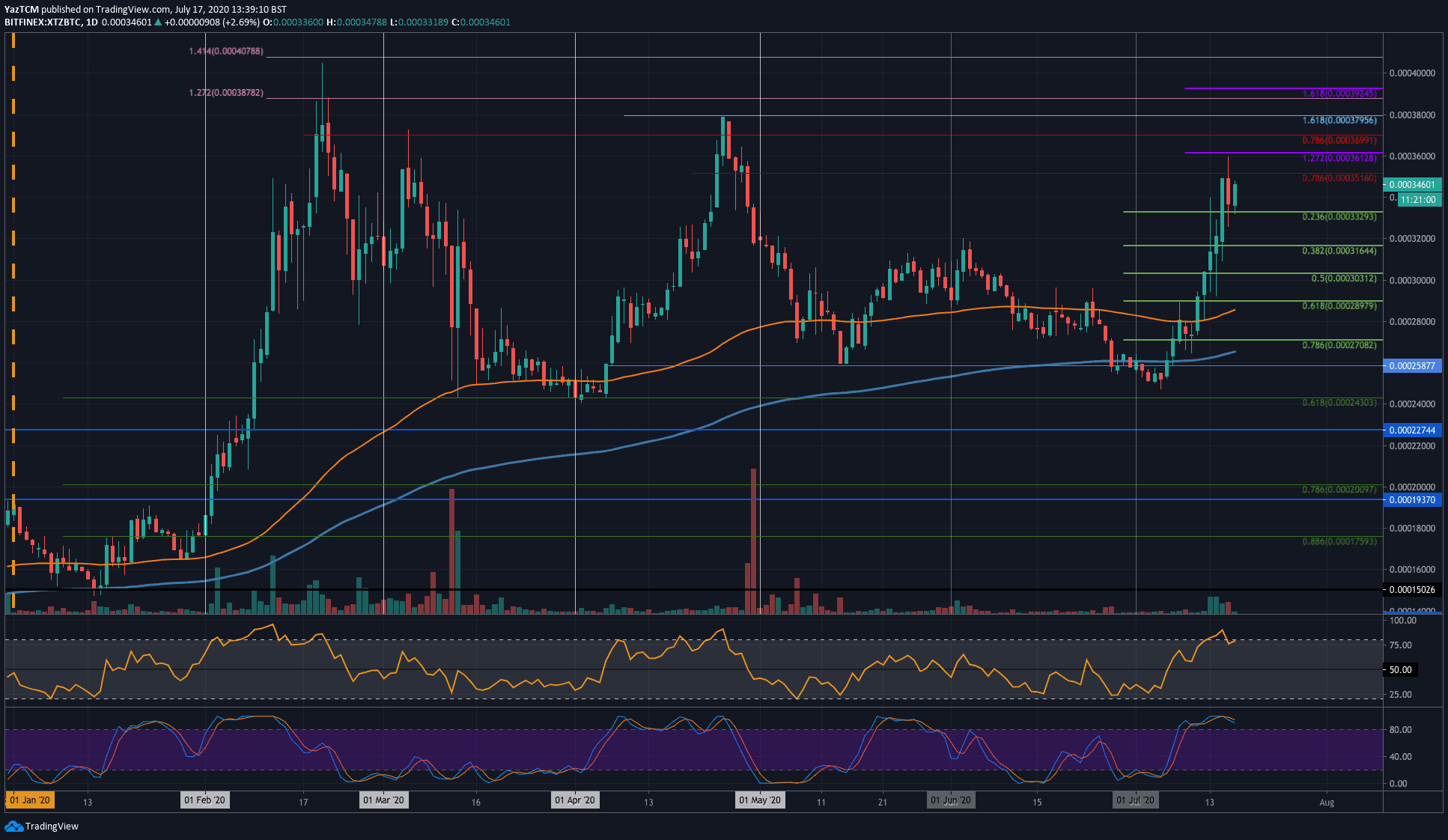

Tezos has also surged significantly against Bitcoin. The coin started the week beneath the 100-days EMA at 28,000 SAT. From there, it surged throughout the week until resistance was found at 31,160 SAT (bearish .786 Fib Retracement).

It has since dropped into the support at 33,300 SAT (.236 Fib Retracement level).

Moving forward, if the sellers break beneath 33,300 SAT, support is found 31,600 SAT (.382 Fib Retracement) and 30,000 SAT (.5 Fib Retracement).

On the other side, the first level of resistance lies at 35,160 SAT (bearish .786 Fib Retracement). Above this, resistance is found at 35,128 SAT, 37,00 SAT (bearish .786 Fib Retracement), and 38,000 SAT.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato