Bitcoin

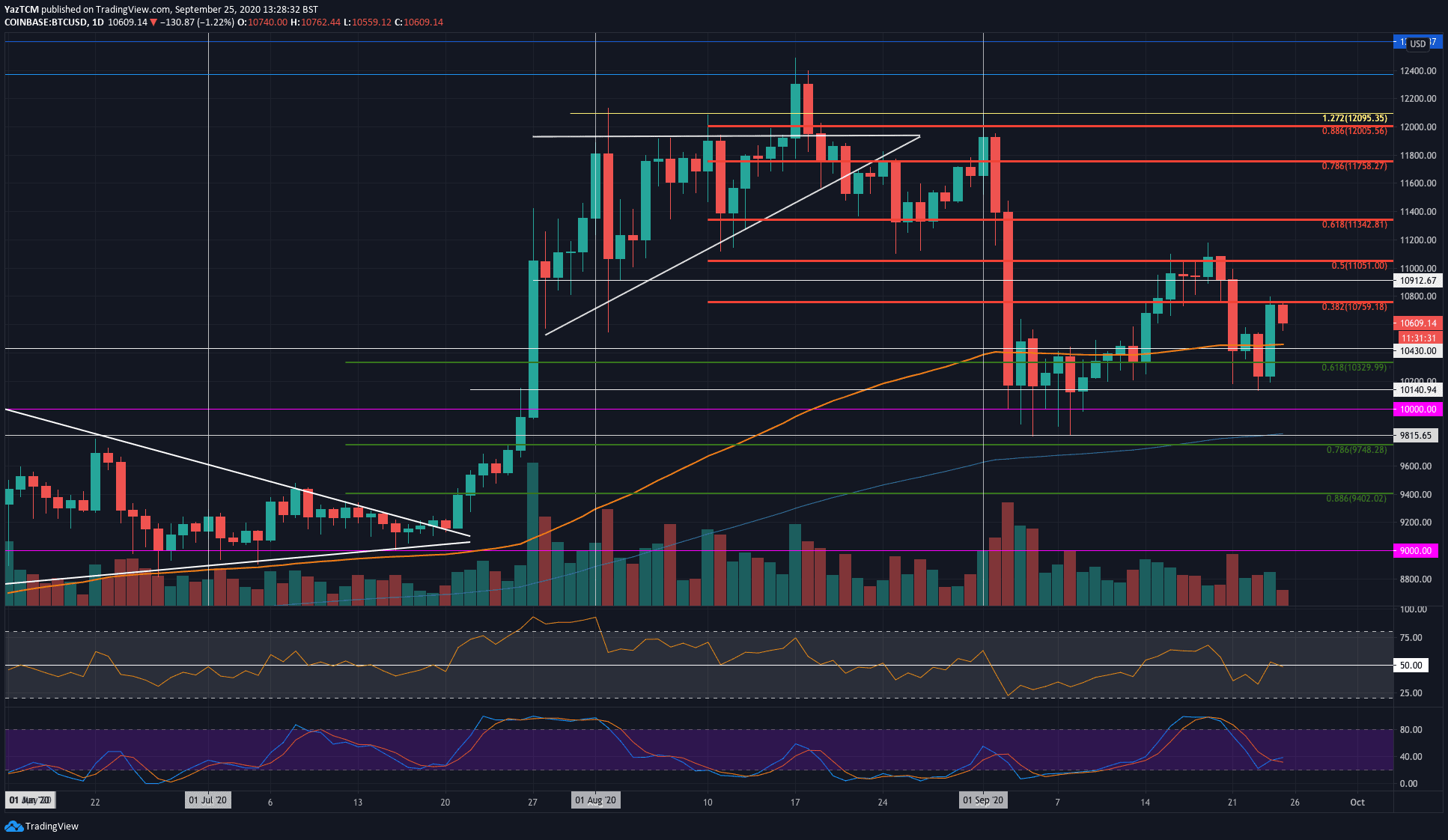

Bitcoin dropped by a total of 3% over the past seven days of trading as it reached the $10,600 level today. The cryptocurrency briefly pushed above the $11,000 mark last Friday but could not sustain this level as it broke beneath it during the weekend. On Monday, BTC saw a precipitous 7.5% fall as it dropped from $10,910 to reach as low as $10,200.

Bitcoin continued to head lower on Wednesday as it reached $10,140 before the buyers regrouped to initiate a rebound, which happened yesterday. During the rebound, BTC managed to break back above the 100-days EMA and reach as high as $10,760 – where it ran into resistance at the bearish .382 Fib Retracement.

The coin has dropped slightly from there to trade at $10,600 today.

Looking ahead, if the bulls can continue above the $10,760 level, higher resistance lies at $10,900 $11,000, and $11,200. Added resistance is expected at $11,340 (bearish .618 Fib Retracement), $11,500, and $11,600.

On the other side, the first level of support lies at $10,430 (100-days EMA0. This is followed by support at $10,330, $10,140, and $10,000.

Ethereum

Ethereum suffered a steeper 11.3% price decline over the past week as it reached the $346 level today. The coin was trading above $380 last Friday but started to drop lower during the weekend. On Monday, Ethereum fell from $365 to reach as low as $335 (100-days EMA).

The price decline continued on Wednesday, which saw ETH drop as low as $320. Luckily, the bulls regrouped for a rebound on Thursday in which ETH managed to reach the $252 resistance (bearish .236 Fib Retracement). It also produced a bullish engulfing candle, which is a strong bullish signal.

Moving forward, if the buyers can break the $352 level, resistance lies at $364 (2019 high), $382, $390, and $400.

On the other side, support is first expected at $336 (100-days EMA). Beneath this, support lies at $320, $306, and $300.

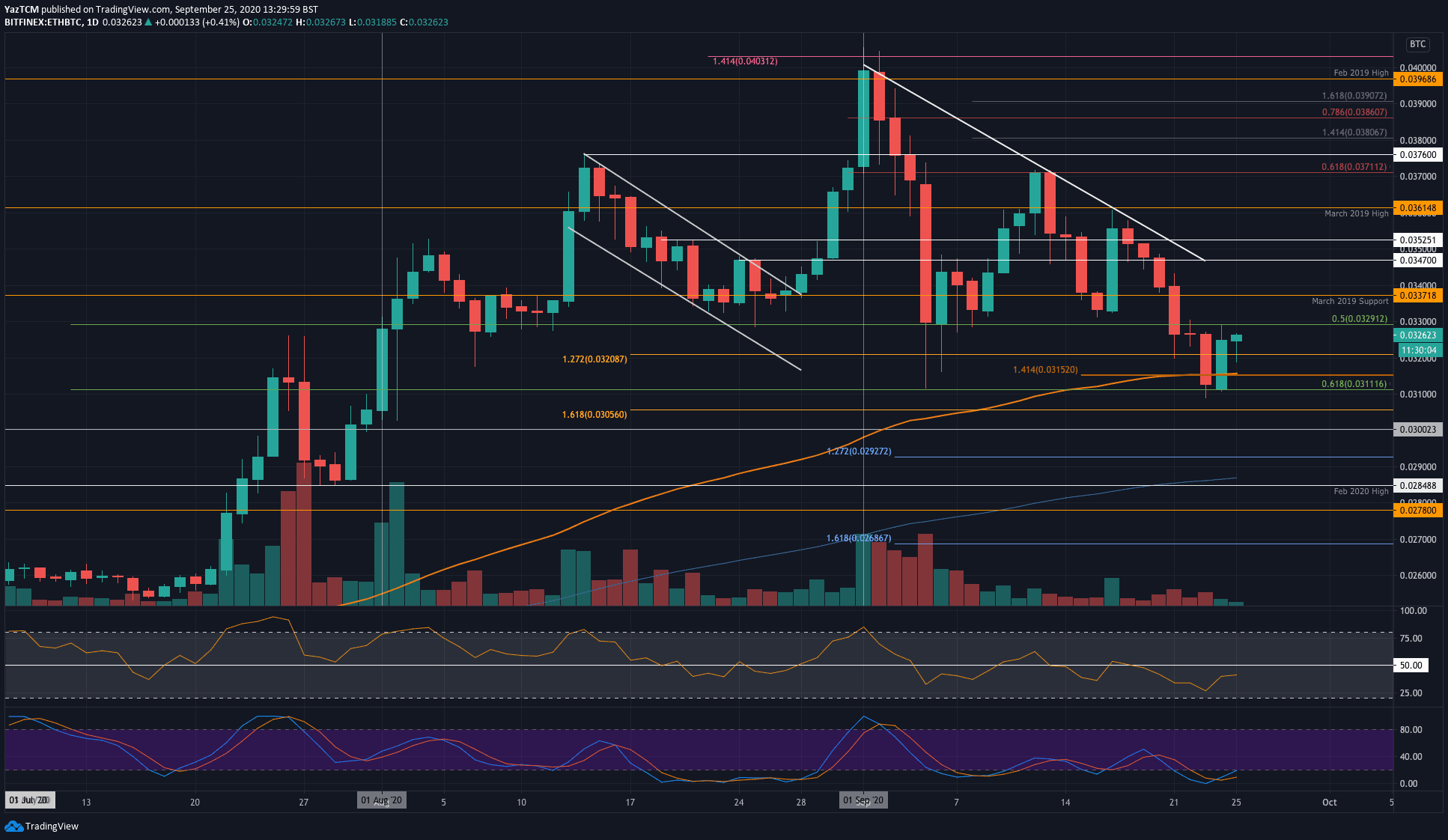

Ethereum also struggled against Bitcoin this week as it fell from 0.035 BTC to reach as low as 0.0311 BTC yesterday. The coin had found support yesterday at the .618 Fib Retracement, which allowed it to bounce higher to the current 0.0326 BTC level.

Looking ahead, if the bulls push higher, the first level of resistance lies at 0.033 BTC. Above this, resistance is located at 0.0337 BTC (March 2019 Support), 0.0347 BTC, and 0.0352 BTC.

On the other side, the first level of support lies at 0.032 BTC. This is followed by support at 0.0315 BTC (100-days EMA), 0.0311 BTC (.618 Fib Retracement), and 0.030 BTC.

Ripple

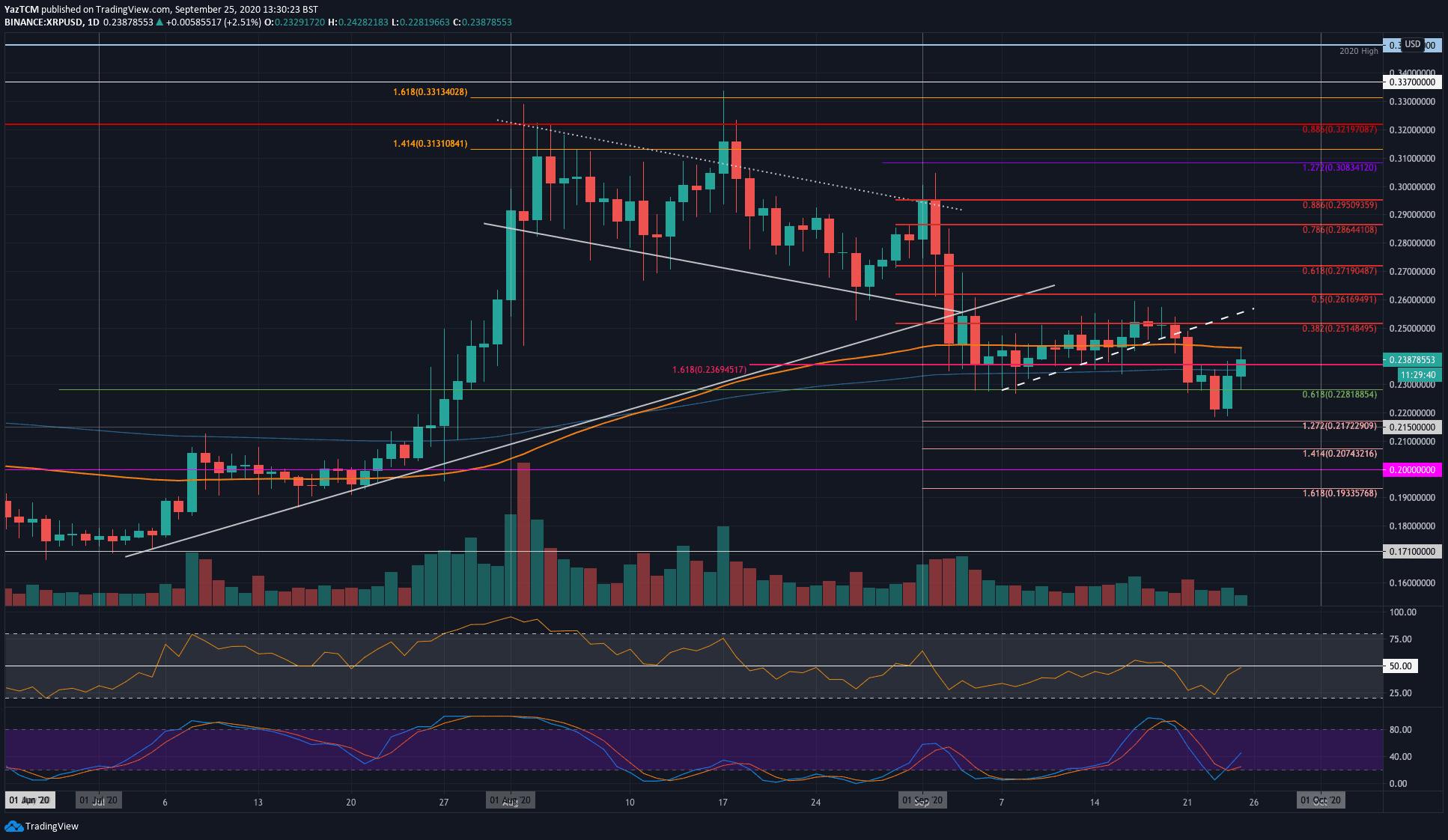

XRP witnessed a 5.5% price fall this week as the coin dropped from $0.25 to reach as low as $0.22 yesterday. The cryptocurrency managed to rebound from there to get as high as $0.24 today. However, the market is facing resistance at the 100-days EMA and must pass this to continue higher.

If the bulls break $0.24, the first level of resistance lies at $0.251 (bearish .382 Fib Retracement). Following this, resistance lies at $0.261 (bearish .5 Fib Retracement), and $0.271 (bearish .618 Fib Retracement).

On the other side, the first level of support lies at $0.235 (200-days EMA). This is followed by support at $0.23, $0.22, and $0.217.

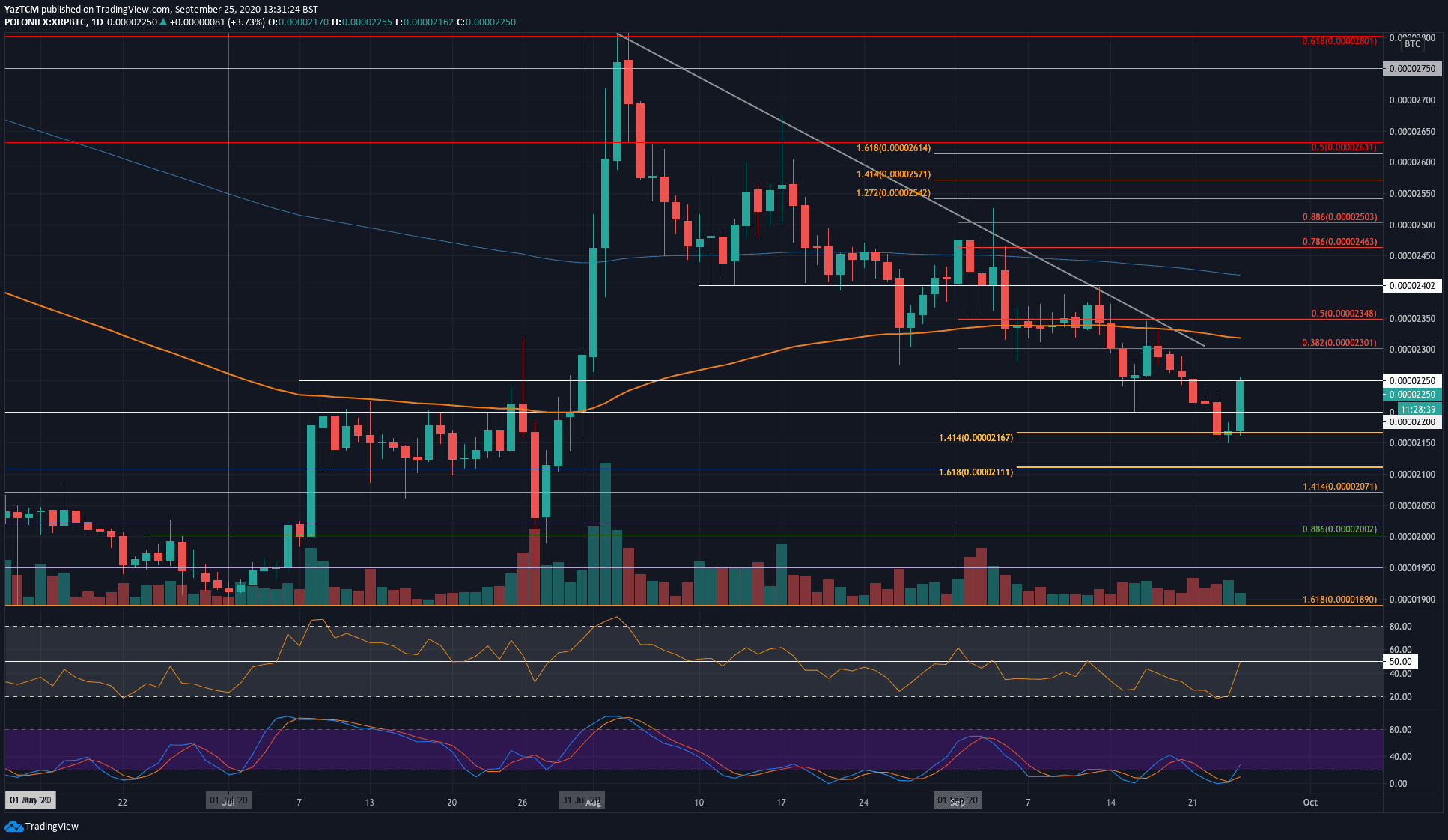

XRP is also struggling against BTC as it posted a fresh 2-month low at 2165 SAT (downside 1.414 Fib Extension) yesterday. The coin had slipped from 2300 SAT last Friday and continued lower until it hit the 2165 SAT support.

XRP has since bounced higher to reach the 2250 SAT level today.

If the bulls can break 2250 SAT, resistance is first located at 2300 SAT (bearish .382 Fib Retracement). Above this, resistance lies at 2350 SAT (bearish .5 Fib Retracement), 2400 SAT, and 2460 SAT.

Alternatively, support lies at 2200 SAT, 2165 SAT, and 2111 SAT.

Chainlink

LINK saw a substantial 10% price fall over the past seven days, which saw the coin breaking beneath the $10 level and hitting as low as $7.31. There, it found support at a downside 1.272 Fib Extension level, which allowed it to rebound yesterday to reach the $9.90 resistance level today.

If the bulls can break $10, the first level of resistance lies at $10.40. Above this, resistance is found at $11.37 (bearish .382 Fib Retracement), $12, and $12.63 (bearish .5 Fib Retracement).

On the other side, support first lies at $9.00. Beneath this, support is found at $8.67, $8.00, and $7.31.

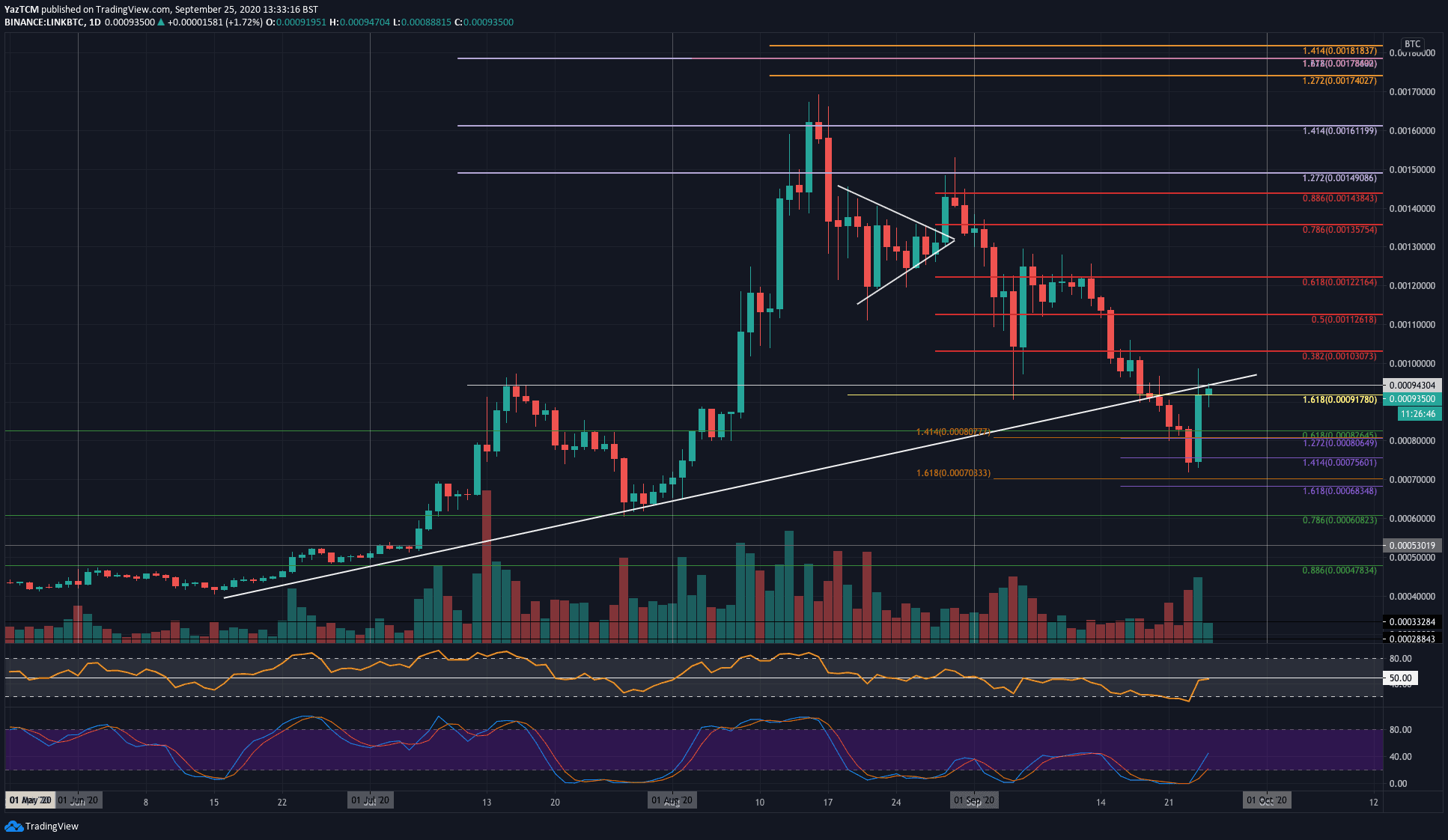

Against BTC, LINK dropped as low as 0.00072 BTC during the week. It was trading above a 3-month-old rising trend last Friday, but it went on to collapse beneath this support over the weekend. After reaching 0.00072 BTC, LINK bounced higher to get to the current 0.000935 BTC level today. Notice that it has returned to the previous rising trend line, which is now acting as resistance.

Looking ahead, the first level of resistance lies at 0.00095 BTC. This is followed by resistance at 0.001 BTC, 0.00103 BTC (bearish .382 Fib Retracement), and 0.00112 BTC (bearish .5 Fib Retracement).

On the other side, support is first found at 0.00091 BTC. This is followed by support at 0.0082 BTC, 0.00072 BTC, and 0.0007 BTC.

Tezos

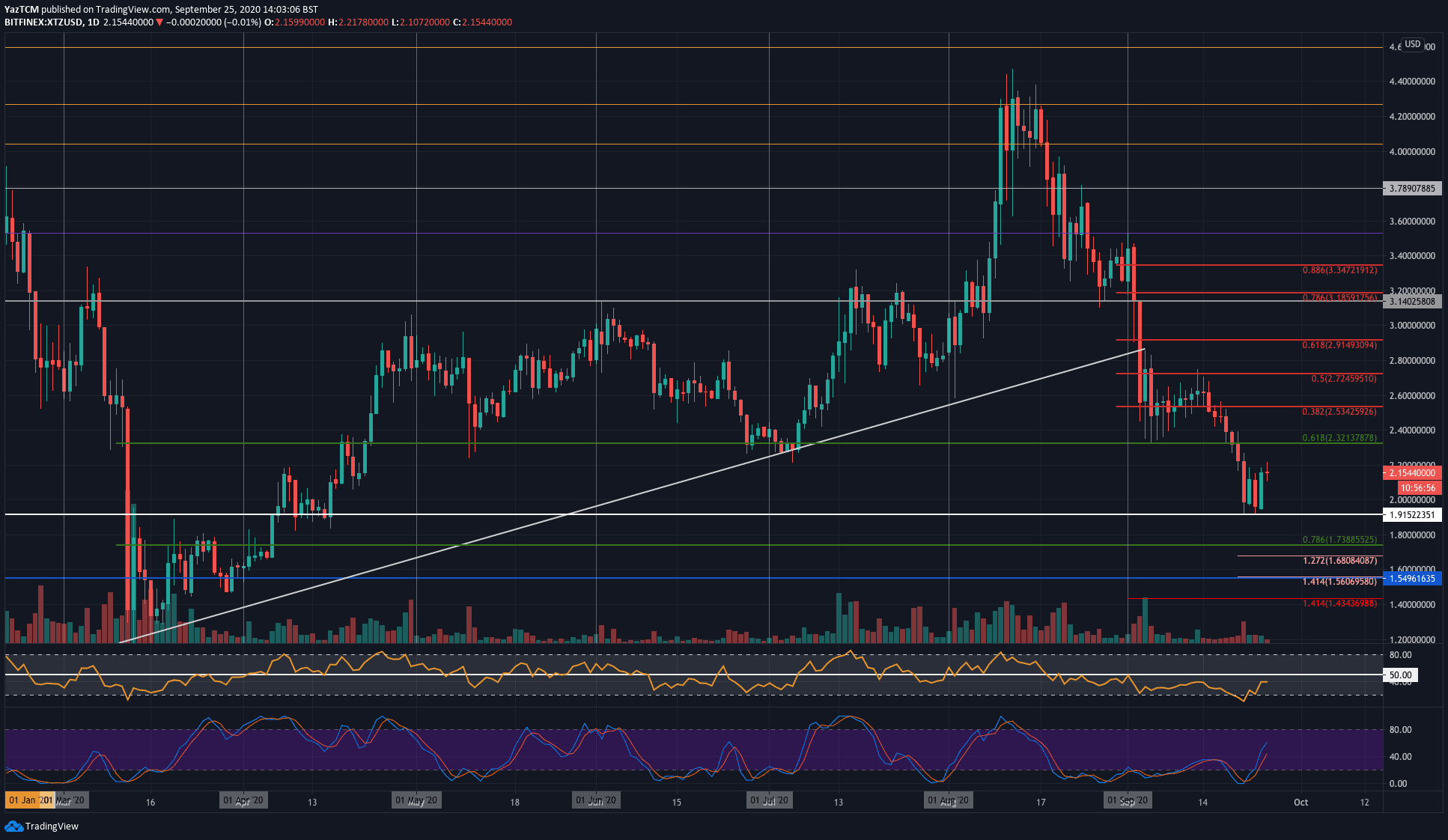

XTZ saw the steepest price fall on this list as it dropped by 13% over the past 7 days. The coin fell beneath the $2.32 (.618 Fib Retracement) support on Friday and continued lower to crate a new 5-month price low as it reached $1.91. This support held over the past few days, and Tezos rebounded from here yesterday to reach $2.15 today.

Looking ahead, if the bulls break $2.20, resistance is found at $2.32, $2.53 (bearish .382 Fib Retracement), and $2.72 (bearish .5 Fib Retracement).

On the other side, the first two levels of support lie at $2.00 and $1.91. Beneath this, support is expected at $1.74 (.786 Fib Retracement), $1.68, and $1.56.

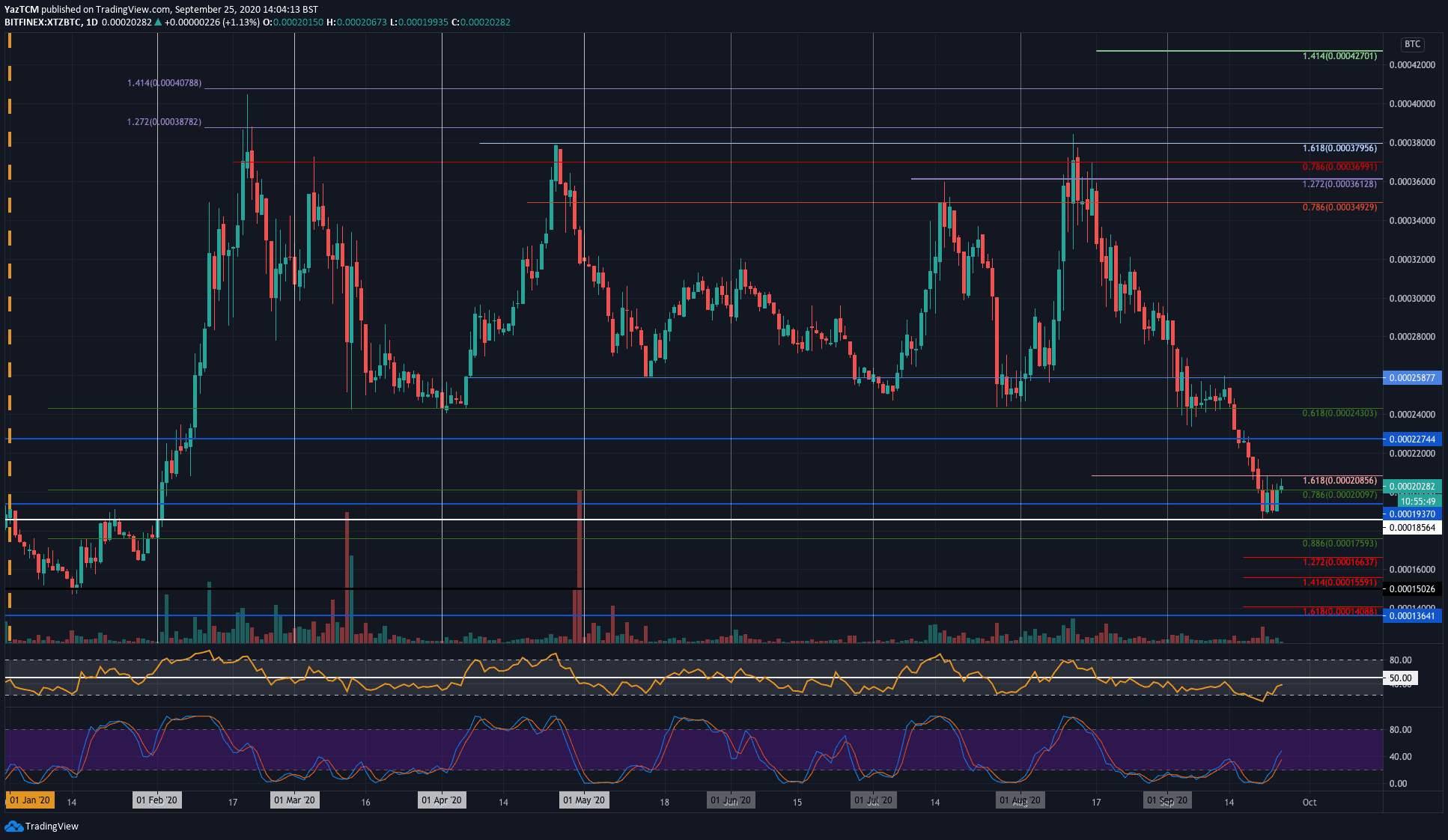

Tezos is suffering further against BTC as it produced a 7-month price low this week after reaching 18,600 SAT. The coin has since bounced from here to break back above 20,000 SAT today.

Looking ahead, the first level of resistance lies at 21,000 SAT. This is followed by resistance at 22,000 SAT, 21,750 SAT, and 24,300 SAT.

On the other side, beneath 20,000 SAT, support lies at 19,380 SAT, 18,600 SATm ad 17,600 SAT (.886 Fib Retracement). Added support lies at 16,600 SAT and 15,600 SAT.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato