Indian economy is going through a rough phase and the unemployment rate is at 45-year high while its yearly growth rate is taking a back seat. From being one of the fastest-growing economies in the world to the present situation where economists are concerned if immediate measures are not put in place, India might see a massive economic meltdown.

Unemployment has been one of the biggest concerns for the Indian youths lately and that dilemma becomes even more grave given more than 50% of Indian population fall under the age of 25, while the percentage of population under 35 rises to 62%. Having such a high percentage of the population under the age of 25 should be an advantage for any country but only if they have jobs and they are contributing to the country’s economy.

According to the State of India’s Environment (SoE) In Figures, 2019 the youth (between 20 and 24 years), who constitute around 40 percent of India’s labor force, has an unemployment rate of 32 percent. The unemployment rate among the educated youths who (at the least) have a graduation degree has increased from 10.4% in May-August 2017 to 13.17% in September-December 2018. The overall unemployment rate stood at 8.3% in August 2019, the urban unemployment rate is at 9.4% while the rural unemployment rate stands at 7.8%.

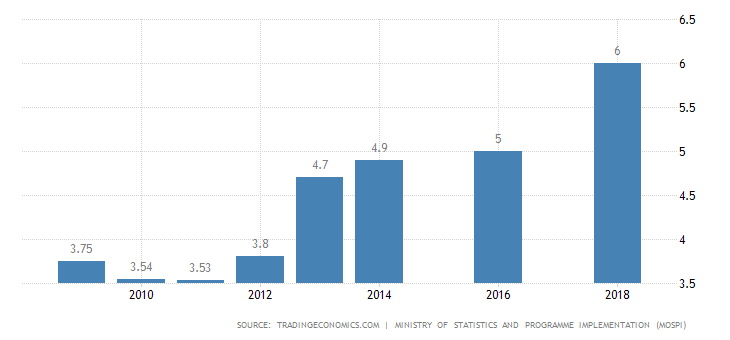

The following graph shows the rising unemployment in the country and why it should be alarming for policymakers.

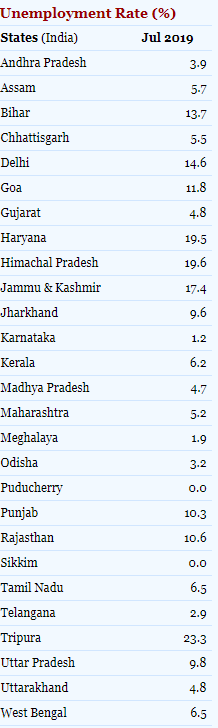

The state-wise unemployment data suggest the state of Tripura has the highest unemployment rate at 23.3%, followed by Himachal at 19.6% and Haryana at 19.5%. The capital Delhi also ranked among the highest unemployment rates with 14.6%.

Source: CMIE

Global power is seeing a gradual shift from the West towards East especially Asia and if India does not strategize their policies with long-term goals it might miss another economic revolution.

Crypto and blockchain is going to play an instrumental role in the next industrial revolution

Financial experts and governments around the globe were quite skeptical of cryptocurrency and its role in the financial world at the start, however, that has changed drastically in recent years as regulators have realized it’s impossible to ban a network which is decentralized.

Countries like the US, China, and S.Korea had regressive regulatory policies towards crypto earlier; however, looking at the increasing popularity and acceptance of cryptocurrencies they have realized that regulating it is much easier than completely banning it.

Countries which looked beyond the skepticism and invested in the” dot com” boom in early 2000 saw a new stream of revenue and job opportunities. India was not one of those countries as the economy was just an infant compared to the west and did not have the resources to harness the evolving tech. However, things are quite different now and India is well-positioned to be a part of the next revolution with plenty of human resources at hand.

Positive crypto regulations can revive the struggling Indian economy

Indian economy is in dire need of revival, and regulating crypto itself can lead to an addition of $12.9 billion worth of revenue. This is just a rough estimate from direct revenue generated by firms, exchanges, and individuals if crypto was legalized. However, this is just the tip of the iceberg, as regulating would not just provide thousands of direct job but many miscellaneous jobs that come along with it.

CREBACO, a blockchain, and crypto-focused analysts firm in their research detailed how regulating crypto can lead to direct job creation for professional crypto traders, expert blockchain coders along with many miscellaneous job opportunities that would arise due to the opening of new exchanges and crypto-oriented service providers.

| Category | Number of jobs/Revenue generated |

| No. of Companies that will emerge in Blockchain and Cryptocurrency domain | 1500 |

| No. of Expert Blockchain Coders | 3500 |

| Approx. minimum salary of per coder | Rs.420,000 per annum |

| Total salary (as per minimum salary) of all coders | Rs.1.47 billion per annum |

| No. of Technical Content Writers | 2650 |

| Approx. minimum salary of a Technical Content Writer | Rs.540,000 per annum |

| Total salary (as per minimum salary) of all Technical Content Writer | Rs.1.43 billion per annum |

| No. of Cryptocurrency Traders | 10000 |

| Approx. minimum salary of a Cryptocurrency Trader | Rs.300,000 per annum |

| Total salary (as per minimum salary) of all Cryptocurrency Traders | Rs.3 billion per annum |

| Creating & Maintaining Crypto Exchanges | 2000 |

| Indirect jobs created which includes CAs, lawyer, real estate, and freelancers | 3500 |

Note: The above numbers do not count if blockchain projects are outsourced to India, in that case, the figures would increase several-fold.

Siddharth Sogani, the CEO of CREBACO told AMBcrypto that given the interest and awareness towards blockchain and crypto, there will be a certain boom in fintech jobs. He explained,

“The economy is in a recession.. looking at the gold prices, the patterns are similar to the recession which happened in 2008. I think this could be one of the last few recessions as decentralization will take over and long term inflation by banking and financial institutions will not be possible. Let bitcoin evolve a bit more.”

The RBI banking ban which came into effect in the first quarter of 2018 crippled the budding crypto scene in India as several crypto exchanges operating in the country had to abruptly shut their operation in absence of any banking support. Koinex, CryptoKart, ZebPay were some of the prominent crypto exchanges that had to shut their operations due to the banking ban. As of today, WazirX is among the few Indian crypto exchanges left operational in the country.

Nischal Shetty, CEO of WazirX and one of the biggest advocates of positive crypto regulation, listed several advantages to regulating crypto from an economic perspective:

- New foreign Venture Capital investments into Indian startups

- Growth in jobs

- Opportunity to bank the massive 300M+ unbanked people in India

- ICOs can be a new global fundraising mechanism for early-stage Indian startups

- Making Remittances cheaper and faster

Shetty went on to emphasize the importance of regulation in India and its impact on a global level, he said,

“We’re a technology-focused nation and technology is one of the largest job creators as well as exporters in India. Technology brings in a lot of foreign exchange as well. Crypto is the next frontier of technology and if India was to ban it then what signal are we sending to the world?

That we do not fully understand cutting edge technology. Such a signal will play out negatively as it will be clear that India cannot produce any Crypto talent after that. Fewer jobs will come to India in technology and as a result, we’ll lose out on foreign capital investments.

The ripple effect of a crypto ban will be felt across the technological growth of India. In the long run, India will lose massive brains to other countries such as the US, UK, EU etc which support Crypto and encourage entrepreneurs there.”

Indian IT sector can benefit the most from positive regulations

India is the among the topmost global sourcing destination for IT companies and has provided both on- and off-shore services to global clients. However, despite being such a significant force, the major focus has always been on providing services rather than being a leader. Blockchain and cryptocurrencies can very well pave the path for Indian engineers and entrepreneurs to lead the global circuit.

Matic labs one of the biggest success story originating from India in the decentralized world is taking big strides and shining example of India’s potential. AMBCrypto got in touch with the co-founder and COO of Matic Network Mr. Sandeep Nailwal to understand his views on how blockchain and crypto can put India in the driving seat. Mr. Nailwal told AMBcrypto,

“The concerns and cautious approach of the government are understandable given the slew of scams that arose in the last couple of years. However, this caution should not hamper them from seeing the larger picture and importance of the emerging technology which most of the countries are betting big on.”

Matic lab was founded back in 2017 as a second layer blockchain scalable solution and went on to raise the total hard cap of $5m. At the moment Matic lab has a total circulating supply cap of $30.5 million and a fully diluted market cap of $138 million.

Country at crossroads

India as a country is on another technological adoption crossroad, being seen as the IT capital, it cannot afford to miss out on the crypto and blockchain wave especially when major superpowers like China and USA have come around from their early skepticism to realize that cryptocurrencies cannot be banned completely.

The post appeared first on AMBCrypto