Bitcoin futures contracts allow traders to speculate on the price of Bitcoin without necessarily have to own it. They are a derivative product that gained serious popularity in the past years.

Traders are always looking for information that would give them an edge in the market. Arguably, the most valuable data is that which offers an insight into what other traders are doing.

Open Interest (OI) could provide some of this information with appropriate interpretation. Understanding it and its impact on the Bitcoin’s price could help traders make better decisions.

Open Interest And Trading Volume

The overall trading volume and open interest are somewhat related concepts. While the volume accounts for all of the contracts that have been traded in a given period, open interest only considers the total number of open positions by market participants at any given time.

Open interest is calculated by summing up all the opened positions, regardless of whether they are long or short, and subtracting those that have been closed.

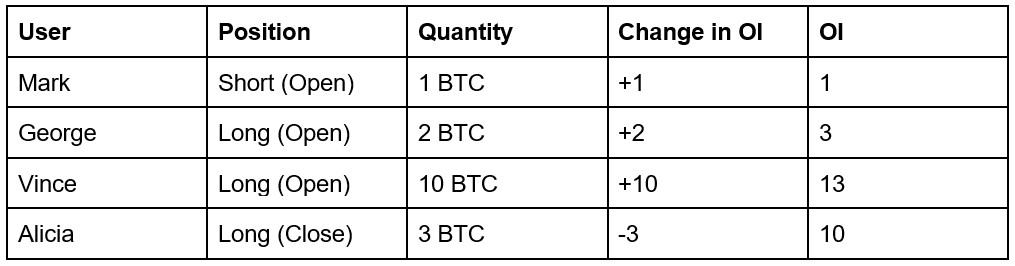

The following chart exemplifies how open interest (OI) changes as a result of user activity.

Evidently, the open interest increased from 1 to 13 as traders place new positions. However, as Alicia closed a position of 3 BTC, the open interest declined. This above example shows how open interest changes depending on the number of open contracts.

Why Does Open Interest Matter In Bitcoin Trading?

In legacy markets, traders monitor the changes in open interest closely. Analysts typically use it as an indicator to pinpoint the strength behind price trends and market sentiment.

Open interest is indicative of the capital flowing in and out of the market. If more capital flows to Bitcoin futures, the open interest will increase. However, if the capital flows out, the open interest will decline.

Hence, increasing open interest is indicative of a bull market, whereas if it decreases, this signals a bear market.

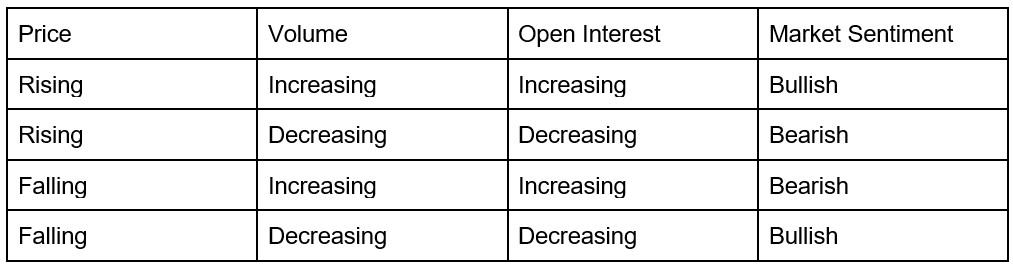

Usually, analysts monitor the correlation between the asset’s price, volume, and open interest to analyze the current market sentiment. The following table shows the interpretation of market behavior based on the changes in the above factors.

Open Interest And Its Correlation To BTC Price

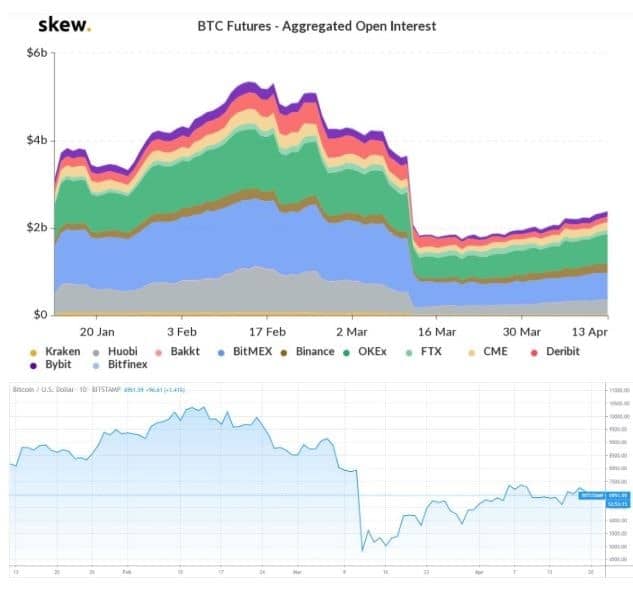

Looking at the historical performance of Bitcoin’s price regarding its open interest, there is an evident positive correlation. Data from the widespread monitoring resource Skew tracks the open interest for Bitcoin futures since the beginning of the year. Below is a chart that reveals how it relates to the price.

As seen in the picture, Bitcoin’s price tends to correlate to its open interest on the way down and when it’s increasing. The drop in both is particularly evident on March 12th – 13th when Bitcoin lost almost 40% of its value.

It’s important to note that this could be explained with the liquidated long positions that took place during that time, mainly on BitMEX exchange. As the price dropped, a lot of long positions got instantly liquidated, hence decreasing the open interest as well. On the contrary, when the price was increasing, OI was also on the way up.

As outlined above, open interest can be used combined with the price and the trading volume to determine the current market sentiment. It’s unwise to rely on a single indicator when making trading decisions.

Conclusion

Many crypto traders and analysts believe that the proper interpretation of the changes in open interests could give relevant information about the current market sentiment. For instance, if the open interest increases along with the volume and the price, this could mean that a bull trend is forming.

As such, open interest can assist traders in getting a better sense of whether the market is getting stronger or weaker, bullish or bearish. This could also be used to identify specific trading opportunities.

With Bitcoin Futures, a growing open interest usually reflects the increasing market participation and capital inflow. As such, traders could benefit from higher liquidity as well.

The post Crypto Trading Academy: What Is Open Interest In Bitcoin Futures And How Traders Use It? appeared first on CryptoPotato.

The post appeared first on CryptoPotato