When the Crypto Twitter community reacts, it does so in a big way. And when the guys from the Bitcoin neighborhood unite, there’s nothing to stop them, especially when it comes to criticizing traditional financial institutions —whether they’re crypto-friendly or not.

If this seems hard to believe, ask PayPal, who had to deal with significant criticism after publishing something about Bitcoin that was not swallowed easily by the Crypto Twitter community.

What PayPal Did

In October 2020, PayPal announced its decision to let users buy, store, and sell Bitcoin, Bitcoin Cash, Litecoin, and Ethereum. The news was received with joy by the community, especially after Bitcoin took off in the wake of expectations that PayPal could introduce crypto to the mainstream.

Moreover, PayPal accelerated its efforts and started supporting all American customers on November 12, 2020.

Everything was going well, and Crypto Twitter’s relationship with PayPal was one of absolute love… Until PayPal started introducing the technology to its 179 million customers, a large majority of which had probably never used a crypto wallet before.

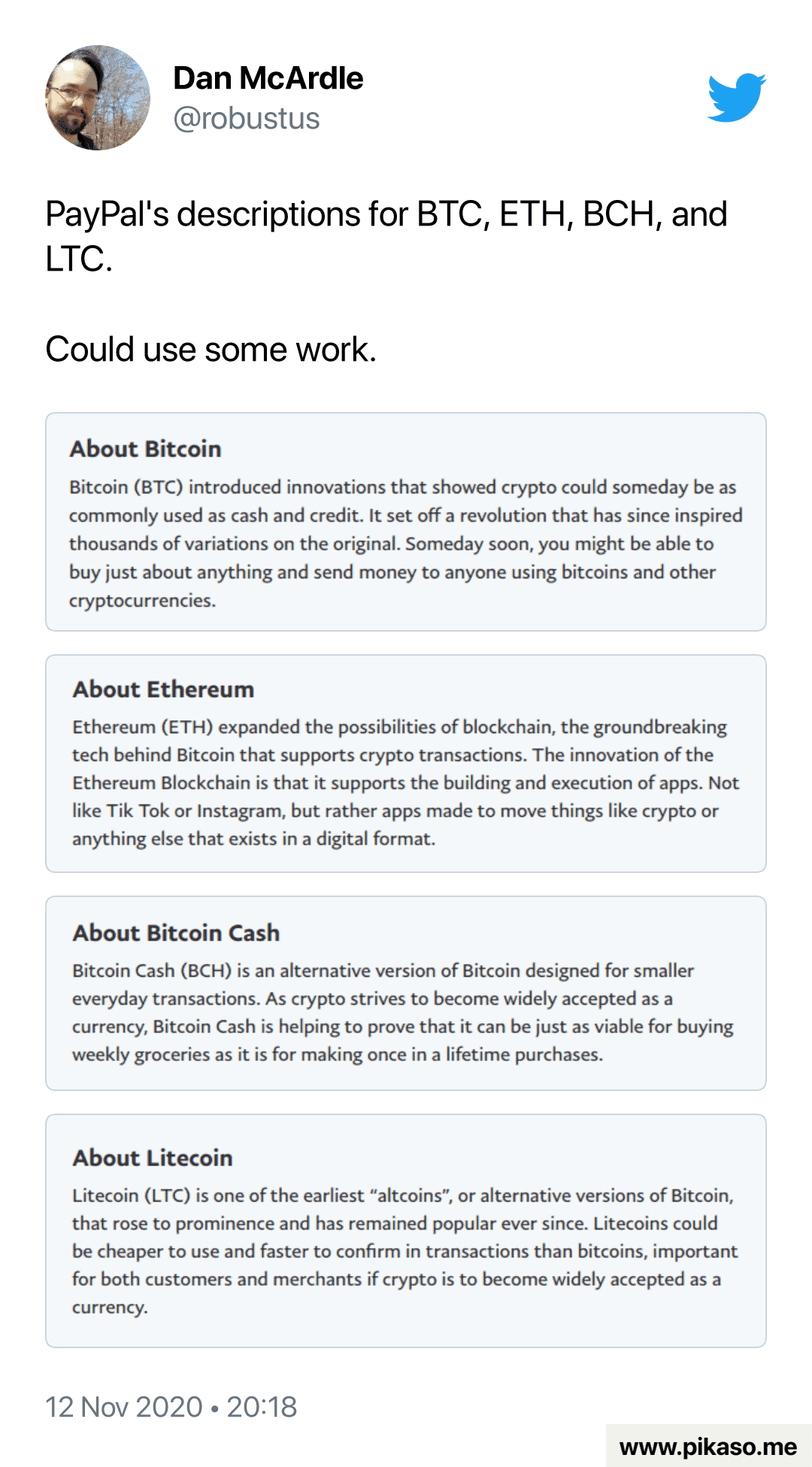

Here’s how PayPal explains Bitcoin to its users:

“Bitcoin (BTC) introduced innovations that showed crypto could someday be as commonly used as cash and credit. It set off a revolution that has since inspired thousands of variations on the original. Someday soon, you might be able to buy just about anything and send money to anyone using bitcoins and other cryptocurrencies.”

Definitions of other cryptocurrencies are just as basic. In summary, Paypal points out that Bitcoin Cash focuses on day-to-day micropayments, Ethereum allows users to run applications —not like TikTok, but programs oriented to work with crypto-currencies— and Litecoin focuses on fast and cheap transactions.

They also describe altcoins as “alternatives version of Bitcoin.” Oh God… They didn’t know what was coming.

PayPal Enrages the Bitcoin Community in Crypto Twitter

Reactions were not long in coming. From emojis of disgust and anger to laughter, insults, and threats; bitcoiners made sure PayPal was aware of their disapproval.

Dan McArdle, co-founder of Messari Crypto, wrote one of the tweets with the most interactions. He simply pointed out that the definitions “could use some work.”

But his tweet was replicated with various reactions, such as that of Melten Demirors, who only needed an emoji to express her “love”. A sentiment that David Coen, author of Q/A about Bitcoin, shares.

— Meltem Demirors (@Melt_Dem) November 13, 2020

Neeraj K. Agrawal, from Coincenter, also raised his voice. From his point of view, not only were the definitions wrong, but PayPal had to explain what a hard fork was so that users could understand the concept of Bitcoin Cash.

For one thing, I think if you’re going to list a fork you should explain forking. Yeah it’s complicated but it’s an essential component of understanding what any of this is beyond numbers on a screen

— Neeraj K. Agrawal (@NeerajKA) November 13, 2020

Others even threatened the possibility that the explanations might trigger a legal battle:

Hey @PayPal, your crypto descriptions are so bad that somebody is going to sue you.

Seriously. I’m a lawyer who works in crypto. This is egregious *negligent misrepresentation.*

Altcoins are not “alternative versions of Bitcoin.”

Stop saying bullshit. https://t.co/RhX8MQgHbP

— Clint Ehrlich (@ClintEhrlich) November 13, 2020

The “KISS” Principle: Why Others Defended PayPal’s Choice of Words for Bitcoin

For their part, other users insisted that PayPal was doing the right thing, explaining the concept to users with zero technicalities —and zero tribalism.

Podcaster JChains noted that “normal people” didn’t really care for techincal issues like hash power or cryptography algorithms:

I disagree. These are very simple descriptions for a reason. What you crypto nerds don’t understand is normal people don’t give a fuck about jiggawatts and hashrates or Satoshi for that matter.

I’d love to see what complicated, non-understandable nonsense y’all suggest.

https://t.co/4SCLUDheSW

— JChains (@CryptoJChains) November 13, 2020

Another user mocked that many people criticized PayPal because its explanations were not as flashy as many bitcoiners expected.

cryptobros mad that PayPal accurately describes coins w/o referencing how they’ll save the world, end hunger, and be the underlying tech of useless govt systems https://t.co/8j14icsgHe

— Kevin Carter (@KCartero) November 13, 2020

The Devil’s Advocate: Did PayPal Do The Right Thing?

In contrast to PayPal’s definitions, Square —another Bitcoin-friendly payment processor— presents the following explanation:

“Bitcoin is the first and most well known example of a new kind of money called a ‘cryptocurrency.’ It creates, holds, and transfers value using cryptographic equations and codes to ensure that transactions can only be completed once. One of Bitcoin’s most important characteristics is that it is decentralized using peer-to-peer technology—meaning no single institution can control the Bitcoin network.”

Another Bitcoin 101 concept accepted by the community can be found on the Bitcoin.org home page:

“Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network. Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.”

So, considering these 3 concepts, and playing the devil’s advocate, Even though there is no such thing as a completely neutral opinion, PayPal’s choice could be more attractive and easier to understand for a 70-year-old grandfather who’s never heard of Bitcoin, or a housewife who thinks crypto is money for criminals.

But, noboy knows. Perhaps other bitcoiners were right and the task was assigned to some rookie to get the job done quick and easy.

But if this was the case, that rookie certainly knew how to stir up controversy.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato