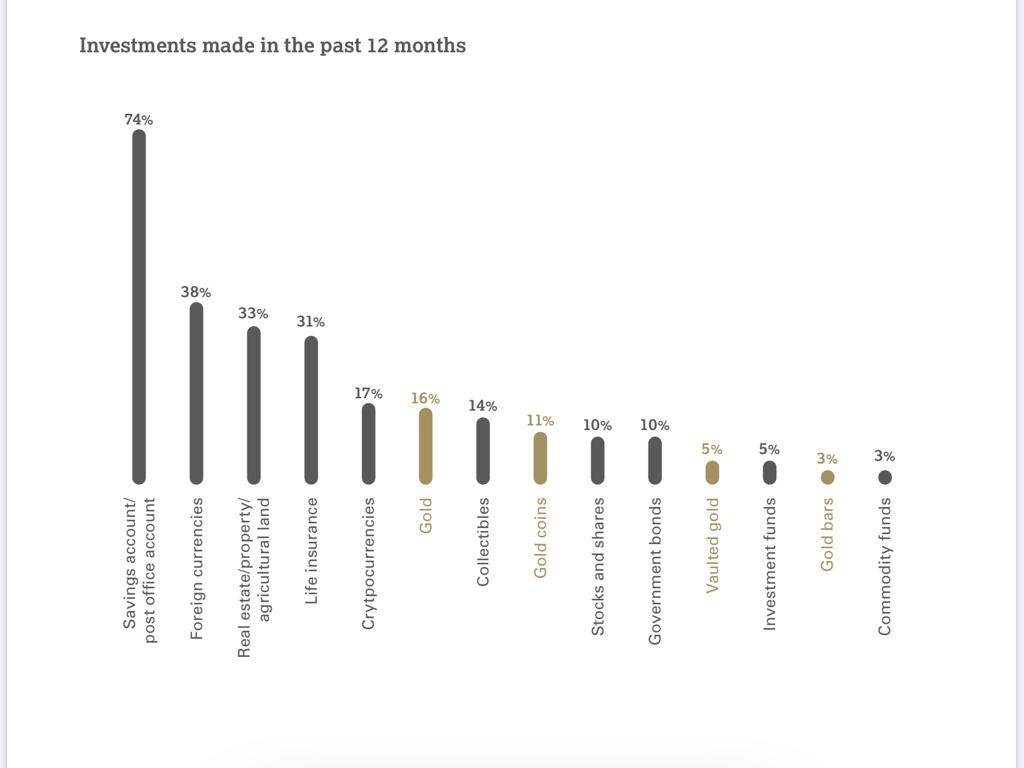

New research about Russia’s retail investment market indicates a prevalence of investment in cryptocurrencies and has ranked crypto as the fifth most popular investment asset, after savings accounts, foreign currencies, real estate, and life insurance. With a quarter of Russia’s investments being carried out online, cryptocurrencies led the way with nearly 80% which were being bought “exclusively online.”

The research was conducted by The World Gold Council, detailing the retail gold insights in Russia. The council surveyed 2,023 investors in Russia who made at least one investment in the 12 months before the survey.

However, since investing through savings accounts ranked first, research council deduced that Russia was “broadly conservative,” and that the region was underpinned by a desire for wealth preservation. But it is important to note the paradox here which shows how the region is tolerant to risk driven by speculative and short-term investment targets. Especially since crypto was one of the mainstream investment products.

Research found that a quarter of investments take place online. In other regions, reports have pointed out how online and even mobile trading has driven the market because of Covid-19 imposed lockdowns. In fact, Russian citizens between the 18- to 24-year-old age group were much more willing to take risks to get “exponential growth.”

As per the research, 65% of Russian youth consider investing in cryptocurrencies, rather than long-term investments, like savings accounts. Furthermore, the research said that Bitcoin (BTC) was popular in Russia in being an “accessible” investment tool.

With regard to gold, the research highlighted out how gold-backed ETFs were competing primarily with cryptocurrencies along with commodity funds, investment funds, and stocks and shares. It further suggested that perhaps the gold industry would embrace fintech as a route to reach its target audience, which could help gold “compete against” cryptocurrencies.

Russia also ranked second in terms of global crypto adoption according to another research from blockchain analyzer firm Chainalysis. However, Russia had passed new regulations on crypto-trading and mining stating that it would not allow its citizens to use crypto in as a payment medium for any goods or services, from 2021 onwards.

The post appeared first on AMBCrypto