In 2019, cryptocurrency-related crime – thefts, hacks, fraud amounted to $4.5 billion. The latest data from blockchain forensics company CipherTrace shows that this number has fallen to $1.8 billion this year – a 60 percent reduction. Nonetheless, the DeFi space has seen an explosion in criminal activity.

Mainstream Cryptocurrency Crime Declining Says CipherTrace

In a tête-à-tête with Reuters, CipherTrace CEO Dave Jevans observed that crypto exchanges and digital asset trading facilitators had upped their security game. This comes after more than decade-long exploitation of cryptocurrency platforms by hackers and malicious actors.

This probably explains the massive 60 percent reduction in mainstream cryptocurrency crime from $4.5 billion in 2019 to $1.8 billion this year.

What we have seen is that exchanges and other cryptocurrency players have implemented more security procedures. They have taken the guidance and implemented the procedures to secure their funds better. So you’re going to see less mass-scale hacks.

But there was a disturbingly noticeable trend that CiperTrace researchers observed this year.

Ugly Defi Hacks Accounted For 20 Percent Of Crypto Crimes in 2020

The CipherTrace report pointed out that digital asset-related thefts and hacks, excluding misappropriation and fraud, amounted to $468 million as of October end. This is a 30 percent appreciation from the $361 million figure for the whole of 2019.

DeFi hacks contributed to 20 percent of 2020’s number, according to the blockchain analytics company.

About 20% of those hacks, or roughly $98 million, came from “decentralized finance” or DeFi, which are transactions on platforms that facilitate lending outside of banks.

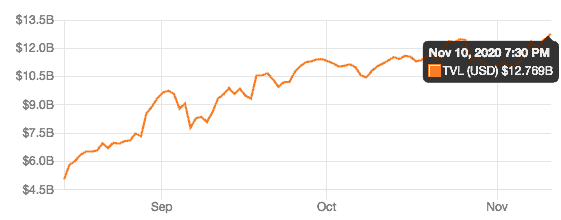

CipherTrace attributed this rising trend of DeFi attacks to the Ethereum-based ecosystem’s explosive growth in 2020. The total USD value locked in decentralized finance protocols is already on the way to touch the $13 billion mark.

This is a humongous growth compared to last year when the total DeFi market valuation merely clocked $680 million. Jevans observed that DeFi hacks in 2019 were near negligible, but this year

Companies and individuals have rushed DeFi products to market that have not gone through security verification and validation. So people are figuring out that there’s a weakness here.

The CipherTrace boss even went forward and called the DeFi markets a potential ‘haven for money launderers.’ Why? Because DeFi protocols are permissionless by design, and this substantially reduces the access barrier for users across the world.

With DeFi networks permissionless by design, which means they often lack clear regulatory compliance, anyone in any country is able to access them with little to no customer-verification hurdles involved.

Ethereum’s DeFi space is growing by leaps and bounds, but will it encourage hackers to carry out much more massive exploitations in the future? Additionally, will it actually become a vehicle for financial criminals? That still remains to be seen.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato