Attention matters, and in a world of social media and online business, attention matters even more. If you can entice more people to visit your website, chances are you can grow faster. But in this era of massive scaling, there is a difference between fast growth and fake growth, a difference that many cryptocurrency exchanges know and often exploit.

According to the quarterly report by CoinGecko for Q2 2020, there is a disproportionate increase in cryptocurrency exchange volume and traffic. The report questioned whether and an increase in web-traffic corresponded to “more traders,” for around 20 top cryptocurrency exchanges and found that for certain exchanges the traffic was “inorganic.”

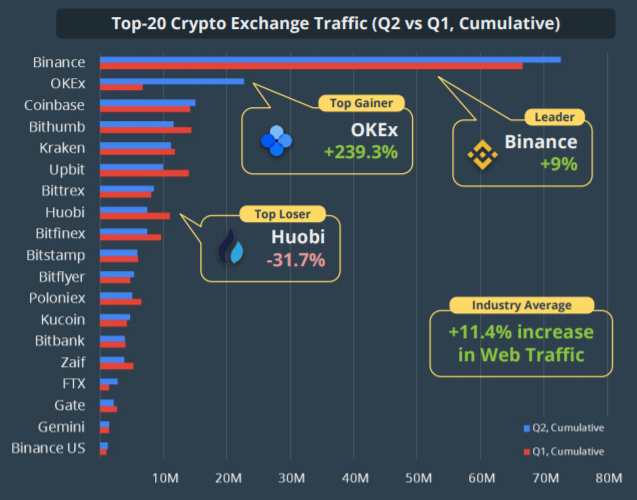

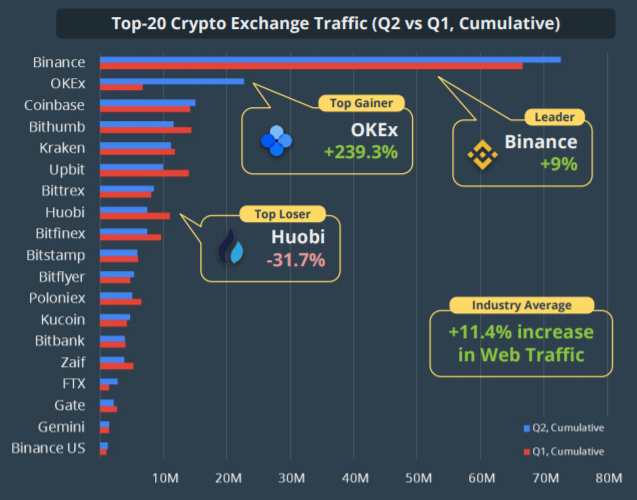

On average, the cryptocurrency exchange industry saw 11.4 percent increase in web-traffic but this was courtesy of the top two spot exchanges in the market – Binance and OKEx. Most exchanges below these two saw drops in their average web-traffic between Q1 and Q2. Binance saw a 9 percent increase which looks paltry to OKEx’s whopping 239.3 percent increase in web-traffic. Despite the vast difference, Binance still has over 70 million visits compared to OKEx’s 20 million.

Coinbase was third with just over 10 million visits followed by Bithumb, Kraken and Upbit. The biggest loser in the top-20 was Huobi with a quarterly drop of 31.7 percent in web-traffic.

Top-20 crypto exchange web-traffic Q-on-Q | Source: CoinGecko quarterly report

Despite the difference in performance and the vast gap between the first two exchanges and the rest of the bunch, the report suggested that “for certain exchanges,” the top traffic referrers came through advertisements.

“However, our research suggests that traffic growth for certain exchanges may be inorganic, as top traffic referrers were crypto ad or faucet sites.”

Referring to OKEx’s triple-digit gain, CoinGecko stated that the exchange’s growth “may appear inorganic” as its top-5 referring sites were crypto ad sites like “adbtc.top and cointiply.com.” Binance also shares similar data as its top-2 referrers were “faucet sites.”

This should be alarming because most exchange analytics websites are including web-site traffic data as a requisite for exchange rankings. Coinmarketcap, which was acquired by Binance in April 2020, recently changes its exchange rankings. On the spot cryptocurrency exchange rankings, Binance holds the top spot with a perfect score of 1000 on “Web Traffic Factor.” Other metrics looked at include average liquidity, 24-hour volume and number of markets covered.

In a recent blog post, CMC explained the methodology for the web-traffic score which looked at the following data points – page views, unique visitor count, bounce-rate, time-on-site, relative ranking, and keyword searches. The scores are tallied for each exchange relative to the top exchange i.e. Binance.

Coingecko, in its first iteration of the Trust Score, launched in May 2019, ranked both trading pairs and exchanges based on web traffic, in addition to liquidity and trading activity. With subsequent updates, the analytics company has included exchanges’ scale of operations, API coverage and cyber-security.

The post appeared first on AMBCrypto