Most of the cryptocurrency market is retracing heavily today after a few days of gains. Bitcoin failed to conquer the $12,000 level and has now dropped by $800. Large-cap altcoins follow suit, and the market loses about $20 billion.

Bitcoin Drops By $800

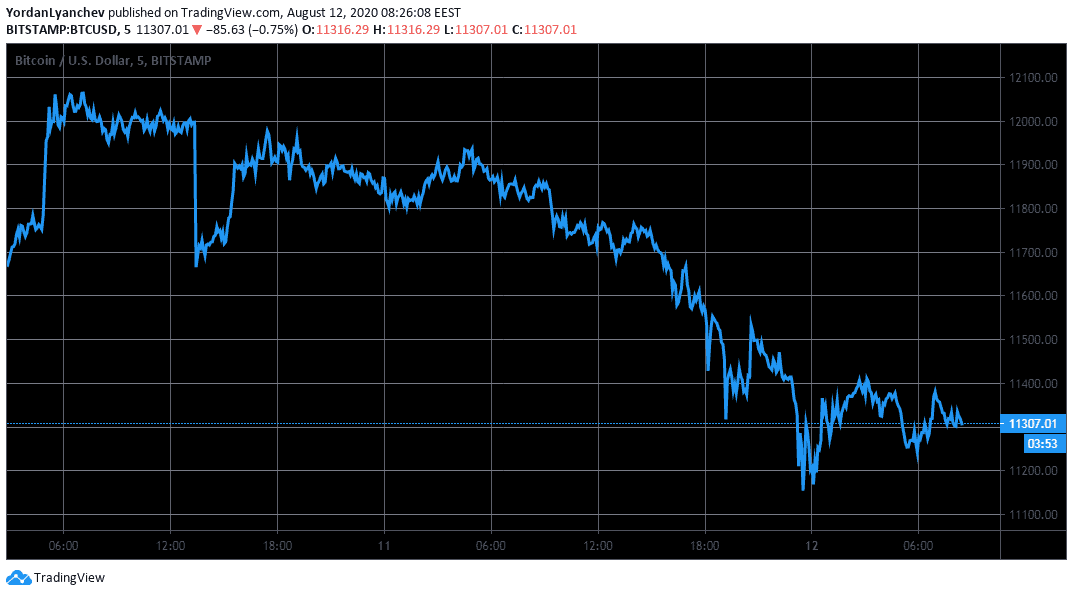

The primary cryptocurrency attempted another break above the coveted $12,000 price tag a few days ago but to no avail. Although it managed to maintain its position just beneath that level for a few hours, the situation reversed rather rapidly yesterday.

BTC began its descend at about $11,950. In a few hourly candles, the asset dipped to $11,150, which was the daily low. Bitcoin has recovered slightly and is currently trading at about $11,300.

From this point on, BTC can rely on $11,200, followed by $11,050 and $10,900 as support if the dive continues. Should the cryptocurrency reverse and returns to its recent bull run, it would have to overcome $11,800 before having a chance to face off with $12,000 again.

Interestingly, just before BTC started dropping, gold led the way with a significant price decline. The precious metal, which has shown an increased correlation with Bitcoin lately, reached an all-time high of approximately $2,070/oz days ago and traded at $2,050 on August 10th. However, the bullion has lost nearly $200 (8%) of its value in two days to its current price of $1880 per ounce.

It’s also worth noting that another precious metal – silver – is also down by 25% from its $30 yearly high reached last week.

Altcoins Bleed Out

Red dominates the cryptocurrency market with some significant losses across low and large-cap alts. Ethereum, which couldn’t break above $400 after a few attempts, has dropped by 6% in the past 24 hours to $372. Ripple has declined by 8% to $0.277, followed by Bitcoin Cash (-8%), Bitcoin SV (-10%), Litecoin (-9.3%), Cardano (-9.3%), and Binance Coin (-7.5%) from the top 10.

Tezos, after reaching a fresh all-time high yesterday of above $4,4, has plummeted by 13% to $3.75. Other evident losers in the past 24 hours include Band Protocol (-20%), Bytom (-15%), Hedera Hashgraph (-14%), Nervos Network (-13.5%), Kusama (-13.3%), IOTA (-13%), Kava (-12%), Ontology (-11.5%), Blockstack (-11%), THETA (-11%), and Algorand (-10.5%).

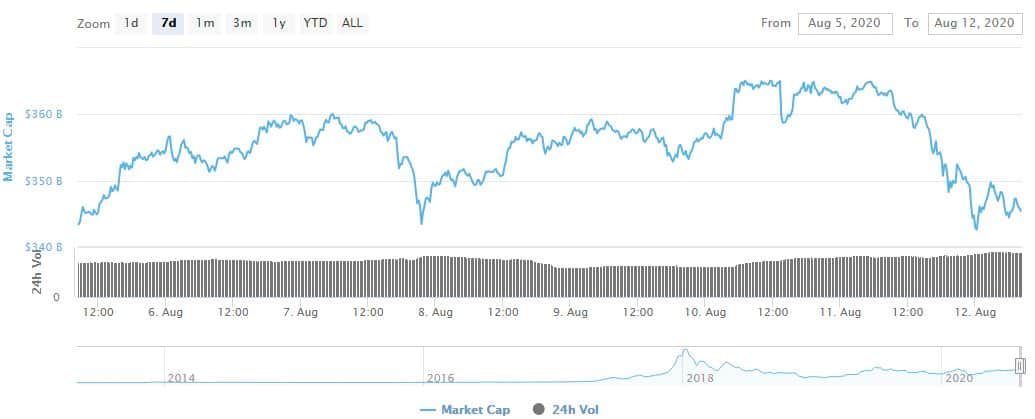

Naturally, these events have affected the total market capitalization. The metric has dumped by over 5% from its high yesterday of $365 billion to $345 billion.

Despite the dominant red color, it’s worth outlining several gainers as well. Compound leads the way with a 29% surge, Maker (15%), Aragon (14%), Ampleforth (14%), Aave (13%), Synthetix Network (9%), and Swipe (6%) are next. Interestingly, SXP continues with its impressive run, and just yesterday marked a fresh all-time high of $3.20 (on Binance).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato