CryptoPotato’s cryptocurrency fund (the Crypto Fund) launched nearly a year ago continues to attract new investors and its performance has increased sharply during 2020 and especially in the past month. The growth comes after a significant change in its asset allocation with the purchase of Augur’s native token – REP.

CryptoPotato’s Crypto Fund History

During the summer of 2019, CryptoPotato launched an innovative fund that invests in several digital assets. Before going live, readers had the chance to vote from 70 different cryptocurrencies which assets would ultimately enter the Fund.

The Fund came alive following a partnership with ICONOMI. The fund platform is based and regulated in the UK, ICONOMI is available to users in more than 180 countries. CryptoPotato’s fund is open for anyone to invest by registering on ICONOMI’s platform.

Crypto Fund Asset Allocation Change

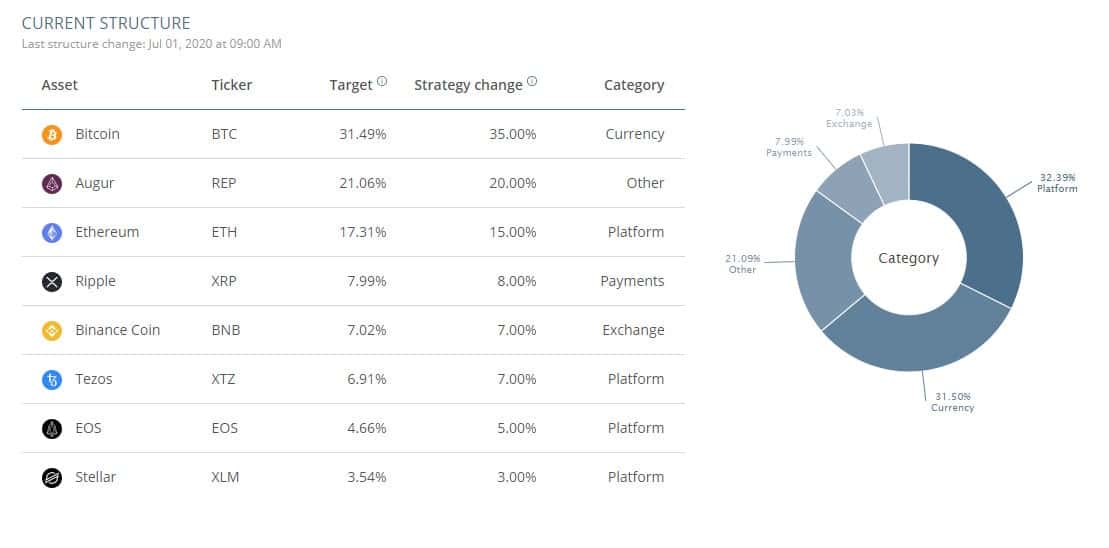

The mentioned above portfolio of cryptocurrency assets received a significant alternation approximately a month ago. After continuous ongoing voting and based on market movements, the group of analysts and experts managing the Fund decided to allocate 20% of the entire portfolio into Augur’s native token – REP.

The addition of REP was primarily prompted by Augur’s growth as a blockchain company in time and that the second version of its project (Augur v2) is expected to launch by July 28th, 2020.

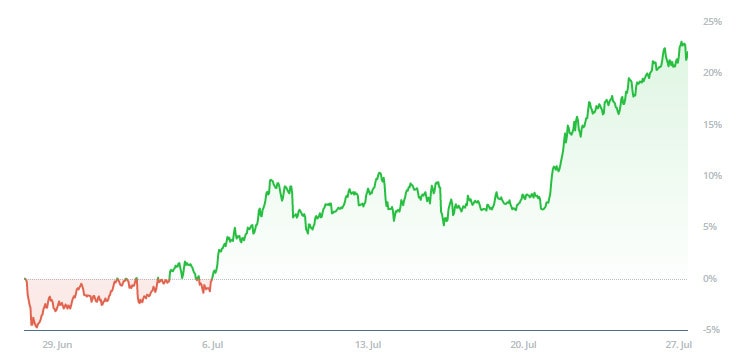

In anticipation of Augur v2, the demand for the REP token has surged since the end of June, and the coin represented 25% at July’s peak, following a price increase of 25% back then.

Crypto Fund Concludes 22% Gains in July

The results after the REP addition, along with the greatest exposure to Bitcoin (35%) and Ethereum (17%), the fund concludes its best month since February 2020 with 22% ROI over the past 30 days.

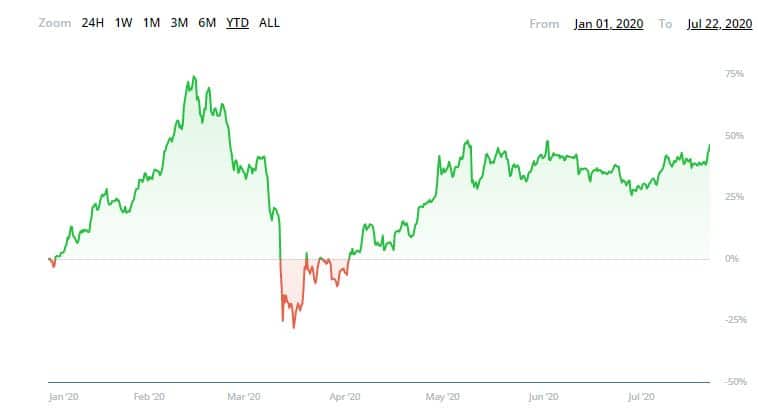

On a macro scale, however, CryptoPotato’s digital asset fund performs even more impressively. It reached a yearly high of over 75% gains in mid-February when the market was booming. Somewhat expectedly, it went into negative territory during the mid-March panic sell-offs. Since then, though, the Fund has been marking substantial returns for its investors, and currently shows a 60% increase since January 1st, 2020.

At that time, Bitcoin saw a slighter increase of 38% on average.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato