Demand for stablecoins has surged this year, mainly on the back of the DeFi sector, which has seen countless crypto earning opportunities arise. MakerDAO’s stablecoin, Dai, has just reached a milestone $400 million supply following the minting of a further $10 million.

This 10 million DAI mint brings the total DAI supply to over 400 million

https://t.co/5yH4a464B8

— Anthony Sassano | sassal.eth

(@sassal0x) August 10, 2020

Surging Dai Demand

Since the beginning of July, Dai market capitalization has surged over 200% as demand soared along with DeFi collateral lockup. Liquidity mining with Dai has become more attractive over the past couple of months as a result of Compound’s June thirtieth distribution patch, according to Messari research.

Before this, investors could earn high interest by simply depositing Dai. However, since the mid-March COVID-crash, the Dai Savings Rate (DSR) has been dropped to zero.

Token swapping and arbitraging have also become popular with yield farmers since Dai and Tether often both wander from their dollar pegs from time to time. Dai is currently trading just over its peg at $1.02, according to Coingecko.

Additionally, Dai finally found its way into Binance’s illustrious listings in late July, which further increased its liquidity and demand. U.S. crypto exchange Coinbase also launched a rewards program for Dai holders late last month, though, as with other Coinbase Learn offerings, most users found themselves stuck on a perpetual waiting list.

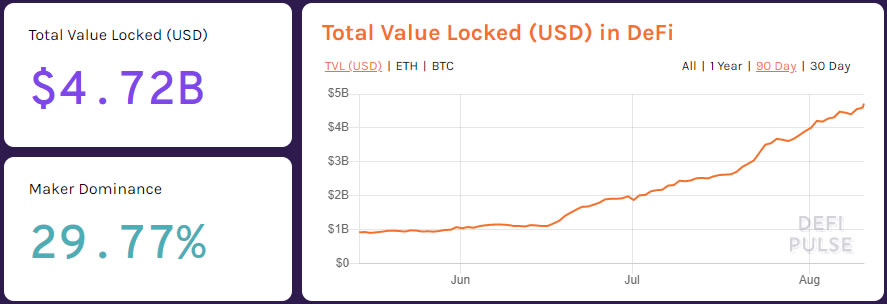

Dai issuer, Maker, is the largest DeFi platform at the moment with a share of a shade under 30%, according to DeFi Pulse. Its total value locked topped a billion dollars in late July and has since surged to a record $1.4 billion.

DeFi Markets Hit Another ATH

The big moves by Maker, and a number of other DeFi platforms, has resulted in a new all-time high across all markets of $4.72 billion. The milestone has been reached just a couple of months after TVL topped $1 billion for the first time.

So far this year, DeFi markets have grown by a monumental 600% in terms of dollar value total lockup. However, some of this must be attributed to Ethereum’s doubling in price since January first. The amount of ETH locked up in DeFi smart contracts is also at a record 4.5 million, which represents 4% of the entire supply.

Even Bitcoin, which has just tapped $12k again, is becoming more popular for use with DeFi platforms as a record 23k BTC has now been tokenized or wrapped, and locked into smart contracts.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato