If you haven’t turned a profit in a while, well, you are not alone. In fact, a recent study by Brazil’s University of São Paulo found that of the share market day traders who persisted for more than 300 days, 97% of them lost money. Further, the study found that the top day trader among those surveyed turned a profit of only $310 in a day, against a risk of $2560.

Here, not only was the risk-reward ratio largely skewed towards a loss, but 66% of day traders quit day trading within a year of starting. Now, there could be several possible reasons for the same, however, fact remains that while many noted a failure in turning a profit and ran out to avoid further losses, others ran out of money and were unable to continue. In fact, 76% dropped out within two years while only 15% survived for three years. Basically, a vast majority was found to drop out at the end of years One and Two. Ergo, one can argue that even active traders are known to underperform.

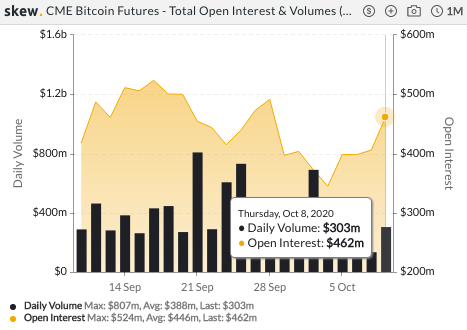

However, contrary to popular opinion on Crypto-twitter, the recent series of events does offer more opportunities than ever seen in the last 5 years. According to data provider Skew, the CME traded $48 million worth of Options during the day, the highest daily volume figure since 28 July on 6 October 2020. At surging volumes, traders took strike prices at $16,000. Further, the situation on the CME was conducive too as corresponding to this development, the Open Interest was up as well.

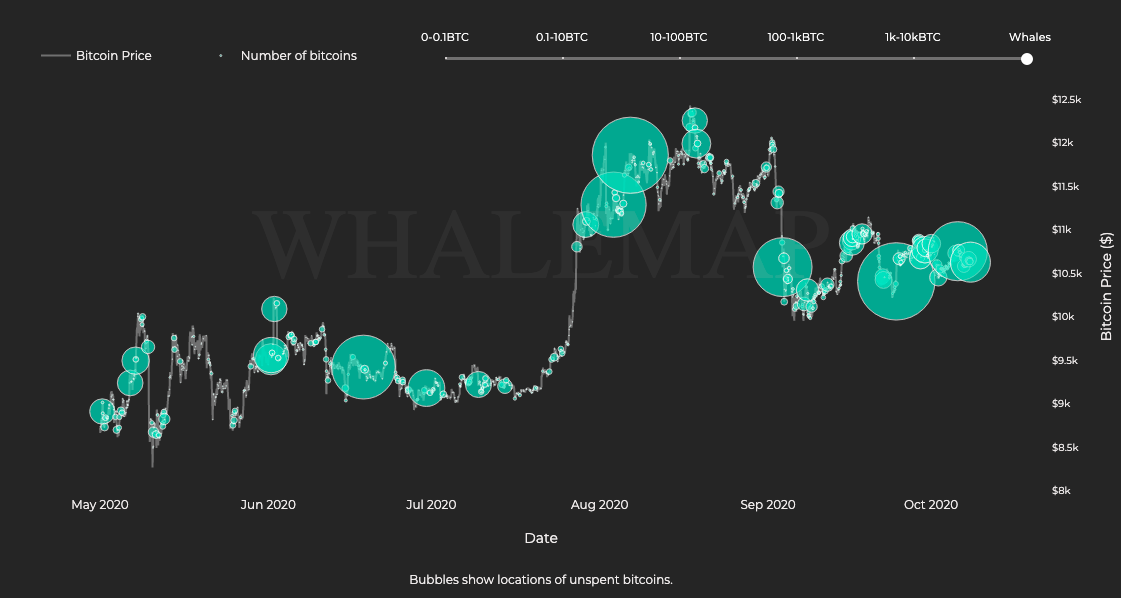

What’s more interesting is that more and more institutions are now inclined to buy Bitcoin using funds from their balance sheets, like Square Inc. and MicroStrategy. In fact, there are other institutions too, other institutions that haven’t made the headlines, since there is accumulation at the $10.3-$10.6k-level, based on data from Whalemap.

Now, the accumulation of Bitcoin at the aforementioned price level may be an indicator of improved market maturity and efficiency. There are more opportunities for booking unrealized profits, when compared to 2018. Harnessing the potential of intra-market spreads, also known as calendar spreads or intra-delivery, is one of the strategies that are effective in a market that is in the accumulation phase.

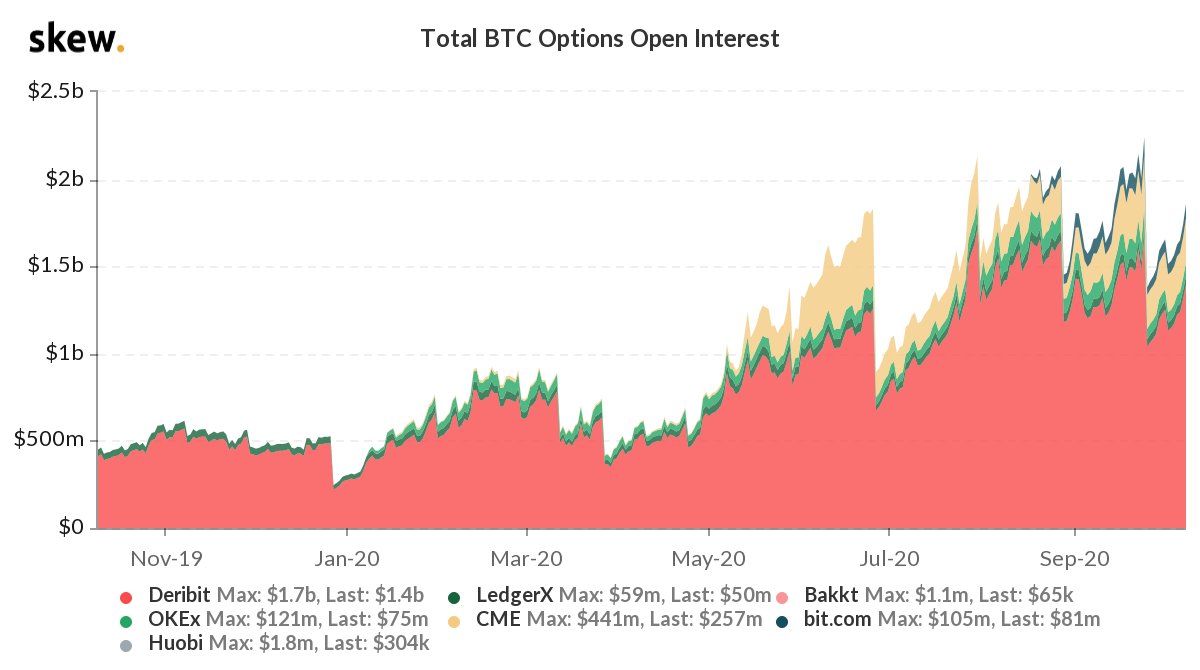

However, to capitalize on the intra-market spread, traders need high Open Interest and currently, Open Interest in BTC Options is 3x, compared to a year ago.

Profitable or not, there are opportunities for booking profits both in the long run and short run on derivatives exchanges like CME, both of which are noting a lot of activity on the part of institutional traders. Go long, or short, or go both ways – The sentiment may appear neutral, but the expectation is that it may turn bullish in the next few weeks.

The post appeared first on AMBCrypto