After failing to reclaim the $11,000 level again, Bitcoin got rejected and dipped below $10,700. Most alternative coins have followed BTC’s move downwards, and the market cap has lost about $6 billion since yesterday.

Bitcoin Fails At $11,000

In the past few days, Bitcoin made a few attempts to challenge the coveted $11,000 line but to no avail so far. The primary cryptocurrency peaked at $10,950 (on Binance) yesterday but couldn’t maintain its bullish run.

During the following hours, BTC headed south firstly to $10,750 and then to its intraday low of $10,660. Despite increasing slightly to about $10,700, Bitcoin is still down more than 2% on a 24-hour scale.

The technical perspective indicates that BTC currently lies on a support level at approximately $10,695. If the asset is to return heading north, it would have to reclaim the resistance lines at $10,730, $10,810, $10,920, and possibly $11,000.

With its recent price decrease, Bitcoin has shown signs of decoupling from other financial markets. Gold’s performance was quite different from BTC’s. Instead of dropping intraday, the precious metal increased from $1,850 per ounce to above $1,880.

The most prominent Wall Street stock indexes also closed yesterday’s trading session deep in the green. The Dow Jones Industrial Average went up by 1.5%, the S&P 500 by 1.6%, and the Nasdaq Composite by 1.87%.

Even after Wall Street closed, the futures contracts continued increasing with some minor gains.

Alts In Red

Most of the altcoin market has followed the largest cryptocurrency. Ethereum and Ripple have dropped by about 1.5% to $353 and $0.242, respectively.

Bitcoin Cash (-1.2%), Chainlink (-5%), Cardano (-2%), and Bitcoin SV (-1.3%) are also in the red from the top 10. Interestingly, BSV has surpassed Crypto.com Coin (-3%) for the 10th spot.

The only two exceptions come from Binance Coin (2.5%) and Polkadot (6%). BNB continues to attract attention as users stake it on the Binance Launchpool to farm new tokens. The latest project added by the leading cryptocurrency exchange’s farming platform is dubbed Venus Protocol.

Further losses are evident from mid and lower-cap altcoins, and especially DeFi-oriented tokens. DFI.Money leads this adverse ranking with a 14% drop. Uniswap (-12%), Yearn.Finance (-11%), Ren (-10%), Ocean Protocol (-10%), and Synthetix Network (-8%) follow.

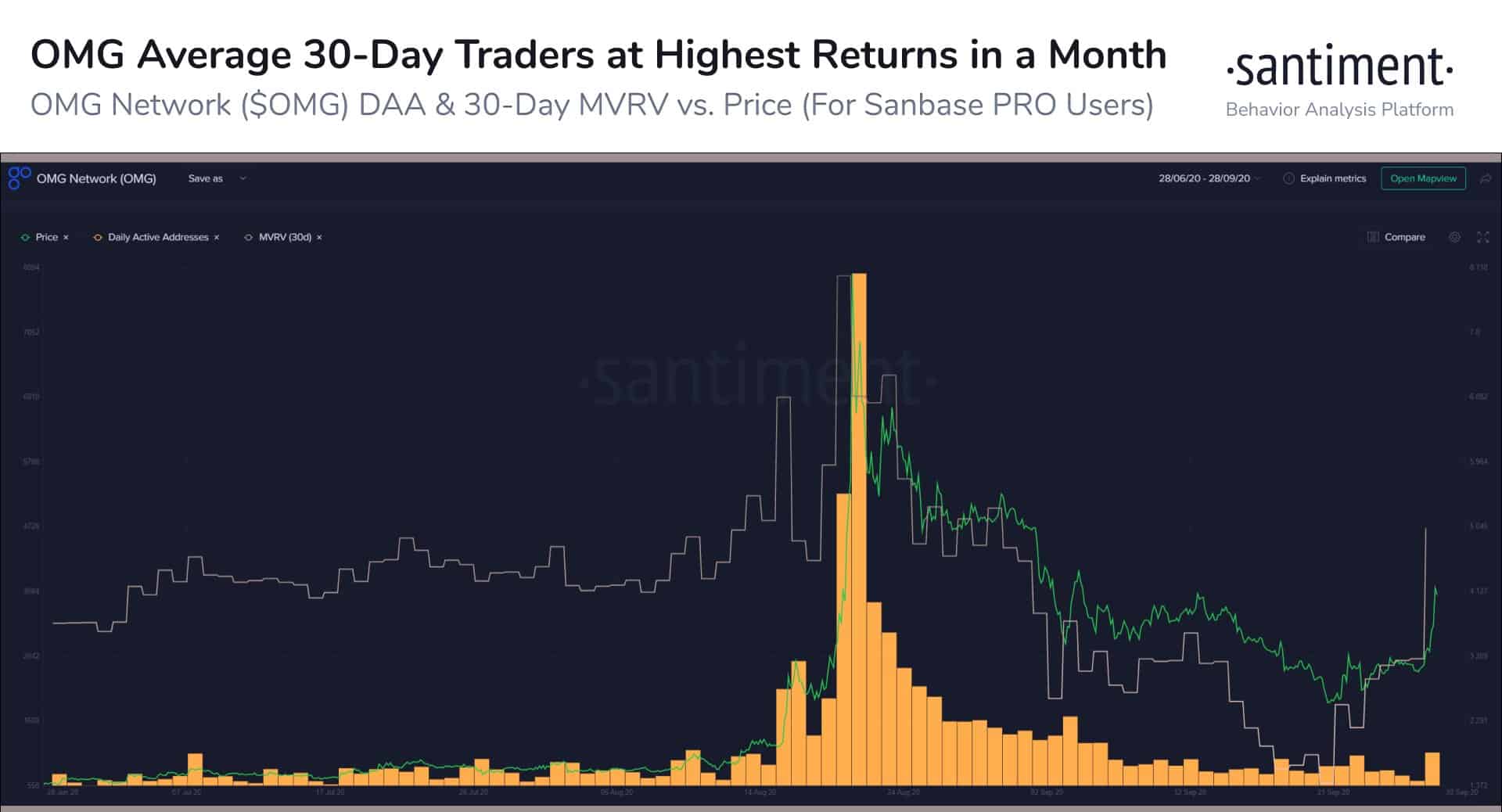

Several coins have also increased in value by significant percentages. OMG Network has gained the most in the past 24 hours – 25%. According to the data analytics company Santiment, the price surge is strongly related to the rising number of daily active addresses.

Other gainers include Arweave (16%), ABBC Coin (13%), The Midas Touch Gold (10%), and Decentraland (8%). Nevertheless, the total market cap has declined from above $350 billion to $344 billion.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato