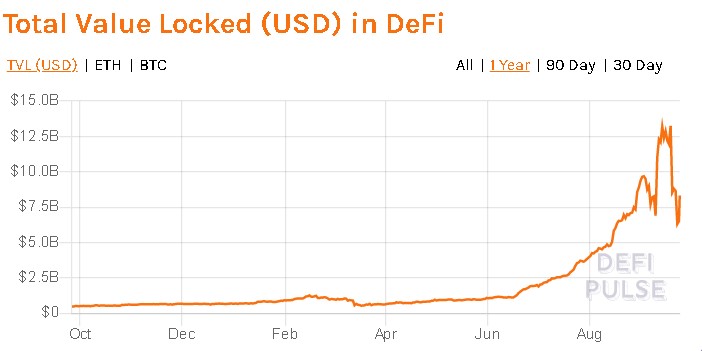

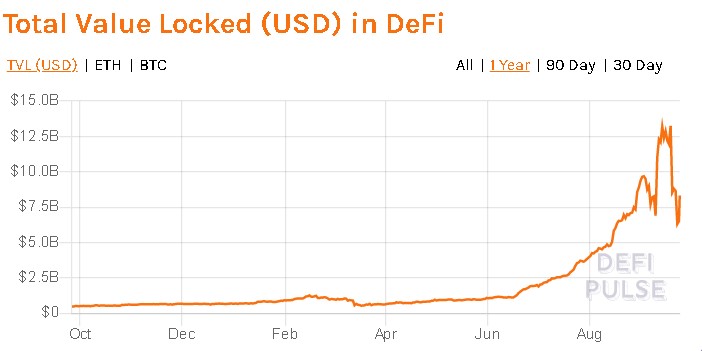

Around four months ago the crypto winds started blowing towards defi. The total value locked up in defi-related protocols increased from about $1 billion to $10 billion. Although a lot of this hype began after Compound’s Comp token, there was a new bubble – it was the governance protocol/token bubble.

Source: Defipulse

Defi aka decentralized finance, as the name indicates is the opposite of centralized finance. With the help of blockchain and smart contracts, it is possible to decentralize finance which has plenty of advantages to it.

Easier said than done

Yes, defi holds a lot of promise, however, the smart contracts and the technology is still too young to actually allow traditional finance to migrate. Defi is no stranger to hacks/exploits, hence, it isn’t ready.

One contrast over cefi is that defi offers are alluring. Platforms offer APY that range not in the double digits but in the triple digits. Platforms are offering yields that go up to 1000% and beyond. Hence, although risky, the rewards are plenty in defi.

In many ways, yield farming evolved from lending/borrowing protocols to what it is now. There are three main reasons why yield farming platforms focus on

- acquiring users

- making sure the users are incentivized

- making sure users chose their protocol

These reasons are synonymous with how ICOs worked.

ICOs made sure the token that was being sold had good returns. Since each ICO aimed at solving a problem using their tokens, it made sure users would use that particular token to get discounts, or transfer value, etc.

Considering the high APY, quick user acquisition, and scams involved in defi and ICOs are arguably more or less the same.

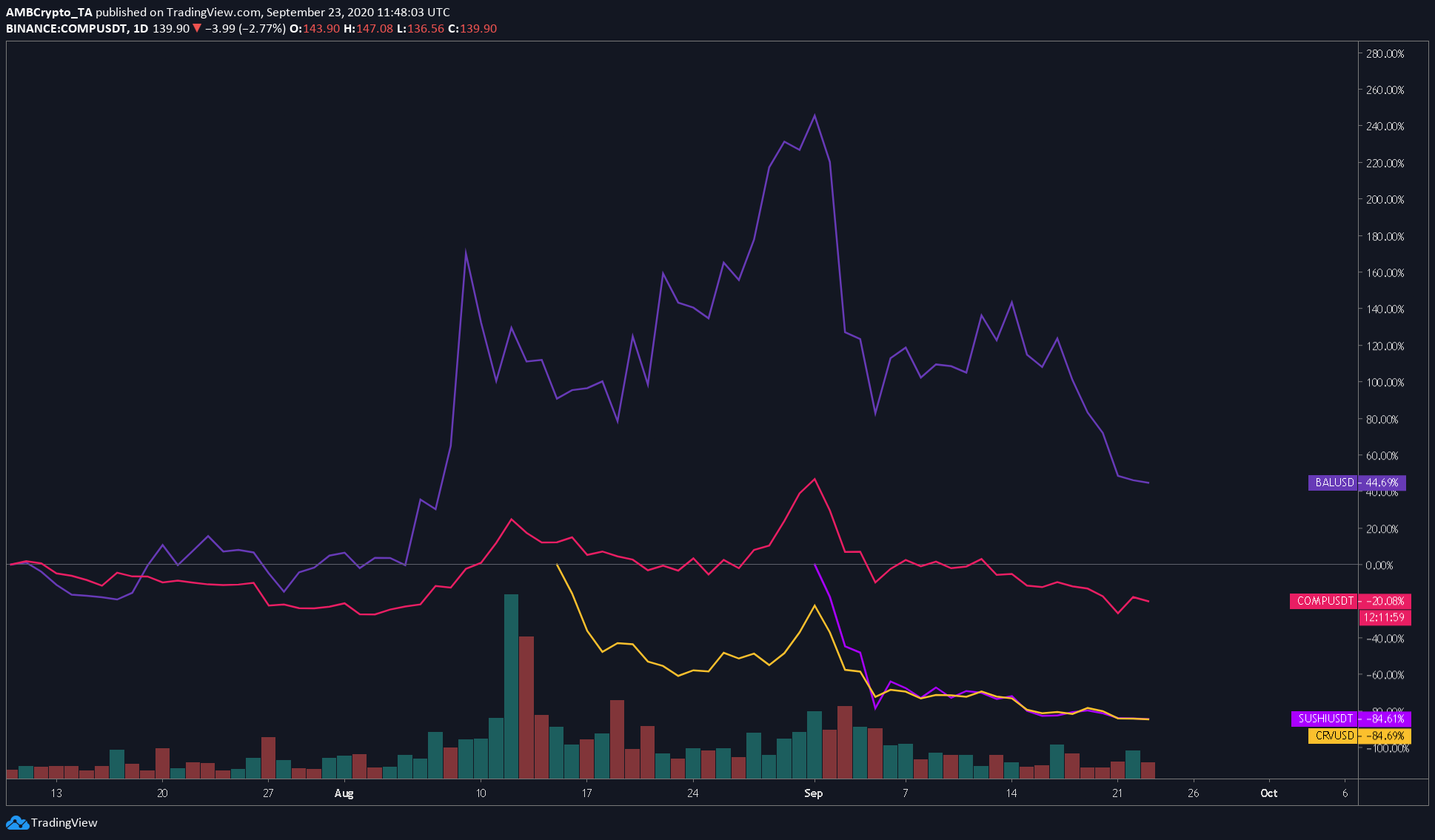

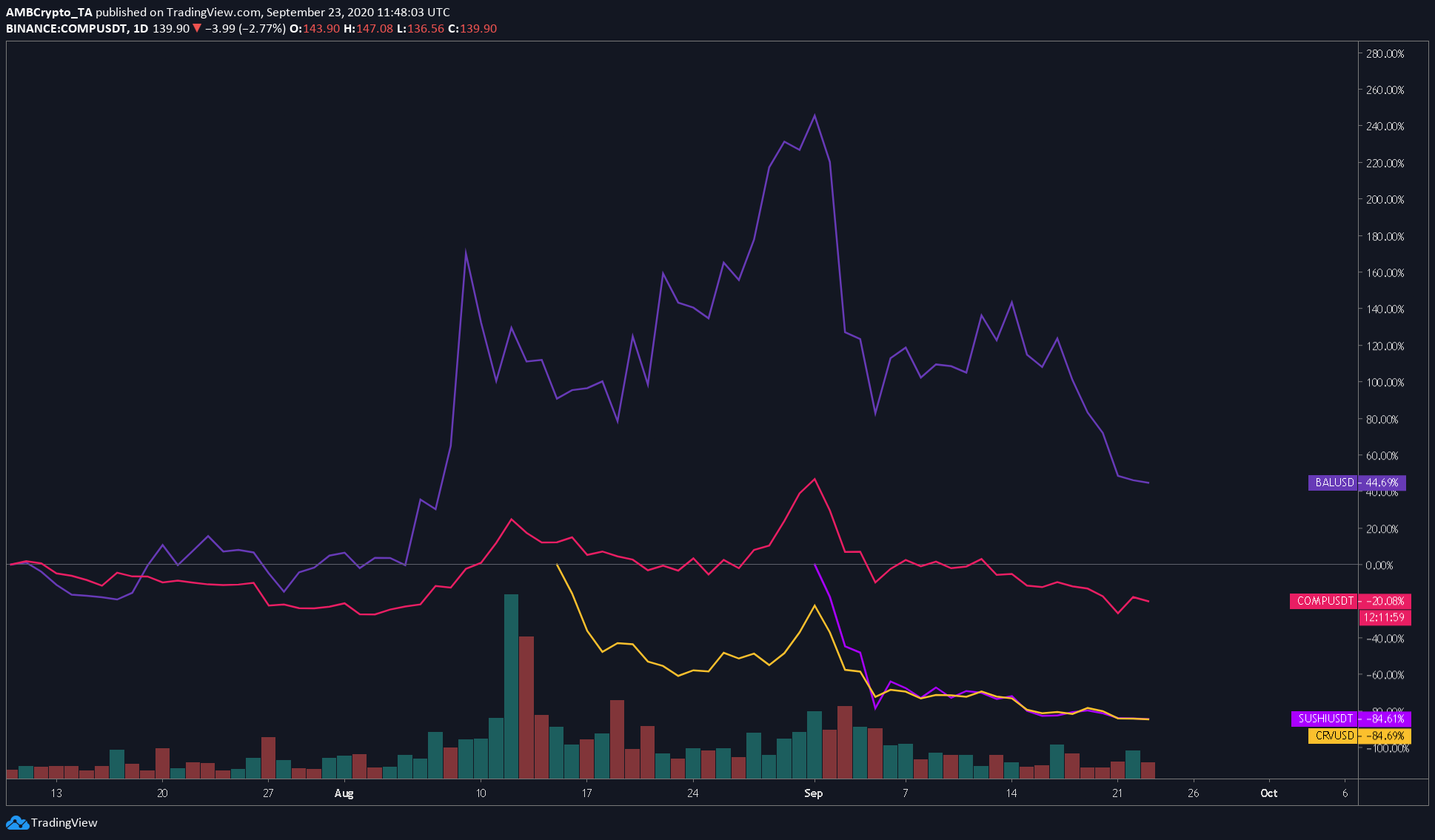

The reason that sets defi apart is the high returns and the governance protocol or yield farming all boils down to the governance tokens. Each protocol has a token – Compound has COMP token, Balancer has BAL token, Curve has CRV token, so on, and so forth.

To make the protocol attractive, the platforms offer high APY by distributing these tokens in a very short time. This would make these tokens a high inflation asset, hence, even though there is initial hype around the platforms or tokens, the tokens crash and lose value.

Source: TradingView

The above chart shows how these tokens rise in value but eventually go down.

The best example is perhaps, the MEME token. Although created as a joke, the token appreciated to a little under $2,000, however, in the last 24 hours, the coin has lost approximately 42% of its value. This is something a lot of defi tokens are familiar with.

Hence, to conclude, although defi does have a lot of potential, it is in many ways similar to ICOs.

The post appeared first on AMBCrypto