The decentralized finance [DeFi] space has managed to carve out its position in the crypto sphere. For the better part of the year, when the crypto market had remained restrained under heavy sell pressure and other global economic turnarounds, the DeFi projects acquired great interest and led to a DeFi hype. During this period Ethereum was the only digital asset experiencing growth, but now that the spot is back on track, the DeFi space has been hit with a bump.

Bitcoin’s price has gone above $14k and managed to stay at $14,441.31, at press time. Along with the largest crypto, the Ethereum price was also close to $400, at $399 while writing. However, this boost in the spot price has stunted the growth of the DeFi.

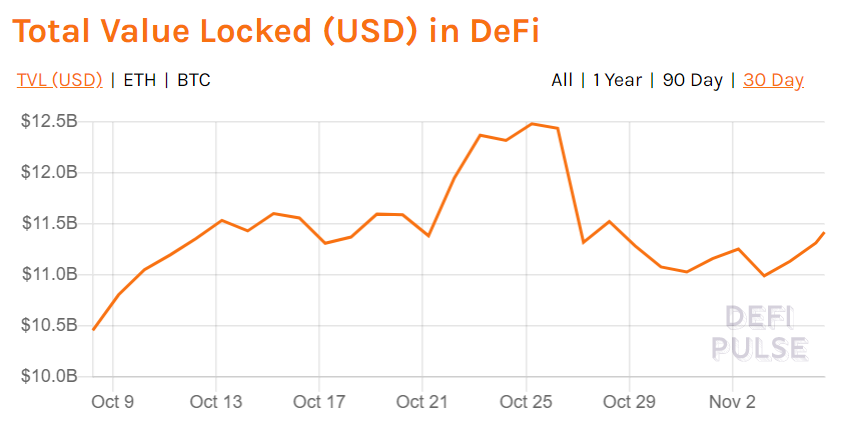

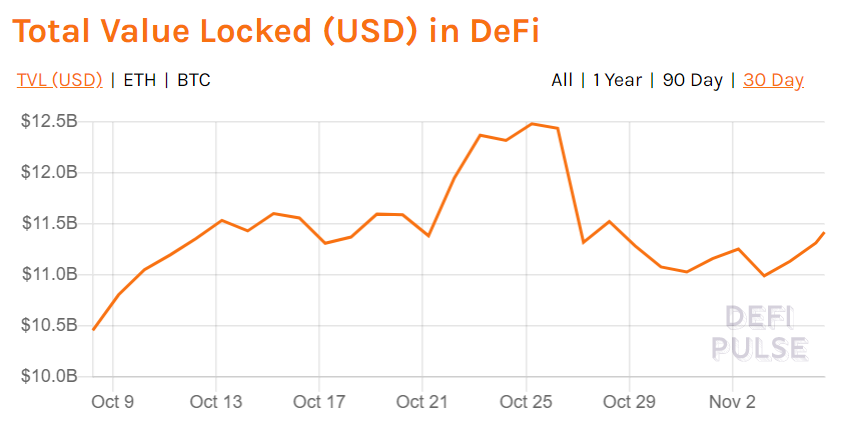

According to data provided by DeFi Pulse, the total value locked in DeFi has been sloping down and has resulted in the loss of 8.19% of the total value locked. Even though a high value of Ethereum could have helped in the TVL not falling by a lot, it has not helped it grow.

Source: DeFiPulse

This stunted growth has impacted the standing of many DeFi projects like Uniswap, MakerDao, and even Wrapped BTC that was reporting new records recently.

As per data, UNI token was one of the popular projects in summer driving DeFi growth. The token peaked at a value of $8 in September but has been on a downward spiral. The token has lost 79% of its value as it traded at $1.81, at press time. While UNI secured the first place in terms of protocol TVL with $2.70 Billion, Maker moved down to the second position with $2.03 billion. Although, the projects were still leading compared to Aave which had lost 5.15% in the past day.

This was an indication of the hype of DeFi exiting the market, but Bitcoin has ensured its returns. The early DeFi hype contributed to increasing the book size in Q3, and Bitcoin might have a similar impact on the DeFi ecosystem during low volatility periods. With TVL still remaining as high as $11 billion, this small set back might just be DeFi catching a break.

The post appeared first on AMBCrypto