The lack of substantial price movements from Bitcoin during the past 24 hours, while simultaneously altcoins and, DeFi tokens, in particular, rise, means that BTC’s dominance over the market continues to decline to its yearly low.

Altcoins And DeFi On The Rise

The altcoin market indicates several impressive gainers throughout the past 24 hours. Above all now stands Ampleforth (AMPL), with a significant increase of over 30% to $4.

This surge comes merely weeks after the company announced the launch of its Liquidity Rewards Program dubbed AMPL Geyser for participants in the Uniswap Protocol. Its ecosystem has grown since then, as Ampleforth announced over $7.5 million in deposits on July 10th.

Another representative of the latest trend in the cryptocurrency community, namely decentralized finance (DeFi) tokens, is on the rise again. Aave (LEND) is up by another 20% today and is currently trading at $0.25. Interestingly enough, in August last year, LEND was trading at around 36 SAT while its current price is around 2690 SAT, giving a return of around 7,300%.

From the top 100 coins by market cap, Bytom and Bitcoin Diamond have also surged significantly since yesterday with similar increases of 14%. Consequently, BTM is trading at $0,10, and BCD is at nearly $1.

It’s also worth noting that Dogecoin, the asset that received major popularity boost as of late, is also in the green. Nevertheless, DOGE is still far from its coveted $1 price target, trading at $0.0038.

From the top 10 coins, Binance Coin (BNB) rises the most with 8%. The native cryptocurrency of the leading digital asset exchange Binance is hovering at over $18.5.

On the other short lie coins such as Stratis, which is down by 6% to $0.63, and Elrond. ERD, after the massive price growth during the past few days, has retraced slightly today 4%, and is at $0.119.

Bancor and Stellar are also in the red today to $1.5 and $0.93, respectively.

Bitcoin Remains Stagnant

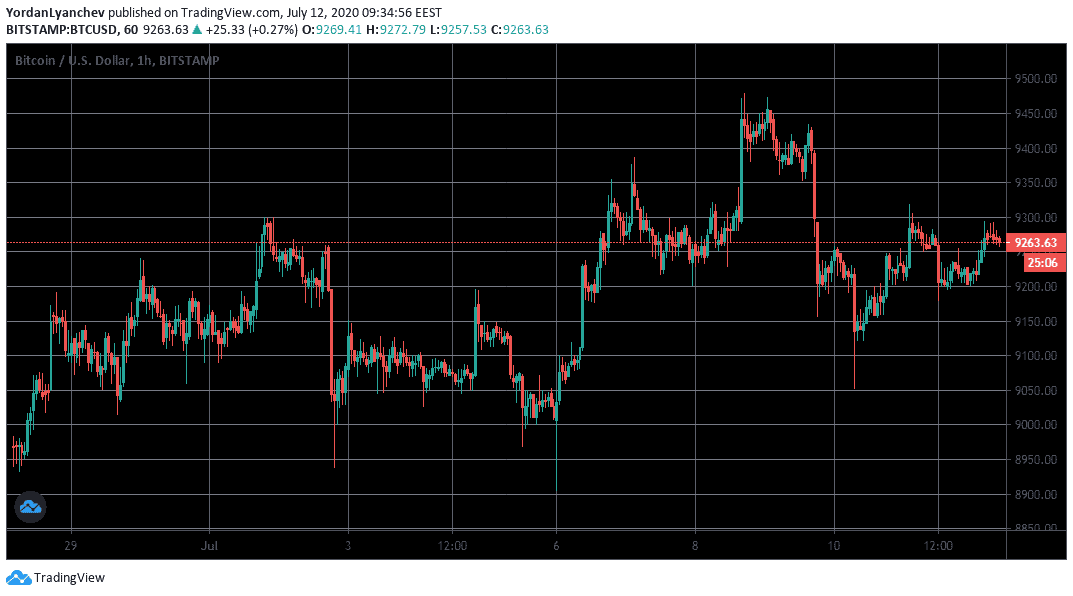

The primary cryptocurrency has illustrated an uncharacteristic lack of volatility during the past several weeks. Outside of a few unsuccessful attempts to break above $9,500 or to dive below $8,900, BTC has been primarily situated between $9,000 and $9,300 since late June.

The past 24 hours have doubled-down on its range. Bitcoin got rejected at the significant resistance at $9,300, before decreasing slightly to $9,180. At the time of this writing, BTC has reclaimed some ground and is trading at $9,270.

Naturally, Bitcoin’s lack of movement and altcoin’s price increases have led to a decrease of BTC’s dominance over the market. As CryptoPotato reported yesterday, this metric has dropped from nearly 70% in May to about 62.5% now. This is the lowest point it has been in approximately a year.

Numerous prominent cryptocurrency analysts believe that Bitcoin’s dominance percentage is now at a critical level, which could ultimately prompt the next altcoin season.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato