Until the previous year, most major nations were up in arms about the launch of the social media giant, Facebook’s stablecoin, Libra. However, after a year we have noted an uptick in the attention paid to not only cryptocurrencies but also to stablecoins. The stablecoin supply has reached 10.116 billion coins, among which Tether [USDT] accounted for a market share of 74.18%. This increase could be associated with the rallying price of Bitcoin along with the movement of 1 billion USDT coins from Tron to Ethereum blockchain.

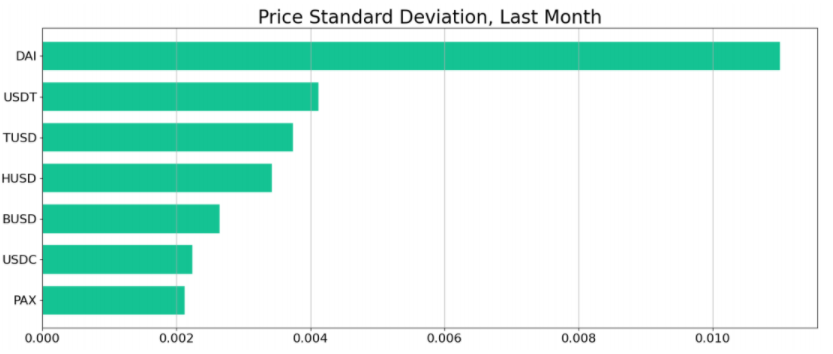

Even though Tether’s share in the market remained untouched by another stablecoin, DAI’s share in the market has been increasing. According to data provided by Santiment, the native stablecoin of the MakerDAO system accounted for 4.18% of the market share, behind USDC that accounted for 12.4% of the total supply. Despite ranking third in terms of the size of its supply, DAI had become the most volatile stablecoin in the past 30 days, according to data provided by Santiment.

Source: Santiment

Tether was not far behind and occupies second place. The use cases differ depending upon the stablecoins and a change in its price was a reflection of that. Ever since the DeFi boom hit the market, the MakerDAO network and team are focused on development activities, which has impacted the demand for DAI.

Likewise, the increased use of Tether on Ethereum’s blockchain and to trade BTC has also caused fluctuations with regard to its demand. This fluctuation resulted in the changing price of USDT, thus putting it in second place.

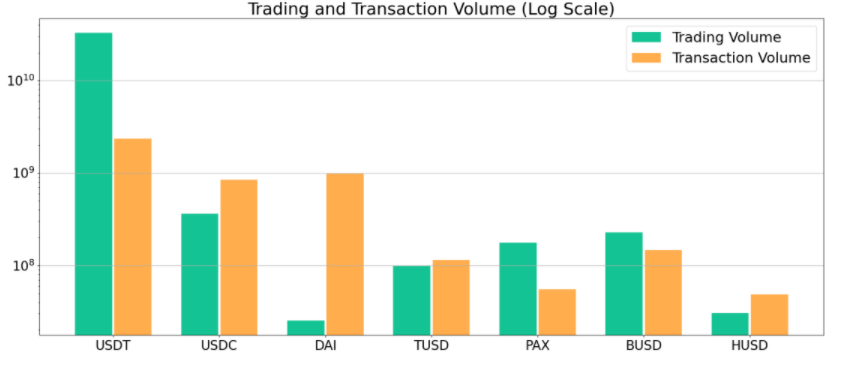

Interestingly, Tether has been witnessing a decrease in its transaction volume [14x] compared to its trading volume in the past month. This suggested that more USDT was transferred daily on the blockchain compared to that being bought and sold on the cryptocurrency exchanges. The utility was high among market speculators. Whereas, for DAI, the transaction volume exceeded its trading volume by 39x.

Source: Santiment

The reason behind an increased transaction volume fo DAI was due to its use in DeFi protocols. This increased popularity of Dai among DeFi enthusiasts can be confirmed through its Token velocity. The Token velocity measures the average number of times that a token changes wallets each day. It suggested that DAI dominated all other stablecoins in terms of relative coin velocity. A single DAI changes its owner 19 times per day, while Tether changes only 4 times on an average.

Tether [USDT] might hold the largest market share, but DAI has been slowly gaining popularity. However, the speculations of DeFi being a bubble were high, and if it popped, the course for DAI might also change. Until then, DAI’s growth may be an indicator of growth witnessed in the DeFi’s ecosystem.

The post appeared first on AMBCrypto