The competition in the field of Bitcoin margin trading exchanges continues to rise. Despite that, though, the 2014- established BitMEX exchange is recording an impressive year so far. It shows a healthy average daily volume and a notable Bitcoin wallet balance rise in the past few months.

BitMEX Numbers In 2020

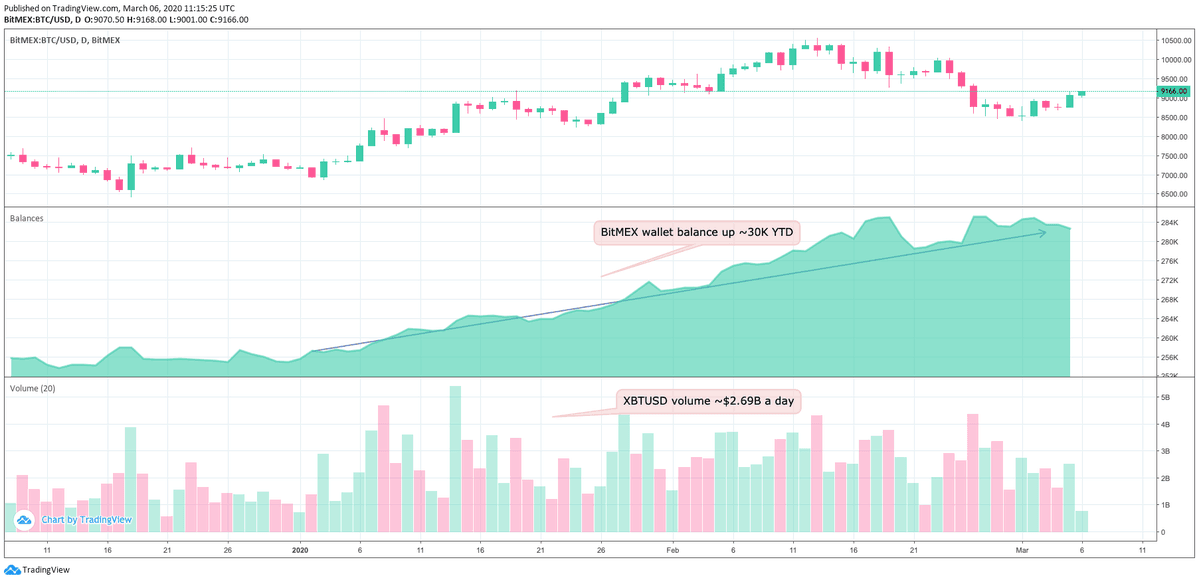

The popular monitoring resource, TokenAnalyst, recently examined BitMEX exchange‘s performance during the initial months of 2020. It concluded that its wallet balance of Bitcoin holdings has grown with approximately 30,000 coins since then.

To put things into a dollarwise perspective, 30,000 bitcoins are worth over $273 million as of writing these lines. As Cryptopotato reported in January, BitMEX cold wallet storage had recently increased by $140 million worth of BTC.

The leading Bitcoin margin trading exchange continues with high volumes, as well. Since the start of the year, BitMEX had seen an average daily volume of nearly $2.7 billion.

The 2020 price increase reflects well on BitMEX rising volume. Bitcoin began this year below $7,000. It broke the $10,000 a few occasions, and as the graph above shows, those days marked some of the most significant trading volumes.

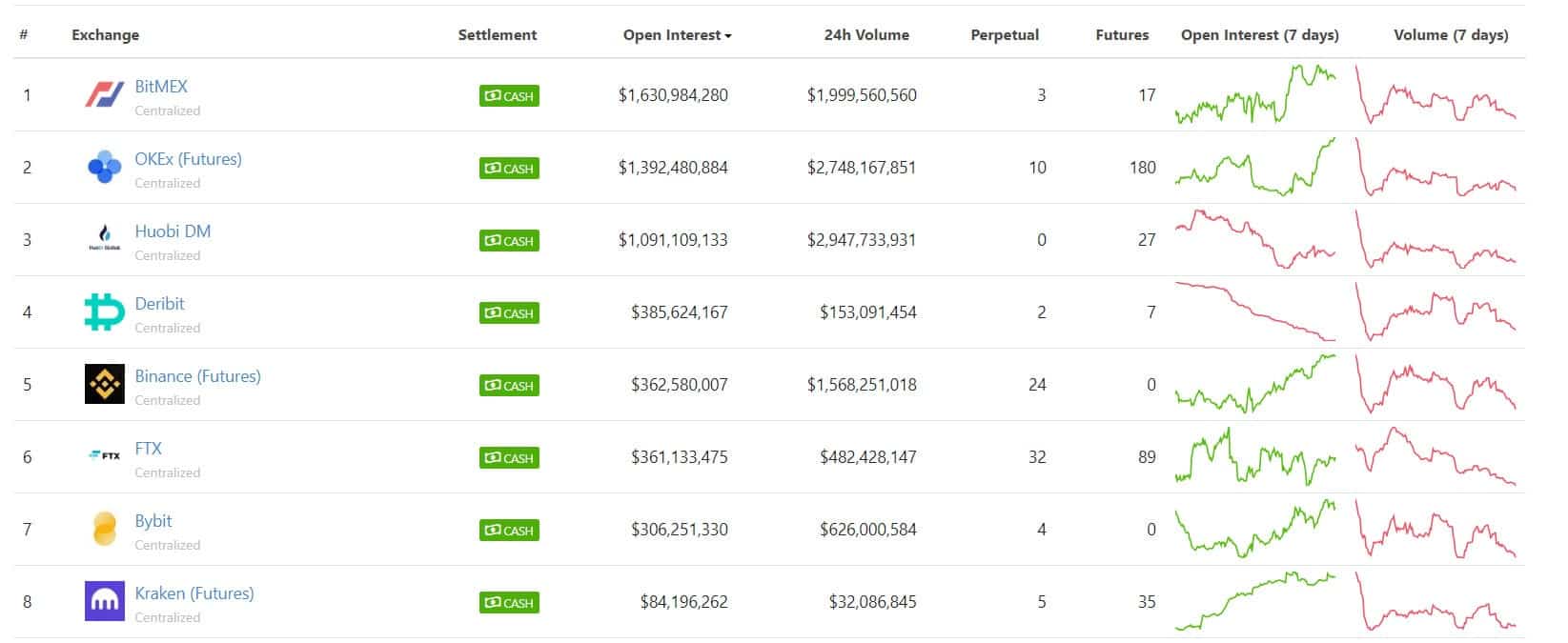

It’s worth noting that the competition in the cryptocurrency margin trading exchanges is at its all-time high level. While BitMEX was one of its kind in 2016, today few hundreds of exchanges allow Bitcoin derivatives and futures trading, one of them is Binance Futures.

Those companies cope with the market demand, which ultimately led to a 60% rise in the Bitcoin Futures Open Interest. Interestingly enough, BitMEX and OKEx had over 50% of that market share.

Data from CoinGecko showing BitMEX leading by open interest, while OKEx and Huobi follows. Binance Futures is currently in fifth place.

UK Regulator Issues A Warning Against BitMEX

The positive information from above was smirched recently when BitMEX received a warning from the U.K.’s Financial Conduct Authority (FCA). The regulator said that the popular cryptocurrency exchange has been targeting British residence without its approval for years.

“Based upon information we hold, we believe it is carrying on regulated activities which require authorization.”- The notice said.

The statement added that “almost all firms and individuals offering, promoting, or selling financial services or products in the UK have to be authorized by us.” At the time of this writing, BitMEX is yet to offer an official response to FCA’s claims.

The post Despite Rising Competition, BitMEX Steadily Leading The Bitcoin Derivatives Exchanges In 2020 appeared first on CryptoPotato.

The post appeared first on CryptoPotato