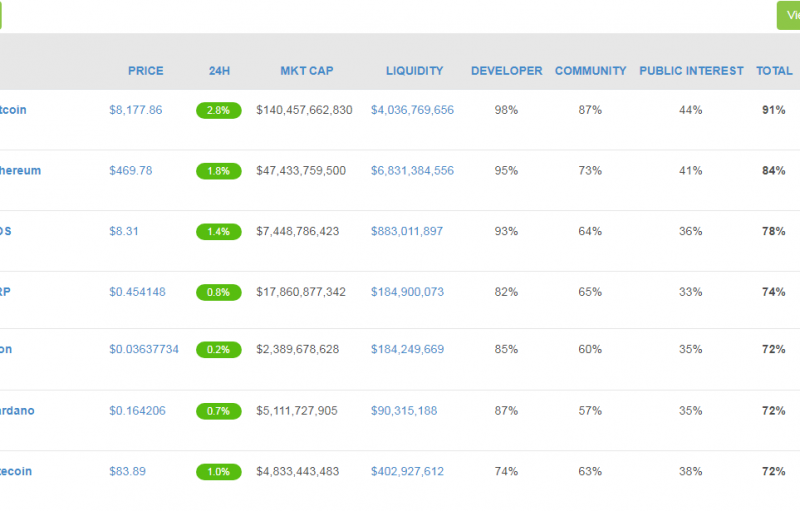

The crypto portfolio tracker allows you to add a portfolio from a variety of exchanges and wallets. From there, you can track a variety of information about the added portfolio. For instance, you are able to track the acquisition costs and the realized profit or loss. You can also track the total value of your holdings for all added coins. It also lets you track the change in profit and losses in the last 24 hours.

You are able to track the lowest and highest value, your portfolio has been as well as monitor the least and most profitable coins from your portfolio. It is possible to check the worst or best crypto in terms of the lowest growth and highest percentage growth.

The crypto portfolio tracker also allows you to do some risk analysis by using a chart to show how much you have kept into exchanges. Also, you are able to know the risks because of exposure to hacking etc. You can also get the chart with information on which coins you are most prone to. Rather, you can know which coin price is likely to affect your total portfolio value the most. You can choose to have multiple coins with a similar percentage in the portfolio. This allows spreading the risks using the portfolio diversification theory.

How does Cryptocompare Portfolio work?

Creating an account on this mobile-friendly crypto tracking tool is done easily by clicking the Login/Register button the top right side of the website. It allows for Google and Facebook login as well as email signup. After that, you do email verification.

Creating a portfolio is done by clicking the “Portfolio” button. You can also create multiple portfolios for your wife and children, for instance. You then select the base currency in addition to setting the name of the portfolio. After this, decide and tick whether it is a private/public/encrypted or non-encrypted.

The next process after the creation of a portfolio is to add in the coins you own or wallets on exchanges. Click the +coin button. ‘Pick a coin’ allows you to type your coin. If adding manually, enter the amount in the base currency of the crypto amount you own for a given type of coin. Then, add the buy price for the price with which you bought the cryptocurrency and price type, the date when you bought and some description.

Press the ‘ADVANCED’ tab where you add the wallet where the coins added from the ‘A wallet’ of ‘An exchange’ buttons. This is not a compulsory section. Just add manually the name of wallet or exchange.

Reviews on other portfolio trackers – CoinFinance, Cryptagon, CoinLoop, CoinCap

More info on Cryptocompare Portfolio

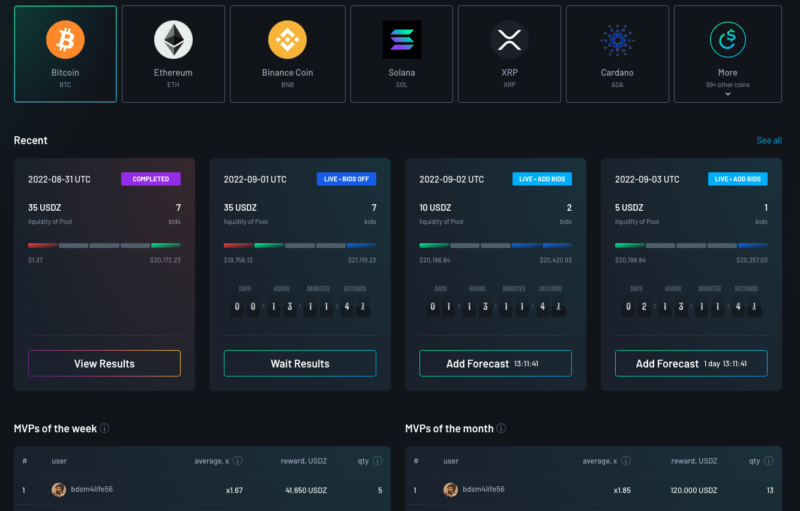

Cryptocompare Portfolio tracker allows you to track your liquidity exposure too. Here, you are able to know the risk you are at of not finding counterparty in case you want to close your open position. This is determined by calculating the “time until liquidation.” The app calculates the liquidation basing on the last thirty days average volume of a coin (versus the base currency of your portfolio) and the quantity of the coin you are holding.

You can also check your volatility exposure chart, which shows an overview of the price swings of your portfolio. Volatility is calculated from the last 30 days price changes returns and then annualized.

Advantages of Cryptocompare Portfolio

This cryptocurrency portfolio tracking tool allows you to calculate income (i.e cryptocompare calculator) statements. The income is the cost and revenue of the sold positions within a period. Plus, you can calculate the realized profit or loss. You can even calculate your tax payable by adding local capital gains tax and tax-free allowance.

There is also the cash flow statement that allows you to check the cash inflows of your account within a given period.

Final Verdict

As a trader and Bitcoin enthusiast, I think it’s OK. There still are some areas for improvement though.

Good points:

- real live trading

- interesting graphs and charts

- graphs at top page

- lots of great information about Bitcoin and cryptocurrencies (great stuff for beginners)

Areas for improvement:

- time periods for graphs not clear. As a long-term trader, I’d like to see longer time horizon on charts. Allow for annotations on the graphs / charts so I can post them to my friends

- too many exchanges are graphed. It’s fine to have prices for various exchanges, but you don’t need to graph them all. Just graph one, list others as an option to view (i.e. the most liquid market). Then if the user clicks on others, use JS or AngularJS code to switch to that graph.

- design should be minimalist. Yes, even financial sites. Not easy to do for trading sites, it’s truly an art form, but you can do it.

- less jargon. If we’re ever going to make Bitcoin or other cryptocurrencies available for the masses, we’ll need simple language to help them understand it better.

My opinion is CryptoCompare should consider having one version for first-time users and another for expert users. Re-organize the site so beginners see information helpful to them.

The market for beginners is obviously exponentially bigger than niche Bitcoin users. From a business standpoint, that is where the platform should be focusing their efforts.

The post appeared first on Coinpedia