Bitcoin is yet too volatile to threaten the existence of cash, and the latter will survive, states a new report conducted by Deutsche bank. Moreover, the report claims that digital assets will help with rebalancing the global economic power.

Deutsche Bank had seen better years than in 2019. The German bank had to layoff 18,000 of its employees during recent July as a part of a longer-term reduction plan to cut its workforce to 74,000 by 2022.

As of writing these lines, the bank’s market cap is only $19 billion following a constant drop in its shares’ value since 2010. The DB stock is trading for $9 after recording a high of nearly $80 during 2010.

Cash Will Survive

The recent report conveyed by the German multinational investment bank surveyed many of its international customers regarding numerous financial topics.

One of its findings surrounds the expanding motion that humanity will soon live in a cashless society. The report indicates that banks, debit, and credit card providers, and especially governments are attempting to eliminate cash from daily usage. It outlines the main concern that large paper bills are utilized in the black market, and some countries are removing them from their economies.

Ultimately though, the document refutes the possibility of “the end of cash.” Moreover, it states that people tend to trust cash during times of uncertainty, and they can track their financial budgets easily:

“Over the centuries, people have developed a deep-rooted trust in paper and coins during uncertain times. Today is no different. For example, the trade war between the U.S. and China has led notable investors to increase their cash holding. Our survey shows that people also like cash because it allows them to more easily track their spending.”

With that being said, the report also indicates that digital payments will grow “at light speed, leading to the extinction of plastic cards.” The main reasons are mobile payments and cryptocurrencies if they manage to overcome their regulatory hurdles.

Bitcoin Is Too Volatile

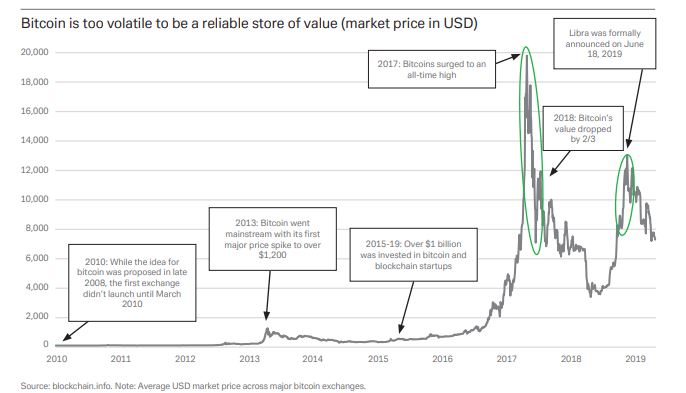

The report is not skipping the most popular cryptocurrency. Bitcoin’s high volatility stops it from serving as a “reliable store of value,” the report argues.

This statement actually supports Ray Dalio’s opinion on the matter. The prominent U.S. investors recently pointed out that the largest cryptocurrency fails the purposes of money due to the same reason.

Bitcoin’s Volatility. Source: The Deutsche Bank

However, the paper also displays Bitcoin’s improvements over the past several years, including CME Bitcoin Futures and Options, and the introduction of Bakkt. The latter is mentioned as a “significant gateway for institutional investors to enter the market because of its regulated warehousing.”

Additionally, the report outlines the benefits of cryptocurrency transactions over regular ones, and it concludes that “blockchain is highly secure.”

“Under the current global system, people must go through several intermediaries to transfer money. This includes a sending bank, a receiving bank, and a credit-card operator. This system increases transaction costs as each intermediary takes a fee. Because cryptocurrencies are based on cryptography and the decentralized system, transfers operate directly between peers, thus removing various middlemen.”

The post appeared first on CryptoPotato