Bitcoin’s on-chain metrics suggest that the market is overly bearish. This has been the case for most of 2020.

Source: Coinmarketcap

Up till now, on-chain metrics are considered a reliable source of data for predicting Bitcoin’s market sentiment and price. It is assumed that the Bitcoin Network needs sufficient on-chain volume in order to fuel a bull market.

Source: Coinmarketcap

The current on-chain volume is higher than the 2018 and early 2019. The price is above 10k and has sustained at that level for over 4 months in a row. Trading volume does not pose a grim picture, unlike 2018.

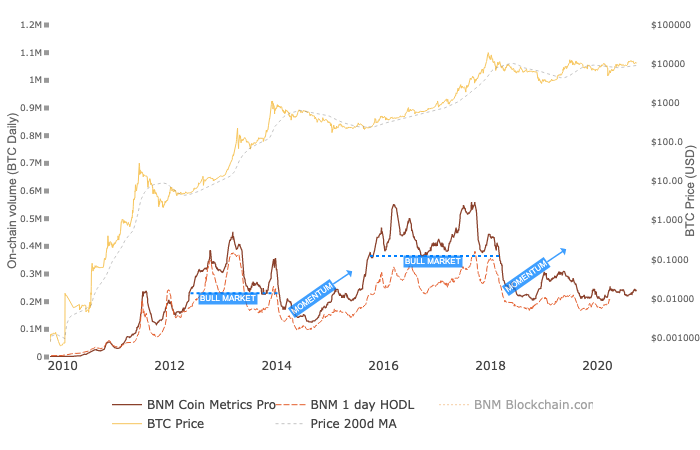

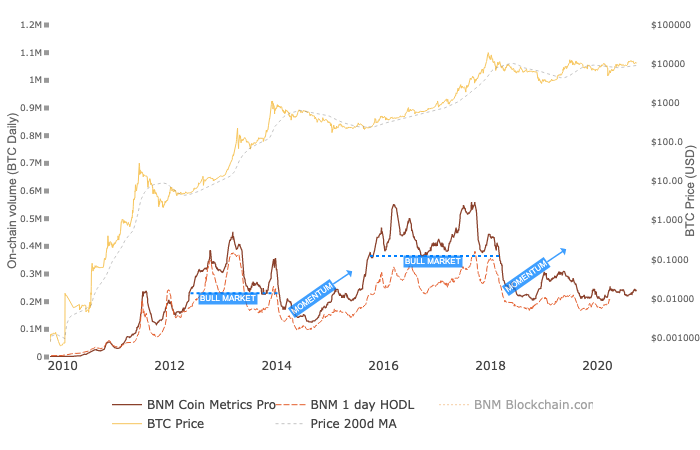

However, do on-chain metrics give complete information required for price prediction and making trading decisions? There are other metrics like Willy Woo’s Bitcoin network momentum, that help estimate the state of the market.

Source: Woobull Charts

Bitcoin’s network momentum was at its peak in 2016 till the end of 2018. However, following bull markets, there is a phase where the asset gathers momentum before hitting the next peak. In 2020, the on-chain volume has increased and ranges above the 200d MA, additionally, the momentum is gathering. This phase may be labeled the accumulation phase and there are no signs of a bearish market. In fact, if Bitcoin is trading $2141 above its fair price, would it be fair to term it bullish.

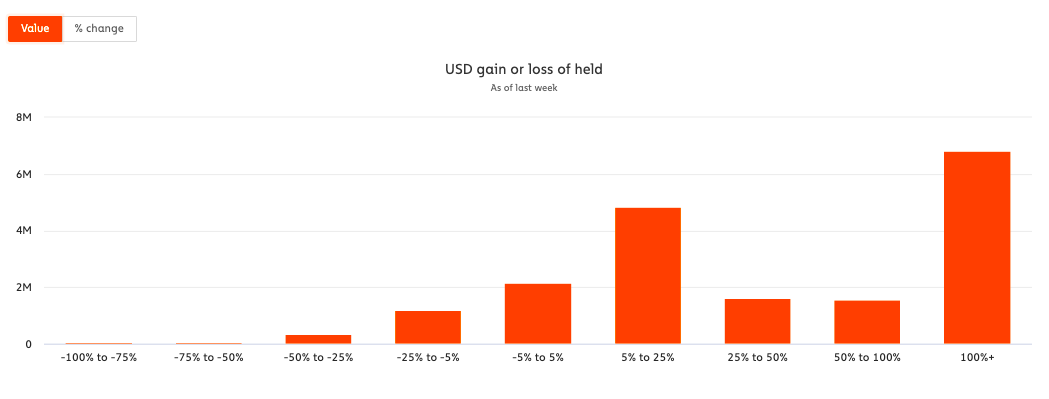

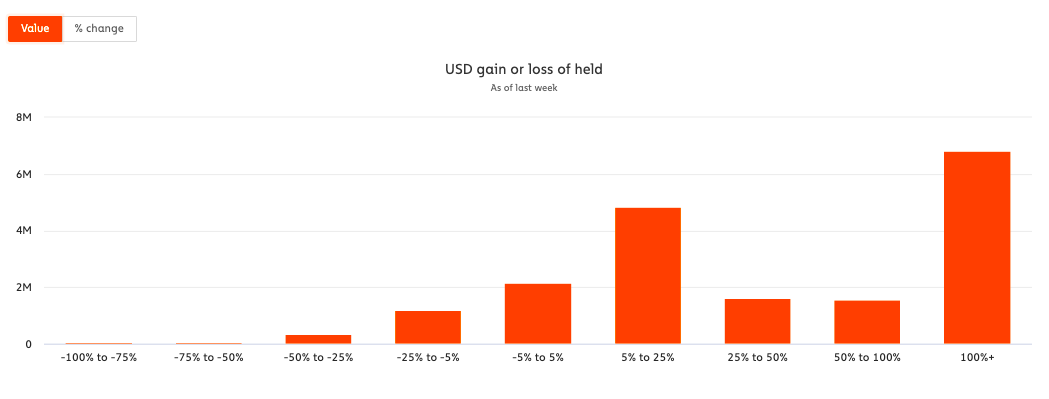

Another factor that doesn’t add up in the bearish narrative of Bitcoin is the profit of Hodlers. Currently, over 83% of Hodlers are profitable, as per data from CoinMarketCap.

Source: Chainalysis

Hodlers are profitable to the extent that there is over $6.24 M in BTC Hodlers wallets with 100%+ unrealized profit. The Bitcoin derivatives market would give a nod to the bullish sentiment here as open interest in Bitcoin Futures has increased 40% in the past month. Despite the price volatility, institutional interest in Bitcoin has grown considerably. This is evident from the rise in open interest and daily trade volume on CME.

While on-chain metrics act as a quick reference, there are gaps in the predictions based on them. A retail trader on a spot or derivatives exchange is directly impacted by the movement of whales and institutions. Events like BTC Futures Contract expiration have an impact on the price and volume of the asset traded on spot exchanges. Considering derivatives market performance while making price predictions may fill some of these gaps.

The post appeared first on AMBCrypto