The Dow is leaning toward a strong open on Wednesday but the optimism could be short-lived, according to one former Fed insider. | Source: AP Photo/Aaron Favila

By CCN Markets: Dow Jones Industrial Average (DJIA) futures ticked up 200 points in early trading Wednesday, pointing to an optimistic open on Wall Street ahead of the Federal Open Market Committee (FOMC) minutes release later today.

But one former Federal Reserve insider doesn’t share the market’s optimism. Former Minneapolis Fed President Narayana Kocherlakota – an alternative voting member of the FOMC – said the Federal Reserve has run out of ammunition and a deep 2008-style recession looms large. He envisions:

“Another recession, perhaps of the magnitude we saw in — hopefully not, but could lead to a recession the kind of magnitude we saw in 2007 to 2009, with those same kind of persistent effects on output.”

Dow Futures in triple-digit leap

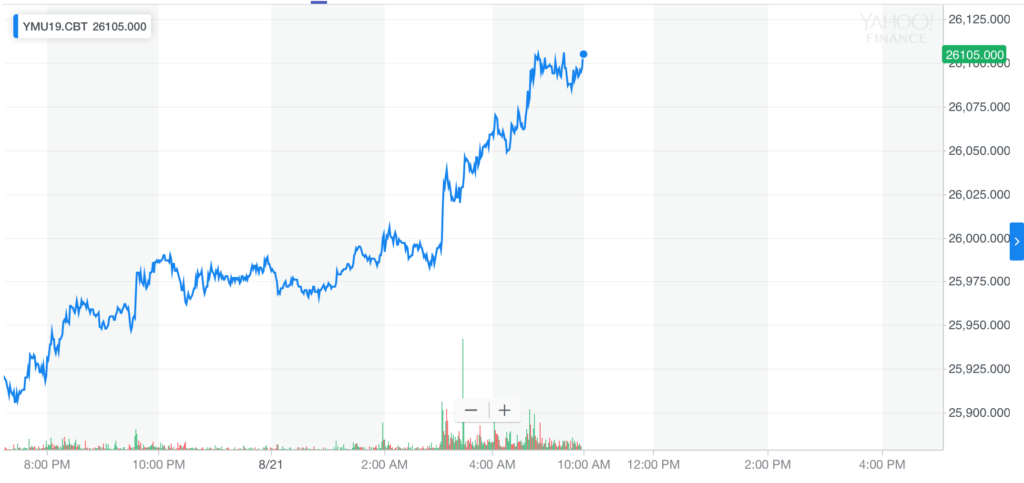

At 5.52 am ET, Dow Jones Industrial Average (DJIA) futures climbed 162 points to 26,093. It’s a positive swing after the US stock market snapped a four-day winning streak yesterday.

Dow Jones Industrial Average (DJIA) point to a strong open on Wall Street on Wednesday, despite an ominous warning from a former Fed official. Source: Yahoo Finance

S&P 500 futures and Nasdaq Composite futures also point towards a strong open.

The Federal Reserve is running out of stock market ammo

Any trader optimism in the market is driven by hopes of monetary easing by the Federal Reserve. CME futures are pricing in a 99.6 percent chance of a rate cut in September, and analysts predict we’ll see five quarter-point cuts in the base rate over the next year, a move that many hope will stimulate the stock market.

Kocherlakota isn’t so sure. He thinks the Federal Reserve doesn’t have the capacity to halt a recession at this point.

“I think the concern that you see in bond markets about the future is really tied to the lack of policy capacity that we have in central banks, that we’re going to see these downside shocks and central banks and the fiscal authorities are not going to be able to respond effectively.”

As a former alternative vote holder at the FOMC, he has an inside view of the tools at the Fed’s disposal. It’s certainly a red flag that he doesn’t see the central bank wielding enough power to stem the bleeding.

Dow traders wait for Fed minutes and Powell

The Federal Reserve will issue the minutes from July’s FOMC meeting later today. While this shouldn’t deliver too many surprises, the real action will come from Jerome Powell’s statement on Friday.

Delivered from Jackson Hole, we’ll get an insight into whether Powell stands by his “mid-cycle adjustment” narrative or if a string of rate cuts are on the horizon. As CCN reported, Donald Trump would certainly like to hear the latter, after calling for a huge 1 percent interest rate cut.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY