Donald Trump and White House officials played down fears of a recession on Sunday, giving a much-needed boost to the stock market. Source: AP Photo/Evan Vucci

By CCN Markets: Dow Jones Industrial Average (DJIA) futures rocketed 200 points in early trading Monday as President Donald Trump sought to allay fears of a recession.

Speaking to reporters in New Jersey on Sunday, he said:

“I don’t think we’re having a recession… “We’re doing tremendously well. Our consumers are rich. I gave a tremendous tax cut and they’re loaded up with money.”

It comes after the Dow suffered a painful 800 point slide on Wednesday after a key recession indicator flashed red for the first time in more than a decade.

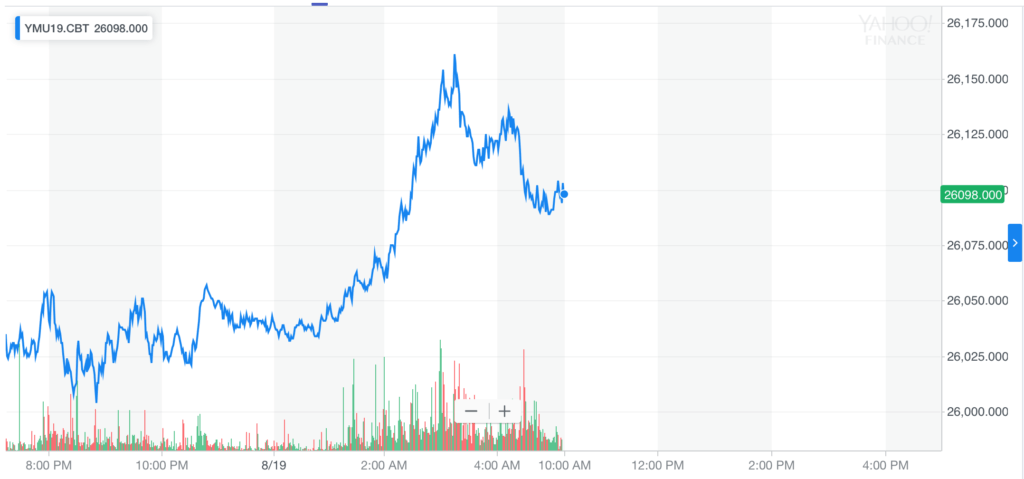

Dow futures leap 200 points on Monday

After a disastrous week on the stock market, the Dow Jones Industrial Average (DJIA) looks set to open with a bang on Monday. At 5.34 am ET, Dow futures traded 218 points higher at 26,125.

Dow Jones Industrial Average (DJIA) futures rocketed higher on Monday morning as Trump and the White House played down recession fears. Source: Yahoo Finance

It marks a strong recovery after last week’s painful stock market collapse. The pain point was triggered when the 10 year Treasury bond yield inverted below the 2 year yield. A classic recession indicator which has historically preceded every major downturn for the last 50 years.

Trump and White House shrug off recession fears

After the Dow’s brutal plunge last week, Trump spoke to the heads of Citigroup, JP Morgan Chase, and Bank of America, seeking reassurance on the economy. Trump concluded that the economy is stable for now, even as European nations like Germany tip into recession territory.

“Most economists actually say we are not going to have a recession… “Most of them are saying we will not have a recession but the rest of the world is not doing well like we are doing” – President Donald Trump.

[embedded content]

Trump’s White House advisors doubled down on the same rhetoric. As CCN reported, Trump’s economic advisor Larry Ludlow shrugged off recession fears yesterday.

“No, I don’t see a recession. And let me add just one theme … Just one theme. We’re doing pretty darn well, in my judgment. Let’s not be afraid of optimism.”

White House trade advisor Peter Navarro went a step further, claiming the yield curve didn’t even invert. In his rose-tinted view of the market, he said the yield curve was flat and it signified a strong Trump economy.

“In this case, the flat curve is actually the result of a very strong Trump economy.”

Strong Dow crucial for Trump re-election

It’s no surprise to see the White House come out in defense of the economy at this juncture. As former Congressional aide Michael Steel explains:

“The economy is absolutely critical to [Trump’s] re-election… The handling of the economy is, generally speaking, the only issue that he is viewed positively on in polling.”

As the campaign for re-election begins in earnest, Trump will be watching the recession indicator like a hawk.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY