The Dow Jones surged on Wednesday as Wall Street gambled that the Fed would execute titanic interest rate cuts in the coming months. | Source: AFP PHOTO / Stan HONDA

By CCN Markets: The Dow executed a swift recovery on Wednesday, erasing its previous-day losses as Wall Street doubled down on its belief that the Federal Reserve will aggressively lower interest rates throughout the remainder of the year – and possibly even into 2020.

President Trump, meanwhile, continues to throw his weight around in a bid to pressure the Fed into giving the market the easing cycle it wants.

Dow Whips Toward Triple-Digit Rally

The US stock market’s three major indices all zipped toward substantial gains during the morning session.

The Dow Jones Industrial Average rose 218.09 points or 0.84%, lifting the DJIA to 26,180.53.

The Dow spiked more than 200 points on Wednesday, reversing yesterday’s decline and extending its recovery. |Source: Yahoo Finance

The S&P 500 added 23.4 points or 0.8% to climb to 2,923.57. All 11 primary sectors reported gains.

The Nasdaq once again cleared the 8,000 mark following its 61.42 point or 0.77% gain. The tech-heavy index was last seen trading above 8,009.

Wall Street Waits for FOMC Minutes Dump

[embedded content]

Stock prices rose ahead of Wednesday’s FOMC minutes dump, which will set the stage for Federal Reserve Chair Jerome Powell’s remarks later this week at Jackson Hole.

While the economic landscape has shifted considerably since the July FOMC meeting, analysts are eager to discover more details about the Fed’s policy debate, which culminated in the first interest rate reduction since the financial crisis.

Wednesday Highlights

0830 AM GMT $GBP Public Sector Net Borrowing

1230 GMT $CAD CPI m/m

1400 GMT $USD Existing Home Sales

1430 GMT $USD Crude Oil Inventories

1800 GMT $USD FOMC Meeting Minutes#Forex #FXPRIMUS— FXPRIMUS (@FXPRIMUS) August 21, 2019

The FOMC minutes should expose whether other FOMC voters agree with Powell’s evaluation that the 25 basis point cut was a “mid-cycle adjustment.” Wall Street will also search for clues about what would compel policymakers to adopt a deliberate easing cycle.

The Federal Reserve will publish the FOMC minutes at 2 pm ET.

Dow Climbs as Market Bets on Aggressive Fed Easing

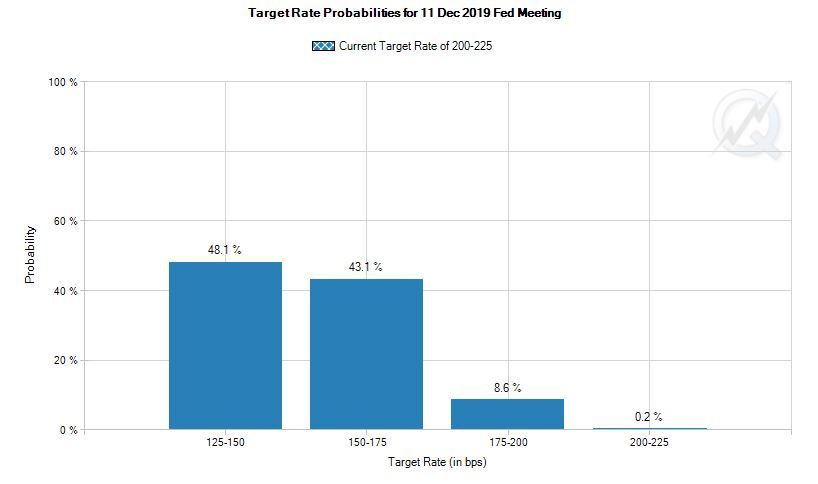

According to CME’s FedWatch Tool, the market has overwhelmingly priced in rate reductions at the September and October FOMC meetings. There’s also a 48.1% probability of a December cut, which would reduce the Fed’s target to 1.25-1.5% heading into the new year.

Wall Street anticipates as many as three more interest rate cuts in 2019. | Source: CME FedWatch

However, Danske Bank analysts believe the Fed will be even more aggressive.

A Danske Bank team led by Mikael Olai Milhoj predicts that the Fed will implement 25 basis point cuts at each of the next five FOMC meetings. That would plunge interest rates to 0.75-1.00% following the Fed meeting in March 2020.

“In our view, U.S. growth has peaked and will likely slow but we do not expect a recession to show up in the data near term (depending on Fed action),” the analysts wrote.

Trump: Powell Is a ‘Golfer Who Can’t Putt’

Trump, an avid golfer, said that Jerome Powell is “can’t putt.” | Source: AFP PHOTO / ANDY BUCHANAN

President Trump, meanwhile, continues to hold Powell’s feet to the fire, alleging that he “has called it wrong” and “only let us down.”

The Fed chair, Trump said on Wednesday, “is like a golfer who can’t putt, has no touch.”

…..We are competing with many countries that have a far lower interest rate, and we should be lower than them. Yesterday, “highest Dollar in U.S.History.” No inflation. Wake up Federal Reserve. Such growth potential, almost like never before!

— Donald J. Trump (@realDonaldTrump) August 21, 2019

Earlier this week, Trump called for the Fed to slice rates by 100 basis points “over a fairly short period of time.”

“If that happened, our Economy would be even better,” Trump said, “and the World Economy would be greatly and quickly enhanced-good for everyone!”

Click here for a real-time Dow Jones Industrial Average chart.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY