Following the launch of its mainnet earlier this summer, Elrond continues with new developments. The company recently introduced a new economic model for its native cryptocurrency and a token swap implemented firstly on Binance that transitioned ERD to the new coin called eGLD in a 1000:1 ratio.

Elrond’s Token Swap Implemented On Binance

As CryptoPotato reported in late July, Elrond launched its mainnet as the company also unveiled the first application utilizing the Elrond blockchain dubbed Maiar.

Further developments continued with a few listings for the native cryptocurrency on different exchanges and integration with Aurachain AG – a provider of low-code workflow automation layer enabling organizations to digitize and automate their business processes.

Another announcement shared last week attracted eve more attention to the blockchain company. Elrond revealed a significant alternation for its cryptocurrency ERD, which now carries the name eGLD – an abbreviation for eGold. According to the company, this is “the most intuitively powerful metaphor of what the Elrond currency aims to become.”

The token swap, which made the transition possible, is currently available in two ways – through the leading cryptocurrency exchange Binance or through the Elrond swap bridge.

Binance, which carried Elrond’s IEO on its Binance Launchpad last year, firstly suspended trading for the old ERD tokens on August 31st and then reactivated it starting September 3rd, 3:00 AM (UTC) under the name – eGLD. The swapping process on the exchange was entirely automatic, and users previously holding ERD should now have eGLD.

ERD investors holding their coins outside of Binance can swap them on the Elrond swap bridge as of a couple of days ago.

The swap occurs with a 1000:1 ratio. Meaning, that for every 1,000 ERD tokens the investor has, he should receive one eGLD.

What Does The Token Swap Really Represent

CryptoPotato reached out to Dan Voicu, Head of Communications at Elrond, who explained the in-depth significance behind the token swap. He noted that the new economic model “deducts transaction fees from issuance.” In other words, the more transactions occur on the network, the fewer new coins are minted. “Scarcity increases with adoption,” Voicu added.

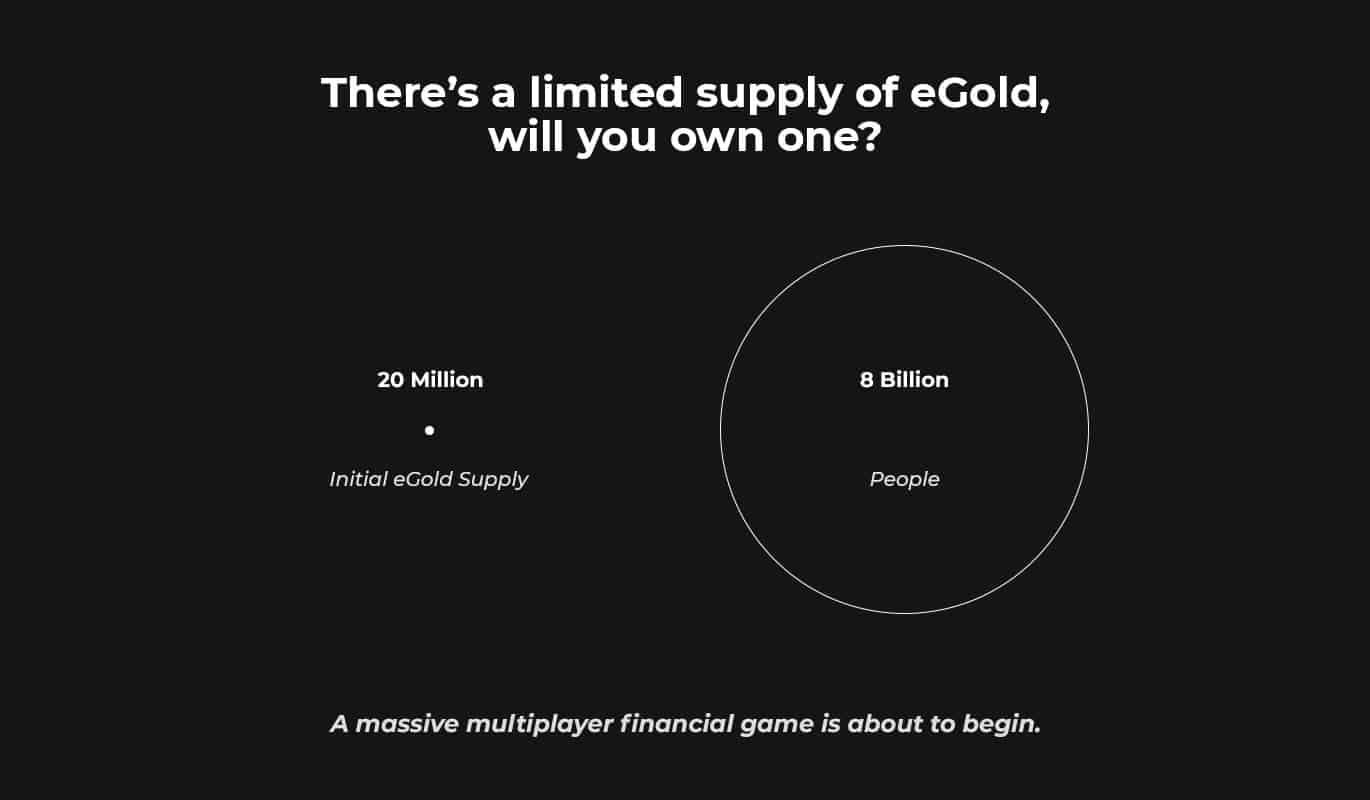

Additionally, ERD’s supply was uncapped, and it had a planned 5% inflation per year. In contrast, eGLD will start with 20 million coins and will have a “theoretical supply limit of 31,415,926” that can be reached over the next ten years.

The swap’s completion will enable all “native Elrond services such as general staking and delegation, and native DeFi options.” The company also plans additional listings on new exchanges and integrations.

“Overall, an exciting time for Elrond. The token swap marks an important milestone for us. After its completion, the Elrond economy is ready to begin in earnest. Staking, delegation, DeFi products, and a lot of other cool things coming.”- Voicu concluded.

Price Performance And Changes For eGLD

The aforementioned token swap ratio of 1000:1 expectedly affected the price of Elrond’s native digital asset. Before the swap, ERD traded at about $0.025, which automatically transitioned to $25 as soon as Binance introduced the new token eGLD.

The high interest towards the token came in the first hours as it peaked at over $35, but has since retraced. Voicu said that the trading volume skyrocketed to $5 million in the first hour alone.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato