On 28 September, the first phase of transitioning our legacy KDB engine to the Java engine began – a move made to further improve BitMEX’s core engine architecture and subsequent trading improvements for our users.

When the transition is complete by the end of 2023, the BitMEX trading engine will have three times more throughput, with impacts from the first phase already visible through reduced order book latency and significantly faster trading request handling.

The upgrade – care of our engine team – is another step towards aligning with our purpose to provide professional and institutional traders with an exchange platform that caters to their needs – a key one being low latency.

For a lowdown on the new upgrade, why these changes are important to all users, and the additional improvements that are on the way, read on.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000 USD worth of BMEX Tokens to new users – you can register here.

Why is the Java Upgrade Important?

An exchange’s core engine architecture is the component responsible for matching incoming executions, managing order books, and reporting trades. This means the Java upgrade will increase our platform’s overall capacity, whilst reducing end-to-end latency via increased throughput limits of incoming actions.

To date, there are significant and positive impacts visible to two aspects of our trading engine: order book latency and request handling.

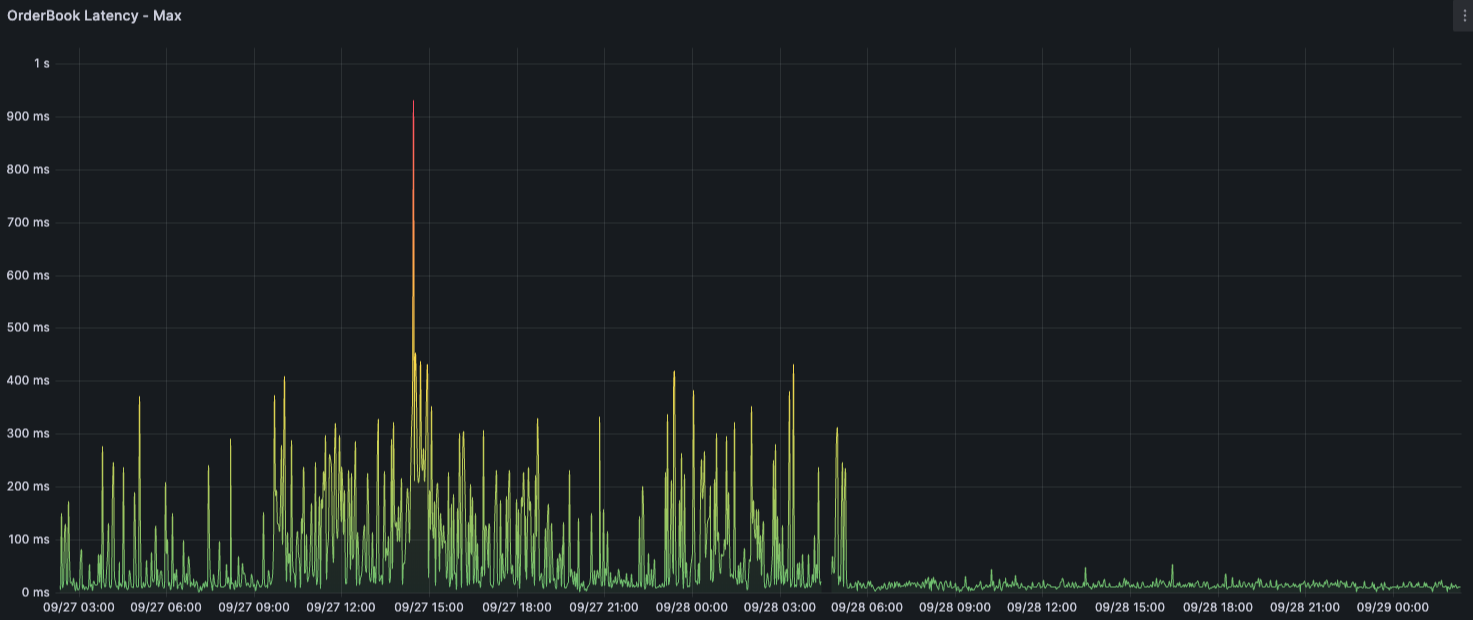

Order Book Latency

Order book latency is the time it takes for users on BitMEX to identify any changes made to the order book. As of 28 September, when the first phase of this project began, our maximum order book latency has drastically decreased by close to 95% – from a peak of 400ms to 20ms – as indicated by the graph above.

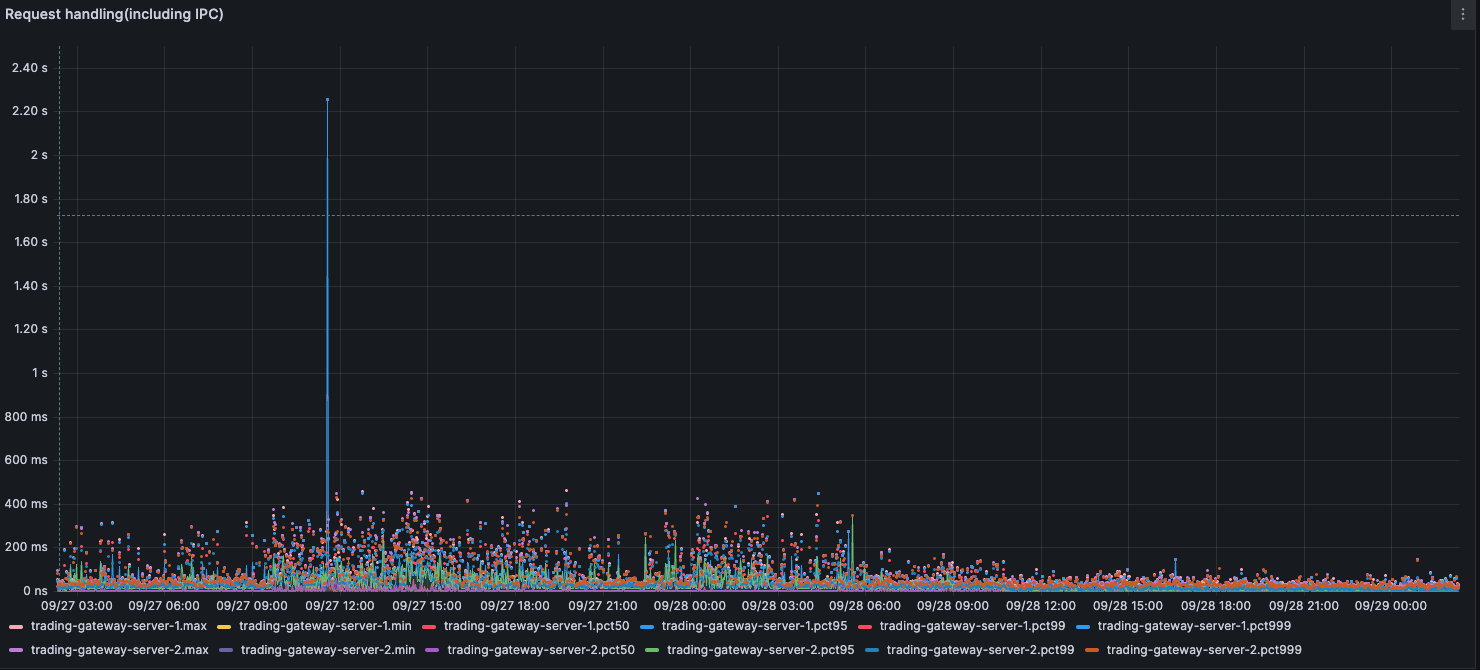

Trade Request Handling

Trade request handling refers to the end-to-end time taken for users to receive a response after submitting a trade request. Post the upgrade, users will experience much faster responses of under 200 ms for any trading requests they put through.

Looking Forward: What’s Next?

By the end of 2023, our engine team will continue working to transition the core components of our engine architecture to the Java matching engine.

Once the transition is complete, all users will benefit from simpler, more seamless cross-margining capabilities, resulting in an exchange that is poised for high volume and low latency trading.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.

Related

The post appeared first on Blog BitMex