The crypto industry is scrambling to find a solution for the unfeasibly high gas fees that make smaller transactions on the Ethereum network financially unviable. The 2020 DeFi boom and explosion in yield farming platforms have strained the Ethereum network so much that whales and minnows alike are now fighting for block space to get their transactions through.

Binance Chain to The Rescue?

In a tweet on Tuesday, September 1, Binance CEO Changpeng Zhao hinted at a solution without giving anything away.

Madness. Luckily, we might have a solution… – Tweeted Zhao.

The mysterious message may hint at leveraging the company’s own Binance Chain to compete with Ethereum, which it has been trying to do since inception in April 2019. The world’s leading crypto exchange migrated its own Binance Coin (BNB) from the ERC-20 standard to the company’s own BEP-2 standard when the DEX was launched.

While Binance Chain has gained some partners, it remains a long way away from Ethereum in terms of developers, dApps, active addresses, and users. Like it or not, Ethereum is the industry standard at the moment, and re-writing all of those smart contracts to work on a different blockchain is not going to be an easy task.

Ethereum Fees at ATH … Again

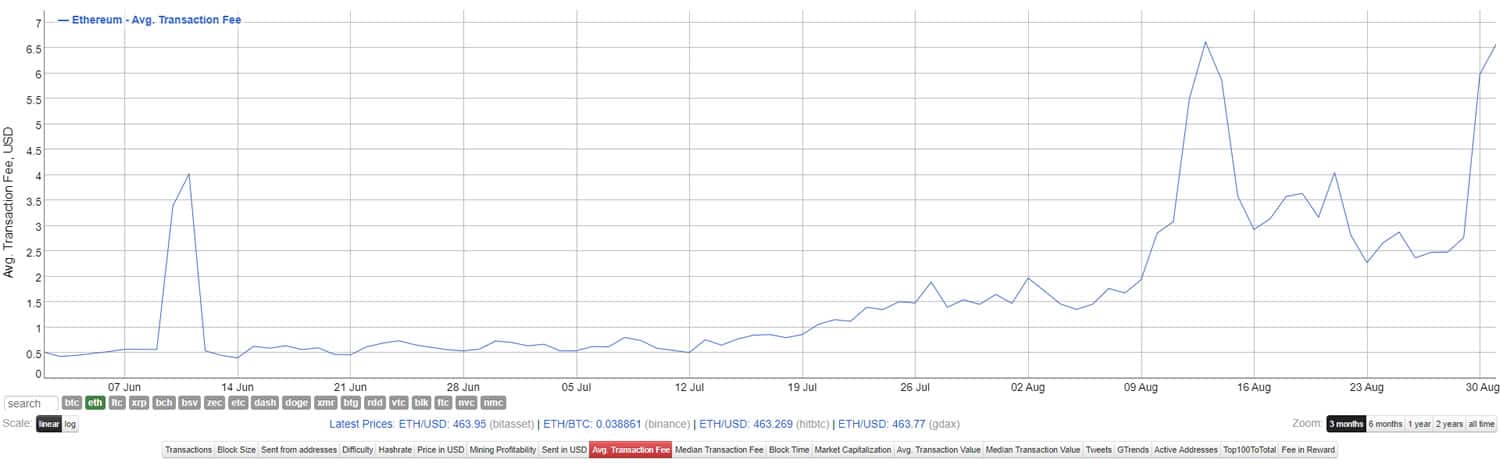

Average Ethereum transaction fees have skyrocketed back to their highest ever levels just below $6.60 according to Bitinfocharts.com.

The surge may well have been driven by the Sushi farming frenzy as liquidity providers pull their collateral from Uniswap to load up SushiSwap pools and earn some of the tokens.

Following the last gas fee surge, which was also driven by yield farmers seeking Yam profits at the time, things started to return to some kind of normalcy. Average transaction prices dropped back to $2.30 (which is still too high).

The only ones benefitting from an expensive to use the network are the Ethereum miners. Analytics provider Glassnode has reported that Ethereum miners have earned over $500,000 in fees over the past hour, marking a new record. Compared to April, in August, miners earned 38 times the amount in transaction fees only.

#Ethereum miners earned over $500,000 USD in transaction fees in the past hour.

That is a new record high for a single hour (anomalous transaction fees earlier this year excluded).

Chart: https://t.co/RZz5yMV44U pic.twitter.com/fmyD5zZSYs

— glassnode (@glassnode) September 1, 2020

Glassnode also reported that Ethereum’s blockchain growth rate has skyrocketed in the past months to 260MB per day, doubling since the beginning of the year. It added that this is 40% higher than Bitcoin’s current blockchain growth rate, which is at an all-time high of 186MB per day.

The other thing that has increased is ETH prices which have hit their highest level since July 2018, touching $465 a couple of hours ago.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato