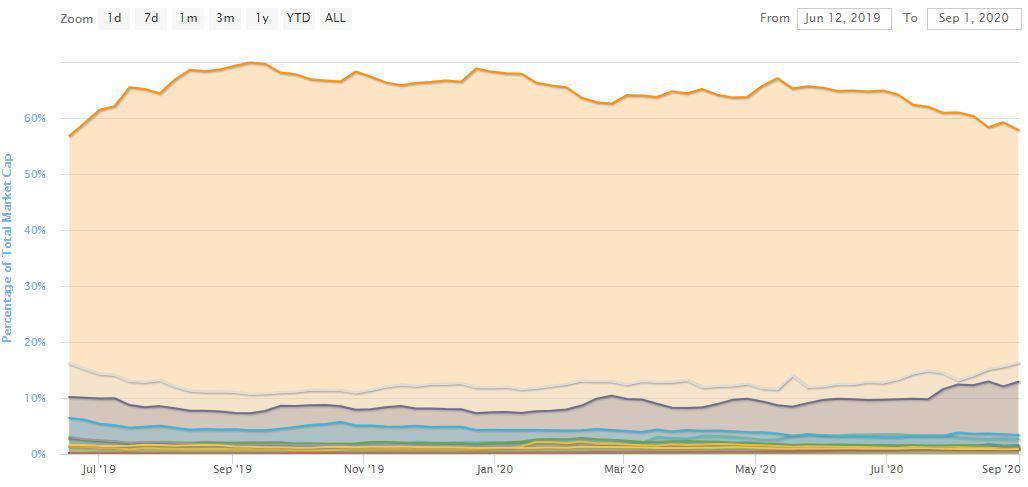

Bitcoin continues to improve its position slowly and is currently hovering above $11,900. However, double- and even triple-digit price pumps from lower-cap alts continue to decrease BTC’s dominance to a yearly low of beneath 57%.

2-Year High For ETH, Sushi Enters Top 100

Ethereum doubles-down on its recent price pump with another 10% increase. ETH now trades at $465, which is a 23% surge since bottoming at $380 last week. This is the highest level Ether has marked since the summer of 2018 and the community wonders if the second-largest digital asset can now top $500.

Polkadot is among the most impressive gainers in the top 10 with a 9% surge. Simultaneously, Chainlink has dropped by 6%, meaning that DOT is closing down and may soon overtake LINK again in the top 5.

Sushi, the governance token of the Uniswap fork – SushiSwap, has reacted accordingly to the quick rise of the new trend in decentralized exchange protocols. As SushiSwap just passed over $1 billion locked in TVL, the token has skyrocketed by 150% in the past 24 hours alone and has entered the top 100.

According to CoinGecko, Sushi traded at $0.70 on August 29th. With its price currently sitting at $7.70, this represents a three-day price surge of 1,000%.

Further gains are visible from Kusama (38%), BitShares (28%), Serum (27%), another Sushi-related coin – UMA (27%), Compound (22%), and Ren (19%). Tron is also advancing price-wise with a 15% surge following the partnership with Band Protocol announced yesterday.

In contrast, after reaching an all-time high of over $5,500 a few days back, DFI.Money continues its retrace with another 16% dump to $3,500. Loopring (-9%), bZx Protocol (-8%), Flexacoin (-7%), and Ocean Protocol (-6%) are also in the red.

Bitcoin Tops $11,900 But Dominance At A Low

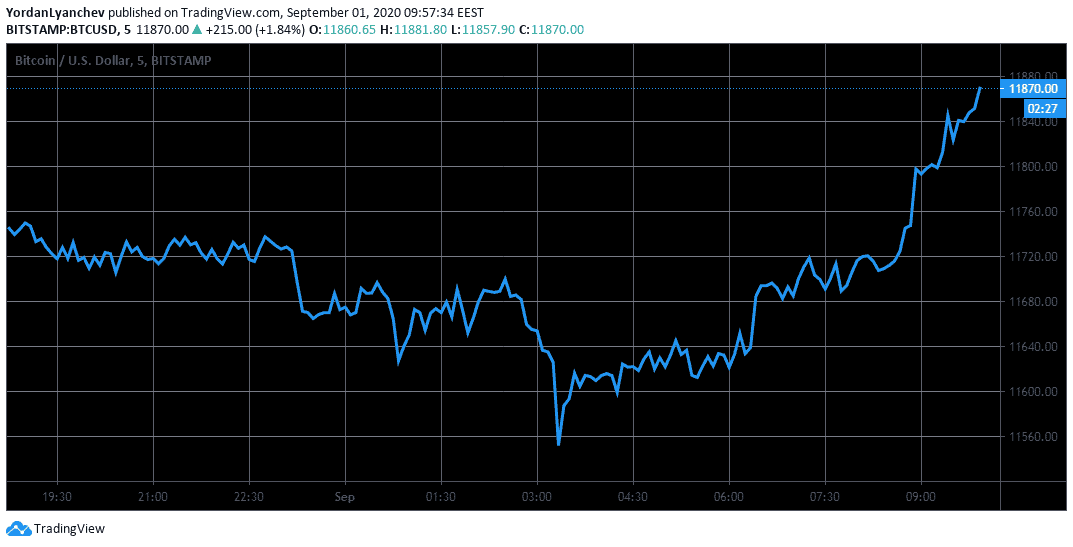

In the past 24 hours, BTC firstly reached an intraday high of nearly $11,800, where it got rejected and dumped to its daily low of about $11,550 shortly after. However, the bull quickly took charge again and pushed the price further upwards to its current level just shy $11,900.

Exploring the weekly scale, BTC is up by 7% since the low marked on August 27th at $11,150. If Bitcoin plans to continue on its price pump, it has to take down the first resistance level at $12,000 before having a chance to fight for a new yearly high above $12,450.

In case it drops in value, it can rely on $11,600, $11,400, and $11,100 as support before the psychological line of $11,000.

The gains marked by the primary cryptocurrency are not sufficient for Bitcoin to protect its market dominance. The metric tracking BTC’s share relative that of the entire market has declined to a new yearly-low of 56.7%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato