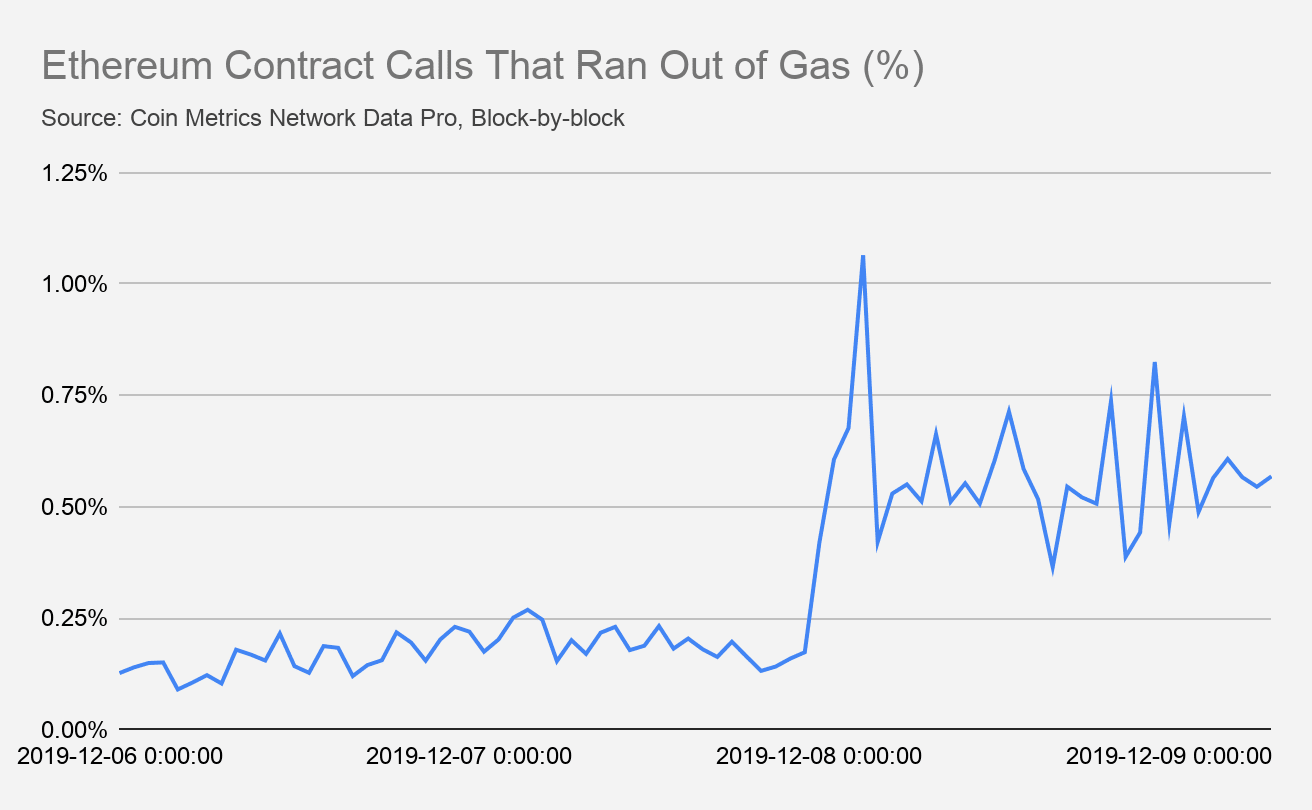

Ethereum recently completed the Istanbul hard fork, at block number 9,069,000, and it followed the St. Petersburg and Constantinople hard forks. The upgrade included several protocol changes that included changes to gas costs. The change in gas costs was something the developers were apparently not prepared for, as the Etheruem contract calls ran out of gas from 6 December to 9 December, according to Coin Metrics’ recent report.

Source: Coin Metrics

The charts noted the percentage of Ethereum contract calls that ran out of gas between the aforementioned dates. It appeared that the contracts running out of gas spiked by over 1% on 8 December, as Istanbul went live.

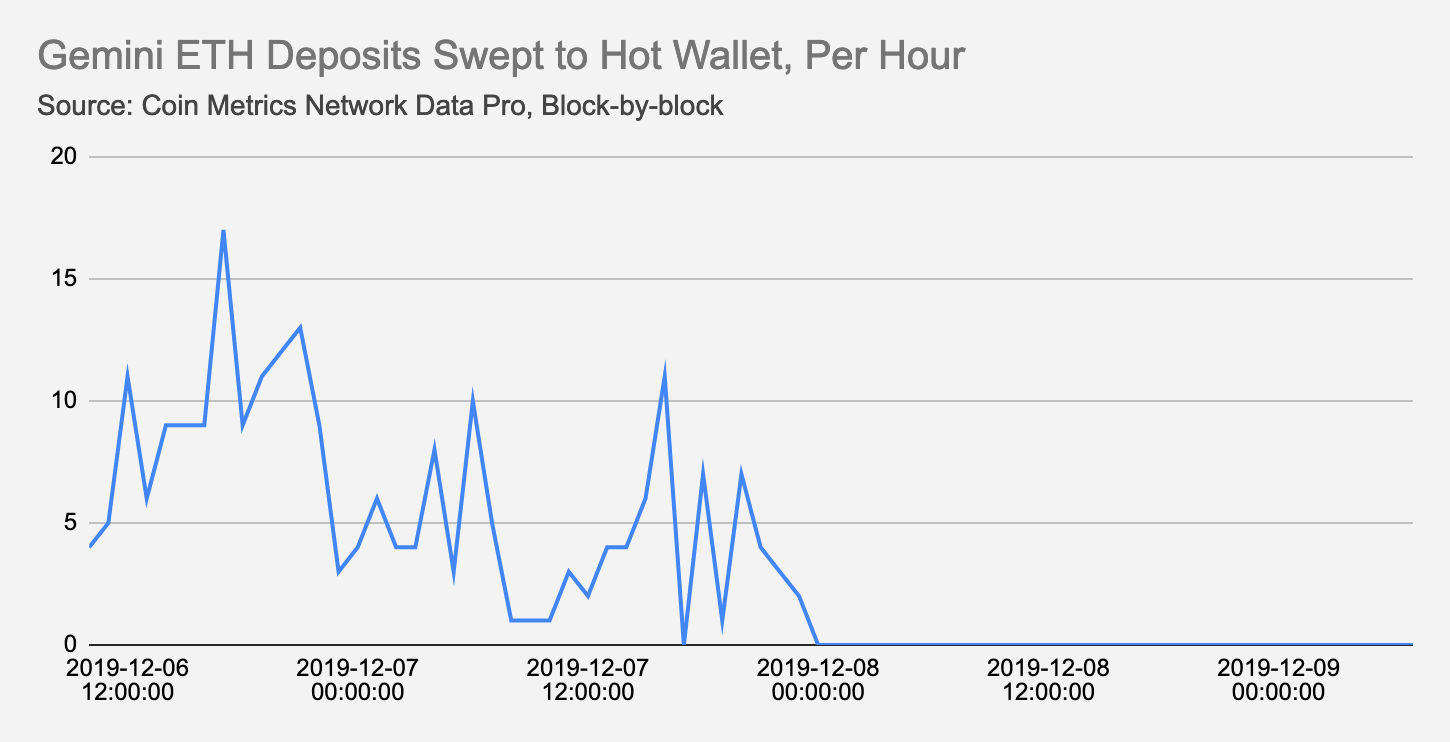

This change also impacted the regulated cryptocurrency exchange, Gemini, as per the said report. Post the Istanbul hard fork, Gemini did not pull user deposits into its hot wallet. Thus, any attempts by the exchange resulted in an “out of gas” error, as was pointed out by Coin Metrics’ resident data analyst, Antoine Le Calvez.

Source: Coin Metrics

The exchange promptly fixed the issue, reporting the cause to be a bad estimate of the post-fork gas cost to sweep user funds. The data engineer called the hard fork successful, but noted that it had “negative consequences” in a tweet.

The tweet read,

“While technically successful, the recent Ethereum hardfork wasn’t without negative consequences. Some EVM operations were repriced to be cost more in fees which affected some smart contract activity.”

The EIPs in the network upgrade were mainly focused on reducing costs and introducing new functions to smart contracts. However, Calvez also pointed out that the smart contract calls were running out of gas, impacting Gemini. It soon announced the sweeps were regularly processing and reveled that it encountered an “old Solidity quirk” leading to the addition of more gas.

The post appeared first on AMBCrypto