Median transaction fees on Ethereum just hit their highest point in almost two years, as the network struggles under heavy congestion.

Meanwhile, Ethereum creator Vitalik Buterin confirmed on June 30 that the network would have to make do with current off-chain scaling solutions for the next two years. That’s until the planned scaling capabilities of Ethereum 2.0 are finally brought to fruition.

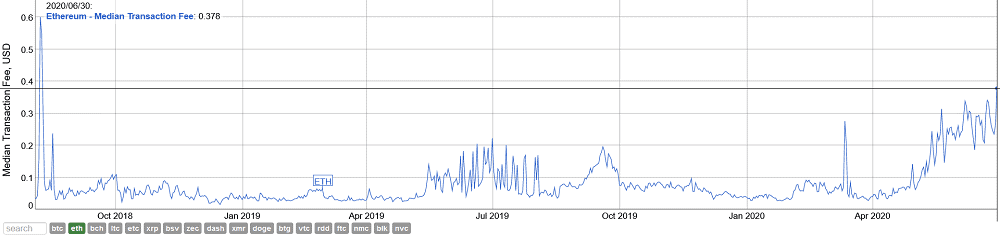

Ethereum Median Transaction Fees Spike

In the 48 hours leading up to June 30, the median transaction fee on the Ethereum blockchain spiked 60%, climbing from $0.23, up to $0.37, according to Bitinfocharts. Despite the suddenness of the spike, it marks the continuation of a trend that has seen median ETH transaction fees rise 510% since the turn of the year when median fees were a mere $0.06.

When calculating average transaction fees, the sum of all the fees is divided by the number of transactions. This statistic can be misleading when trying to find the typical cost of using Ethereum since a few large transactions can push the number up.

The median fee, however, gives a better idea of what kind of fee is paid on a more regular basis by Ethereum’s users. In this instance, the steadily rising median transaction fee is indicative of the increased cost of using the network on an everyday basis.

It could also be a sign that more people are using Ethereum on the ground level. This is backed up partly by data, which shows a 140% increase in the number of Ethereum transactions since January, coupled with a steady decrease in the average ETH transaction value since 2018.

Vitalik Buterin Gives Two-Year Temporary Scaling Plan

Amid the slowly rising cost of using Ethereum, the blockchain’s creator Vitalik Buterin gave some insight into a short-term scaling plan for Ethereum 2.0. On June 30, the Ethereum co-founder offered up this slightly technical summary of how Ethereum, and Ethereum 2.0, can scale in the short-term. Buterin tweeted:

ETH2 scaling for data will be available *before* ETH2 scaling for general computation. This implies that rollups will be the dominant scaling paradigm for at least a couple of years: first ~2-3k TPS with eth1 as data layer, then ~100k TPS with eth2 (phase 1). Adjust accordingly.

— vitalik.eth (@VitalikButerin) June 30, 2020

In Layman’s terms, Ethereum 2.0 will be able to handle large quantities of data before it gains the ability to compute that data. Therefore, in the interim, a technology known as ZK-rollups will be used as a stop-gap for the next two years.

ZK-rollups operate by stacking multiple transactions into a single smart-contract, without having to be validated by the main chain. The contract is then validated on the main chain at a later date. This acts as a layer-2 scaling solution for Ethereum since users can retain full functionality, while the strain on the blockchain is eased.

Buterin later advised that people who were just moving tokens around on Ethereum should look into using a ZK-rollup tool – many of which already exist.

“Anyone who’s *just* moving ETH / ERC20 / ERC721 tokens around should be looking at how to get onto a rollup today. Gas prices on base chain would probably fall greatly if it was only used for the more complex stuff,” said Buterin on June 30.

Given that this would cause a swift drop in Ethereum’s average and median transaction fees, most Ethereum users would likely share Buterin’s sentiments.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato