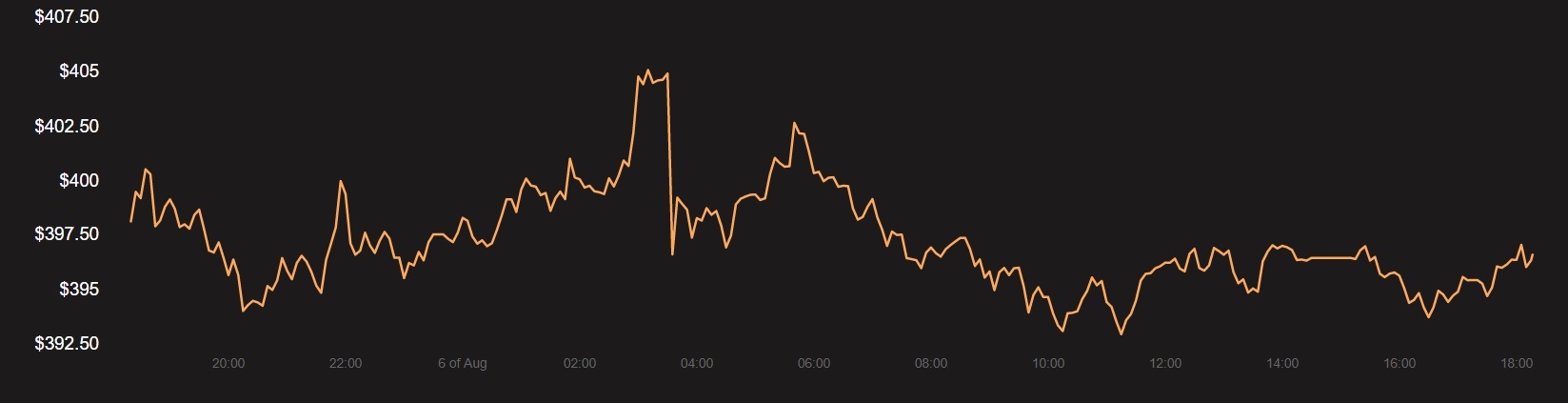

Medalla, Ethereum 2.0’s final public testnet, went live on 4 August with over 20,000 validators. This testnet was the final leg before ETH 2.0 goes live tentatively by the end of 2020. According to Beaconchain block explorer, with 21,605 current active validators, approximately 691,360 ETH have been staked. Medalla’s launch may have also contributed to the surge observed in the spot price of Ether. With the coin reporting a nearly 71% rise in its price over the last 2 weeks, the press time value of the world’s second-largest crypto stood at $396.42.

With the spot market surging and developments galore in the ecosystem, the derivatives market has also been noting great interest from users. In fact, such interest has gradually risen, alongside Ethereum’s value on the charts. According to data provided by Skew, the Ethereum Futures contract has hit an all-time high of $1.422 billion.

This growth in interest was led by two exchanges, OKEx and Huobi Global. OKEx reported interest of $32o million, followed by Huobi Global with $300 million. Similarly, the OI on the Options market also registered an ATH of $390 million, with Deribit responsible for $351 million in OI alone.

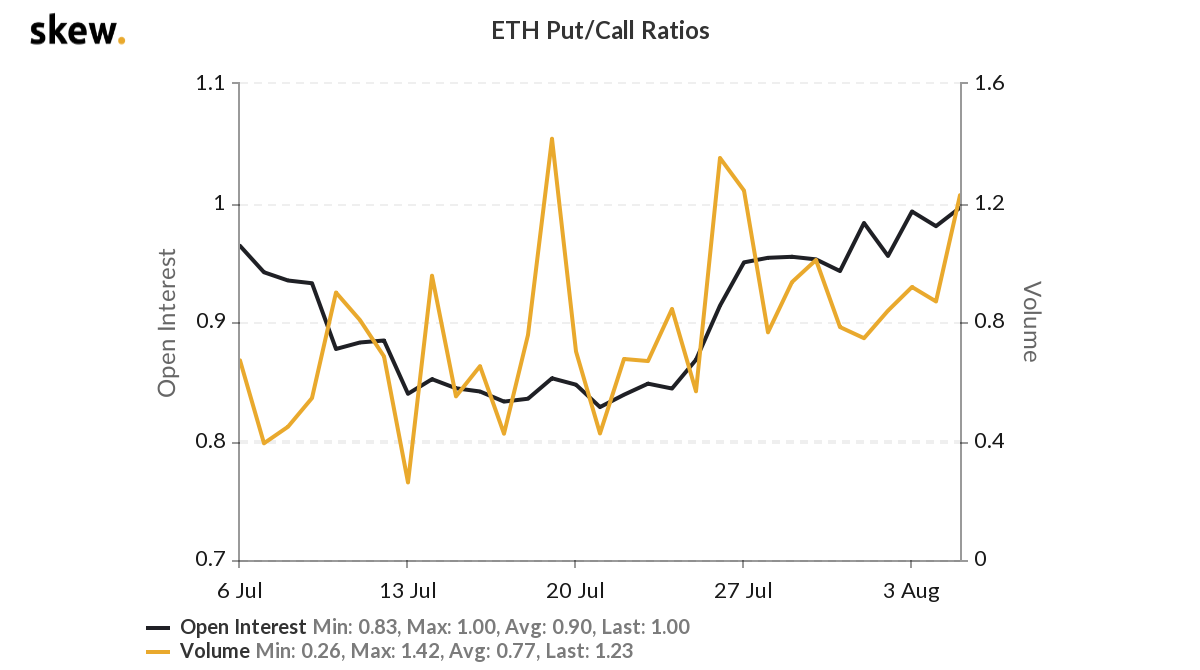

This suggested that with traders increasingly on the rise in the market, Options contracts may have reached their saturation point. According to the Put/Call ratio, Ethereum traders have been buying more puts than calls, pointing to an emerging bearish sentiment in the ETH market.

The Put/call ratio had moved over 0.7, something that could mean that the investors are expecting a dip in the market or are hedging their portfolios in case of a sell-off. With Ethereum’s value nearly reaching a two-year high, there could be some corrections setting in soon.

Source: Skew

Further, the extended DeFi ecosystem has been contributing largely to the transaction volume on the blockchain. The Ethereum application transaction volume recently surpassed $12 million and hit an ATH in July. In fact, as per a report by DappRadar, 92% of all transactions were related to Defi DApps.

As the market moved higher, Ethereum’s correlation moved away from Bitcoin, possibly a sign of the world’s second-largest crypto reporting independent growth.

The post appeared first on AMBCrypto