Ethereum’s native cryptocurrency, Ether has experienced an explosive price action in the last few hours. ETH surged by more than 8 percent to move past the $420 price mark breaking out of a week-long consolidation.

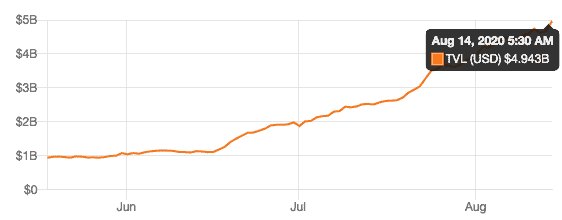

Also, the Ethereum based decentralized finance ecosystem just registered a new milestone. The total USD value locked in DeFi hit the $5 billion mark.

ETH Regains Position Above the $420 Level After 2 Years

In a thunderous bout of volatility, ETH jumped by more than 8 percent to register a local top above the $420 price level. Ethereum’s native cryptocurrency has achieved this feat after precisely two years of undergoing an overall bearish market stance. The last time ETH was trending around $400 was during the first few days of August 2018.

Although ETH’s market outlook has been bullish since the beginning of the year, one might wonder what caused this sudden movement in price. There are a few reasons – the soaring DeFi craze being one of them. But looking at Ethereum futures markets, the reason becomes pretty evident.

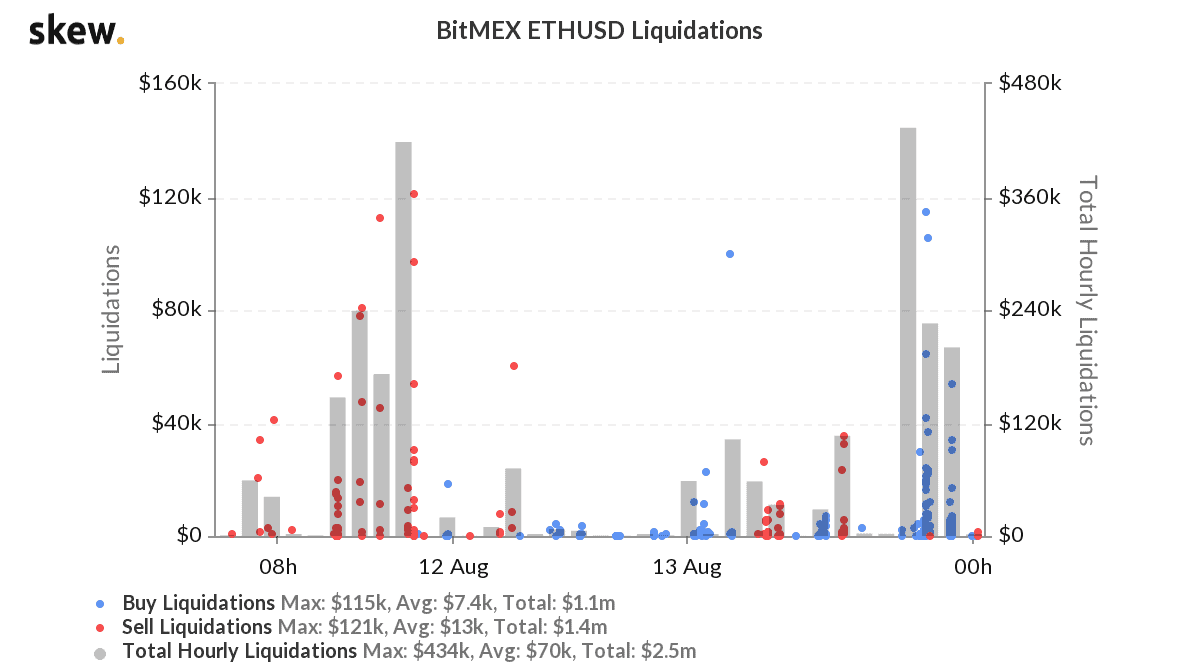

Over the last three days, crypto derivatives platform BitMEX saw around $1.4 million worth of ETHUSD sell liquidations. Since the overall stance is bullish futures traders shorting, ETH ended up receiving the short end of the stick.

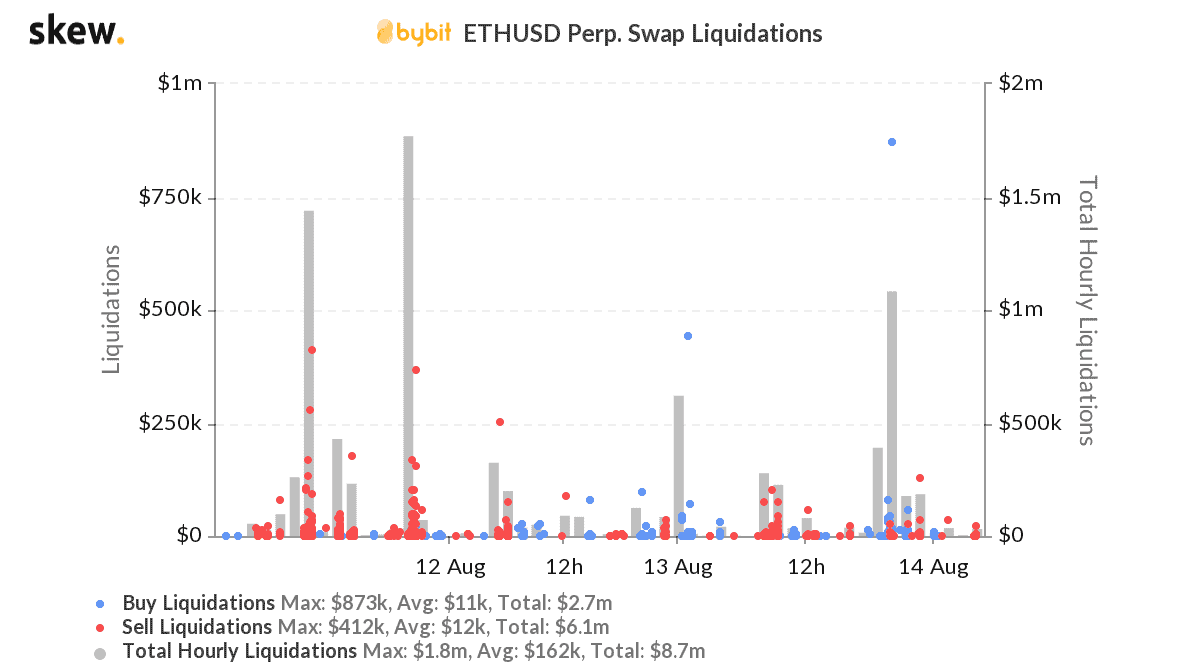

But the liquidation story is gorier when it comes to Bybit. According to the market analytics firm, Skew, the futures trading platform saw around $6.1 million of ETHUSD short liquidations taking place in the 3-day timeframe.

Together these two platforms contributed to around $7.5 million worth of ETHUSD shorts being liquidated. Futures markets have a significant impact on the prices of cryptocurrencies. This time too, wasn’t different.

Total Value Locked in DeFi Hits $5 Billion

It’s only the 8th month since the year began, but it seems Christmas has arrived early for Ethereum. As mentioned above, ETH prices soared above $400, but on the other hand, the Ethereum-based decentralized finance (DeFi) ecosystem is also rising in valuation.

As per the DeFi tracking website, DeFi Pulse, the total USD value locked in DeFi is already above the $5 billion mark with $4.94 billion being the exact figure. Currently, there are 4.5 million ETH, and 27k BTC locked up in the ecosystem.

This comes amidst the rising popularity of Curve Finance, one of DeFi’s top protocols. Curve experienced a 45 percent appreciation in USD fund deposit in 24 hours.

$CRV, the protocol’s governance token launch today is the supposed reason behind the massive funding pump.

Someone deployed $CRV based on smart contracts we had published on github, front-running our efforts.

While we initially were skeptical, it appeared to be an acceptable deployment with correct code, data and admin keys.

Due to the token/DAO getting traction, we had to adopt it.— Curve (@CurveFinance) August 14, 2020

The Curve DAO token is currently doing $2.8 million in daily trading volumes with a $100,000+ liquidity against ETH, on Uniswap.

According to analysts, this rally is just the beginning for ETH. The second most popular cryptocurrency has more fuel left to achieve a higher price in the days ahead.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato