- Ethereum saw a 23.4% price surge over the past week as it closes in on the $400 level.

- This has allowed ETH to create a fresh 2-year high, not seen since August 2018.

- Against Bitcoin, Ethereum is of testing the 0.035 BTC resistance.

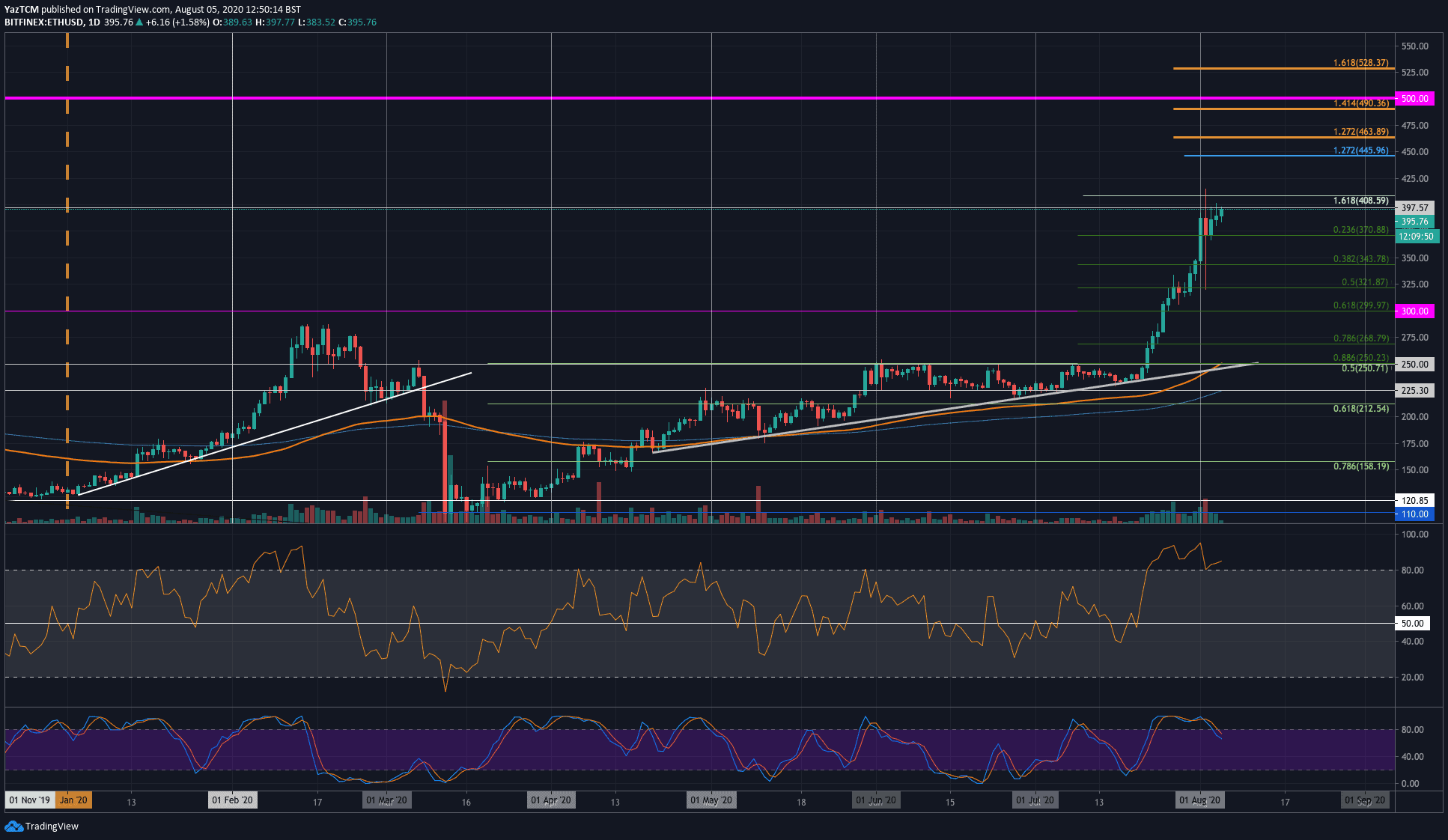

ETH/USD – Bullish Close Above $400 Imminent

Key Support Levels: $370, $350, $321.

Key Resistance Levels: $400, $408, $425.

Ethereum has performed remarkably well since breaking $250 and exiting the previous consolidation in July. After breaking above, the coin went on to close July at $350. In August, ETH pushed even higher and managed to spike to $410 on August 2nd.

The volatility on August 2nd caused ETH to drop to $325, where it rebounded from the support at a .5 Fib Retracement. It has since recovered as it attempts to break and close above the $400 level for the past 3-days.

ETH-USD Short Term Price Prediction

Looking ahead, if the bulls break above the $400 level, the first level of resistance is expected at $408. Above this, resistance lies at $425, $445, and $463 (1.272 Fib Extension).

On the other side, the first level of strong support lies at $370 (.236 Fib Retracement). Beneath this, added support is found at $350, $321 (.5 Fib Retracement), and $300 (.618 Fib Retracement).

The RSI is still in overbought territory as the buyers dominate the market momentum. The Stochastic RSI did produce a bearish crossover signal which could suggest the bulls are a little overextended.

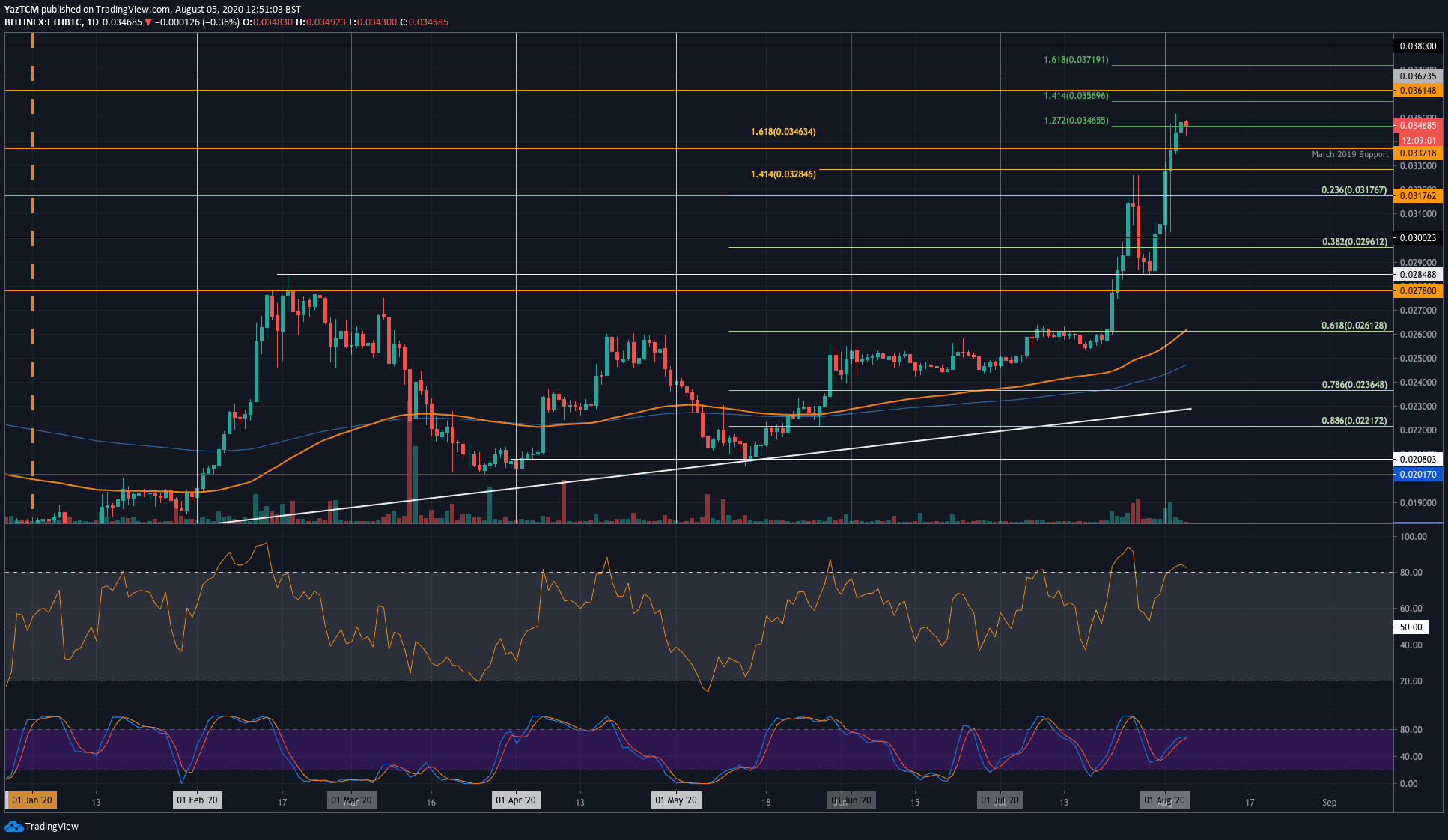

ETH/BTC – Ethereum Tackling 0.035 BTC Resistance.

Key Support Levels: 0.0337 BTC, 0.0317 BTC, 0.031.

Key Resistance Levels: 0.035 BTC, 0.0356 BTC, 0.0361 BTC.

Etheruem has been performing well against Bitcoin as it managed to push above the 0.0328 (1.414 Fib Extension) resistance at the start of the month. The coin has continued further higher in August as it broke the March 2019 support at 0.0337 BTC to reach the current 0.0346 BTC resistance.

ETH is now attempting to break the 0.035 BTC resistance.

ETH-BTC Short Term Price Prediction

Looking ahead, if the bulls do break 0.035 BTC, the first level of resistance is expected at 0.0356 BTC (1.414 Fib Extension). This is followed by resistance at 0.0361 BTC, 0.0367 BTC, and 0.0371 BTC (1.618 Fib Extension).

Alternatively, if the sellers push lower, the first level of support lies at 0.0337 BTC. Beneath this, support is found at 0.0317 BTC (.236 Fib Retracement), 0.031 BTC, and 0.0296 BTC (.382 Fib Retracement).

Likewise, the RSI remains overbought as the bulls dominate the market momentum.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato