When it comes to the altcoin market, the past few months have shown how important a cryptocurrency Ethereum is. With DeFi growing substantially in 2020, the gains have been felt by ETH in many ways. While ETH has miles to go before it can challenge the market cap and dominance of Bitcoin, its remarkable growth thanks to DeFi and the proposed ETH 2.0 shift cannot be overlooked. With Ethereum’s use cases diversifying, users and investors within the ecosystem are reaping its benefits too.

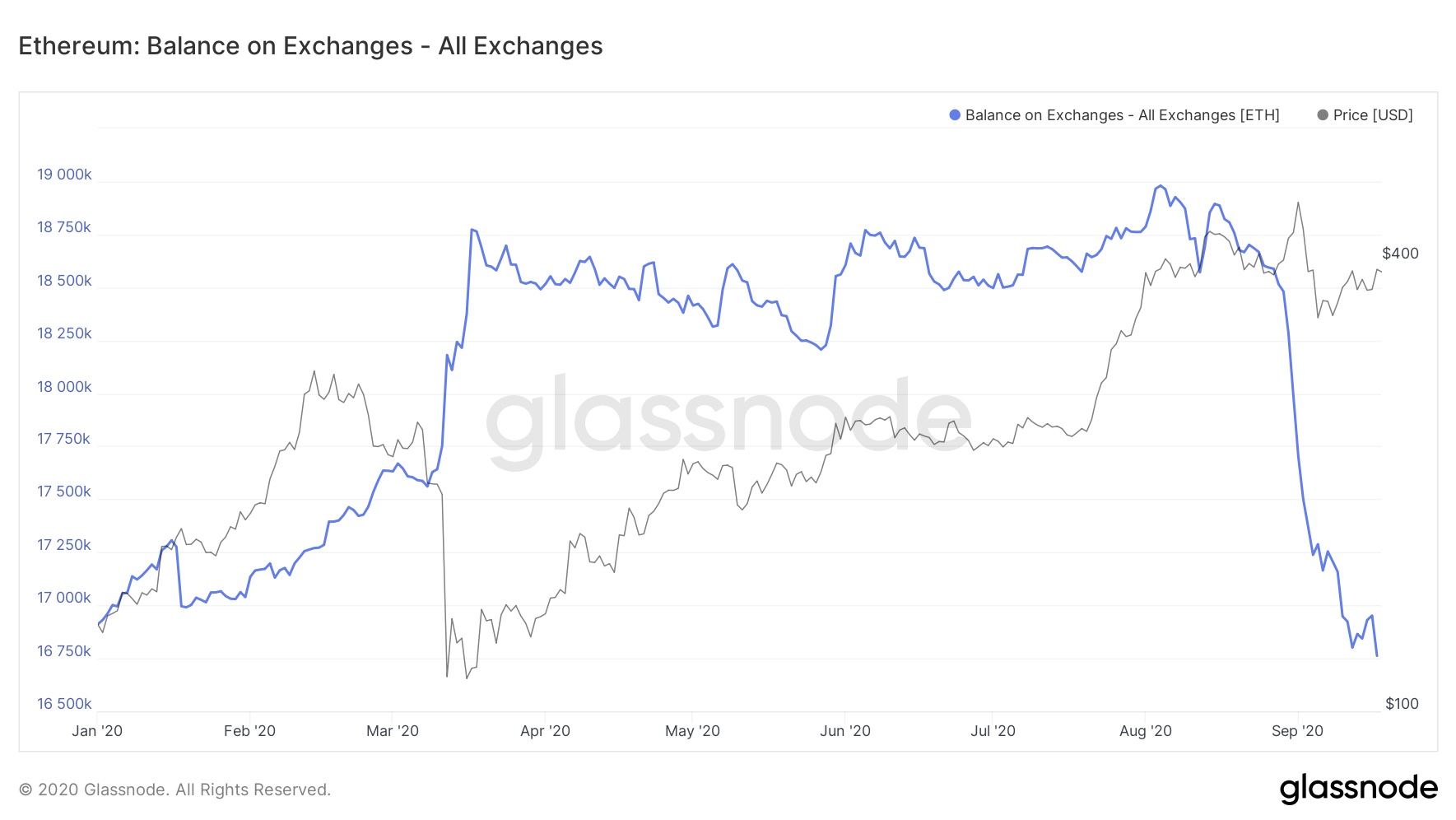

Source: Glassnode

According to recent network data provided by Glassnode, Ethereum balances on centralized exchanges have fallen substantially over the past few weeks. In fact, the aforementioned data showed a drop from over 18,750K to around 16,750K, resulting in Etherum balances on exchanges falling to their lowest level for the year 2020, at the time of writing.

While this drop may seem alarming to some, it also illustrates a silver lining of sorts for the cryptocurrency. A fewer number of users are now holding their Ethereum on exchanges. Instead, they are moving them to cold storage or cold wallets – a sign commonly associated with increased hodling sentiment. As more users hold on to their Ethereum, the price of the cryptocurrency is also likely to be positively impacted.

One of the reasons why many users are feeling inclined to do so can be due to its recent performance, as well as its ability to derive growth from a booming DeFi ecosystem that is based on its platform.

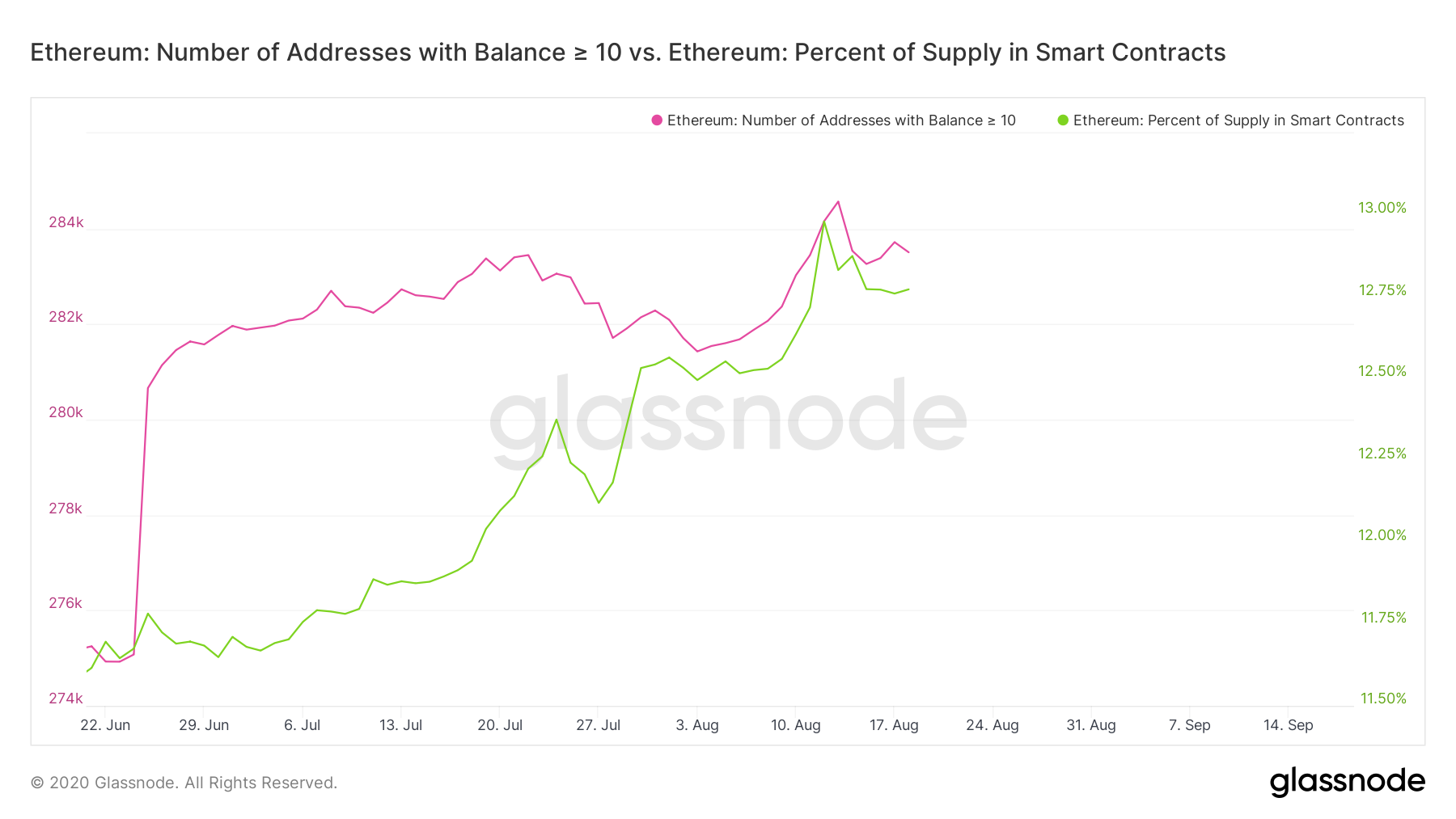

Source: Glassnode

In fact, it is also interesting to note that over the same timeframe, Ethereum addresses with greater than 10 ETH have also seen a significant rise. According to network data provider Glassnode, such addresses have risen from 275K to 283K in the last three months alone.

One of the key reasons behind the aforementioned drop in Ethereum stored on exchanges ties back to increased hodling sentiment within the Ethereum community, as highlighted above. This, coupled with a rise in Ethereum locked in smart contracts (Since investors are looking to generate greater returns at a time when Etherum’s price is consolidating on the charts), bodes well for the cryptocurrency’s ecosystem.

The post appeared first on AMBCrypto